In the high-stakes world of corporate finance, we often get lost in the takeover jargon. We talk about “synergies” and “accretive value.” But for the average Australian, what does this actually mean?

To start from ground zero: a merger is effectively a corporate marriage. Two companies combine their assets, staff, and operations to become a single, more powerful entity. On paper, this sounds like good business. It can lower costs and improve efficiency.

However, there is a dark side. If two large competitors merge, they can become a monopoly. When one company holds all the cards, it can dictate prices to suppliers and families.

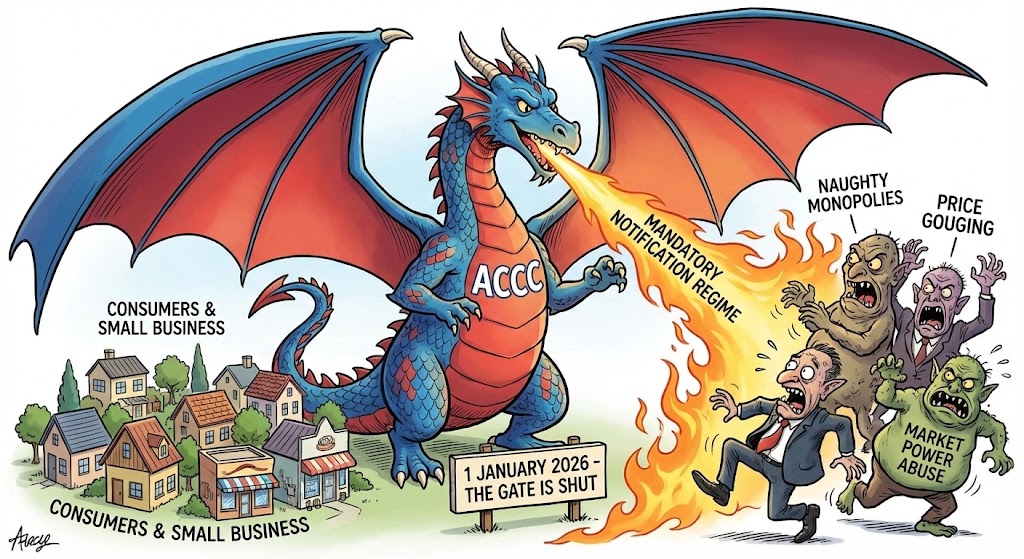

This is where the Australian Competition and Consumer Commission (ACCC) steps in. The ACCC is the market’s referee. Its job is to ensure that business ambition does not crush the “fair go.”

The Historical Context of Approving Mergers in Australia: The “Voluntary” Flaw

For decades, notifying this referee was effectively a handshake. While section 50 of the Competition and Consumer Act 2010 (Cth) (CCA) has long prohibited deals that substantially lessen competition, the mechanism for pre-completion notification and clearance was largely voluntary.

As of 1 January 2026, that era was over. The Competition and Consumer (Notification of Acquisitions) Amendment (2025 Measures No 1) Determination 2025 (Cth) was registered on 18 December 2025.

The regulator fought an uphill battle under the old system. This is illustrated by the landmark Metcash case (ACCC v Metcash Trading Ltd [2011] FCAFC 151; (2011) ATPR ¶42-380).

When Metcash proposed buying Franklins, the ACCC argued it would crush competition. It lost. The Full Federal Court held the ACCC failed to establish the “counterfactual”—effectively, the regulator could not prove, on the balance of probabilities, that a more competitive alternative would occur if the merger was blocked.

This case exposed the practical height of the evidentiary bar. It meant that companies could engage in “killer acquisitions”—buying small competitors before they became a threat—without facing any mandatory pre-completion review.

The New Australian Merger Rule: Permission, Not Forgiveness

The Federal Government has now registered the Competition and Consumer (Notification of Acquisitions) Amendment (2025 Measures No 1) Determination 2025 (Cth). This instrument turns the new framework into reality.

The new rules flip the dynamic. Notification is now mandatory and suspensory under the rules, with completion prohibited until clearance is granted.

Transparency is the default. All notified acquisitions will appear on a new public ACCC acquisitions register, listing the parties, status, and outcomes. The days of the quiet, informal chat are gone.

However, the Government has adopted a phased approach to the last-minute changes to the new merger laws under the Competition and Consumer (Notification of Acquisitions) Amendment (2025 Measures No 1) Determination 2025 (Cth), which was registered on 18 December 2025:

- 1 January 2026: The majority of the new merger laws began on a compulsory basis.

- Transition Window: Critically, share acquisitions that do not result in control are exempt from notification until 31 March 2026.

- 1 April 2026: The full suite of rules applies, including specific new thresholds for discrete asset acquisitions and voting power thresholds for share acquisitions where the acquirer does not control the corporation immediately after the acquisition, or the acquirer already controlled the corporation before the acquisition.

The regime uses a sophisticated tiered threshold system:

- General test (Large merged firms): Notification is required if the acquisition is connected with Australia, and no exceptions apply, and the combined Australian revenue of the merger parties and their connected entities (counting the target’s connected entities only if they are being indirectly acquired) is ≥ $200 million AND either:

- The Australian revenue of the target and its connected entities being indirectly acquired is ≥ $50 million; OR

- The global transaction value is ≥ $250 million (or $200 million from 1 April 2026 for discrete asset acquisitions).

- Very large acquirers: If the Australian revenue of the acquirer and its connected entities ≥ $500 million, the threshold drops significantly. They must notify if the Australian revenue of the target and its connected entities being indirectly acquired is ≥ $10 million (or if cumulative serial Australian revenue is ≥ $10 million, or in the case of discrete asset acquisitions from 1 April 2026, the transaction value ≥ $50 million) if the acquisition is connected with Australia, and no exceptions apply.

- Serial acquisitions (explained below)

- Designated supermarket corporations (Coles and Woolworths): Strict rules apply specifically to Coles, Woolworths and their connected entities. They must notify all acquisitions of supermarket businesses. They must also notify land acquisitions exceeding 1,000m2 of gross lettable area (if built) or 2,000m2 (if vacant), unless specific exemptions like lease renewals apply.

The intricate details regulating whether a merger or acquisition needs to be notified to the ACCC, including the thresholds, targeted notification requirement for supermarkets, control and voting power thresholds, exceptions, definitions, scope of the merger laws, progress stage or category of the acquisition and indexing of threshold amounts. Parties to an acquisition do not need to notify if the ACCC grants a waiver.

Here is how the new merger laws hit the ground in practice.

Scenario 1: The “Creeping” Takeover Acquisition (The Roll-Up)

Consider a large national corporation buying small competitors.

- Before 1 January 2026: It buys 20 small family businesses over 3 years. Each deal is small (around $3 million each), so the ACCC is rarely notified.

- After 1 January 2026: The new rules catch “serial acquisitions”, unless an exception applies. The system now looks back at all acquisitions in the same or substitutable market over the last 3 years, where the combined Australian revenue of the target and its connected entities being indirectly acquired was $2 million or more, the acquisition was not previously notified, the acquisitions were connected with Australia, and the control test is satisfied (in the case of shares) or the assets are still held (in the case of assets other than shares).

If the cumulative Australian revenue of the targets and their connected entities being indirectly acquired meets the serial threshold (treating the current acquisition and acquisitions from the past 3 years as a single acquisition) —$50 million for large merged firms or just $10 million for very large acquirers, the acquisition must be notified to the ACCC. The “roll-up” strategy now happens in broad daylight.

Scenario 2: The WA Resource Trap when it comes to mergers and acquisitions

This is where Western Australia’s view is distinct.

- The WA Risk: In Sydney, a company with under $10 million in revenue is a small business. In the Pilbara, a junior miner might have $0 revenue but sit on a $1 billion critical mineral deposit.

- The Policy Gap: While the tiered system is comprehensive, a “revenue” test can still miss the strategic value of WA resources. As a practitioner, I argue that the regime may eventually need to look beyond the profit-and-loss statement to the balance sheet to protect national interests.

From 1 April 2026, a transaction value test of ≥ $50 million applies to very large acquirers, but it only applies in the case of discrete asset acquisitions, i.e., acquisitions of assets (other than shares) that do not have the effect that a person will/can acquire (substantially) all of the assets of a business.

Scenario 3: The Property Developer engaging in mergers and takeovers

For my clients in property, the “Ordinary Course of Business” exemption is the vital lifeline.

- Exempt: The exemption applies broadly to genuine, ordinary-course activities, such as land acquisitions for development or commercial leases. It is assessed on the facts, including the nature of the transaction.

- Caught: However, exemptions do not cover targeted sectors like supermarkets. Even if you claim a lease is “ordinary course,” if you are a major supermarket chain acquiring a site, specific rules likely pull you back into the mandatory notification zone. It is a fact-dependent test, not a blanket pass.

The Butcher’s Son: A Question of Fairness when it comes to stopping monopolies

The shift to a mandatory regime is not just red tape. It is about addressing the procedural limitations highlighted by cases such as Metcash.

I view this through the lens of my own history. I am the son of a butcher. I was the first in my family to attend university. I know that when the rules are loose, the small players—the families and independent businesses—often get squeezed out.

The Commonwealth has built a robust fence. The challenge now is to implement the new laws in light of both legal nuances and commercial realities.

References

- Treasury Laws Amendment (Mergers and Acquisitions Reform) Act 2024 (Cth).

- Competition and Consumer (Notification of Acquisitions) Amendment (2025 Measures No 1) Determination 2025 (Cth).

- Competition and Consumer (Notification of Acquisitions—Forms) Determination 2025 (Cth).

- Australian Competition and Consumer Commission v Metcash Trading Ltd [2011] FCAFC 151.

By Dr Brett Davies, Adjunct Professor, UWA, Managing Director of the PLT course by the Institute of Legal Training (IOLT)

| How to build Commercial legal documents online | |

|---|---|

| Independent Contractor Agreement – avoid PSI | |

| Service Trust Agreement – compliant with ATO safe harbour | |

| Lease – Commercial | |

| Lease – Self-Managed Super Fund | |

| Mutual Non-Disclosure Agreement vs Confidentiality Agreement – everyone keeps the secret |

| Loans & Gifts | |

|---|---|

| Loan Agreement | |

| Loan to husband | |

| Loans to Children – override with the Family and Bankruptcy Courts | |

| Loans to Parents | |

| Deed of Gift | |

| Forgive a Debt Agreement – also gets rid of Family Trust’s UPEs | |

| Division 7A Loan Deed – revolving; never needs updating | |

| Recognition of Loan Deed – freshen up old Loan Agreements |

| Business Structures | |

|---|---|

| Partnership Agreement | |

| Family Trust with a human as trustee – only if holding ‘safe’ assets | |

| Build a company to be the trustee of a Family Trust – excellent for running a mum-and-dad business | |

| Build a company to be a trustee of a Unit Trust – excellent for running a business with non-family members | |

| Service Trust Agreement – run it alongside your main business, e.g. doctor, accounting house, dentist, law firm and engineering practice | |

| 3-Generation Testamentary Trust Will – tax-free income for 80 years, but you have to die to get it to operate | |