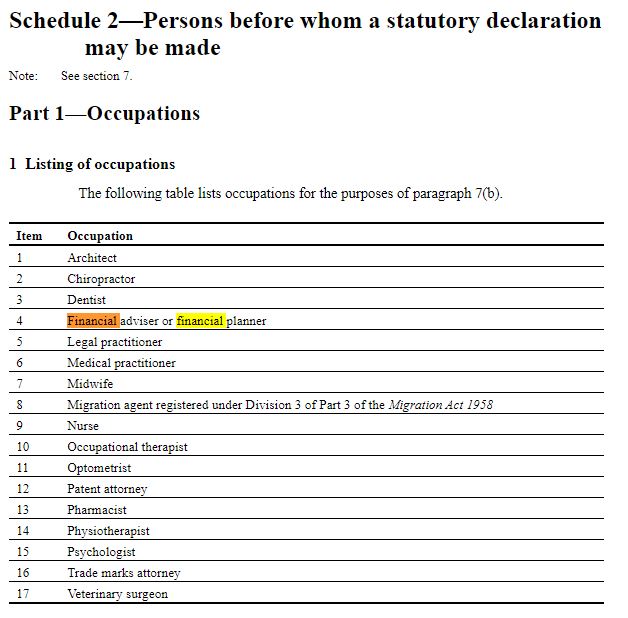

The Statutory Regulations 2018 (Cth) allows financial planners and advisers to witness Commonwealth statutory declarations. This has been the case since 18 September 2018.

This means that financial planners are in the group of ‘authorised witnesses’. This is long overdue and I applaud the FPA and many other groups, including Legal Consolidated in lobbying for this.

As an authorised witness, you ensure that the Statutory Declaration meets the form and content requirements that are set out in Schedule 1 of the Regulations.

Help for financial planners witnessing POAs

For help with these rules see here: FAQ’s on the Attorney-General’s Department website – have all your questions answered including:

- What address to use?

- Non-English speaking?

- Cannot put pen to paper?

- What information should be included in my statutory declaration?

- Should a statutory declaration be typed or handwritten?

- What requirements apply to attachments to statutory declarations?

- How do I amend a statutory declaration? Are there time limits?

- Can I draft my own statutory declaration form or make changes to the standard form?

- What should I do if my statutory declaration goes over multiple pages?

- What information is included in my statutory declaration?

Each State has its own rules on who can witness a POA

Different Australian States and Territories have different requirements for witnessing a Power of Attorney (POA).

As a national Australian law firm, Legal Consolidated provides, on our website, both enduring and lifestyle POAs for:

- New South Wales

- Enduring/Money –

- Lifestyle/Medical – Enduring Power of Guardianship

- Victoria

- Enduring/Money –

- Lifestyle/Medical – Appointing Medical Treatment Decision Maker

- Queensland

- Enduring/Money –

- Lifestyle/Medical – Enduring Power of Attorney

- Western Australia

- Enduring/Money –

- Lifestyle/Medical – Enduring Power of Guardianship

- South Australia

- Enduring

- Lifestyle/Medical – Advanced Care Directive

- Tasmania

- Enduring

- Lifestyle/Medical – Enduring Power of Guardianship

- Australian Capital Territory (ACT)

- Enduring

- Lifestyle/Medical – Enduring Power of Attorney

- Northern Territory

- Enduring

- Lifestyle/Medical – Advance Personal Plan

Over 30% of POAs prepared on a government website are wrong. About 12% of lawyer prepared POAs also do not work.

If you prepared a POA for a client on a government website or non-law firm website, then you are the adviser are liable for that document.

You should not take the risk. You should build your POAs for your clients of Legal Consolidated Barristers & Solicitors’ website. Our law firm is then responsible for the document. Not you the adviser.

Because a financial planner can witness a Commonwealth Statutory Declaration for many States that is one of the classes of people that can also witness POAs.

Nearly one-third of POAs from a government website do not work. Only witness a POA built by Legal Consolidated or another law firm. If you witness a POA that is not prepared by us or another law firm then you may be held responsible for that document if it ends up not working.

In all States, only lawyers can prepare ‘Deeds’. A POA is a ‘deed’. So don’t build the POA on the government website. Instead, build it on a law firm’s website and be protected by our law firm Professional Indemnity insurance.

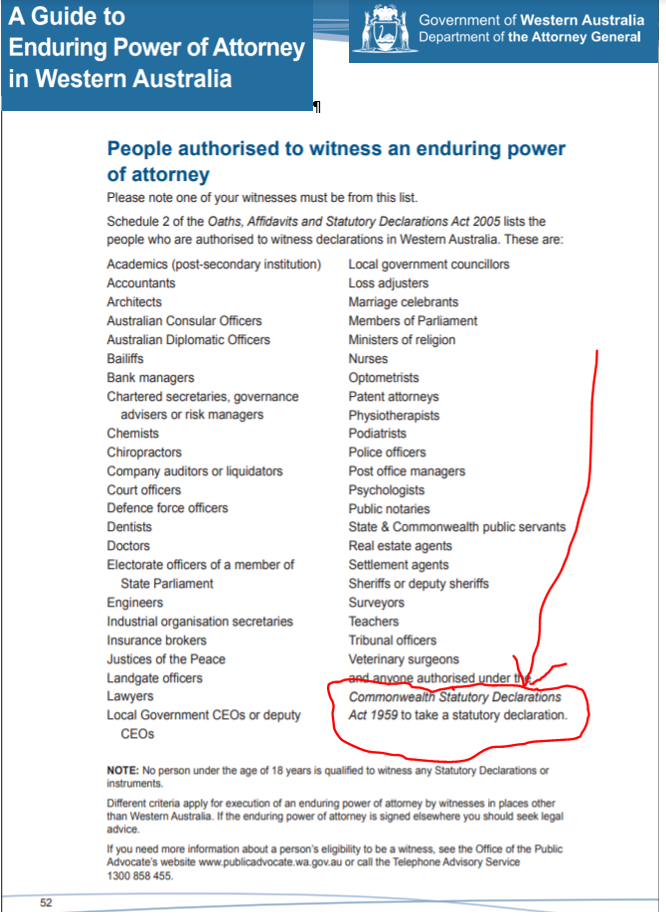

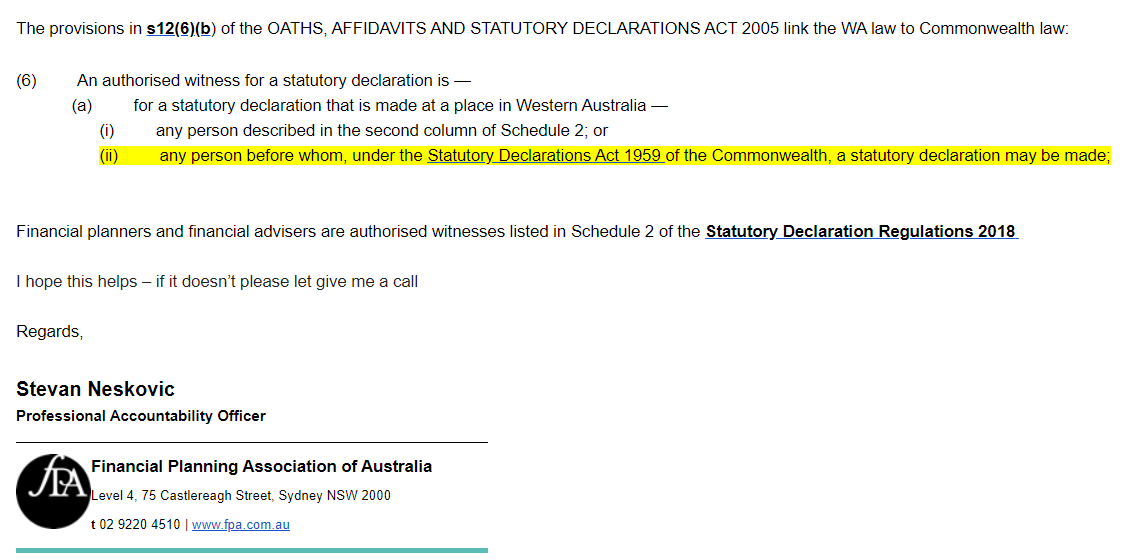

Financial Advisers witnessing Western Australian POAs

- A person can witness a WA POA if they can witness Commonwealth Statutory Declarations.

- As stated above financial planners can witness Commonwealth Statutory Declarations.

- Therefore, a Financial Planner (anywhere in Australia) can witness WA Enduring POAs and Lifestyle/Medical POAs (Power of Guardianship) that are built on our law firm’s website.

See Appendix B of the WA Attorney General’s A Guide to Enduring Power of Attorney in Western Australia dated December 2013 (page 52):

——————————————————————————————–

Advisers cannot witness NSW POAs

Sadly in NSW only Court officials and lawyers can witness a NSW POA. At the time this seemed a good idea to make money for lawyers. But it has proved a hindrance to both lawyers and the Court. Legal Consolidated continues to lobby to NSW government to free up this draconian and time-wasting restriction.

Advisers cannot be an ‘authoristed witness’ for a Victorian Enduring POA

Financial advisors are not authorised witnesses for a Victorian Enduring POA. The Victorian POA Act requires the person be authorised to witness affidavits in Victoria. Under section 19(1) Oaths and Affirmations Act 2018 (Vic). Sadly, financial advisors are not listed as authorised.

Each state has is own Medical POA. It is called a Medical Treatment Decision Maker. They are regulated by the Medical Treatment Planning and Decisions Act 2016 (VIC). Advisers, for the reasons set out above, can NOT be the ‘authorised’ witness for this document.

Financial planner Certifying documents (certifier)

In Victoria Section 39 Oaths and Affirmations Act 2018 (Vic) allows the “Financial adviser or financial planner” to certify a document as a true copy of the original. This has been the case since 1 March 2019.

Accountant certifying documents as original

Also these accountants may also certify documents as original in Victoria:

- Fellow of the National Tax Accountants’ Association

- Member of Chartered Accountants Australia and New Zealand

- Member of the Association of Taxation and Management Accountants

- Member of CPA Australia

- Member of the Institute of Public Accountants

When you build a POA on our law firm website we stand by that document for the life of your client.

But every lawyer builds their POAs differently

This advice only relates to POAs prepared by Legal Consolidated. If you are using another law firm to prepare your POAs then speak to that law firm. Each law firm has its own way of preparing POAs.

And if you are building a POA from a government webpage, then good luck. Nearly one-third of POAs prepared on government websites do not work. (This figure is far lower in Tasmania.)

Telephone us for legal advice on building this document.

[divider height=”30″ style=”default” line=”default” themecolor=”1″]

Adjunct Professor, Dr Brett Davies, CTA, AIAMA, BJuris, LLB, Dip Ed, BArts(Hons), LLM, MBA, SJD

Legal Consolidated Barristers and Solicitors

National Australian law firm

National: 1800 141 612

After hours: 0477 796 959

Email: brett@legalconsolidated.com

[divider height=”30″ style=”default” line=”default” themecolor=”1″]