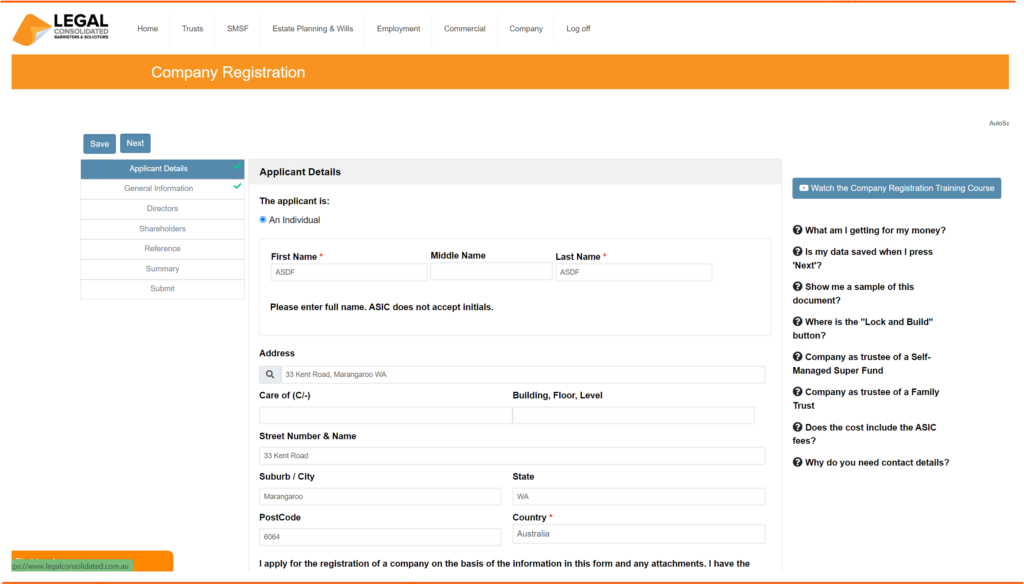

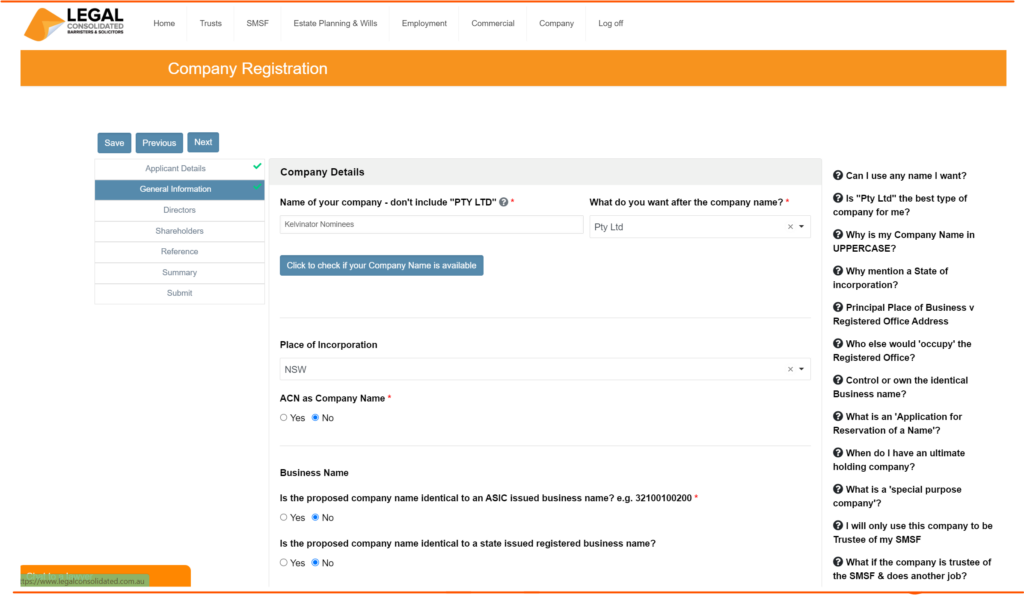

Fixing mistakes in a new company. ASIC Form 492 – Request for correction

If you make a mistake on a form that you have already lodged with ASIC, you can lodge an amendment. This is by preparing and lodging a Form 492 – Request for correction. Use this form if you or your adviser find a mistake on the form, and want to notify ASIC to correct the mistake. (ASIC stands for the Australian Securities and Investments Commission.)

This link allows you to download Form 492 – Request for Correction.

For example, use this Form 492 if you have newly incorporated a company: Form 201 “Application for Registration as an Australian Company”. This is if you find:

-

- that you put in the incorrect information on your application for a new company;

- ASIC has not understood what you wanted; or

- ASIC made a mistake.

Can I telephone ASIC and correct the mistake?

If you notice a mistake in your new company within 24 hours of its registration, you may be able to fix the mistake by calling ASIC on 1300 300 630 or 61 3 5177 5407 (outside of Australia).

But, in most cases, a Form 492 – Mistake Correction form is required.

Further, generally, only typographical errors or misspelled words are accepted over the telephone. In particular, corrections to dates are not accepted over the telephone. This is because they require supporting documents.

Fixing a spelling error in the new company name

Telephone ASIC, and find out the best way to proceed. ASIC may allow a For 492 to be lodged to correct this.

However, usually, a Change of Name is required. Sadly, ASIC charges you additional money to change a company name.

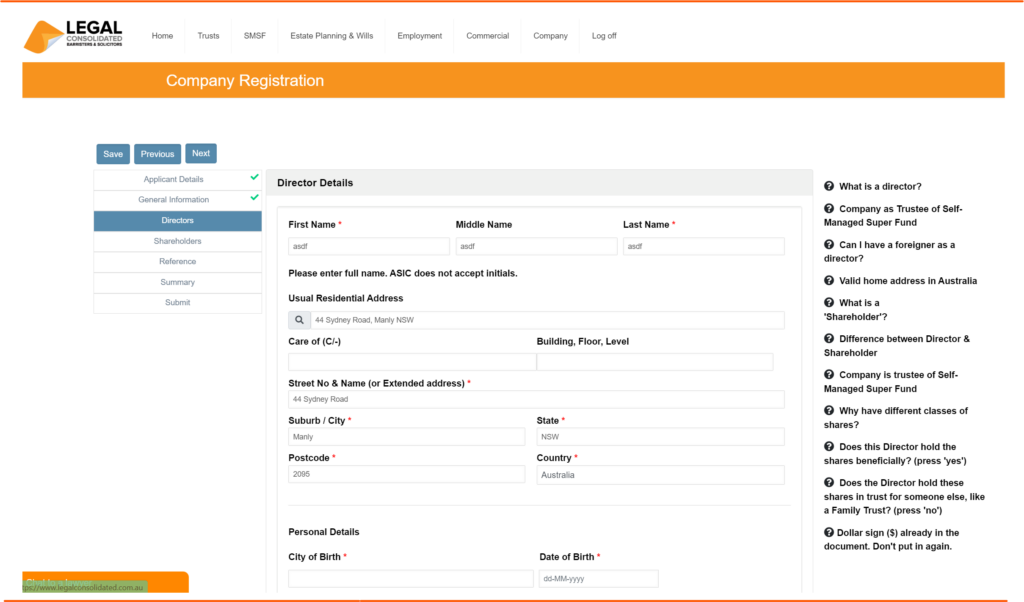

Examples of common mistakes when registering a new company

For a new company, Form 492 can be used to fix, things like:

- Address discrepancies

- Incorrect name spellings (e.g. correction of shareholder name)

- birth date details

It does not matter who made the error on the ASIC Form 201

Form 492 is required regardless of whether the ‘error’ is made by:

- the company (ie, the person or adviser completing the original Form 201 “Application for Registration as an Australian Company”); or

- ASIC in transcribing it onto its own database.

What does ASIC Form 492 require?

The ASIC Form 492 requires:

-

- Company name / ACN (“Australian Company Number”)

- Lodging party details

- Details of the original document – form number e.g. Form 201 if a new company and date

- Details of correction

- dated and signed by a director or Company Secretary

Can Form 492 be lodged ‘electronically’ to fix Form 201 for a new company?

Normally, Form 492 can be lodged manually or electronically.

However, Form 494 cannot be lodged electronically if it is being used to correct details for Form 201 “Application for Registration as an Australian Company”. In that case, it is lodged manually.

A new company is incorporated via Form 201 (to start a new company). Forms 201 are lodged electronically. However, Form 492 must still be lodged manually despite the fact that Form 201 is lodged electronically.

Once you have completed the form, print the signed documents and mail them to:

Australian Securities and Investments Commission

Post Office Box 4000

Gippsland Mail Centre VIC 3841

Form 492 cannot be used to fix ‘omitted’ events

Form 492 cannot be used to notify of ‘omitted’ events. For example, you forgot to name all the directors. In those cases, a new document advising the change is lodged. This is done electronically. But, for a new company, this is after you get the ASIC Corporate Key posted to you by ASIC. You need the ASIC Corporate Key so you can log on and make those changes.

What is an “ASIC Corporate key”?

An ASIC Corporate Key is a unique identification number. Each new company in Australia gets its very own ‘key’.

The ASIC Corporate Key is not actually a key. Rather it is merely a 12-digit number that serves as a reference identifier for companies.

This is so that the company can use ASIC’s online services. It is part of ASIC’s efforts to streamline and enhance its services. It is to make it easier for companies to conduct transactions and fulfil regulatory obligations online.

The purpose of the ASIC Corporate Key:

- Uniqueness: Each company is assigned a unique Corporate Key. This ensures that every business or organisation has its distinct identifier, reducing the potential for confusion or errors in transactions and regulatory filings.

- Online Transactions: The ASIC Corporate Key is used primarily for online transactions with ASIC. It provides a secure way for the company to access ASIC’s online services, submit various forms and documents and perform administrative tasks electronically.

- Authentication and Security: The Corporate Key helps authenticate businesses when they access ASIC’s systems. It is a security measure to ensure that only authorised individuals within a registered entity can access and manage the organisation’s details and transactions.

- Updating Information: Companies use the Corporate Key to update their details with ASIC, such as changes to company addresses, directors, shareholders, and other pertinent information. This helps keep ASIC’s records accurate and up to date.

No lodgement fee for a Form 492

There is generally no lodgement fee for Form 492.

To correct a mistake in a “date” for the new company

Appropriate supporting documents are required to correct an incorrect date.

“Documents” may include:

- an email from a client to the adviser

- a copy of any company record (minutes, resolution, file note, memorandum, letter, etc) evidencing the company’s decision for the corrected date.

The copy of the information provided as evidence to support the correction to a date is duly authorised by a director or Company Secretary of the company.

How do I correct a Director’s date of birth for a newly incorporated company?

If the change relates to something like a director’s date of birth, then a certified copy of the birth certificate must be lodged together with Form 492.

How do I correct the Registered Office address for a newly formed company?

To correct the date on which the company’s Registered Office changed, a Form 492 is used and is accompanied by an extract from the relevant board minutes where it isresolved to relocate the Registered Office.

Can ASIC refuse to act on the Form 492 to fix the mistake?

Of course. ASIC can decline to act on your Form 492. There is no guarantee that ASIC accepts or acts to correct the mistake. So be polite and demure in your dealings with ASIC.

Summary of how to correct a new company with ASIC

If you need to correct a mistake on your ASIC Form 492 (Request for Correction), you send a written request to the Australian Securities and Investments Commission (ASIC). The request includes the details of the correction needed and any supporting documents.

There may be fees involved in making a correction, and the time it takes for the correction to be processed depends on the nature and complexity of the correction.