We do not set up ‘Child Maintenance Trusts’

We do not set up ‘Post-Death Testamentary Trusts’ or ‘Child Maintenance Trusts’. We cannot fix the tax problem you left behind because you failed to plan while you were alive.

Rather, this article is a cautionary tale. It explains the high taxes and legal costs your family faces if you die, with young children, without a 3-Generation Testamentary Trust Will.

What is the tax rate for a child when the parents die?

In a perfect world, you build a 3-Generation Testamentary Trust Will. Therefore, when you die, your Estate has a better tax position.

A 3-Generation Testamentary Trust Will is designed to reduce the four de facto death duties:

- Capital Gains Tax

- Stamp Duty

- Income Tax

- 32% tax on superannuation

But this is not a perfect world. People die without tax-effective Wills.

Mum’s car rolls over. She dies. Mum’s Will contains no 3-Generation Testamentary Trust. Her Non-Tax-Effective Will leaves everything to Dad.

Without a 3-Generation Testamentary Trust, the government taxes the baby’s income at 66%.

The tax villain for young children: Division 6AA

The government penalises ‘unearned’ income received by minors.

Adults have a tax-free threshold. Children do not. Under Income Tax Assessment Act 1936 (Cth) pt III div 6AA (‘ITAA 1936’), a minor pays penalty tax rates on passive income.

Passive income is income you get without working. This includes:

-

Rent from an investment property

-

Interest from a bank account

-

Dividends from shares

If a child receives more than $416 per financial year in passive income, the ATO taxes the excess at up to 66%.

This prevents parents, while they are alive, from hiding assets in their children’s names. Unfortunately, it also destroys orphans’ inheritance.

See the legislation: Income Tax Assessment Act 1936 (Cth) s 102AE.

The after-death fix: the ‘Child Maintenance Trust’

Dad survives the crash. He is the Executor. He realises Mum’s Will is non-tax effective. It is not a 3-Generation Trust Will. He knows that the income generated from Mum’s assets is taxed at 66% in the child’s hands.

Dad attempts to fix the mess. He sets up a ‘Post-Death Testamentary Trust’. Lawyers also call this a ‘Child Maintenance Trust’.

He relies on ITAA 1936 s 102AG(2)(d)(ii). This section allows the Commissioner to treat the income as ‘excepted trust income’. This means the child pays tax at adult rates, rather than penalty rates.

See the legislation: Income Tax Assessment Act 1936 (Cth) s 102AG.

Why Child Maintenance Trusts are terrible

You should never rely on a Child Maintenance Trust. They are a “poor man’s” Testamentary Trust. They are restrictive and dangerous.

Five problems with Child Maintenance Trusts

1. You must die first: You cannot set one up while you are alive. The trust must be created after death to manage the estate assets.

2. Strict time limits: Dad must create the trust within 3 years of Mum’s death. If he waits too long, the opportunity is lost.

3. The child must get the capital: In contrast to the 3-Generation Testamentary Trust, the assets stay in the trust. This protects the assets from the child’s divorce or bankruptcy. In a Child Maintenance Trust, the child must get the capital when the trust ends. If the child is undergoing a divorce or has a drug habit, they still get the cash. The asset protection is lost.

4. Court involvement: Child Maintenance Trusts are difficult to set up correctly. Often, the Executor needs Court approval to vary the Will or set up the CMT.

5. The ATO watches Child Maintenance Trusts closely. The ATO seems not to like these trusts. In Confidential Trust v Federal Commissioner of Taxation [2014] AATA 878, the Tribunal affirmed the imposition of high tax rates on minors where the trust was not properly structured. The children paid the penalty tax.

Child Maintenance Trust vs 3-Generation Testamentary Trust Will

Do not force your family to build a restrictive Child Maintenance Trust after you are dead.

Rather, build the 3-Generation Testamentary Trust Will.

The 3-Generation Trust sits dormant in your Will. It activates only when you die.

Why is tax planning in a Will better than a CMT?

1. Tax advantages: The ATO treats income from a Testamentary Trust as ‘excepted trust income’ automatically under ITAA 1936 s 102AG(2)(a)(i). Minors pay tax at adult rates.

2. Asset Protection: You do not have to give the capital to the children. You can keep the assets in the trust.

3. Divorce Protection: If your child divorces, the assets in the Testamentary Trust are harder for the Family Court to attack.

4. Bankruptcy Protection: If your child goes bankrupt, the assets remain safe in the trust.

Do not leave Estate Planning until after you die

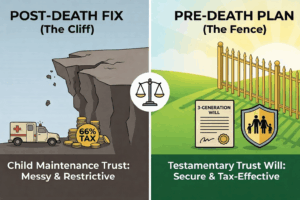

A Child Maintenance Trust is an ambulance at the bottom of a cliff. A 3-Generation Testamentary Trust Will is a fence at the top.

We do not build Child Maintenance Trusts. We do not want that work. It is messy and restrictive.

We do build 3-Generation Testamentary Trust Wills.

Start building your 3-Generation Testamentary Trust Will here.

Written by Adj Professor, Dr Brett Davies (Partner) and Madeleine Baxter (Solicitor) at Legal Consolidated Barristers & Solicitors

Free resources to help protect young and vulnerable children:

- How to Build a Will to Protect Vulnerable Children – watch free training course

- Parents lending money to children – Loan Agreements in case they divorce or go bankrupt

- Divorce Protection Trusts in Wills – in case a beneficiary, child or grandchild separates

- Making Wills for your children

- Special Disability Trusts – for disabled children in Wills

- Elder and Child Abuse – protecting the children as well

- Life Estates do NOT protect children

- Child renounces a gift or Family Trust distribution for Centrelink and stops the Trustee-in-Bankruptcy

- Child pays 32% tax on superannuation when you die

- Only disabled children can take your SMSF Reversionary Pension

- Dad’s Will: child vs charity

- Son loses the farm to his mean sisters

- Mentally disabled dad has $9m but two children and no Will!

- Court rewrites disabled Dad’s Will to protect children