Divorce Protection Trust in your Will – stop step-children taking your money at death

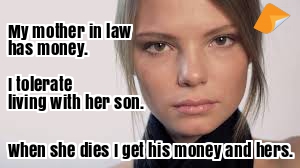

Your daughter-in-law knows you have money and that you are old. She tolerates living with your son a little longer. You die. She immediately leaves your son. She asks the Family Court for half of your son’s inheritance.

When you build your tax-effective Wills on our website the trusts available in your Wills include:

- 3-Generation Testamentary Trusts – to reduce Capital Gain Tax, Transfer duty (stamp duty) and income tax

- Superannuation Testamentary Trusts – remove the 15% or 30% (plus Medicare) tax on your Superannuation when your Superannuation goes to adult children

- Protective and Maintenance Trusts – if a child, grandchild or beneficiary is under the Age of Majority

- Bankruptcy Trusts – if a beneficiary is bankrupt

- Divorce Protection Trusts – if a beneficiary suffers a split up from a spouse or de facto partner

- Considered Person Clause – to stop people from challenging your Will

- Special Disability Trust – child keeps getting Centrelink benefits after you die

- Able to sell your parent’s home 2 to 3 years after their death – CGT-free

How does the Divorce Protection Trust work in my Will?

The Divorce Protection Trust seeks to delay or stop capital and income going to the beneficiary who is suffering a divorce or separation. It reduces the opportunity for the Family Court to get its hands on your money.

The Family Law Act gives the Family Court power over third parties. See also the Federal Court case in the West Point collapse.

In a divorce, the Family Court looks at how the assets came into the trust. It considers who gave the money to the trust in the first place.

1. If assets come from one of the couples during the relationship and are then put into a trust, the assets are considered part of the marriage. The Court is free to order the transfer of the assets to your child’s ex-spouse.

2. However, this may not apply where the money comes via a Will. Instead of your divorcing child putting money into a trust, it is you who is putting the money into the trust (via a Divorce Protection Trust). It is arguably different when the person’s parents gift their assets into a Divorce Protection Trust.

Trusts set up to limit the reach of the Family Court can be disregarded by the Family Court as a sham. However, that relates predominantly to where one of the separating couple has taken their money and tried to hide it in a trust. This is not the case here. This money is not from one of the separated couples. Rather, the money is from the parent of one of the separated couples. The money is from an inheritance of a parent, grandparent or great-grandparent. The Divorce Protection Trust is designed so that the inheritance never becomes an asset of the marriage. It is designed to be a trust for the benefit of many beneficiaries, not just the separating person.

Divorce Protection Trusts more resilient to Family Court attacks

A Divorce Protection Trust is one of the many types of Testamentary Trusts we put in your Will. There are not many cases on Testamentary Trusts. However, from our experience, the Family Court is less likely to break open a trust in a Will. Testamentary Trusts are less often plundered by the Family Courts. The Divorce Protection Trust provides further restraints to escape the Family Court. This is over and above all the other types of trusts, we put in your 3-Generation Testamentary Trust Will.

Dad dies. Son divorces 3 years later – Bernard v Bernard

In Bernard v Bernard [2019] FamCA 421 the husband and wife married in 1988. They separated in 2015. They divorced in 2017. In 2012, the husband’s father died. He leaves his estate equally to the husband and the husband’s sister. This is under two discretionary testamentary trusts. The husband is the trustee of his sister’s trust. His sister is the trustee of his trust.

Each is the primary beneficiary of their own trust. Each trust has a number of potential beneficiaries. These include the spouse, children and grandchildren of the primary beneficiary. The facts are:

- Dad dies.

- The son uses the Divorce Protection Trust in dead Dad’s Will.

- Three years later the son divorces.

Testamentary Trust provides spouse protection in a relationship breakdown. Bernard v Bernard facts:

- Divorce Protection Trust: set up in Dad’s Will

- Divorce Protection Trust name: they used the divorcing son’s name (pretty irrelevant, I know, but the family court is psychological warfare)

- Primary Beneficiary: divorcing son

- Appointor: friendly third party (often the accountant or financial adviser)

- Trustee: divorcing son’s loving sister

- Beneficiaries: the usual suspects, including the divorcing son, his children, spouses (including the divorcing wife), distant relatives, charities, etc…

Wife tries to defeat the Will’s Divorce Protection Trust

The wife argues that:

- The divorce protection trusts mirror each other.

- The husband and his sister have the same rights and obligations as trustees of each other’s divorce protection trust.

- They use the two trusts to operate a partnership.

- The husband controls his own trust as does the sister.

- The husband controlled his own trust and this control equated to ‘property of the marriage’

- According to the court, at paragraph 74 the wife’s argument is that:

- ‘The reality is the husband and his sister operate their business as a partnership and that their trusts are mirrors of each other [with both] having effective control of the assets in their trusts and therefore those assets are matrimonial property of the husband’.

- The Judge, in paragraph 81, states that the ‘facts do not support such a finding’.

Bernard v Bernard Decision: Good news: Divorce Protection Trust is not part of the matrimonial pool.

The Court held that the Divorce Protection Trust did not form part of the matrimonial pool. The divorcing wife could not touch the assets. This is because:

- Settlor (Will-maker): was dead dad, not the divorcing son.

- The trusts were established from the assets of the late father’s estate and not from property acquired by the husband either before or during his marriage to the wife. The court states in paragraph 66:

- ‘… the husband does not have legal title to any asset of the trust, nor does he have any power to appoint a trustee or appoint the assets of the fund to a beneficiary.

He is a mere beneficiary, albeit described as a primary beneficiary. The husband is dependent upon the trustee of his trust to distribute income, accumulate income, and the trustee has complete discretion in determining any distributions made by the trust.’

- ‘… the husband does not have legal title to any asset of the trust, nor does he have any power to appoint a trustee or appoint the assets of the fund to a beneficiary.

- Trustee: was the sister, not the divorcing son

- Appointor: was not the son

- Power and control: remained solely with the Appointor and Trustee (the sister). The husband is a mere beneficiary of his trust. He had no more than a right to due administration and consideration. He has no control over his sister to procure a distribution or appointment of the trust’s assets in his favour. As the trustee, his sister legitimately owed fiduciary obligations to all of the beneficiaries, not just her brother. At paragraph 96 the Court quotes Harris v Dewell [2018] Fam CAFC 94:

- ‘Control is not sufficient of itself. What is required is control over a person or entity who by reason of the powers contained in the trust deed can obtain or effect the obtaining of a beneficial interest in the property in the trust.’

- Primary Beneficiary: while the husband was a primary beneficiary, this of itself created no legal title to the trust property

- Sham? there was nothing to suggest that the structure of dead Dad’s Will was a sham

- Sister had her own Divorce Protection Trust in dead dad’s Will: that is fine. Having more than one Divorce Protection Trust in a Will is acceptable

- Good records: the Court was impressed with the accountant for his excellent records, resolutions and tax returns. Each trustee was ‘scrupulous’ in filing separate tax returns, making resolutions under the trust deed and avoiding the mingling of trust assets. Professor Brett Davies stated, “rarely does the Court see a family law matter where tax returns and disclosure is so up-to-date and thorough.”

Was the trust merely for the benefit of only the divorcing son?

This is not directly mentioned in the case. However, it is clear that the Divorce Protection Trust is not just for the sole benefit of the divorcing husband. This is not a ‘bare trust‘.

Instead, it is a trust from which many generations can share the wealth. That is one of the four requirements we put in your Divorce Protection Trust.

To help with Divorcing children: Young and Vulnerable Children tool kit

Free resources to help protect young and vulnerable children:

- Vulnerable children in Wills – free training video

- Loans to children – in case your children, grandchildren or beneficiary divorce or go bankrupt

- Divorce Protection Trusts in Wills – if a beneficiary, child or grandchild separates

- Making Wills for your children

- Special Disability Trusts – for your family members who suffer mentally after you die

- Elder Abuse – protects the children as well as people with dementia

- Life Estates do NOT protect children

- Child renounces a gift or Family Trust distribution for Centrelink and stops Trustee-in-Bankruptcy

- Children paying 32% on your super when you die

- Only disabled children can take your SMSF Reversionary Pension

- Parent dies child pays 66% tax

- Dad’s Will: child vs charity

- Son loses farm to his two sisters

- Disabled dad has $9m, two children and no Will

- Court rewrites disabled Dad’s Will to protect children

For divorce and asset protection should brothers control each other’s 3-Generation Testamentary Trusts?

Q: I completed a Legal Consolidated tax effective Will yesterday. The accountant has forwarded it to their commercial solicitors, as you suggested.

The 3-Generation Testamentary Trust Will names both sons as executors. Each receive 50%.

The commercial lawyer believes that each brother should be the respective trustee of the other’s death trusts. So, that the trustee is not also the Primary Beneficiary.

A: The commercial lawyer is smart. And I completely agree.

And you will be happy to know that the 3-Generation Testamentary Trust Will allows that strategy (and many other versions of it) to be followed. It has sufficient flexibility to allow this excellent approach which is put in place after the Will maker’s death.

Further, to buttress the protection our 3-Generation Testamentary Trust Wills also contain Bankruptcy Trusts, Divorce Protection Trusts and Special Disability Trusts.

The weaponry to protect your clients is in the 3-Generation Testamentary Trust Will. And available to be used as they see fit as their lawyer, adviser and accountant advise after the Will maker is dead.

It may be the case that the brothers hate each other when dad dies. Or a brother is dead.

This is why the number one requirement of a Will is flexibility. You do not know the hour of your client’s death. You do not know what assets the dead person will have. And we have no idea of the laws of the land. Tax, superannuation, family law and bankruptcy are forever changing. The greatest gift that a Will can give the children is ‘flexibility’. And the most flexible Will is a 3-Generation Testamentary Trust Will.

For a Divorce Protection Trust should the other child be trustee?

Q: I have two children. Is it better protection if, after I am dead, they are the Trustee or Appointor (Primary Beneficiary) of the other Testamentary Trusts? Do you recommend that each of the children be the trustee for the other’s Testamentary Trust?

And, should each of the children remain as Appointors of their own Testamentary Trusts?

For example:

- Bill is Trustee of Sue’s Trust. Sue is the Appointor and Primary Beneficiary of this Trust.

- Sue is Trustee of Bills Trust. Bill is the Appointor and Primary Beneficiary of this Trust.

I am aware of the case Bernard v Bernard. But I would like to get your practical perspective based on your Divorce Protection Trust. This is because Legal Consolidated’s Divorce Protection Trust goes one step further than the Testamentary Trust in Bernard’s case. It automatically removes the power of the Primary Beneficiary when attacked. This is very strategic.

A: The Divorce Protection Trust is designed to operate even if there is only one beneficiary in your Will. For example, your only child is Fred. When you and your spouse both die, Fred is the sole executor and the sole Primary Beneficiary. That is fine.

The wealth in your Will is left not just to Fred. But for 100s of other potential beneficiaries. The way that Legal Consolidated drafts the Divorce Protection Trust is that Fred loses control if there is activity or threat by his partner, spouse or mistress. Another person, other than Fred, takes control. That may be Fred’s company, friend or relative.

But of course, the more you muddy the water, as they did in Bernard’s case the harder it is for the divorce courts and bankruptcy courts to hand over your hard-earned money in your Will to your child’s divorcing partner. So mixing up the Trustee position is common. And the fictional Fred can do that by interposing a corporate trustee, friend or relative to hold the trusteeship. The Legal Consolidated Divorce Protection Trust authorised and allows that strategy. And Fred may well set it up that way after you are dead.

However, while the Divorce Protection Trust allows it – because it is full of flexibility – I find the strategy of having another person as the Appointor to not be the best. If you are the Appointor (or rather Primary Beneficiary, at the moment of death) then the Appointor controls the money.

If Fred is bent on removing himself as an Appointor, then his accountant would look at making a company an Appointor. Like having a company as trustee of your SMSF, the corporate trustee avoids having to transfer the titles. As would be the case if the Primary Beneficiary used a human to be the trustee of one of their Testamentary Trusts.

If a corporate trustee is used for each of the children’s Testamentary Trusts:

The beauty of the Divorce Protection Trust is the flexibility. And the fictional Fred will be guided by his accountant after you are dead. This is on how to best take advantage of the Divorce Protection Trust.

When does the Divorce Protection Trust operate?

The Divorce Protection Trust sits dormant in the dead person’s Will until needed. The Divorce Protection Trust activates for the benefit of the married person and that person’s children and grandchildren. (This is your divorcing child, then their children and their grandchildren). The assets in the Divorce Protection Trust are provided by the parents (you), not the married person (e.g. your child). Ther e is higher protection from the Family Court because of this. See, for example, Bernard v Bernard. The money is not from the divorcing couple. It is from an external person – the Will-Maker.

e is higher protection from the Family Court because of this. See, for example, Bernard v Bernard. The money is not from the divorcing couple. It is from an external person – the Will-Maker.

Your descendants (children, grandchildren and great-grandchildren) are beneficiaries of the Divorce Protection Trust but not owners of the assets.

What if a descendant controls the trust? This is where the descendant is the sole trustee or appointor. (This position of power controls the trust.) The Family Court states that the ‘controller’ is also the ‘owner’.

In these circumstances, a court may decide that it has the power to make an order affecting assets held by the trust. For example, the Court orders the transfer of the trust assets to the former spouse of the controller or to a trustee in bankruptcy.

However, the Divorce Protection Trust removes that person’s power to control the trust while they are suffering the separation. This removes control.

Who is the new Trustee of the Divorce Protection Trust?

The Primary Beneficiary under attack is automatically removed from all positions of power for their testamentary trusts. This includes the Appointor and Trustee positions. The power passes to the other executors named in the dead person’s Will – or their next of kin if they are also dead – or if there are none then blood relatives of the Primary Beneficiary. Of course, the Primary Beneficiary can always amend the Divorce Protection Trust to change this.

For example, widower Dad has 3 children. He leaves them everything and makes them the executors. Dad dies leaving 33 1/3% of the assets to his son Gavin. Ten years after dad dies Gavin separates from his hot trophy wife. Immediately his two other siblings are automatically in control of all his testamentary trusts that Gavin got from his Dad. However, one is dead and their children take on the job. They must act only in Gavin and his children’s best interests. So the siblings and their children can’t benefit themselves from the trust.

The Divorce Protection Trust benefits the current and succeeding generations. It not only protects your children. It also protects your grandchildren and grandchildren, for up to 80 years after you die. This helps protect the assets from the Family Court.

Why does the family court attack assets you ‘don’t own’?

The matrimonial pool includes:

- assets held in the parties’ individual or joint names

- businesses

- inheritances received in their personal names

- superannuation

- assets held within trust structures.

Financial resources typically include trust income or capital that the parties access.

Not all testamentary trusts protect against the powers of the Family Court. The Court has wide powers:

- power to make orders against trustees of trusts

- power to make orders that direct or alter the rights, liabilities or property interests of a third party

- power to attribute a trust as a financial resource of a party to the marriage and adjust the matrimonial pool available for distribution accordingly.

Can the family court control dead people’s estates?

Consider Hsiao v Fazarri [2020] HCA 35. The ‘Husband’ is in a relationship for 4 years. And only married for 23 days.

The Husband (58) and the Second Wife (44) start an intimate relationship. This is while the Husband is still residing with his First Wife. The Husband and Second Wife only live together intermittently. While this happened off and on for four years they are never ‘de facto’.

The Husband’s assets are high – $20m. The Husband is required to pay his Second Wife $100,000. And he is required to pay her legal fees of $80k. This brings up her assets to only $430k. She appeals this decision by the family court.

After a heart attack,

What do we learn from the Hsiao v Fazarri’s decision

- The relationship is short. Only 4 years.

- The ex-wife’s provided little both financially and non-financially.

- Her financial contribution to the asset pool is low. She had no particular claim to it.

- The ex-wife’s earning capacity did not diminish.

- There are no children.

Can the family court hear the matter if one of the parties is dead? The family court said it can.

Separated for 4 years. But wife still gets the dead father-in-law’s money

Calvin & McTier

In Calvin & McTier the rich husband and poor wife:

- marry on 2 February 2002.

- separate on 9 April 2010.

- divorce on 2 August 2011.

Their one child is born in 2005. The child is cared for equally by the two parents after the separation.

In 2014, the husband inherits $430,686 from his father. This is four years after the couple separated. And is 3 years after the divore.

Even after all these years, the judge awards 35% of the inheritance to the wife.

The husband is furious. “She bled me dry. And now she gets my Dad’s money, as well!” He appeals to a higher court.

The husband loses – the wife gets her dead father-in-law’s inheritance

In the case, Calvin & McTier [2017] FamCAFC 125 the Family Court rejects the husband’s appeal. It finds in favour of the wife.

The trial magistrate in the lower court held that the inheritance is still property available for division. The fact that the father died four years after separation does not matter.

Section 79(1) Family Law Act is all-powerful. Some would say too powerful. It gives the court power to alter property interests.

Chief Justice Bryant states that the assets from the dead father’s Will may be included in the pool of assets. This is long after separation. Multiple cases are referenced to support this.

The husband pleads further: “Look after-acquired property should only be considered if there is some nexus between the property and the marriage. My father is not part of the marriage.”

Again, the all-powerful, some would say a court without rules, strikes down the husband’s argument. The Court states that no clear connection is required.

If the dead father could go back in time, his son would have got him to put a Divorce Protection Trust in his Will. (And his Mum’s Will as well.) You can build such Wills here:

- Mutual 3-Generation Testamentary Trust Wills (all to your mother and father in the first instance)

- Single 3-Generation Testamentary Trust Will (where your parents are separated, themselves, leave everything to you and your siblings when they die)

- Bundle: Mutual 3-Generation Testamentary Trust Will with the four POAs (recommended)

- Bundle: Single 3-Generation Testamentary Trust Will with the two POAs (recommended)

All Legal Consolidated 3-Generation Testamentary Trust Wills contain Divorce Protection Trusts. Divorce Protection Trusts are automatically put into the 3-Generation Testamentary Trust Wills.

Does a Divorce Protection Trust in your Will protect your children BEFORE you die?

The Divorce Protection Trust protects your assets for up to 80 years AFTER you die. (Longer in South Australia.) It not only protects your children, grandchildren and great-grandchildren, it protects all beneficiaries and their offspring. It is not just for your children. The benefit is for all beneficiaries – whether related to you or not.

But, in this instance, your children (or beneficiaries) are divorcing and you still haven’t died. Your Will does not operate until you die. And you can change your Will. But the Famly Court can still take the ‘potential’ gift into consideration. The Family Court can therefore give more money to that horrid ex-inlaw. This is on the basis your child gets some money under your Will – at a later time, when you are dead!

What is a Prospective inheritance?

A prospective inheritance is an anticipation of getting assets in the future. The Will maker may change their Will or go bankrupt. Therefore, the courts often exclude prospective inheritances from the divorcing couple’s property pool. But it may consider such ‘expectancies’ either as a financial resource (s 75(2)(b)) or as ‘any other matter that is relevant’ (s 75(2)(o)).

Prospective inheritances are not marital property. This is because they have not been received yet. They are also ‘mere expectancies’. However, the all-powerful Family Court can factor in prospective inheritances. See, for example, White & Tulloch v White and de Angelis v de Angelis.

White & Tulloch v White (1995)

In White & Tulloch v White (1995) 19 Fam LR 696, the Wife’s mother is 81 years old. She is widowed, in reasonable health and has two children. The Husband got the Family Court to subpoena his ex-mother-in-law’s Will! Remember, the poor old lady is not dead. Sadly, her Will does NOT contain a Divorce Protection Trust.

The Full Court stated that a prospective inheritance is NOT a financial resource:

“We do not consider there is any absolute rule. The ultimate criterion is whether the evidence is, or maybe, relevant to the just and equitable process under section 79. An expectancy of inheritance will not be relevant in many s79 proceedings. In the end, relevance must depend upon the nature of the claims being put forward and the facts of the particular case.

For example, if the claims were based entirely upon contributions, it could not be suggested that an issue of expectancy could be relevant because no section 75(2) factors would be involved. Where the claim includes section 75(2) factors, the nature or degree of suggested relevance between those specific claims and the expectancy question would need to be analysed. That is to say, there must be a worthwhile connection between a specific element of the party’s case and the suggested expectancy.”

In White & Tulloch v White, we note:

- Where the Will maker has already made a Will favourable to the divorcing party but no longer has testamentary capacity and there is evidence of her likely death in circumstances where there may be a significant estate, and where there is a connection to 75(2) factors, the prospective inheritance is relevant.

- The court stated that the mother had significant property and was likely to die wealthy and give half of it to her daughter.

- The husband therefore got more money, even though his mother-in-law is not yet dead!

De Angelis states the same.

De Angelis v De Angelis

In de Angelis v de Angelis [2003] VSC 432, the court considers a wife’s expected inheritance from her aunt. The aunt had dementia and is unlikely to change her Will. The court found it fair to add the anticipated inheritance to the family assets. In other words, the ex-husband ended up getting more money because of the Aunt’s Will. This is the case even though the Aunt is not yet dead. The case:

Parties: The case involved a husband and a wife, Mr. and Mrs. De Angelis, who are getting a divorce.

Prospective Inheritance: Mrs De Angelis is expecting to receive a significant inheritance from her Aunt. Her Aunt suffers from dementia and is unlikely to change her Will.

Property Settlement: Can the husband take into account the prospective inheritance? And therefore get more money.

Court Decision: In its decision, the Family Court found that it is fair to the husband for the court to consider the wife’s anticipated inheritance. This is in determining the property settlement claim. As a result, the court added the prospective inheritance to the marital asset split!

The Court shows that a prospective inheritance is considered as part of the property settlement. If the Will had of contained a Divorce Protection Trust then the Court would have given the ex-husband less.

MacDowell v Williams (2012)

In MacDowell v Williams (2012) the wife has a prospective inheritance of over $20 million. But the Court held that there was no reason to suppose that she is likely to receive it in the near future, as her parents were still in good health and working. They could also change their Will.

A Divorce Protection Trust safeguards prospective inheritances. This trust effectively prevents the family court from including your future inheritance as part of the matrimonial property of your children and beneficiaries.