When you die do you want a specific person to replace you as a director?

Your company may be:

- special purpose company trustee of an SMSF

- corporate trustee of your Family Trust

- trustee of your Unit Trust

- trading in its own right

It is bad asset protection to have both you and your spouse as directors. Normally you only have a single director. 94% of companies set up with us since 1988 have a single director company. (Obviously, this does NOT include non-SMSF trustees. A company set up to be a trustee of a Self-Managed Superannuation Fund must have all the fund members directors.)

Control the director position? Or control the shares?

Controlling the director position is the wrong way of looking at succession planning for a company. The director is just the person who does the work of running the company. This is for the benefit of the shareholder(s). The director has no ownership of the company. Directors just look after the company.

A better question is “how do I move ‘control’ of the company to a certain person”? This is at death.

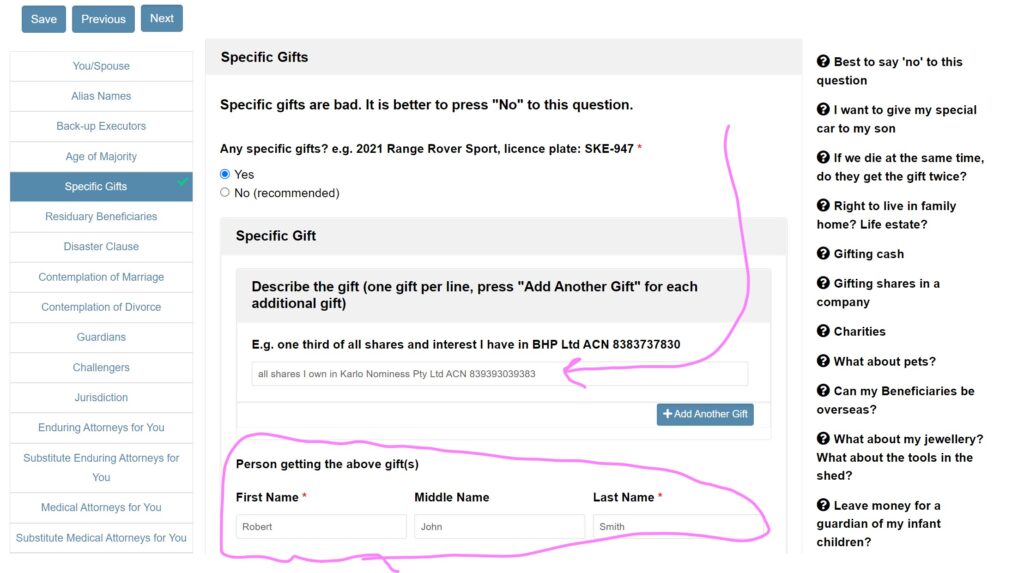

This is easily done in the “Specific Beneficiary” question as you build your Will. Just leave the shares you own to your chosen person. The chosen person then appoints themselves, or anyone they wish as directors of ‘their’ company.

Shareholders hire and fire directors. This is as they see fit. To put it another way, the director only holds that job at the whim of the shareholders. The shareholders ‘own’ the company. The director just ‘manages’ the company. And the director must act in the shareholders’ best interests at all times.

The life of a director is horrible. The directors:

- often go bankrupt if the company fails.

- are duty-bound to do the bidding of the shareholders (or risk being sacked).

- sit only at the pleasure of the shareholders.

- must always act in all of the shareholder’s best interests, at all times.

I still want to name my replacement director at my death

So after everything we told you, you still want to control who replaces you as director of the company when you die?

Interesting. It sounds like someone is trying to get some money from you to set up a complex succession structure. Speak to your own accountant, financial planner and lawyer, first, before you waste your money.

Is the right to be a director ‘property’?

Being a director is not an ‘asset’. The right for you, as a director, to appoint a replacement director is probably also not ‘property’.

Instead being a director is considered an obligation. It is a job – an office. It is a burden.

Your Will only has one job. To give away your ‘assets’. So you cannot ‘deal with’ directorships in a Will. All these Specific Gifts in a Will fail:

- “Directorship in Toorak Nominees Pty Ltd – to my son Thomas James Smith.”

- “To my wife, Louise Kelly James the directorship in Acamme Pty Ltd.”

- “The right to be Director and Chairman of the company known as Petrus Christus Nominees Pty Ltd.”

All such gifts in a Will fail.

At the moment of your death, you lose all directorship positions. To put it another way, a condition of being a director of a company is that you are living. So even if a directorship is an asset (it is not) you have nothing to give. This is because your directorship position dies with you.

Q: But does not section 201F Corporations Act allows me to nominate my replacement director at my death?

That is not correct. And it is not the purpose of the section. Section 201F states:

Section 201F Corporations Act

Special rules for the appointment of directors for single director/single shareholder proprietary companies

(1) The director of a proprietary company who is its only director and only shareholder may appoint another director by recording the appointment and signing the record.

Appointment of new director on death, mental incapacity or bankruptcy

(2) If a person who is the only director and the only shareholder of a proprietary company:

(a) dies; or

(b) cannot manage the company because of the person‘s mental incapacity;

and a personal representative or trustee is appointed to administer the person‘s estate or property, the personal representative or trustee may appoint a person as the director of the company.

(3) If:

(a) the office of the director of a proprietary company is vacated under subsection 206B(3) or (4) because of the bankruptcy of the director; and

(b) the person is the only director and the only shareholder of the company; and

(c) a trustee in bankruptcy is appointed to the person‘s property;

the trustee may appoint a person as the director of the company.

(4) A person who has a power of appointment under subsection (2) or (3) may appoint themselves as director.

(5) A person appointed as a director of a company under subsection (2), (3) or (4) holds office as if they had been appointed in the usual way.

Section 201F is a waste of time

Section 201F Corporations Act 2001 provide that, at the death of a single member/director of a proprietary company, the executor or other personal representative appointed to administer your estate may appoint a new director to the company. The new director:

- has all the powers, rights and duties of the dead director; and

- keep the company running until shares are transferred to beneficiaries who may then appoint new directors if they wish.

Section 201F only operates if your company is, at the date of your death, a one-director/one-shareholder company. This is rare. For asset protection, the high-risk ‘straw person‘ is the director. And the low-risk ‘person of substance‘ is usually the shareholder.

Secondly, I can not see much value here. Would not the ‘person of substance’ who owns the shares merely appoint a director of their choice? This person has that power both before and after your death. Nothing changes. Well, except for the fact you are dead, which is sad.

Thirdly, it is the dead person’s executor that has the right to appoint the replacement director. But, this power is subject to the shareholders. So you give the shares to the replacement director, to make this work. This again is pretty much a waste of time, since the person with the shares has the right to appoint directors anyway.

Instead, do not rely on section 201F of the Corporations Act 2001. Just specifically gift the shares to the correct people in your Will. ASIC has a similar view.

Does the Legal Consolidated company constitution allow for 201F to operate?

Yes, it does. It is a power that the Legal Consolidated Consitution does not stop. If you have a non-Legal Consolidated Constitution then speak with the lawyers that prepared the Company Constitution. Or, upgrade your Constitution.

Does the Legal Consolidated company constitution allow for ‘successor director clauses’?

A ‘successor director clause’ is a common expression in the USA. In Australia, there is no legislation regarding the use of this expression.

At Legal Consolidated we use the expression as the Americans would do. This is a two-stage process:

- a Shareholders Agreement; and

- a resolution setting out the rules when a certain director dies, and who replaces that director.

This is explained below.

For what it is worth, the Legal Consolidated company constitution allows for such resolutions. Or, to put it more correctly our constitutions do not stop the shareholders from agreeing on this amongst themselves. However, if you have a company constitution from another law firm then contact that law firm to see if that is the case. Or, upgrade your company constitution.

Q: Can I type into the company constitution who my replacement director will be?

Company constitutions do not contain that power. So do not waste your money.

Do you disagree with me?

Well, think about it. The majority shareholder just calls a General Meeting and changes the company constitution to remove the ‘replacement’ director clause.

Also, it is common, from time to time, to update the company constitution. They go out of date, much like trust deeds. In which case the special clause is lost.

Do not waste your money.

Q: Can I type into the Family Trust deed who my replacement director will be?

The Self-Managed Super Fund, family trust or unit trust only has the power to appoint or remove the company as the trustee. So nothing in these deeds helps. Nothing in those deeds controls the internal workings of the company.

I still want to name my replacement director when I die

You are certainly persistent.

There are three ways to help with this. The first way is, in your Will. Leave all the shares in the company to your proposed replacement director. Or an entity that your replacement director controls. E.g. spouse.

The second way is a Shareholders Agreement. The third way is a Company POA.

Let us consider the Shareholders’ Agreement and Company POA.

Shareholders Agreement to force the other shareholders to accept your replacement director at death.

A Shareholders Agreement is a contract between all the shareholders. Under a Legal Consolidated, new shareholders have to accept the terms of the Shareholders Agreement.

- Build a Shareholders Agreement

- Pass a unanimous irrevocable shareholders resolution that all shareholders agree that at your death your replacement director will be [Name of your Replacement Director].

- Before your death, the Replacement Director signs a “Consent to act as a Director”

Obviously, the directors are not involved in this. Their rights are subservient to the rights of the shareholders. It would probably be illegal for the directors to give those promises in any event.

Why unanimous? We do not believe a Special Resolution is enough. (A special resolution is a resolution that is passed by at least 75% of the votes cast by shareholders who are entitled to vote on the resolution.)

Company Power of Attorney

Probably, the simplest way is to merely get your company to appoint the lucky person to be a company POA. Do this before you die or become of unsound mind.

Consider also an Enduring POA. This is in case you do not die, but, rather, become of unsound mind. Therefore, the person holding the POA can exercise the voting rights for the shares you own in the company.

Succession Planning for a Self-Managed Super Fund with a corporate trustee

For a Self-Managed Superannuation Fund get rid of the whole problem by:

- setting up a Reversionary Pension

- Binding Death Benefit Nomination

Who gives me advice on succession planning for my company?

Firstly, it is often about the succession planning of the trust. For example, a Family Trust. In this case the control of the shares in a trustee company is less important.

If you wish to read my doctoral thesis on business succession planning you can do so here.

Finally, your accountant, financial planner and lawyer know you best. Take their advice before you become involved in some exotic expensive succession strategies.