| Build these Estate Planning documents online | Price |

|---|---|

| Estate Planning Bundle (Recommended) – 3G Testamentary Trust Wills, Enduring and Medical POAs | (free updates for life) |

| Last Will and Testament – reduces the 4 defacto death duties & 32% tax on your superannuation |

$495 – $975 (free updates for life) |

| Enduring Power of Attorney – stop government meddling, every Australian state & territory |

$128 (free updates for life) |

| Medical POAs, Guardianships, Directives & Medical Treatment Decision Maker – lifestyle in each state |

$128 (free updates for life) |

| Company Power of Attorney – for insane, missing and dead directors |

| Free Online Training Courses |

|---|

| Estate Planning Training Course – Free |

| Protecting Vulnerable Children in Wills Training Course – Free |

| Advisers, Licensees and Accounting Practices – Quality Assurance | Price |

|---|---|

| Standards & Accreditation – for building Estate Planning documents on our law firm’s website | $480 |

| Build additional Estate Planning documents online | Price |

|---|---|

| Contractual Will Agreement – for second marriages | $575 |

| Spouse Loan Agreement | $683 |

| Loans to Children – override Family and Bankruptcy Courts | $683 |

| Loans to Parents | $683 |

| Forgive a Debt Agreement – also gets rid of Family Trust’s UPEs | $440 |

|

Deed of Gift – survives your death |

$345 |

|

Who controls the Family Trust at death? – succession planning |

$1,100 |

| Who gets your Self-Managed Superannuation at death | $440 |

| Reversionary Kit for an SMSF keeps super going when you die | $440 |

| Vest and get rid of a Family Trust | $444 |

| Vest and wind up Unit Trust | $550 |

| Vest and wind up old Self-Managed Superannuation Fund | $585 |

Tax dead people? Australian death taxes.

Testamentary Trusts vs 3-Generation Testamentary Trusts

We prepared our first Testamentary Trust Will in May 1994. We stopped preparing them in 1997 when we invented the 3-Generation Testamentary Trust. These are the advantages:

- A 3-Generation Testamentary Trust works for the next 3 generations. Your children can pass down the 3-Generation Testamentary Trust to their children. They last for up to 80 years – longer in South Australia.

- The 3-Generation Testamentary Trust is permissive. Each beneficiary (without reference to any other beneficiary) can set up none or as many 3-Generation Testamentary Trusts as they wish.

For example, you die leaving everything equally to your three children. The first child sets up one 3-Generation Testamentary Trust for herself. The second child sets up none – just takes the money (that is not tax effective but it is their decision). The third child sets up five 3-Generation Testamentary Trusts. Why did the third child set up five trusts? You would need to ask them that question. Perhaps there were high-risk business assets and their accountant wanted to quarantine them. Perhaps they had a succession plan for their children. Perhaps some of their inheritance is going to be invested overseas.

In contrast, the Testamentary Trust is mandatory. There is one trust per beneficiary. Each beneficiary must set up the trust. That is not flexible.

- Sadly, a standard Testamentary Trust Will requires, that all assets go straight into a Testamentary Trust – it is a mandatory requirement of the Will. In contrast, in a 3-Generation Testamentary Trust Will, the beneficiaries decide what goes or does not go into a 3-Generation Testamentary Trust.

It is not always appropriate to automatically put every asset into a trust. For example, for a family home, your beneficiaries have two (often three) years to sell it and not pay any CGT on the increased value from the date of your death. However, they lose that two-year upside if you put a dead parent’s family home into a trust.

- If all the beneficiaries agree they can take specific assets without stamp duty or triggering CGT. For example, you may have $1m in shares, $1m in real estate and $1m in cash. One child wants only shares. The other only wants real estate. The youngest wants cash. Not a problem. With a 3-Generation Testamentary Trust Will, they can distribute your estate in that way and not incur any stamp duty or CGT. In contrast, with a Testamentary Trust, the children have to pay stamp duty and trigger CGT to obtain that outcome.

- Your beneficiaries can use these additional trusts which are in the 3-Generation Testamentary Trust Will:

-

- 3-Generation Testamentary Trusts – reduces CGT, income tax & stamp duty for up to 80 years from the date of death

- Superannuation Testamentary Trust – stops the 17% or 32% tax on Super going to adult children (better than a Superannuation Proceeds Trust)

- Bankruptcy Trusts – if a beneficiary is bankrupt

- Divorce Protection Trust – if a child separates stops Family Court from taking your money

- Maintenance Trust – if the beneficiary is under 18 or vulnerable

It is all about flexibility. As tax and superannuation lawyers we believe the art of preparing Wills comes down to one word: flexibility. This is because you do not know:

- when you will die

- what the tax and other laws will be

- what assets you own (upon getting dementia the children put you into a nursing home, your family home and shares are often sold)

Free storage and monitoring of your signed Wills

Your original signed Legal Consolidated Will is valuable. Keep it safe and let your Executors know where it is stored. (You may wish to email a soft copy of your Will to the Executors.)

- You can store a signed Legal Consolidated Will at home, at the bank or with the Executors.

- Alternatively, you can store your Legal Consolidated Will with another law firm that specialises in Will storage. There is no cost to you. Email admin@legalconsolidated.com.au and we will let you know how to proceed with storing your Will in that law firm’s safe custody. The other law firm monitors death notices. When you die they use best endeavours to get the original Will into your executor’s hands. They also show your executors how to administer your estate. Legal Consolidated does not provide this service. It is provided by another law firm that specialises in storing and monitoring Wills. Legal Consolidated has no involvement or relationship with the other law firm.

Should I tear up old Wills and POA’s?

You do not need to destroy old Wills. You do not need to tell anyone you made new Wills. It is a private and personal matter. Legal Consolidated Wills are drafted so that they override and replace old Wills.

However, if you have any old Wills it is best to tear them up.

The Public Trustee often gets upset when you tell them you made new Wills. They stamp their feet and demand that you send them the original Will or at least a copy. Most people tend to ignore the Public Trustee and the Victorian State Trustee.

Does a Legal Consolidated Will revoke an old Public Trustee Will?

Q: My elderly parent’s Wills are trapped with the Public Trustee. I want to make new Wills appointing myself and my brother as the executors. This is so as to not waste money with the Public Trustee.

However, my Dad is now in a hospital in palliative care. He is unlikely to return home. The Public Trustees said the new Will has to expressly render the old Will null and void.

A: Firstly, read the above article.

Secondly, all Legal Consolidated Wills automatically revoke all previous Wills. This includes Wills prepared by the Public Trustee and Victorian State Trustee.

Thirdly, the Public Trustee is worried about whether your Dad still has mental capacity. As you build your dad’s Will on our law firm’s website we:

- guide you through the question of capacity; and

- show you how to sign a Legal Consolidated Will in isolation or hospital.

This is how to build Wills for your parents.

Which Will is best: non-tax effective or 3-Generation Testamentary Trust?

If your family home, superannuation, shares and life insurance are over $1m then you should build 3-Generation Testamentary Trust Wills. However, if you can afford it you should always build 3-Generation Testamentary Trust Wills.

The 3-Generation TestametnRY Trust Wills:

- reduce the 32% tax on your Superannuation

- contain a Divorce Protection Trust if your children, grandchildren or beneficiaries get divorced

- save tax for up to 80 years from the date of your death

Is it a good idea to have more than one original signed Will?

Sorry, but that is not possible. You can only have one original signed Will. You cannot have two signed Wills. To labour the point: if you sign a Will now, and in 2 minutes’ time sign another Will then the second signed Will is the only Will in existence. When you sign a Will it automatically renders all older Will void. In contrast, you can have additional signed original POAs and, if you have a company, a Company POA.

What about POAs – can I have more than one?

Q: How do I get certified copies of POA’s to store with the POA’s so they have immediate access to the power in the event of an emergency? Is this just getting photocopies of the original document and getting a police officer to certify each page?

A: Certified copies are usually not accepted by a bank. They are never accepted by the local title office. In the cover letter that you get with each POA, it suggests that you print out two copies of each POA. But you can print out and sign more if you wish. If you want five copies of each POA then print out 5 copies and sign all of them. (As you see from above, you can only have one Will, but you can have many POAs.)

Do you have a template to jot down the assets of the Willmaker?

Your financial planner and accountant consider your assets and how they are owned. However, this is of little interest in the building of the Will. For example, if you are leaving ‘everything’ to your spouse and then everything to your children once both dead then what assets you own are not relevant. ‘Everything’ is going to your spouse. Also, as you do not know the time of your death. And, therefore, you do not know what assets you own at death.

What happens if we both die and all our children die with us?

Disaster Clause

I assume that you have young children that travel with you. The car could roll over and you and your spouse, together with your children could all die together. When you have young children select ‘yes‘ to the Disaster Clause question. Read the hints on this topic as you build the Wills.

You may, in the Disaster Clause, leave 50% of your assets to your side of the family. And the other 50% to your spouse’s side of the family. For example:

- Your Mum: 25% Your Dad 25%, Your Mum-in-law 25% and Your Dad-in-law 25%; or

- Your cousins – 50%, Your spouse’s nephews and nieces – 50%

As with most Australian Wills, there is a ‘blood-giving clause’ in all Legal Consolidated Wills. (The Latin is ‘per stirpes‘ – down the bloodline.) This is where, if a person dies before you then what they would have got goes to their children. So, for example, if your child has died before you and they themselves have children then what your child would have got goes to their children. For example:

Dad and Mum die. They leave everything to their two children: Mary and John. Sadly Mary died many years ago leaving behind Ross and Ken (your grandchildren). What Mary would have got now goes, in your Will, to your grandchildren Ross and Ken.

(Obviously, if Mary died never having had children, then her brother, John, inherits everything.)

I don’t want my grandchildren to get my money if my child dies before me

You can override the blood gifting clause. For example, you are leaving half your assets to your child John Raymond Smith. But if John dies before you then you want the gift to fail. So John outliving you becomes a condition of John (or rather John’s estate) getting any of your assets in your Will. To achieve that in the Residuary Clause after the surname Smith type in (but this gift fails if John Raymond Smith dies before me).

Eg. “Smith (but this gift fails if John Raymond Smith dies before me)”

So, in the unlikely event, your son dies before you then his 50% goes back into the ‘pot’. And the other child inherits 100% (instead of 50%).

I don’t want my grandchildren to get my money, after my child dies

So in this instance, you die. You want your child to get your wealth, but after that child dies (say, 50 years after you are dead) then you want the rest of the money, or the money that is left to go back to someone else – they may be other members of the family. For example, you love your son John, but you hate his children. In that instance, you leave John a Specific Gift called a ‘life estate’. After John dies, what is left goes to the ‘Residuary Beneficiaries’. The ‘life estate’ can be money, shares, a home etc…

Lawyers do not like Life Estates because they are not tax-friendly. Nevertheless, it is simple to put a Life Estate into a Legal Consolidated Will.

I am leaving some money in my Will to an old friend. But I want the gift to fail if he dies before me.

Now, this is a lot more common than cutting out your grandchildren. Which is the above example. You follow the same process as above. Your old friend is “Helen Hodgson”.

You type in: “Hodgson (but this gift fails if Helen Hodgson dies before me)”

I want to control my money forever. After I die I want to continue to control my money

Your accountant and financial planner will tell you to ‘stop being a control freak’. Once you leave your wealth to a person then that person decides what they will do. If you do not like that then watch the Vulnerable Children video and increase the Age of Majority for that Beneficiary to 99 years of age. And add some extra Executors into the Will. However, if your beneficiary is vulnerable (drugs, mental issues) then obviously you do need the Vulnerable Children Trust. All Legal Consolidated Wills allow you to do this.

But holding money in trust is expensive. Someone has to look after the money. Also, no one looks after money as well as you look after your own money.

If my beneficiary dies before me then I want their spouse to get the estate

For your children this is unusual. Your daughter or son-in-law has their own family. After your child dies the in-law can remarry or leave ‘your’ wealth outside your bloodline.

This is not uncommon for non-family members. So in this instance, you are leaving part of your estate to your old friend “Helen Hodgson”. You do not know Helen’s children and if Helen dies before you then you don’t want her children to inherit. But you do know Helen’s long-term boyfriend “Maxwell Remington”. And you like Max. In that instance, you answer the question:

“Hodgson (but if she dies before me then what she would have got goes to Maxwell Remington”

What happens when all the beneficiaries in the Will are dead?

So you are dead. Your spouse is dead. Your two children die before you. And your three grandchildren die before you? I assume you are in some type of war zone! If you die and your beneficiaries are dead then your Will fails. And your assets go to your next of kin, distant relatives or the Australian government.

If your beneficiaries start dying off during your lifetime then update your Will. You can update your Will for free, as often as you wish. Just email us the Tax Invoice and we will email you a voucher to update your Will.

But you may not be able to update your Will. You may forget. You may be of unsound mind. So best to put a Disaster Clause into your Will, especially if:

- your children are young and you travel with them

- your beneficiaries are all older than you, such as your parents

- you and your entire family live in a war zone

Does my Will work if my beneficiaries live out of Australia?

All Legal Consolidated Wills work. This is the case even if all your beneficiaries live outside of the Commonwealth of Australia.

You do not need to update your Will if a beneficiary changes an address or moves out of Australia.

Does my Legal Consolidated Will work in all countries in which I have assets?

Generally, yes. We draft all Wills so that they comply with the Hague Convention.

Can I see a sample of the POA and Will documents?

Yes, all our documents have a sample that you can see before you start building the document.

Can I get a list of the questions that are asked to build my Wills and POAs?

Yes, all our documents have a checklist that you can download and print.

Is a Will valid if the signing clause is on a page by itself?

Depending on the pagination of the Will, the signing clause may appear on its own page. That is common for many legal documents such as leases and Employment Contracts.

Apart from the Will, Enduring POA and Medical POA what else should I consider for my Estate Planning?

You may also consider:

- Contractual Wills Agreements – for 2nd marriages

Plus when you have a Family Trust:

- Family Trust Update with succession planning

- Deed of Debt Forgiveness to get rid of money the Family Trust owes the children

Plus when you have a Self-Managed Superannuation Fund:

Are there any Estate Planning training courses?

Yes, there are two training courses (which are currently free) you can complete online:

Our accounting house wants to develop an internal Policy for Estate Planning and building Wills online. Can you help?

Yes, dealer groups, financial planners and accounting houses can build their own Estate Planning Standard Policy here. It sets out best practice when your staff build Wills and Estate Planning documents on our law firm’s website. It also has marketing information you may wish to use.

Can each Beneficiary ‘turn on’ the different death trusts as they each see fit?

Q: The front page of the Legal Consolidated 3-Generation Testamentary Trust Will states that it contains the following trusts:

- 3-Generation Testamentary Trust

- Super Testamentary Trust

- Bankruptcy Trusts

- Protective Maintenance Trusts

- Divorce Protection Trust

- Severability Rights Protection

Does each beneficiary have the right to set up one or all of these trusts? This is independent of each other? Can the executor also set up the trusts?

A: That list is just some of the death trusts. Your Legal Consolidated Will contains many more trusts. They are discretionary and flexible. Therefore, each beneficiary sets them up as required. If a beneficiary is ‘vulnerable’, suffering a divorce etc… then the Executor will turn them on and off, as required. However, the executor always acts in the Primary Beneficiary’s best interests. Further, many trusts in our Wills can be set up many years after you die.

We are amazed, since we introduced the 3-Generation Testamentary Trust in 1994, to the flexible use of the trusts. We are often telephoned by lawyers, accountants and financial planners who excitedly tell us what they have achieved with the 3-Generation Testamentary Trust after the willmaker is dead. The different trusts and combinations of trusts are being used in ways we could never have imagined. It brings us joy and we continue to provide the greatest flexibility in our 3-Generation Testamenaty Trust Wills. We seek to empower lawyers, accountants and financial planners to continue to innovate using our 3-Generation Testamentary Trust Wills after the Willmaker is dead.

Can the Testamentary Trusts be ‘turned on’ by my family BEFORE I die?

Q: My lawyer and accountant are very excited as to what my Beneficiaries can do with the many available trusts in my Legal Consolidated Will. Can any of them be ‘turned on’, before I die?

A: I know that Testamentary Trusts are better than Family Trusts, have bankruptcy and family court etc… But your Will only starts with you die. The Will is dormant until then. All the wonderful protection in your Will is only available when you die! The ultimate sacrifice to your family!

Make sure your parents have 3-Generation Testamentary Trust Wills.

Does a beneficiary have to set up a Testamentary Trust?

Sadly, when the Will only contains a standard Testamentary Trust, the beneficiary is forced to set up a Testamentary Trust. This is when the Will maker dies. However, this is not the case with a 3-Generation Testamentary Trust. With a 3-Generation Testamentary Trust Will, each beneficiary can set up one or more Testamentary Trusts – or none.

Say the beneficiary is getting the dead person’s family home. The beneficiary is at liberty to just transfer the home directly into their name. This is without the need to set up the testamentary trust.

Is a Family Home automatically part of a Testamentary Trust?

In a standard Testamentary Trust, all assets in the dead person’s Will must go into the Testamentary Trust. This is blunt and silly. In a 3-Generation Testamentary Trust, the beneficiary has the choice. You can:

- take the asset absolutely; or

- you can put the asset in the 3-Generation Testamentary Trust.

So when your parents or spouse die you can put their family home into your name. Or you can put the family home in a testamentary trust.

There are two reasons to NOT put your dead parent’s or spouse’s home into a Testamentary Trust:

- you lose the extra 2 or 3 years to sell the home CGT free

- you may want to live in the home and retain the CGT free status

An argument to keep a family home in the testamentary trust is for asset protection, bankruptcy and divorce. If you put the asset in your own name absolutely and then go bankrupt or get divorced then the asset is lost. But if you keep the family home (or any asset) in the testamentary trust then it is protected by the Bankruptcy Trust and the Divorce Protection Trust.

Alternatively, you may be left a rental property. If you put this property in your own name and live in it then it starts to attract the principal place of residence exemption. This is from this point on.

Can a willmaker be a discretionary beneficiary of their own 3-Generation Testamentary Trust?

Yes, from a tax perspective, you can use the dead person’s generous marginal tax rates for up to 3 years from their date of death. This is for any 3-Generation Testamentary Trust.

Normally, a trustee pays the highest marginal tax rate on the trust’s net income. This is each financial year. So you would expect the Executors of the dead person’s Will to pay the highest rate of tax. This is while the executors go through the process of getting Probate and administering the Will.

But when the Executors lodge the first deceased estate trust tax return they apply for a concessional rate of tax.

The concessional rate is the same as the dead person’s income tax rate. Remarkable, this is the benefit of the full tax-free threshold.

But the concessional rate only applies for the first 3 income years from death.

To always ensure this advantage, it is not uncommon to make the Will maker themselves a discretionary beneficiary of the 3-Generation Testamentary Trust in the Will.

Who are the trustees of each of the 3-Generation Testamentary Trusts in my Will?

The Primary Beneficiary controls the trust for their percentage of your estate. To begin with, the trustee is automatically that Beneficiary. Of course, that Beneficiary can change the Trustee as that Beneficiary sees fit.

E.g. You have 4 children. They are getting 25% each after you and your spouse die. One of the children is called Beth. Upon your death, Beth is the trustee of her testamentary Trust which has a 25% interest in the trust. There is a change to the law 20 years after you die, and there are now tax incentives in making a company the trustee. Accordingly, Beth changed the trustee to a company to save tax. Thirty years later Australian tax laws change again and there are tax advances in having Beth’s children the trustee. Beth, therefore, changed the trustee from her company to her children.

What is the cost for my beneficiaries to set up and maintain 3-Generation Testamentary Trusts?

Only after you die are your beneficiaries at liberty to activate their 3-Generation Testamentary Trusts which you put in your Will all those years ago. There is no cost for them to set them up. However, your beneficiaries instruct their accountant to do yearly trust tax returns. For example, the accounting fees for my now deceased father, for the yearly tax returns on his Testamentary Trust, is $550 per year. That is what the accountant charges.

There is no cost to set up the Testamentary Trusts when you die – they are already in your 3-Generation Testamentary Trust Will. They sit dormant in your Will. When you die only then do your beneficiaries consider activating the Testamentary Trusts in your Will. That is the decision of each beneficiary. Each beneficiary independently sets up their Testamentary Trust(s) without regard to what the other beneficiaries are doing. For example, if you have 3 children then after you and your spouse die the 3 children get a third each. One child may set up 4 Testamentary Trusts for their third. The second child may activate just one Testamentary Trust. The third child activates no testamentary Trust – that child just takes the money (which would be very sad because the 3-Generation are natural tax havens.)

Q: Adult child does not want anything to do with testamentary trusts. They just want their money. They vest the trust. How is it taxed?

The advantage of a 3-Generation Testamentary Trust over the standard Testamentary Trust is that each Primary Beneficiary chooses how many testamentary trusts they wish to set up.

A beneficiary can even set up no testamentary trust. There are no tax consequences for the beneficiary doing so. There is no vesting of the trust as it is never started. However, sadly, the benefits of the 3-Generation Testamentary Trust are immediately lost. When the beneficiary comes to dispose of an asset then they have to wear the CGT and income tax. This is on their personal tax return. Just like a normal Will.

Before you decide to set up testamentary trusts from dead people’s Wills talk with your accountant and financial planner. There are major tax advantages in taking up the opportunities in 3-Generation Testamentary Trust Wills.

Q: Adult child wants to keep the 3-generation testamentary trust. But does not want to borrow the funds. Instead, they want to draw some capital. How is it taxed?

I do not think an accountant would recommend that strategy. This is of taking out money from the testamentary trust. Similarly, I do not believe that a person should, unnecessarily take out money from their superannuation. Both are wonderful tax havens and provide asset protection.

Instead, as you correctly state the beneficiary can ‘borrow’ the money from the testamentary trust. And the beneficiary can do so for no interest if they desire.

However, should the beneficiary wish to just withdraw money from the testamentary trust then they can do so. There is no tax on the money they take out.

But obviously, if the 3-Generation Testamentary Trust has income then income tax has to be paid. This is whether the proceeds are taken out of the trust or not. And obviously, if a capital asset is being sold then there is a CGT liability. This is whether the proceeds of the sale remain in the trust or are taken out.

But there are different matters. And the taxes are generally lower than a standard Testamentary Trust Will. This is because, instead of the beneficiary paying the tax on their own personal income tax, they have other beneficiaries, including young children, to pay the tax at their low or even zero tax rates.

Is Probate more complex or expensive when the Will contains Testamentary Trusts or 3-Generation Testamentary Trusts?

There is no added expense in getting Probate. Your executors can usually do their Probate online for free. This is on the Probate Office’s website.

However, there is an ongoing yearly expense in maintaining testamentary trusts. This is the fee that your accountant charges to do the trust tax return each year. However, the savings in tax is usually worth this accounting cost. They operate for up to 80 years from the date of the Will maker’s death. But a trust can be wound up in any year if it is no longer required.

What if Mum and Dad die together?

Mum and Dad only have one 12-year-old child. Their backup Executors are the child, an uncle and an aunt. The child is probably in their 60s when Mum and Dad die. In that instance, the uncle and aunt are likely to renounce their positions as executors (they may be dead themselves). But what happens if Mum and Dad both die today? In that sad situation, the only Executors are the uncle and aunt. The child cannot be an executor because the child has not yet turned 18.

What is the difference between an executor, trustee and guardian?

In a Will, the ‘executor’ and ‘trustee’ are the same thing. The executor/trustee carries out your wishes in your Will. They administer your estate. They set up the appropriate trusts. They lodge tax returns.

However, a guardian is someone who looks after your under-16-year-old children. The executor gives the guardian money to look after your young children. They can be the same people. You don’t state in the Will how much money. This is because there is a Maintenance Trust. It provides the Executor with the ability to release the correct monies for expenses that are considered to be in the child’s best interest. It is inappropriate for the Will maker to add an extra layer to this and set amounts to be paid to the child. This ‘ruling from the grave’ is not correct and is too rigid.

Executors older than you?

Q: My husband and I have appointed my father-in-law as executor. He is nearing his 70’s. For the longevity of our Wills, can we nominate two executors, or change executors? We didn’t appoint our unborn children or our 5 and 8-year-olds.

A: You should go back and read the hints on this. As Back-up Executors, you should have appointed your unborn children, and the 5 and 8-year-old. On average your children are in their 60s when you both die. In the unlikely event, that you die in the next few years, then you also put in a few additional people – this is in addition to the unborn and current children. This may be your father-in-law, and a few other people, such as your brothers and sisters. When you die, and your children are old enough these people can renounce and let your children do the job of being executors.

You can update your Wills and POAs for free. As often as you wish. But you should assume you can never update your Will again and think ahead.

What do ‘free updates’ of my Wills and POAs mean?

Once you build your Will or POAs on our law firm’s website you can update those documents for free.

Just log back in. Go to “Your Documents”. And email us the Tax Invoice. We prepare and email you a voucher.

You can change anything in your Will and POAs as you wish. There is no restriction to the changes. You can build the Will from scratch if you wish to. Or you can pick up the data from your old Will or POA that you built on our law firm’s website and just make changes to the old data.

My daughter’s name and address have changed. Do I need to update my Will?

Will makers and their beneficiaries move addresses all the time. Legal Consolidated Wills are designed so that if anyone changes their address you do not need to update your Will.

Similarly, if your daughter gets married or divorces and changes her name you do not need to update your Legal Consolidated Will.

Of course, you can update your Legal Consolidated Wills and POAs as often as you wish. For free. This is for any reason. But you do not have to update your Legal Consolidated Will if addresses change.

However, if a Will maker changes their name then they may need to update your Will. Telephone us and we can discuss it with you.

Wife still uses her maiden name. How do I deal with alias names in a Will?

Q: As an accountant, I am completing the data entry for their Estate Planning bundle. She is legally married. But still goes by her maiden name. She intends to change everything to her married name in the next 6-12 months. How do I enter the data for her Will on this basis allowing for the future name change?

A: We have been preparing Wills since 1988. I author the two main Australian textbooks on estate planning. Whenever we get a new question (this is not a new question) we put up another hint. For all our documents you can start the building process for free. There you will discover a new world of enlightenment. As a Professor in a law school, my life is one of education. Just press the “Start for free” to build your desired document. And your education begins. Enjoy this free service.

Can the people who look after my infant children (guardians) use the money in my Will to help my children?

You are better to start building the Wills. You need to embark on that journey. Read the hints and watch the training videos it answers all of these questions. But, to answer this question, of course, money can be used to protect your children. We are working on a matter at the moment where the Executors and Guardians have decided to put an aunt in the family home until the children all finish high school. But start building the Wills to get the full answer.

Guardians in the Will suffer ‘minimal financial burden’

Q: The Will states the “executor and trustees exercise such power as to ensure that the persons caring for any of my children suffer a minimal financial burden or loss as a result of caring for them.” What is generally considered a minimal financial burden? How is this determined?

A: Ask the Executors they answer that question. They control the purse strings. They must do so with only one criterion: what is in the best interests of the children. This is more than just toilet paper and Woolworth’s shop. It may be money to get married. It may be a car to get to university. It may be a carer to live with the children until they finish school. Speak to the Executors.

When a beneficiary reaches the Age of Majority does the trust ‘vest’. Or is there just a change of control?

A 3-Generation Testamentary Trust Will contains many trusts. For example, if you die with a child under 18 then the ‘Maintenance Trust’ is automatically activated. When the child turns 18 they take control of the trust. The adult child can, at any time, change the trustee. Whether the trust ‘vests’ (finishes) is a question you need to ask the child – it is their decision. However, the child is likely to continue using the Testamentary Trust because:

- there are many tax benefits.

- the child can borrow money from the trust, or buy a boat or a house. They do anything they want. The 3-Generation Testamentary Trust merely saves tax it doesn’t stop the child from using the money as that child sees fit.

- if the child, grandchild, or great-grandchild separates the wealth in the Trust is not available to the family court or the bankruptcy court. This is because there is a Divorce Protection Trust and Bankruptcy Trust in the Will.

You can increase the age of majority to above 18. You can make it 21 years of age – or even 99 years of age if the child is mentally challenged.

What happens to mortgages when I die?

Q: What happens if, when we die, there is still a mortgage attached to the properties? If we were to die soon, each house would have a $400k mortgage. Most of this ($300k) could be cancelled out using the equity from our primary residence, but what happens if there is some debt left over? Should we try to make sure there is enough cash/ insurance to wipe it out? Given there would be a lot of equity (the investment property plus half the primary residence) for a small residual debt ($100k), would the banks allow the girls to borrow to cover that debt, paying off the borrowings over time?

A: You should address this question to your beneficiaries – your children. They, themselves, make the decision as to what they do with ‘their’ new assets and debts. Usually, the executor pays out all debts first. And then transfers the properties (or whatever is left) to the beneficiaries. The net value goes to the children. The children can keep on selling assets, perhaps one of the properties to, keep reducing debt. Or a child can seek to take out a loan. I don’t know. Ask your children and they will answer this question.

Death is a default under the loan

Death is a default on the loan and the bank can demand payment within (usually) 7 days. This is unless you can rectify the default. But it is hard to come back from the dead!

The children are entitled to seek to borrow money, secured against their new assets if they wish.

I think it is a very good idea to speak to your financial planner and accountant about taking out insurance. You may also be able to do this in your superannuation fund. This often makes insurance premiums more tax-effective.

Your question suggests that you have a house for each child. That is all rather nice. But it is often the case the child no longer lives in Australia. Or does not want that particular house. In any event, you will be happy to know that because you have 3-Generation Testamentary Trust Wills your children can move the assets around. Each can have their own property. This is without triggering Capital Gains Tax or transfer (stamp) duty. You also have a Divorce Protection Trust in your Will so your assets are protected when your children, grandchildren and great-grandchildren divorce.

Beneficiaries overseas? Appoint Australian executors?

Q: A client, whose only beneficiaries are mum and dad currently living overseas. In his Will, he would like his friends to be executors. Do we also add Mum and Dad as executors so his parents can become trustees of the testamentary trust and existing family trust?

A: The beneficiaries should generally be the executors. It makes no difference that they live overseas. I would not appoint ‘friends’ to be executors. Just appoint your mum and dad. If they need help they can instruct an Australian real estate agent to sell property. They can instruct an Australian accountant to do the tax returns. The job of being an executor is normally over in a few months. So if you went against our advice and appointed your ‘friends’ then after a couple of months, once the estate is administered, then your mum and dad ‘take back control’ and look after the 3-Generation Testamentary Trusts as they wish. This begs the question of why you made the friends suffer the job of being the executors in the first place.

Family Trusts vs Wills – never the twain shall meet

Family Trusts have nothing to do with Wills. And Wills have nothing to do with Family Trusts. They have separate laws and tax rules. A Will gives away what you own. In contrast, you don’t ‘own’ the assets in your Family Trust you merely control the assets. To put in place a succession plan for a Family Trust build a “Deed of Variation to update the Appointor“.

Most of my assets are in my Family Trust

Q: My understanding is that the beneficiary’s spouse can claim the assets in my Family Trust. This is after I am dead and my child divorces. This is because such assets are not held by the trustees of the 3-Generation Testamentary trusts contained in my Will. And therefore are not protected by the Divorce Protection Trust.

It is difficult to move my assets from the Family Trust into my name or into my deceased estate. This is because of stamp duty, CGT, Unpaid Present Entitlements and Division 7A. It is also not good for asset protection.

Also, if you distribute the assets of the Family Trust, after I am dead, into my deceased estate then my Testamentary Trust loses the tax-favourable status for minor children. This is under section 102AG Income Tax Assessment Act.

However, in my case, the Family Trust has a company as the corporate Trustee. I own the shares in that corporate trustee. And, therefore, obviously, the shares in the company go into the Will. This is when I die. But that does not help me, either. This is because the Appointor in the Family Trust can sack the corporate trustee.

My last option is that I get my children’s spouses, as they come and go, to sign Binding Financial Agreements. Obviously, that only works while I am of sound mind and can keep changing my Will. Also, it seems that Binding Financial Agreements do not work anyway.

A: You are correct. It is almost impossible to fight the Family Court. Consider:

- somehow getting your wealth out of the Family Trust into your name, before death. Then it goes into your 3-Generation Testamentary Trust Will. And is then protected by the Divorce Protection Trust.

- changing the Appointor clause in the Family Trust.

And do not forget the Unpaid Present Entitlements. This is money owed by the Family Trust to a beneficiary. If you are owed money by the Family Trust then this money belongs to you. It obviously then gets into your 3-Generation Testamentary Trust Will.

What happens after 80 years?

Does it really matter? All Australian trusts vest after 80 years. See here. But for trusts in Wills, the 80-year period only starts on the date of your death. So your spouse and children are all dead by the time the 80-year period comes about. Probably your grandchildren have died of natural causes as well.

No one knows what is going to happen to Australia. We have no idea of the tax laws that will apply. It is likely that the 80-year law of perpetuity will be abolished. That is why if you narrow estate planning and Wills to one word it is ‘flexibility’. The 3-Generation Testamentary Trust is the most flexible structure you can put in a Will.

But to answer your question: under the current Australian CGT laws when a trust vests CGT is payable on those assets as if they were ‘disposed’ of. However, during the 80 year period, the beneficiaries can sell and manipulate your estate assets as they see fit. They have 80 years to plot and plan. However, generally with a 3-Generation Testamentary Trust, your beneficiaries have the highest chance of reducing CGT and stamp duty to zero. And obviously, cash can be distributed from a 3-Generation Testamentary Trust for free at any time.

Does my Will operate in all states of Australia?

Yes, we are a national law firm. You, Will, is drafted to operate in all States and Territories of Australia. Also, the Will is drafted under the Hague Convention and works in most other countries as well.

1. Address changes after I sign my Will and POAs?

An advantage of Legal Consolidated Wills, POAs and all our legal documents is that if:

- your address changes in your Wills, POAs or any other legal documents; or

- the addresses change for your executors, beneficiaries, attorneys in your POAs, attorneys and other parties in any contract

then you do not need to update your Wills, 3-Generation Testamentary Trust Wills, Enduring POA or Medical Lifestyle POAs. Your estate planning documents remain valid even if addresses change.

2. Address changes before I sign my Will and POAs?

Your address, your attorneys, your beneficiaries and your executors’ addresses must be correct at the date of signing.

What if an address changes before you get a chance to sign the Estate Planning document? Don’t waste your time signing out-of-date Wills and POAs. Update the Will or POA before you sign. You can update your Wills and POAs as often as you wish. This is for any reason for the rest of your life. Just email us your Tax Invoice. We email you a voucher to update your Wills and POAs.

Can Testamentary Trusts lend money for free?

A Trustee of a 3-Generation Testamentary Trust prepared by Legal Consolidated can lend money to anyone. The Trustee can lend money to him or herself. They can lend money to their children or strangers. They can do whatever they want. (They can just transfer the wealth out of the 3-Generation Testamentary Trust and give it away if they wish).

The money can be lent with or without a Loan Agreement. Obviously, you should prepare a Loan Agreement if you want the money back, or to protect the assets from the family court and bankruptcy court. You can lend the money at zero interest. You can lend the money at any interest rate you want. You can have the loan repayable on demand etc…

This is how we draft our 3-Generation Testamentary Trust Wills. As to non-Legal Consolidated Wills, the answer may be different.

Obviously, if a company lent money you would need a Division 7A Loan Deed. But a 3-Generation Testamentary Trust in your Will is a “Trust”. It is not a company. Even if you had a corporate trustee company holding the trust money, it is still a trust.

My wife is cheating on me. Do I update my Will now or after the divorce?

Q: When is a good time to renew the Will? When the client separates? Or after one year but is not legally separated yet and is still sorting out their financial separation and children etc?

A: Catch your spouse in bed with someone else? That night you update your Will. You do not wait for the property settlement. You do not wait for the divorce. You do not wait for 12 months to pass since you separated.

But divorce invalidate the Will?

Yes, divorce invalidates the Will. But just put a Contemplation of Divorce clause in your Will.

As you build your new Will on our website one of the questions we ask is “Are you contemplating Divorce”. If you are separating you tick yes to that question. You put in your spouse’s name. Now if you divorce your Will remains valid. And if you never actually get a divorce, then your Will is still valid.

Autistic child in Will v’s Centrelink

Q: My autistic child is on invalid support from Centrelink. He is set to inherit under my 3-Generation Testamentary Trust Will. How does it affect his Centrelink pension?

A: Best to watch the Vulnerable Children in Wills course for the full answer. The short answer is that the 3-Generation Testamentary Trust is designed to allow the Centrelink pension to be drip-fed just the right amount of income to continue to get Centrelink disability support. But let your Accountant and Financial Planner help you with how much that is.

3-Generation Testamentary Trusts Wills

We were the first lawyers in Australia to prepare Testamentary Trust wills. This was in May 1994. We stopped preparing them in 1997 when we invented the 3-Generation Testamentary Trust. These are the advantages:

- A 3-Generation Testamentary Trust works for the next 3 generations. Your children can pass down the 3-Generation Testamentary Trust to their children. They last for up to 80 years – longer in South Australia.

- The 3-Generation Testamentary Trust is permissive in nature. Each beneficiary (without reference to any other beneficiary) can set up none or as many 3-Generation Testamentary Trusts as they wish.

For example, you die leaving everything equally to your three children. The first child sets up one 3-Generation Testamentary Trust for herself. The second child sets up none – just takes the money (that is not tax effective, but it is their decision). The third child sets up five 3-Generation Testamentary Trusts. Why did the third child set up five trusts? You would need to ask them that question. Perhaps:

- there were high-risk business assets and their accountant wanted to quarantine them.

- they had a succession plan for their own children.

- some of their inheritance is going to be invested overseas.

In contrast, the old-fashioned Testamentary Trust is mandatory. There is one trust per beneficiary. Each beneficiary must set up the trust. That is not flexible.

- Sadly, a Testamentary Trust Will requires, that all assets go straight into a Testamentary Trust – it is a mandatory requirement of the Will. In contrast, in a 3-Generation Testamentary Trust Will, the beneficiaries decide what goes or does not go into a 3-Generation Testamentary Trust. It is not always appropriate to automatically put every asset into a trust. For example, for a family home, your beneficiaries have 2 (often 3) years to sell it and not pay any CGT on the increased value from the date of your death. However, they lose that 2 years upside if you put a dead parent’s family home into a trust.

- If all the beneficiaries agree they can take specific assets without stamp duty or triggering CGT. For example, you may have $1m in shares, $1m in real estate and $1m in cash. One child wants only shares. The other only wants real estate. The youngest wants cash. Not a problem. With a 3-Generation Testamentary Trust Will, they can distribute your estate in that way and not incur any stamp duty or CGT. In contrast, with a Testamentary Trust, the children have to pay stamp duty and trigger CGT to obtain that outcome.

- Your beneficiaries can use these additional trusts which are in the 3-Generation Testamentary Trust Will:

-

- 3-Generation Testamentary Trusts – reduces CGT, income tax & stamp duty for up to 80 years from the date of death

- Superannuation Testamentary Trust – stops the 17% or 32% tax on Super going to adult children (better than a Superannuation Proceeds Trust)

- Bankruptcy Trusts – if a beneficiary is bankrupt

- Divorce Protection Trust – if a child separates stops Family Court from taking your money

- Maintenance Trust – if the beneficiary is under 18 or vulnerable

It is all about flexibility. As tax and superannuation lawyers we believe the art of preparing Wills comes down to one word: flexibility. You don’t know:

- when you will die

- what the tax laws will be

- what assets you own (when the children put you into that nursing home your family home and shares are often sold)

Is there a formal process for retrieving and destroying our previous Wills and POA’s from our old lawyers?

You don’t need to destroy old Wills. You don’t need to tell anyone you made new Wills. It is a private and personal matter. You can if you wish, contact the old lawyers and ask them to destroy the old Wills. The Public Trustee often get upset when you tell them you made new Wills. They stamp their feet and demand that you send them the original Will or at least a copy. Most people tend to ignore the Public Trustee and State Trustee in Victoria’s demands – which is good advice.

We can build two types of Wills: simple or 3-Generation Testamentary Trust. Which is best?

If your family home, superannuation, shares and life insurance are over $1m then you should build 3-Generation Testamentary Trust Wills. However, if you can afford it you should always build 3-Generation Testamentary Trust Wills. They 1. reduce the 30% tax on your Superannuation 2. contain a Divorce Protection Trust in case your children, grandchildren or beneficiaries ever get divorced, and 3. generally save tax for up to 80 years from the date of your death.

Is there any value in a 3-Generation Testamentary Trust if I leave everything to my wife?

This is a common question. It comes about because when the husband dies the wife gets his superannuation without suffering the non-depenancy tax of 32%. In contrast, everyone usually pays 15% or 30%, which the Superannuation Testamentary Trust often reduces to zero. When you leave everything to your spouse the Superannuation Tesmtnery trust has no value. The question suggests that the only value of a 3-Generation Testamentary Trust is the Superannuation Testamentary Trust. That is not correct.

There are two taxing points for super from dead people:

- The first is the immediate payment of the non-dependency tax. Adult children who have a Superannuation Testamentary Trust in their dead parent’s Will and spouses often escape this death tax. I agree.

- But, what about the income generated from the proceeds of the super? Say you leave $3m in super to your spouse and it generates a yearly income of $180k. There is often no tax payable on this for the entire 80 years after you die.

Further, the 3-Generation Testamenaty Trust has a lot more than just a Superannuation Testamentary Trust. If you love your wife then you will build a 3-Generation Testamentary Trust Will. Therefore, after you die:

- if she remarries your assets are protected by the Divorce Protection Trust

- if she goes bankrupt your assets are protected by the Bankruptcy Trust

- if she loses mental capacity she is protected by both the Disability Trust and the Special Disability Trust

- the income she gets from your assets and the superannuation that was paid out to her is reduced

- the capital gains tax from the sale of your assets is reduced, often to zero

Also, your wife may die before you. In this case, your Beneficiaries gain the benefits of the 3-Generation Testamentary Trust Wills.

Is it a good idea to have more than one original signed Will?

Sorry, but that is not possible. You can only have one original signed Will. You cannot have two signed Wills. To labour the point: if you sign a Will now, and in 2 minutes time sign another Will then the second signed Will is the only Will in existence. When you sign a Will it automatically renders all older Wills null and void. In contrast, you can have many signed original POAs.

What about POAs – can I have more than one?

Q: How do I get certified copies of POA’s to store with the POA’s so they have immediate access to the power in the event of an emergency? Is this just getting photocopies of the original document and getting a police officer to certify each page?

A: Certified copies are usually not accepted by a bank. They are never accepted by the local title office. In the cover letter that you get with each POA, it suggests that you print out two copies of each POA. But you can print out and sign more if you wish. If you want 5 copies of each POA then print out 5 copies and sign all of them. (As you see from above, you can only have one Will, but you can have many POAs.)

Do you have a template to jot down the assets of the Willmaker?

Your financial planner and accountant consider your assets and how they are owned. However, this is of little interest in the building of the Will. For example, if you are leaving ‘everything’ to your spouse and then everything to your children once both dead what assets you own is not relevant. ‘Everything’ is going to your spouse. Also, as you don’t know the time of your death you do not know what assets you own at death.

What happens if we both die and all our children die with us?

I assume that you have young children that travel with you. The car could roll over and you and your spouse, together with your children could all die together. When you have young children select ‘yes’ to the Disaster Clause question. Read the hints on this topic as you build the Will.

Normally, you would, in the Disaster Clause, leave 50% of your assets to your side of the family. And the other 50% to your spouse’s side of the family. For example:

- Your Mum: 25% Your Dad 25%, Your Mum-in-law 25% and Your Dad-in-law 25%; or

- Your cousins – 50%, Your spouse’s nephews and nieces – 50%

As with most Australian Wills, there is a ‘blood-giving clause’ in all Legal Consolidated Wills. (The Latin is ‘per stirpes‘ – down the bloodline.) This is where, if a person dies before you then what they would have got goes to their children. So, for example, if your child has died before you and they have children then what your child would have got goes to their children. For example:

Dad and Mum die. They leave everything to their two children: Mary and John. Sadly, Mary died many years ago leaving behind Ross and Ken (your grandchildren). What Mary would have got now goes, in your Will, to your grandchildren Ross and Ken.

(Obviously, if Mary died never having had children, then her brother, John, would inherit everything.)

Can I see a sample of the POA and Will documents?

Yes, all our documents have a sample that you can see before you start building the document.

Can I get a list of the questions that are asked to build my Wills and POAs?

Yes, all our documents have a checklist that you can download and print.

Is a Will valid if the signing clause is on a page by itself?

Depending on the pagination of the Will, the signing clause may appear on its own page. That is common for many legal documents such as leases and Employment Contracts.

Apart from the Will, Enduring POA and Medical POA what else should I consider for my Estate Planning?

You may also consider:

- Contractual Wills Agreements – for 2nd marriages

Plus when you have a Family Trust:

- Family Trust Update with succession planning

- Deed of Debt Forgiveness to get rid of money the Family Trust owes the children

Plus when you have a Self-Managed Superannuation Fund:

Are there any Estate Planning training courses?

Yes, there are two training courses (which are currently free) you can complete online:

Our accounting house wants to develop an internal Policy for Estate Planning and building Wills online. Can you help?

Yes, for free financial planners, dealer groups and accounting houses can build their own Estate Planning Standard Policy here. It sets out best practice when your staff build Wills and Estate Planning documents on our law firm’s website. It also has marketing information you may wish to use.

Does a beneficiary have to set up a Testamentary Trust?

Sadly, when the Will only contains a standard Testamentary Trust, the beneficiary is forced to set up a Testamentary Trust. This is when the Will maker dies. However, this is not the case with a 3-Generation Testamentary Trust. With a 3-Generation Testamentary Trust Will, each beneficiary can set up one or more Testamentary Trusts – or none.

Say the beneficiary is getting the dead person’s family home. The beneficiary is at liberty to just transfer the home directly into their name. This is without the need to set up the testamentary trust.

Who are the trustees of each of the 3-Generation Testamentary Trusts in my Will?

The Primary Beneficiary controls the trust for their percentage of your estate. To begin with, the trustee is automatically that Beneficiary. Of course, that Beneficiary can change the Trustee as that Beneficiary sees fit.

E.g. You have 4 children. They are getting 25% each after you and your spouse die. One of the children is called Beth. Upon your death, Beth is the trustee of her testamentary Trust which has a 25% interest in the trust. There is a change to the law 20 years after you die, and there are now tax incentives in making a company the trustee. Accordingly, Beth changed the trustee to a company to save tax. Thirty years later Australian tax laws change again and there are tax advances in having Beth’s children the trustee. Beth, therefore, changed the trustee from her company to her children.

What is the cost for my beneficiaries to set up and maintain 3-Generation Testamentary Trusts?

Only after you die are your beneficiaries at liberty to activate their 3-Generation Testamentary Trusts which you put in your Will all those years ago. There is no cost for them to set them up. However, your beneficiaries instruct their accountant to do yearly trust tax returns. For example, the accounting fees for my now deceased father, for the yearly tax returns on his Testamentary Trust, is $550 per year. That is what the accountant charges.

There is no cost to set up the Testamentary Trusts when you die – they are already in your 3-Generation Testamentary Trust Will. They sit dormant in your Will. When you die only then do your beneficiaries consider activating the Testamentary Trusts in your Will. That is the decision of each beneficiary. Each beneficiary independently sets up their Testamentary Trust(s) without regard to what the other beneficiaries are doing. For example, if you have 3 children then after you and your spouse die the 3 children get a third each. One child may set up 4 Testamentary Trusts for their third. The second child may activate just one Testamentary Trust. The third child activates no testamentary Trust – that child just takes the money (which would be very sad because the 3-Generation are natural tax haven.)

Is Probate more complex or expensive when the Will contains Testamentary Trusts or 3-Generation Testamentary Trusts?

There is no added expense in getting Probate. Your executors can usually do their Probate online for free. This is on the Probate Office’s website.

However, there is an ongoing yearly expense in maintaining testamentary trusts. This is the fee that your accountant charges to do the trust tax return each year. However, the savings in tax is usually worth this accounting cost. They operate for up to 80 years from the date of the Will maker’s death. But a trust can be wound up in any year if it is no longer required.

What if Mum and Dad die together?

Mum and Dad only have one 12-year-old child. Their backup Executors are the child, an uncle and an aunt. The child is probably in their 60s when Mum and Dad die. In that instance, the uncle and aunt are likely to renounce their positions as executors (they may be dead themselves). But what happens if Mum and Dad both die today? In that sad situation, the only Executors are the uncle and aunt. The child cannot be an executor because the child has not yet turned 18.

What is the difference between an executor, trustee and guardian?

In a Will, the ‘executor’ and ‘trustee’ are the same thing. The executor/trustee carries out your wishes in your Will. They administer your estate. They set up the appropriate trusts. They lodge tax returns.

However, a guardian is someone who looks after your under-16-year-old children. The executor gives the guardian money to look after your young children. They can be the same persons. You don’t state in the Will how much money. This is because there is a Maintenance Trust. It provides the Executor with the ability to release the correct monies for expenses that are considered to be in the child’s best interest. It is inappropriate for the Will maker to add an extra layer to this and set amounts to be paid to the child. This ‘ruling from the grave’ is not correct and is too rigid.

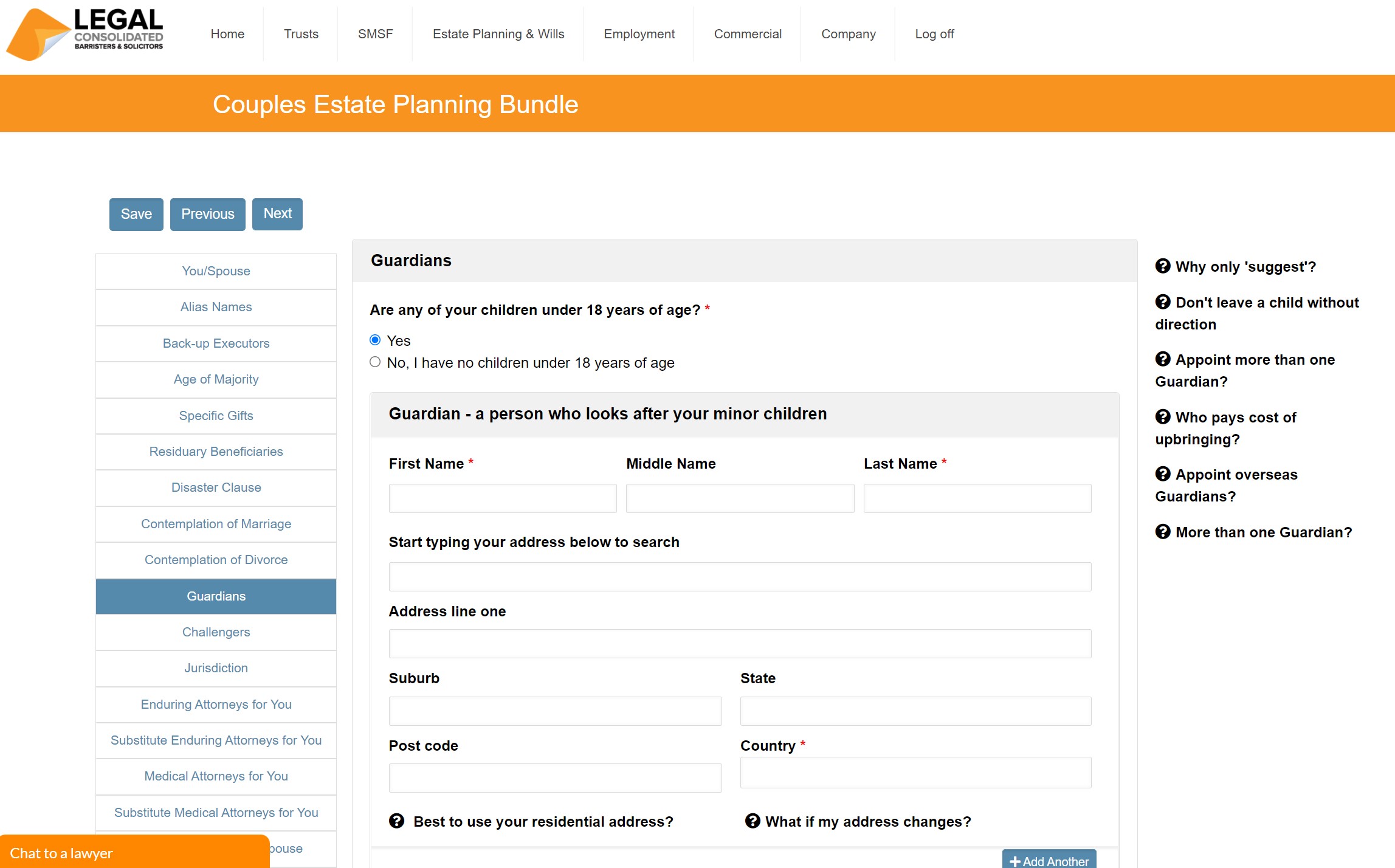

Do I name my ex-spouse, the other biological parent, as the Guardian of our young children?

As you build your Will on our law firm website you come to a question on Guardianship. This is for your young children.

The Guardians that you name in a Legal Consolidated Simple Will or 3-Generation Testamentary Trust Will only take effect after both you and the other natural parent are dead. For the Guardianship clause to work you:

- is you have to die; and

- the other biological parent is also dead.

So if your ex-spouse is still alive and of sound mind then your “ex”, usually, takes on Guardianship of your mutual minor children.

The situation is different if:

- the child is adopted out to someone else; or

- the other biological parent is fit enough to look after the minor children (your ‘ex’ may be selling drugs to children, in prison etc..)

Sure, you can name the other biological parent. This is in the Guardianship clause in your Will. But you can assume that the other parent usually takes on full-time guardianship and custody anyway.

Even if the other natural parent is alive and kicking, you should still put a Guardianship clause in your Will. This is just in case the other natural parent dies before you. Or is not fit or not willing to perform the service.

Executors older than you?

Q: My husband and I have appointed my father-in-law as executor. He is nearing his 70’s. For the longevity of our Wills, can we nominate two executors, or change executors? We didn’t appoint our unborn children or our 5 and 8-year-olds.

A: You should go back and read the hints on this. As Back-up Executors, you should have appointed your unborn children, and the 5 and 8-year-olds. On average your children are in their 60s when you both die. In the unlikely event, you die in the next few years, then you also put in a few additional people – this is in addition to the unborn and current children. This may be your father-in-law, and a few other people, such as your brothers and sisters. When you die, and your children are old enough these people can renounce and let your children do the job of being executors.

You can update your Wills and POAs for free. As often as you wish. But you should assume you can never update your Will again and think ahead.

Can the people who look after my infant children (guardians) use the money in my Will to help my children?

You are better to start building the Wills. You need to embark on that journey. Read the hints and watch the training videos it answers these questions. But, to answer this question, of course, money can be used to protect your children. We are working on a matter at the moment where the Executors and Guardians have decided to put an aunt in the family home until the children all finish high school. But start building the Wills to get the full answer.

Guardians in the Will suffer ‘minimal financial burden’

Q: The Will states the “executor and trustees exercise such power as to ensure that the persons caring for any of my children suffer a minimal financial burden or loss as a result of caring for them.” What is generally considered a minimal financial burden? How is this determined?

A: Ask the Executors they answer that question. They control the purse strings. They must do so with only one criterion: what is in the best interests of the children. This is more than just toilet paper and Woolworth’s shop. It may be money to get married. It may be a car to get to university. It may be a carer to live with the children until they finish school. Speak to the Executors.

When a beneficiary reaches the Age of Majority does the trust ‘vest’? Or is there just a change of control?

A 3-Generation Testamentary Trust Will contains many trusts. For example, if you die with a child under 18 then the ‘Maintenance Trust’ is automatically activated. When the child turns 18 they take control of the trust. The adult child can, at any time, change the trustee. Whether the trust ‘vests’ (finishes) is a question you need to ask the child – it is their decision. However, the child is likely to continue using the Testamentary Trust because:

- there are many tax benefits.

- the child can borrow money from the trust, or buy a boat or a house. They do anything they want. The 3-Generation Testamentary Trust merely saves tax it doesn’t stop the child from using the money as that child sees fit.

- if the child, grandchild or great-grandchild separates the wealth in the Trust is not available to the family court or the bankruptcy court. This is because there is a Divorce Protection Trust and Bankruptcy Trust in the Will.

You can increase the age of majority to above 18. You can make it 21 years of age – or even 99 years of age if the child is mentally challenged.

What happens to mortgages when I die?

Q: What happens if, when we die, there is still a mortgage attached to the properties? If we were to die soon, each house would have a $400k mortgage. Most of this ($300k) could be cancelled out using the equity from our primary residence, but what happens if there is some debt left over? Should we try to make sure there is enough cash/ insurance to wipe it out? Given there would be a lot of equity (the investment property plus half the primary residence) for a small residual debt ($100k), would the banks allow the girls to borrow to cover that debt, paying off the borrowings over time?

A: Your Beneficiaries will answer this question for themselves. They, themselves, decide as to what they do with ‘their’ new assets and debts. Usually, the executor pays out all debts first. And then transfers the properties (or whatever is left) to the beneficiaries. The net value goes to the children. The children can keep on selling assets, perhaps one of the properties to, keep reducing debt. Or a child can seek to take out a loan. I don’t know. Ask your children and they will answer this question.

Death is a default under the loan

Death is a default on the loan and the bank can demand payment within (usually) 7 days. This is unless you can rectify the default. But it is hard to come back from the dead!

The children are entitled to seek to borrow money, secured against their new assets if they wish.

I think it is a very good idea to speak to your financial planner and accountant about taking out insurance. You may also be able to do this in your superannuation fund. This often makes insurance premiums more tax-effective.

Your question suggests that you have a house for each child. That is all rather nice. But it is often the case the child no longer lives in Australia. Or does not want that particular house. In any event, you will be happy to know that because you have 3-Generation Testamentary Trust Wills your children can move the assets around. Each can have their own property. This is without triggering Capital Gains Tax or transfer (stamp) duty. You also have a Divorce Protection Trust in your Will so your assets are protected when your children, grandchildren and great-grandchildren divorce.

Beneficiaries overseas? Appoint Australian executors?

Q: A client, whose only beneficiaries are mum and dad currently living overseas. In his Will, he would like his friends to be executors. Do we also add Mum and Dad as executors so his parents can become trustees of the testamentary trust and existing family trust?

A: The beneficiaries should generally be the executors. It makes no difference that they live overseas. I would not appoint ‘friends’ to be executors. Just appoint your mum and dad. If they need help they can instruct an Australian real estate agent to sell property. They can instruct an Australian accountant to do the tax returns. The job of being an executor is normally over in a few months. So if you went against our advice and appointed your ‘friends’ then after a couple of months, once the estate is administered, then your mum and dad ‘take back control’ and look after the 3-Generation Testamentary Trusts as they wish. Which begs the question why you made the friends suffer the job of being the executors in the first place.

Family Trusts vs Wills – never the twain shall meet

Family Trusts have nothing to do with Wills. And Wills have nothing to do with Family Trusts. They have separate laws and tax rules. A Will gives away what you own. In contrast, you don’t ‘own’ the assets in your Family Trust you merely control the assets. To put in place a succession plan for a Family Trust build a “Deed of Variation to update the Appointor“.

What happens after 80 years?

Does it really matter? All Australian trusts vest after 80 years. See here. But for trusts in Wills, the 80 year period only starts on the date of your death. So your spouse and children are all dead by the time the 80-year period comes about. Probably your grandchildren have died of natural causes as well.

No one knows what is going to happen to Australia. We have no idea of the tax laws that will apply. It is likely that the 80-year law of perpetuity will be abolished. That is why if you narrow estate planning and Wills to one word it is ‘flexibility’. The 3-Generation Testamentary Trust is the most flexible structure you can put in a Will.

But to answer your question: under the current Australian CGT laws when a trust vests CGT is payable on those assets as if they were ‘disposed’ of. However, during the 80 year period, the beneficiaries can sell and manipulate your estate assets as they see fit. They have 80 years to plot and plan. However, generally with a 3-Generation Testamentary Trust, your beneficiaries have the highest chance of reducing CGT and stamp duty to zero. And obviously, cash can be distributed from a 3-Generation Testamentary Trust for free at any time.

Does my Will operate in all States of Australia?

Yes, we are a national law firm. You, Will, is drafted to operate in all States and Territories of Australia. Also, the Will is drafted under the Hague Convention and works in most other countries as well.

1. Address changes after I sign my Will and POAs?

An advantage of Legal Consolidated Wills, POAs and all our legal documents is that if:

- your address changes in your Wills, POAs or any other legal documents; or

- the addresses change for your executors, beneficiaries, attorneys in your POAs, attorneys and other parties in any contract

then you do not need to update your Wills, 3-Generation Testamentary Trust Wills, Enduring POA or Medical Lifestyle POAs. Your estate planning documents remain valid even if addresses change.

2. Address changes before I sign my Will and POAs?

Your address, your attorneys, your beneficiaries and your executors’ addresses must be correct at the date of signing.

What if an address changes before you get a chance to sign the Estate Planning document? Don’t waste your time signing out-of-date Wills and POAs. Update the Will or POA before you sign. You can update your Wills and POAs as often as you wish. This is for any reason for the rest of your life. Just email us your Tax Invoice. We email you a voucher to update your Wills and POAs.

Can Testamentary Trusts lend money for free?

A Trustee of a 3-Generation Testamentary Trust prepared by Legal Consolidated can lend money to anyone. The Trustee can lend money to him or herself. They can lend money to their children or strangers. They can do whatever they want. (They can just transfer the wealth out of the 3-Generation Testamentary Trust and give it away if they wish).

The money can be lent with or without a Loan Agreement. You should prepare a Loan Agreement if you want the money back, or to protect the assets from the family court and bankruptcy court. You can lend the money at zero interest. You can lend the money at any interest rate you want. You can have the loan repayable on demand etc…

This is how we draft our 3-Generation Testamentary Trust Wills. As to non-Legal Consolidated Wills, the answer may be different.

Obviously, if a company lent money you would need a Division 7A Loan Deed. But a 3-Generation Testamentary Trust in your Will is a “Trust”. It is not a company. Even if you had a corporate trustee company holding the trust money, it is still a trust.

Autistic child in Will v’s Centrelink

Q: My autistic child is on invalid support from Centrelink. He is set to inherit under my 3-Generation Testamentary Trust Will. How does it affect his Centrelink pension?

A: Best to watch the Vulnerable Children in Wills course for the full answer. The short answer is that the 3-Generation Testamentary Trust is designed to allow the Centrelink pension to be drip-fed just the right amount of income to continue to get Centrelink disability support. But let your Accountant and Financial Planner help you with how much that is.

Be of sound mind for a valid Will?

For a valid Will:

- you sign without cohesion

- over 18

- sufficient mental capacity – testamentary capacity

Tests of sound mind when making a Will – ‘testamentary capacity

Testamentary capacity when making a Will:

- sound mind, memory and understanding

- understand the effect of signing a Will and POAs (e.g. a Will gives away my worldly assets)

- know my assets (e.g. I have a home in Double Bay, NSW and a pile of BHP shares)

- know my responsibilities to my loved ones, family and friends (e.g. I have a wife and 3 children)

Get a Doctor’s Certificate at the time you sign your Will

Get a Doctor’s Certificate. It states you are of sound mind.

Get the Doctor’s Certificate as close in time to when you sign the Will or POA.

Keep the Medical Certificate with the Wills and POAs.

Are funeral wishes in a Will legally binding?