Why do I need a Gift Deed?

With a Deed of Gift you voluntarily and without payment transfer the money or gift to someone. It is evidence that you gave the money or asset away. No strings attached. It is an absolute gift. You do not want it back. And you want no payment. You want nothing. That is the very nature of a gift.

Can you challenge a Gift? Can you get back a Gift?

Did someone give you a gift? But now want it back? Did your dad give you a gift and after he died your family said it was a loan? And that you now have to pay it back? Now they want to challenge Dad’s Will.

Put the matter beyond doubt by building a Gifting Deed.

What is a ‘gift’ under Australian law?

A gift is a voluntary transfer of property from the gift-giver (Donor) to another. It is made gratuitously to the Recipient.

A Gift Deed is a document. It transfers money or property to another person.

Who is the gift-giver making the gift?

The gift-giver who makes the gift is the Donor. The person to whom the gift is made is called the Recipient (donee).

The Donor is the person that is giving away the asset. Other names for a Donor are:

-

transferor

-

gift-giver

What is a Gift Deed?

The Gift Deed is a document. It records the movement of ownership. This is over the property from one person to another. This is where the Donor requires no payment from the Recipient. The Donor gets no benefit. Well, no benefit other than a warm feeling in your stomach. For the transfer to be effective at law, both parties sign the Gifting Deed.

Gift Deeds are useful for making the Donor’s intentions clear. You can show the Deed of Gift to people who do not agree it is a gift. The Deed of Gift is evidence of an equitable transfer. A Gift Deed seeks to resolve any future misunderstandings as to who owns the property.

This is because once the gifting deed is signed, an irrevocable transfer is made to the Recipient. Thus, a Deed of Gift creates a valid and documented record of the gifting of cash or some other asset. A Deed of Gift is evidence of the movement of equitable ownership of the asset or property from the Donor to the Recipient.

What are the three legal requirements for an outright gift?

Three elements determine whether or not a gift is made:

- delivery

- donative intent by the gift-giver; and

- acceptance by the Recipient

The Legal Consolidated Gift Deed is designed to comply with these rules.

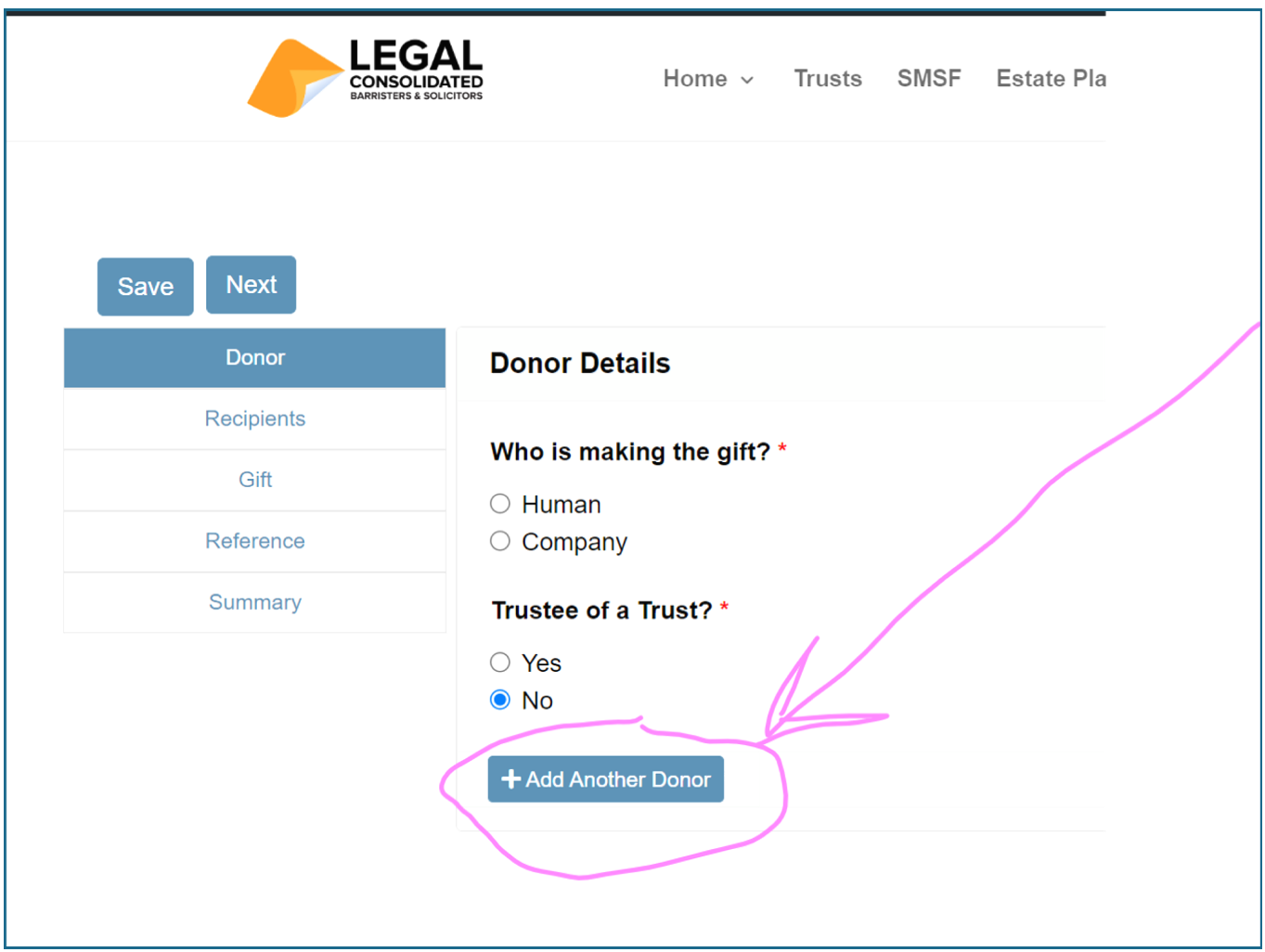

Can I have two or more Donors?

Q: My wife and I are giving money to a grandchild. Can we include both of us as the Donors? Should we?

A: Legal Consolidated allows you to have more than one Donor. You can have as many as you wish. However, this legal document needs to stand up to the Family Court, Bankruptcy Court, deceased estate challenges and Foreign Investment Review Board. The simpler the document the better.

For example, you are a business owner. All business owners and directors are at a higher risk of bankruptcy. You gift your grandchild money. You then go bankrupt, say, within 2 years. Under the bankruptcy clawback provisions the Bankruptcy Court may direct the grandchild to pay the money back to your Trustee in Bankruptcy. It may have been better for your wife, say, a primary school teacher, to have gifted the money to the grandchild.

Do not be clever. Be simple. Keep things simple. Do not look for trouble. A single Donor may be safer. Speak with your accountant.

Dangers of gifting money to two children in one Deed of Gift?

Q: To save money, can I add both of my children to the Deed of Gift as Donees? Can I add two Recipients to save time? Should I do this?

A: Legal Consolidated allows you to have more than one Recipient. You can have as many donees as you wish. However, this legal document needs to stand up to the Family Court, Bankruptcy Court, deceased estate challenges and Foreign Investment Review Board. The simpler the document the better.

Squashing two Recipients into the same Gift Agreement is never a good idea. Do two separate agreements: one for each child. Avoid complexity.

How does the Deed of Gift work?

A Deed of Gift, in Australia, is evidence. It is evidence that the money or asset is actually given to the person by the gift-giver. This is a gift. There are no strings attached.

A Deed of Gift is a deed. It is a legal document. It is signed by the donor. The donor is the person giving the money or the asset away. The Deed of Gift states that the donor voluntarily and without payment gifts the property to the recipient. The Deed of Gift transfers equitable ownership from the donor to the recipient.

1. Why use a Deed of Gift?

When someone hands something to someone ambiguity may arise. For example,

- When a father hands money or an asset to a wife or child it is considered, on the face of it, to be a gift.

- But when a wife (or child) hands money or an asset to the husband, on the face of it, it is deemed to be a loan.

There are many other strange rules. To put the matter beyond doubt the Deed of Gift clearly sets out that the transfer of the asset is a gift – with no strings attached. It is an outright gift.

2. When do I need a Deed of Gift?

You build a Deed of Gift when:

- the donor makes a gift to the recipient, and

- there are no conditions imposed in the making of the gift.

For example ‘mum and dad’ give their son a car. It is an outright gift. They don’t want the car back. And they want no money for the car. ‘Mum and dad’ are the donors. Their son is the recipient.

The opposite of a Deed of Gift is a:

- Loan Agreement

- Loan from a company to a human or a trust – Div 7A

- Parent lending money to a child

- Spouse loan agreement

Do I have to pay the loan back when the gift-giver dies?

The person giving you the gift is called a ‘donor’. The donor now dies. All debts of the donor’s estate are payable. This is to the dead person’s estate. But, because, you have a Deed of Gift you have evidence that it was not a loan. You owe the estate nothing.

The Deed of Gift legally transfers property ownership to the recipient. The transfer takes place before the Donor dies. While you can challenge a Will, you cannot challenge a Deed of Gift through the Family Provisions legislation in your local State.

This is assuming the donor is of sound mind and not forced to sign the Deed of Gift. Get a doctor’s certificate saying the Donor is of sound mind. Keep that with the Deed of Gift.

Examples of things that can be gifted in a Legal Consolidated Deed of Gift

- Cash – the sum of $35,343.93

- Real Estate – 23 Colin Street, North Melbourne being Lot 282 on Certificate of Title Volume 2828 Folio 28

- Rural Land – 2,300 acres of rural land in the Hunter Valley being Lot 383, being all the land contained Certificate of Titel Volume 283 Folio 23

- Personal Property – a painting titled “Sunset Serenity” by Sidney Nolan

- Shares or Stocks – all interest that I have in 200 shares of BHP Group Limited ACN 83839373

- Bonds – government bond with a face value of $10,000 number 283837

- Vehicles – 2024 Toyota Camry Licence Plate XID837

- Gift Cards or Vouchers – $300 gift card to JB HI-FI Group Pty Ltd ABN 37 093 114 286

- Furniture and Household Items – set of 8 antique Jarrah dining chairs (about 85 years old) by Port Jarrah Furniture

- Intellectual Property – ownership of the copyright for the book “Adventures in the Gold Coast” written in 2023 and published in 2024

- Cryptocurrency – 0.05 Bitcoin

- Savings Bonds – savings bond with a coupon face value of $50,000 number 2828373

- Livestock or Animals – purebred Australian Shepherd called Strip licence number 28383

- Antiques or Collectibles – 2012 rare vintage Gibson Les Aul guitar number 28238 circa 1982

- Business Interests – all my interest in Cane Nominees Pty Ltd ACN 83838389

- Artifacts or Historical Items – colonial-era pocket watch by Reuben Schoots

- Family Heirlooms – diamond necklace with gold inlay with 32 diamonds

- Gift a Loan Book (someone owes you money, you are giving that to someone else so that the money is now owed to, not you, but the Recipient) – all interest that I have in a Loan as the lender to the debtor being Mavis Johnson Smith as evidenced by a Loan Agreement dated 28 December 2025

- Gift of a Loan Book plus some money – all interest that I have in a Loan as the lender to the debtor being my son Colin Edwary Vuoi as evidenced by a Loan Agreement dated 17 August 2025 plus the sum of $24,083.33

Does the gift-giver have the authority to make the gift or sign the Deed of Gift?

Before you sign the Deed of Gift check with your accountant as to whether you own the gift and whether you have the authority to hand it over or even sign the Deed of Gift.

Depending on your individual circumstances, your accountant will ask questions such as:

- Does the asset being gifted belong to someone else?

- Is the money coming from a joint bank account? Are both owners of the bank account signing as Donors?

- Is the asset being held in trust for someone else? Do you have their written permission to gift it away?

- Is there an encumbrance over the asset (e.g. a mortgage or caveat)

- Is it legal to gift the asset? (is it subject to ongoing matrimonial proceedings?)

What is the difference between a Deed of Gift and a Deed of Debt Forgiveness?

They are similar. When you build them on our website both are drafted by us as ‘Deeds”. You, therefore, do not need ‘consideration’. And both are legally binding documents.

However, a Legal Consolidated Deed of Debt Forgiveness is an agreement between a creditor and a debtor. This is to forgive or release a debt owed by the debtor. The Deed formalises the process of forgiving a debt. This means the debtor is no longer obligated to repay the amount owed. The creditor decides to waive the debt for ‘natural love and affection’.

Do the Donors have the mental capacity to sign the Deed of Gift?

Any Deed of Gift can be attacked. This is by arguing that some or all the parties that signed the Deed of Gift lacked mental capacity. To sign a Deed, or enter into any legal agreement, you need to be of sound mind. To reduce the chance of someone arguing that you lack mental capacity get a doctor’s note. This is to say you are of sound mind. And keep all such doctor notes with your Deed of Gift.

The Donor needs to get a doctor’s certificate. And where the Donor is a company then the director needs to get a doctor’s certificate. This is to confirm that the director is of sound mind. To put the matter beyond doubt every human that signs the attached Deed of Gift needs to have a doctor’s certificate to say they are of sound mind. The doctor’s note should be obtained on or around the date that the attached Deed of Gift is signed.

Is the gift-giver tricked into signing the Deed of Gift?

Another way to render the Deed of Gift of no effect is to argue that the Donor did not sign the Deed freely. There is no free will.

The person making the attack argues duress, undue influence or elder abuse. Duress is when you are forced to do something against your own will.

Signing a Deed of Gift should be treated to the same high standard that is given to signing a Will. For example, the people potentially benefiting should not be anywhere near the Donors when the Donors sign. In particular, the Recipient (including their spouse and related parties) should not be in the vicinity of the Deed of Gift when it is being signed.

This reduces the argument that the Recipient brought illegitimate pressure to force the signing of the Deed of Gift.

Having separate witnesses may also be preferable.

Who should witness the signatures in a Deed of Gift?

The witnesses should be people of substance, over 18 years of age, of sound mind and not involved in the transaction. If someone challenges the validity of the Deed of Gift in the courts, then the witnesses will need to testify as to the circumstances of the signing. Who was in the room? Did the Donor look flustered or worried? What is your relationship with the Recipient?

No advice on Tax, Transfer (Stamp Duty) and other imposts and regulations

Legal Consolidated does not give any advice on the implications of this Deed of Gift or the gift itself for tax, capital gains tax, transfer (stamp duty), Centrelink, section 100A ITAA, reimbursement agreements, debt forgiveness or any other purpose.

Before signing this Deed of Gift or making any gifts speak with your accountant regarding the taxation and other consequences of making such a gift.

Also, consult with a financial planner on whether making the gift or signing the Deed of Gift is in your best interests.

Without limiting the above, we make these general comments, if you are:

- gifting money to an employee there may be Fringe Benefit Tax.

- a company gives money or assets then there may be Division 7A ITAA 1936 issues.

- on a government pension, there may be a loss of Centrelink or similar benefits under ‘deprivation’ and other rules.

- by gifting to a charity you may get a tax deduction (but if you cannot use the tax deduction it may be better to gift the money to someone that is paying tax and let them gift the money to the charity, instead).

Speak to us, your accountant and financial planner, before you sign the Gifting Deed.

What is ‘gifting’ in the eyes of the Australian government?

The Department of Human Services describes gifting as giving away assets or transferring them for less than their market value.

For example, selling or transferring for free or less than market value:

- units in a unit trust

- shares in a private company or listed company (e.g. BHP shares)

- property, land, home, factory

- car, truck and caravan

I want to explain why I am making the gift

That may be interesting, but it has no place in a formal legal document. If you have a background story then, by all means, tell the story on a separate sheet of paper. Keep it with the Deed of Gift. But, it should not be part of the Deed of Gift. And your story should have no legal force.

From what we see most such stories and explanations weaken the value of the absolute gift.

Q: Is there a place where I can explain what I am doing and why? For example, I am gifting the trust “outstanding debt” that my sons currently have with me. There are two loans and an inheritance.

A: A Loan Agreement does not set out the background or reason for the gift. This would only serve to corrupt the purity of the legal document: this is to gift something to another person and want nothing in return. ‘Stories’ like this often tell another story (excuse the pun) that damages what the Deed of Gift is designed to do.

You mention “I can explain” and then a “trust” is doing something. If you and your Family Trust are giving a gift of ‘forgiving a debt’ then you need two separate Deeds of Gifts. Do not try and put additional parties into the Deed of Gift.

You are welcome to write a note and leave it with the Deed of Gift. But the note should have no force of law. The note could damage the Deed of Gift’s effect. They usually do.

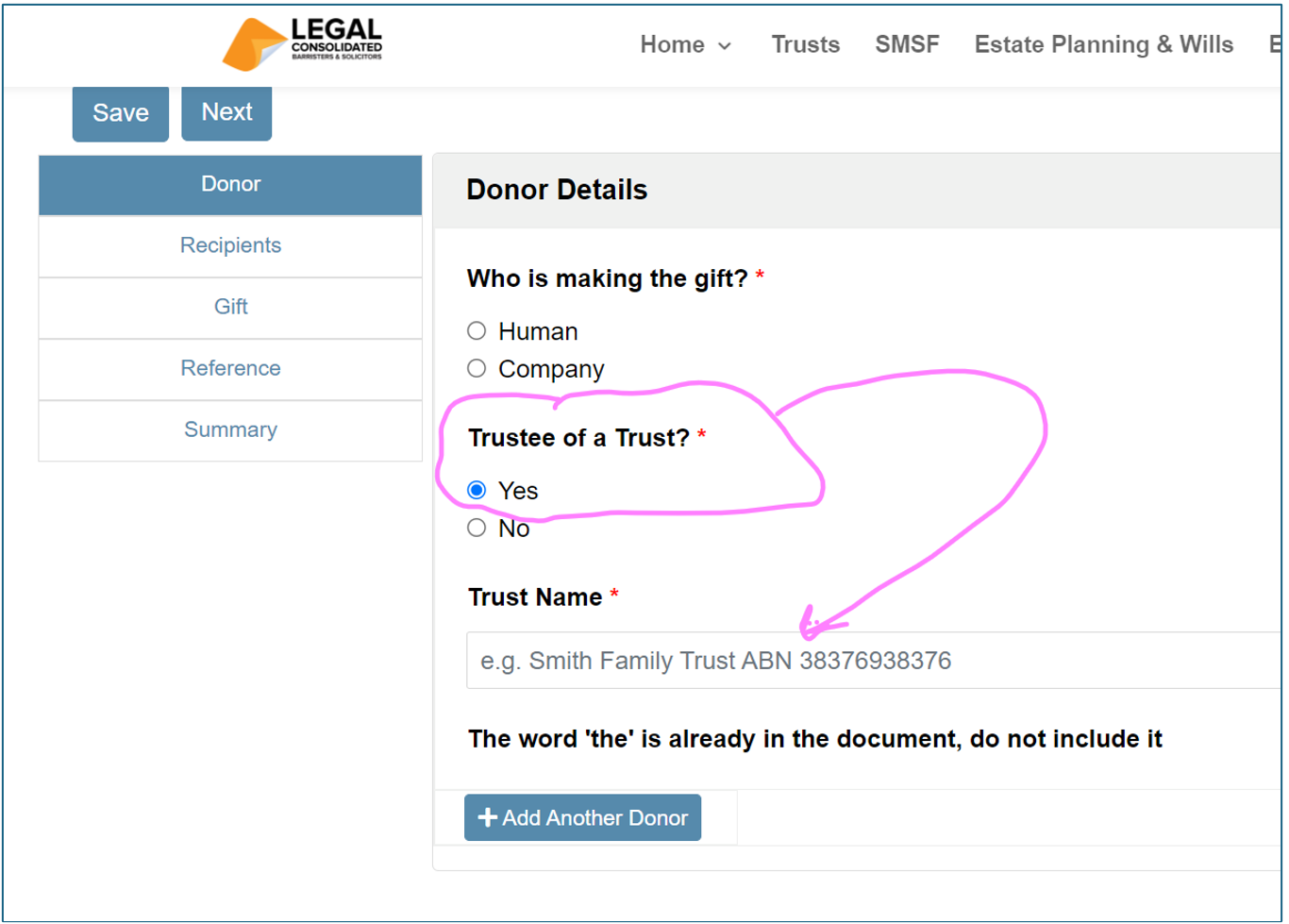

A Trust is giving a gift? Therefore, the Trustee of the Trust is the Donor

A trust only operates through a person (either a company or a human). It cannot operate without a trustee. A Trust makes a gift through its Trustee. Therefore, the Donor is the trustee of the trust. Trusts include Family Trusts, Unit Trusts and Bare Trusts.

Example: Family Trust makes a Gift – where the trustee is a company

The Trustee of the Smith Family Trust is Imperial Accounting Pty Ltd. Therefore:

- Select Company and type in Imperial Accounting Pty Ltd.

- Press Yes to ‘Trustee of a Trust’ and put in Smith Family. (If the Family Trust has an Australian Business Number then put in the ABN as well: Smith Family Trust ABN 38376938876.)

Example: Family Trust makes a Gift – the trustee of the Family Trust is a human

The Trustee of the James Bedrock Family Trust is James Colin Bedrock.

- Therefore: Select Human and type in James Colin Bedrock.

- Press Yes to ‘Trustee of a Trust’ and put in James Bedrock Family Trust. (If the Family Trust has an Australian Business Number then put in the ABN as well: James Bedrock Family Trust ABN 3837383738383.)

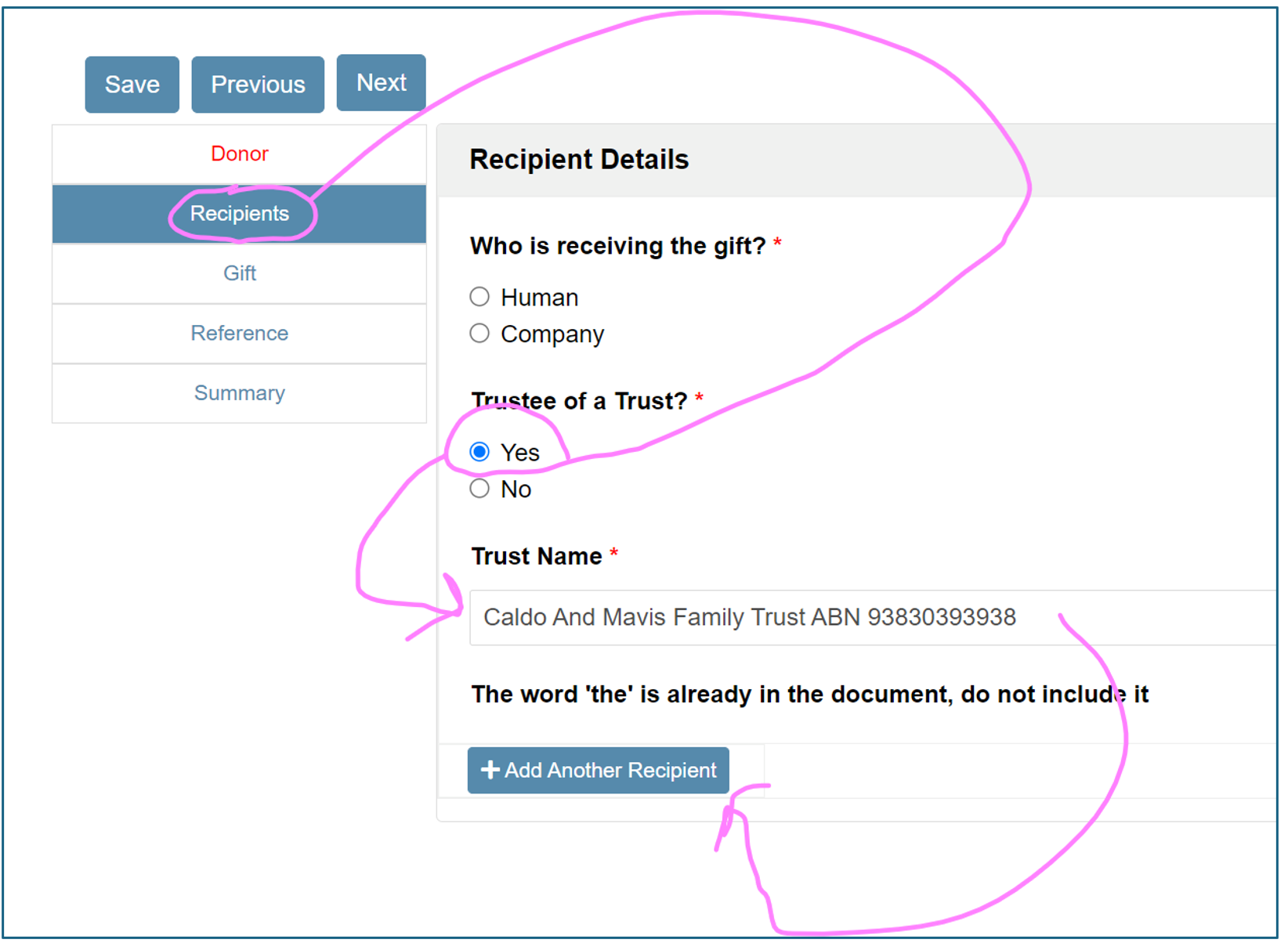

Making a gift to a trust – the Trustee of the Trust is the Recipient, acting as trustee

Here the Recipient of the gift is a Family Trust with two humans as trustees.

A trust operates through its trustee. Therefore the trustee (or trustees) is the Recipient. It is the trustee accepting the gift on behalf of the trust.

In the example diagram, Caldo and his lovely wife, Mavis, are trustees of their Family Trust “Caldo And Mavis Family Trust“. In that instance:

- For the Recipient question select Human and put in Caldo’s full name.

- Press Yes to “Trustee of Trust” and put in the trust name (and ABN if it has one).

- As there is a second human trustee, Mavis press +Add Another Recipient.

- As Mavis is also a Trustee of the same trust, Mavis must also be added as a second Recipient:

- Press Human and put in Mavis’ full name.

- Press Yes to “Trustee of a Trust” and enter the Family Trust name (as you did above).

(Interestingly, the gift may be coming from, say, Mavis, in her personal capacity. So she would be the Donor as well. Therefore, her name is in the Deed of Gift twice. This is common.)

Dad gives me money from overseas

Your Mum is sending you money from overseas. The ATO may take the view that this is income.

The Australian Transaction Reports and Analysis Centre (AUSTRAC) monitors all large flows of money into and out of Australia. All money transfer businesses in Australia are registered with AUSTRAC and comply with the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (Cth).

It passes on information about suspect transactions to the ATO and Centrelink.

Generally, if you’re an Australian resident for tax purposes and you transfer money from an overseas bank account to an Australian bank account it isn’t considered income. But to make it clear that it is a gift build this Deed of Gift where:

- Donor: Mum Full Name

- Recipient: Your Full Name

- Gift: 5,000 British Pounds

It is fine and common that the Donor is from another country. The Donor may never have been to Australia. That is also acceptable.

Build the Deed of Gift. You get the document as a PDF. Email the PDF to your Mum to sign. She then scans and emails it back to you. You sign what she sends back.

You may need to report a money transfer to government bodies. This includes the ATO, Centrelink and the Australian Transaction Reports and Analysis Centre (AUSTRAC). So even more reason, if you are audited by the ATO, to put a Deed of Gift in place.

Sending money to my overseas parents – financial support to loved ones abroad,

You love your parents. They live outside of Australia. You want to send them money. Why not, you live in the best country in the World: Australia. The Australian government and the ATO want to know all about this. Put their mind at ease by clearly documenting what you are doing. Build a Deed of Gift:

- Donor: Your Full Name

- Recipient: Dad’s Full Name

- Gift: AUS$50,000

It is fine that your Dad has never been to Australia.

Whether you’re buying property in London, making an investment in the USA or paying for a destination wedding in Italy, sending large sums of money in and out of Australia doesn’t come without thought. Protect yourself with a Deed of Gift.

What does the Deed of Gift contain?

- Our law firm’s letter of advice on our law firm’s letterhead and signed by one of our partners

- The Deed of Gift Document

A Deed of Gift requires ‘consideration’

‘Consideration’ is when someone pays you for what you are getting. For example, if you sell a car for $30,000 then the consideration for the car is $30,000.

To be legal an agreement requires ‘consideration’.

But with a gift, there is no consideration. However, that is fine if you sign the legal document as a ‘deed’. Your Legal Consolidated Deed of Gift is drafted as a deed. It seeks to be legally binding without the need for ‘consideration’.

But I got the gift last year – can Deeds of Gift work for past gifts

It is better to sign the Deed of Gift before you hand over the asset. But, the Deed of Gift may still work even though the Donor handed over the asset in the past. It is never too late to sign a Deed of Gift. But it is less likely to stand up against bankruptcy and the family court.

Also, the doctor’s certificate to say that the Donor is of sound mind is weaker. There is now a substantial time gap between the signing by the Donor of the Deed of Gift and the note from the doctor saying the Donor is of sound mind.

Deed of Gift of real estate – Capital Gains Tax

While we are not giving the Donor taxation advice, we make the general comment that if you gift Australian real estate you usually still get the main residence exemption. This is provided that you are eligible for the CGT exemption on your family home. Your family home exemption may still apply. Check with your accountant before signing the Deed of Gift.

If it is not your family home then you pay Capital Gains Tax. CGT is payable on:

- what you ‘sell’ the property for; or

- what it is worth.

whichever is the higher amount.

Even if you receive nothing for your property, you are taken to have received its ‘market value’ at the time you ‘disposed’ of it.

This means you pay capital gains tax on any capital gain for the part of the property that was not exempt.

CGT applies to many assets, not just real estate. For example, shares, units in a Unit Trust and an interest in a partnership also suffer CGT. This is the case even if you ‘give’ the asset away.

Usually, the Donor is responsible for the CGT. The Recipient (donee) is not normally the one liable for the Capital Gains Tax.

(Special Disability Trusts often do not pay CGT. If you transfer real estate to the trustee of a special disability trust for no consideration, any capital gain or loss is often disregarded.)

Again the tax issues are complex. Speak to your accountant and financial planner before you sign the Deed of Gift.

Stamp Duty on real estate via a Deed of Gift

When you transfer the value of the real estate the person getting the gift pays stamp duty. Stamp duty, depending on the state, is called: transfer duty, duty or stamp duty. Across Australia, this duty is about 4.5%. It is on the price you sold the property for or the market value. It is the higher amount. So if you (Donor) ‘gave away’ the asset the person getting the asset (Recipient) is usually responsible for the transfer duty.

These issues are complex and peculiar to each Australian state and territory. Get advice from your accountant and financial planner before you sign the Deed of Gift.

Legal Consolidated only acts for the first-named Donor in the Deed of Gift. All other persons, including the Recipient, need to seek their own legal advice from their own lawyer.

Why is there CGT? I gave the real estate away for free!

You gifted a $3m house via a Deed of Gift. The ‘price’ you ‘sold’ the property for is zero. But the market value is $3m:

- CGT: Many years ago you paid $1m for the house. But it is worth $3m on the market. But you gave it away. Surely, CGT on zero should be zero? That is not correct. The ATO deems you to have disposed of the asset for $3m (even though you gave it away). You still add $2m on your income tax return as the capital gain.

- Transfer (Stamp) Duty: The person getting the gift pays the transfer (stamp) duty. The Recipient pays the stamp duty. Stamp duty is roughly about 4.5% in each state. So, 4.5% of $3m is $135,000. So the person that got the property from you ‘for free’ pays $135,000 in stamp duty. This is paid on the Deed of Gift.

These are general examples only. You need to talk with your accountant about your own set of facts. Everyone is different.

Legal Consolidated does not give advice on the taxation aspects of a Deed of Gift. The information is of a general nature. Speak with your conveyancing lawyer and accountant if you need help.

Example of a gift of a ‘family home’ – Gifting Deed

Dad gifts his family home to his eldest daughter, Joanne. The home is worth $1,000,000. Joanne, by law, must take the Deed of Gift to that state stamp duty office in that state. And she pays about $45,000 in (transfer) duty.

But her dad, John, pays no Capital Gains Tax. This is because in this instance (but not in all instances) there is no CGT when a family home is given away. (There is, also, no CGT on a family home when it is sold. But that is another story.)

These are general examples only. You need to talk with your accountant about your own set of facts. Everyone is different.

Stamp duty and CGT on a gift of a property to a Family Trust

Q: Professor Davies, I own a piece of real estate. I am going to gift the real estate. This is from me to my Family Trust. I am the Appointor, Trustee and Specified Beneficiary of the Family Trust. The transfer is via a Deed of Gift. Surely, you are not suggesting that I have to pay CGT? And the Family Trust has to pay stamp duty?

A: We do not provide any taxation or revenue advice on the Legal Consolidated Deed of Gift. We cannot give specific advice because we do not know your individual circumstances.

Generally, I am sorry to tell you but, yes, there is CGT and stamp duty. If you originally acquired the property for $800k and it is now $1.2m. Then you pay CGT on $400k. This is the capital gain. Sure, you got no money for the property. But you still pay capital gain on the $400, regardless.

And to add insult to injury your Family Trust pays stamp duty of about 4.5% on the full $1.2m. Your Family Trust writes a cheque to the State government for about $54,000.

But speak to your accountant about your specific circumstances.

ATO attacks undeclared foreign income disguised as gifts or loans from related overseas entities

We do not provide tax advice on the Deed of Gift or your specific set of circumstances. The information below is of a general nature only. We are an Australian law firm. We do not give advice on matters or laws related outside of Australia.

The ATO reviews, audits and actively engages with taxpayers who enter into arrangements. This is where taxpayers are aware of their residency status. But attempt to avoid or evade tax on their foreign assessable income. This is by concealing the character of funds upon the money coming to Australia. This is by disguising the funds received as a gift, or a loan, from a related overseas entity.

If the money from overseas is income in your hands then you need to declare that income to the ATO when you lodge your tax returns. A Deed of Gift does not magically turn income (which is taxable) into a non-taxable gift.

Relevant arrangements described in Taxpayer Alert TA 2021/2:

- An Australian resident taxpayer derives foreign assessable income and does not declare it in their Australian income tax return. The amounts derived may be:

- actual amounts of foreign assessable income, such as income from employment, interest, dividends, or a capital gain on the disposal of assets, such as shares in a foreign company

- deemed amounts of foreign assessable income, such as amounts assessable under the:

- controlled foreign company (CFC) provisions in Pt X of ITAA 1936; or

- transferor trust provisions in Div 6AAA of Pt III, or

- amounts assessable as dividends: s 47A or Div 7A of Pt III of ITAA 1936 applying

- amounts from trusts assessable: s 99B of ITAA 1936.

- The foreign assessable income is sent to the taxpayer in Australia (or an associate). The repatriation is achieved by:

- a ‘related overseas entity’ (e.g. your dad) transferring the funds directly to the taxpayer (or an associate); or

- using the services of an offshore financial intermediary to transfer the funds.

The ‘related overseas entity’ is often a family member, a friend or an associate such as a related company and trust.

- The foreign assessable income is sent in a single lump sum or in instalments.

- The repatriation of the foreign assessable income may occur in:

- the income year in which it is derived;

- in a later income year; or

- over the course of several income years.

- The true character of the foreign assessable income is concealed. This is upon its sending to Australia. This is under the guise that the foreign assessable income is instead a gift or a loan from the related overseas entity.

- In some cases, documents are prepared. They seek to show that the repatriated funds are a gift or a loan. But the objectively ascertainable facts do not support that characterisation.

- Examples include:

- where the parties may not have acted in a way that is consistent with the documented agreement; or

- in the case of a purported loan, where the terms of the documented agreement lack commercial explanation.

- the repatriated amounts might be properly characterised as a genuine gift or loan but the objectively ascertainable facts demonstrate that the gift or loan is connected or related to foreign assessable income which has not been declared in Australian tax returns.

- Examples include:

- Where the purported loan is used by the Australian resident taxpayer for the purposes of gaining or producing assessable income, the taxpayer claims a deduction for amounts of interest that are said to have incurred. Although withholding tax calculated upon the amount of the claimed interest incurred may be remitted to the ATO, often no amount of interest or principal is ever paid to the related overseas entity. Instead, the claimed interest liability is capitalised resulting in continuously increasing claims for deductions for the purported interest liability.

- When these transactions are identified or audited, the Australian resident taxpayer may subsequently admit that the funds were not actually received as gifts or loans but claim that they were instead disguised transfers of funds from other sources in offshore jurisdictions, including to avoid laws in other countries. However, no evidence is then provided as to an alternative, non-assessable, underlying source of the funds or how the purported method of fund extraction is required to successfully avoid foreign laws.

As part of the process of undertaking reviews, audits and actively engaging with taxpayers who enter into these arrangements, the ATO is using its exchange of information powers to gather information from other countries. This includes the foreign assessable income derived by taxpayers in those countries.

The ATO also use other sources of information, such as data from the Australian Transaction Reports and Analysis Centre (AUSTRAC). AUSTRAC identifies movements of funds into Australia as well as the data it receives via the Common Reporting Standard and the Foreign Account Tax Compliance Act.

Penalties apply to participants in, and promoters of, this type of arrangement. This includes serious penalties under Division 290 of Schedule 1 Taxation Administration Act 1953 for promoters. In more serious cases, sanctions under criminal law may apply.

Registered tax agents involved in the promotion of this type of arrangement are referred to the Tax Practitioners Board. This is to consider whether there is a breach of the Tax Agent Services Act 2009.

Legal Consolidated warns that lawyers, accountants and financial planners must be vigilant to not inadvertently become involved in this loss of tax revenue for Australia.

Interest derived from money you have overseas is not a ‘gift’. It is assessable as income

Interest earned on your foreign bank account is assessable. See Dezfoolian and Fed Commissioner of Tax [2021] AATA 3991 (AAT, Olding SM, 29 October 2021).

Facts of Dezfoolian and Fed Commissioner of Tax

The taxpayer is an Australian resident. In 2011, he transferred $180,000 from his Australian bank account to an account with an Iranian bank. He hopes to benefit from higher interest rates on offer in Iran.

The Iranian bank periodically credits interest to the taxpayer’s account.

Sadly for the taxpayer, the Iranian currency crashed. In October 2018 he returned most of the funds back to Australian dollars. And these Australian dollars are transferred to his Australian bank account.

The taxpayer fails to include in his Australian income tax returns the interest credited to his account. This is by the Iranian bank.

The ATO does an audit. The ATO issues assessments treating the undeclared interest as assessable income. The ATO also imposes penalties for the income years after the taxpayer removed the funds from the Iranian bank (2019 and 2020) as he wrongly returns his foreign exchange losses as gifts or donations.

By doing so, the taxpayer reduces his assessable income by the amount of the losses he claimed in 2019 and the amount he treated as carried forward losses in 2020. There was in any event no tax shortfall in the 2019 income year.

The decision of Dezfoolian and the Federal Commissioner of Tax

Obviously, the AAT confirms the ATO assessments. This is for the interest derived by an Australian resident. It is clearly assessable. The source of the interest is irrelevant. Australian taxpayers are taxed on worldwide income. However, the ATO accepts that the interest should be converted to Australian dollars. This is using a more favourable exchange rate than the one the ATO used in assessing the taxpayer.

What about the penalties? Again, the taxpayer fails to show that he had exercised reasonable care in preparing his 2019 and 2020 returns. The onus to prove is, sadly and unfairly, on the taxpayer.

The AAT points out that the taxpayer had previously been told of the correct treatment of foreign exchange losses and there is no evidence of the taxpayer actually making any enquiries at all. He seems to have spoken neither to the ATO nor his accountant. This is about the proper treatment of the foreign exchange losses and the preparation of his returns.

The AAT also said there were no grounds to remit the penalties. This is even though there is no tax shortfall for 2019. The taxpayer must ensure that his returns are accurate. But the evidence shows that “he took little effort to do so and was more intent on claiming what he considered to be the appropriate tax treatment”.

The taxpayer must prove it was a ‘gift’ from overseas

Where a taxpayer receives a gift from a foreign-related entity, the onus is on the taxpayer. This is to substantiate the position that this gift is a genuine gift. And that it is not an arrangement that falls foul of the Taxpayer Alert 2021/2.

The ATO is not focused on ‘genuine’ gifts

The ATO is not focused on arrangements where you derive no foreign assessable income. This is where you received a genuine gift or genuine loan from a related overseas entity. The three requirements of a genuine gift:

- legally prepared Deed of Gift supporting the characterisation of the receipt as a gift (or loan)

- the parties’ behaviour is consistent with that characterisation; and

- the monies provided are sourced from funds genuinely independent of the taxpayer.

Talk with your accountant and financial planner before getting gifts from your family overseas

Taxpayers who are potentially able to obtain sufficient evidence to prove their gift is genuine should seek professional advice from their adviser and accountant.

Taxpayers who cannot obtain evidence to discharge their burden of proof should also obtain professional advice and voluntarily disclose arrangements to the ATO. As the ATO has outlined in the Taxpayer Alert, arrangements of this nature result in both taxpayers and their advisers facing substantial penalties. Voluntary disclosures can significantly reduce the imposition of penalties of up to 90% of the tax liability.

Do charities need a Gifting Agreement?

A Deed of Gift reduces the opportunities for relatives to come back to attack the gift. This is often the case after the Donor loses mental capacity or dies.

There are two persons in a Gifting Agreement

In the Deed of Gift, the person who is the Donor is gifting the money. The person who is the Recipient is the person receiving the gift:

-

The Donor provides the gift.

The Donor is the entity (human, trust or company) that gives the gift (e.g. money) to the Recipient.

-

The Recipient gets the gift.

The Recipient is the entity (human, trust or company) getting the gift (e.g. money) from the Donor.

How do I build the Deed of Gift in Australia?

Transferring property to someone as a gift? For no cost? Then build a Gift Deed. Start building the Deed of Gift. The building process educates you on how a Gift Deed works:

- Press the “Build” button.

- Read the hints. Answer the questions on our website.

- Telephone us to help you answer the questions.

- Check the Summary page

- Lock and Build your Deed of Gift

- Type in your Credit Card details

- Within seconds, the Deed of Gift and our cover letter are on your screen

- Print and sign the Deed of Gift

Full free sample of the Deed of Gift

To see a full free sample of the Deed of Gift open the PDF at the top of this page.

What do I get from Legal Consolidated when I build a Deed of Gift?

Upon building the Gifting Agreement online you get emailed to you within seconds:

1. Deed of Gift Document

2. Our law firm’s letter of advice on our law firm’s letterhead

Can I gift money ‘from time to time’

Yes, many spouses follow the ‘man of straw and woman of substance’ asset protection strategy. Just sign a Legal Consolidated Deed of Gift every time money is transferred from the ‘high risk’ spouse into the ‘safe’ spouse’s name. For example,

- Donor: High-Risk Business Owner Husband

Recipient: Low Rick Housewife

Or the ‘high-risk’ spouse may be transferring money to a ‘safe house’ (low-risk) family trust. For example:

- Donor: Joanne Doctor Smith

- Recipient: Weith Nominees Pty Ltd as trustee for the Smith Family Trust

In which case, you put in ‘amounts of money provided from time to time’. Just log back into the law firm’s website and go to “Your Documents”. For free, you just keep printing out the same Deed of Gift, dating it and attaching the evidence of transfer (e.g. bank statement or bank receipt).

If you ‘gifted’ money to your spouse 8 times this financial year then make sure you have 8 duly signed Deeds of Gift on record.

Just keep printing it out every time the same Donor makes the gift to the exact same Donee.

Obviously, if you gift to both your Family Trust and your wife then you need to build and pay for two Deeds of Gifts.

Australian Business Structures can use a Deed of Gift

Do you gift money to your Family trust? Or, should you loan money to your Family Trust?

- Family Trust Deed – watch the free training course

- Family Trust Updates:

- Everything – Appointor, Trustee & Deed Update

- Deed ONLY – only update the Deed for tax

- Guardian and Appointor – only update the Guardian & Appointor

- Change the Trustee – change human Trustees and Company Trustees

- The company as Trustee of Family Trust – only for assets protection?

- Bucket Company for Family Trust – tax advantages of a corporate beneficiary

It would be unusual to gift an asset to a Unit trust

- Unit Trust

- Unit Trust Vesting Deed – wind up your Unit Trust

- Change Unit Trust Trustee – replace the trustee of your Unit Trust

- Company as Trustee of Unit Trust – how to build a company designed to be a trustee of a Unit Trust

Corporate and other structures

- Partnership Agreement – but what about joint liability?

- Incorporate an Australian Company – but watch out for Division 7A – a company lending money to a human or a trust has special rules

- Upgrade the old Company Constitution – this is why

- Replace lost Company Constitution – about to get an ATO Audit?

Service trust and Independent Contractors Agreements

- Independent Contractor Agreement – make sure the person is NOT an employee

- Service Trust Agreement – operate a second business to move income and wealth

- Law firm Service Trust Agreement – how a law firm runs the backend of its practice

- Medical Doctor Service Trust Agreement – complies with all State rules, including New South Wales

- Dentist Service Trust Agreement – how dentists move income to their family

- Engineering Service Trust Agreement – commonly engineers set up the wrong structure

- Accountants Service Trust Agreement – complies with ATO’s new view on the Phillips case