Six things that you need for a legal Loan Agreement – for Family Trusts

A Loan Agreement is between a Lender and a Borrower.

A Legal Consolidated Loan Agreement legally sets out the terms of the loan:

- the Lender – the person lending the money

- the Borrower – the person taking your money and promising to pay it back

- the Guarantor– these people do not get the money but promise to pay the debt if, for some reason, the Borrower does not do so

- any interest payable (usually ‘interest as advised by the Lender, from time to time’)

- repayment dates (usually ‘as demanded by the Lender from time to time)

- right for the Lender to register encumbrances over the assets of the Borrower. Including:

- mortgages (over real estate)

- debentures (over company assets)

- personal property (e.g. car) – Personal Property Securities Register (PPSR)

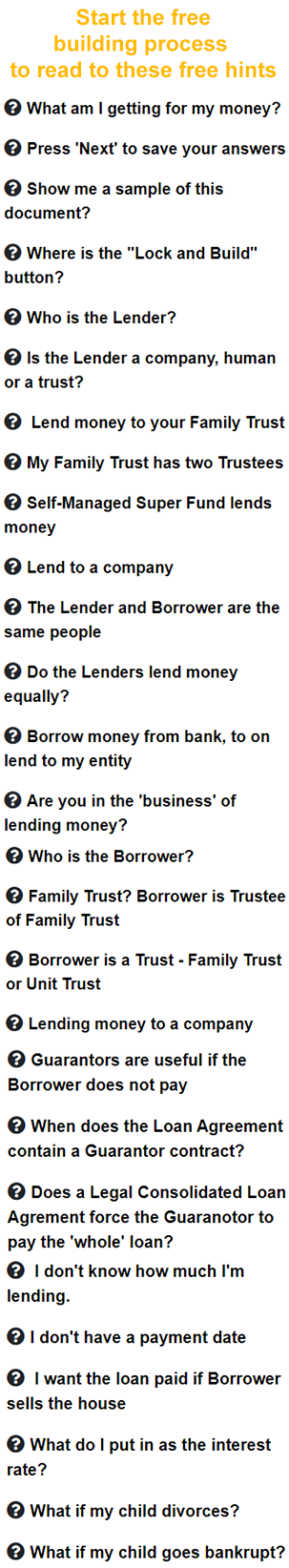

Start building the Loan Agreement for free

Start building the Loan agreement. The building process is free. The building process empowers and educates you. As you build the Loan Agreement read the many hints and watch the training videos. Enjoy the free education.

We have been providing Loan Agreements since 1988. Whatever unique questions you have are usually answered as part of the building process. Start the building process before you contact us for help.

Is the Lender a company, trust or human?

- The Lender may be a human or a company. Or Trustee of a Family Trust or Unit Trust.

- The Borrower can be a human or a company. Or Trustee of a Family Trust or Unit Trust.

Can the Lender and Trustee of the Family Trust be the same person?

Q: I want to borrow from my mortgage and lend it to my discretionary trust and deduct the interest so long as I make a profit. Is this still applicable if the trustee of the trust is me? Is it allowed when I am in effect lending to myself?

A: Legal Consolidated does not provide advice on the deductibility of interest. We do not provide any tax advice. We also do not know your individual circumstances. You need to speak with your accountant.

As to the second part of your question, you are not lending to yourself you are lending to a Family Trust. (You just happen to be the trustee of the family trust, at the moment.) You and your trust have different ABNs and TFNs, they are not the same person.

For the full answers start building the Loan Agreement and read the full hint on this topic.

In this instance, it is the Family Trust is lending money. Note the many free hints which you can read for free. This is once you start the free building process.

Can a company lend money to another company?

This loan agreement can also be used for intercompany loans also – from one company to a related company.

Because of the freedom to determine when repayments are made, it is also possible for this loan agreement to be used as an “at-call” loan, where it is payable on demand if that is what the Lender chooses.

It is important that the Borrower fully understands the nature of what they are getting into as the consequences of not repaying can be very serious.

The Loan Agreement is also applicable when trusts lend or borrow money. But trusts do so through their Trustees. E.g. Colin Nominees Pty Ltd as trustee for the James and Martha Family Trust ABN 28383838399

In this example, the person borrowing the money is a human. If the person has a middle name include their full middle name. Read the free hints on the right-hand side of each question page.

What are the terms of the Loan Agreement?

An advantage of a Legal Consolidated Loan Agreement is that you can design it to suit your circumstances.

For example, what if you do not know the amount that you are lending? That’s ok. If you do not know, then you can leave that to the default answer; “as lent from time to time”.

Or sometimes you might not want to set a specific repayment date in the Loan deed. You can leave it as the default answer; “payable on demand as demanded by the Lender”. Or you can put in an actual date, or you can add the instalment dates or time periods.

Are you charging interest? Not sure what interest to charge, from time to time? Want to charge no interest, but have the right to charge interest in the future?

If you never want to charge interest then you can answer this question as ‘Nil’. Or, or leave it open to be decided in writing later. In which case leave in the default answer as ‘as demanded from the lender from time to time’.

Do I have to pay tax on the interest I charge on a Loan Agreement?

Legal Consolidated does not provide tax advice on the interest charged and other issues of the Loan Deed. You need to speak with your accountant. However, “interest” is generally an income that must be declared on your taxation return.

Lending money to Mum and Dad to move into aged care

Some people argue that children have never been a sound financial investment. However, we are seeing a growing trend of a child lending money to parents to get into a good retirement home. In that case, the child should build this Loan Agreement.

When mum and dad die the other children are less likely to argue that the loan was just a gift to dad and mum. Secondly, if mum and dad go hostile, lose their money or marry a toyboy then you are more likely to recover some of your money. This is because you have a legally documented loan.

Does the Loan Contract allow Mortgages, debentures, charges and PPSR?

The Loan Agreement allows the Lender to lodge caveats, mortgages, fixed & floating charges, debentures and encumbrances over the Borrower’s assets. However, Legal Consolidated does not give advice in this area. If you want to register such encumbrances and do not wish to do it yourself, then speak with a conveyance or securities lawyer.

The Lender is authorised, through a Power of Attorney contained in the Loan Agreement, to direct the Borrower to sign all documents required to charge and register all the Borrower’s interest in:

a) land the Borrower owns or controls from time to time (this includes the right to lodge mortgages, equitable mortgages, Mortgages, caveats and other encumbrances of any nature whatsoever); and

b) other assets, fixtures, choses in action and chattels owned or controlled by the Borrower including by way of debentures, fixed & floating charges, mortgages, equitable mortgages, caveats, Personal Property Securities Register (PPSR) and share capital

Should I add Guarantors to the Family Trust loan?

The Lender can add some additional people to guarantee the repayment of the loan.

- The more people that owe you the money; and

- the more people that guarantee the debt, generally

the higher the chances of getting your money back.

However, Legal Consolidated does not provide advice in this area. We are not giving advice on or involved in the identification or creditworthiness of any persons.

Does the Family Trust Loan Agreement contain a Guarantor contract?

Yes. If the Lender decides to add a guarantor then automatically Legal Consolidated inserts a ‘Guarantor contract’ into the Loan Agreement. It becomes part of the Loan Agreement.

A contract to guarantee is a binding agreement. It is with the Lender, Borrower and Guarantor. The Guarantor promises the Lender to pay back the Borrower’s debt. This is if the Borrower fails to meet their financial commitments.

Loan resources kit

- Loans to children – in case the child divorces or goes bankrupt

- Loans to parents – rich child lends money to parents to get into a retirement home

- Spouse Loan agreement – ‘safe house spouse’ lends to high-risk spouse (man of straw strategy)

- Loan from SMSF for both ‘related parties’ and strangers

- Companies

- Lend your company some money – journal entries do not work, overrides debt/equity rules

- Loan from your company to your family – Division 7A compliant

- Division 7A Loan Deeds – when your company is ‘deemed’ to be lending you money

- Bucket company lends money to the Family Trust

- Forgiving a Debt – for ‘love and affection’

- Deed of Gift

- to a Family Trust – to prove the money you put into your Family Trust was a gift (not a loan)

- to a child – forgive the money your child owes you

- to a person overseas – forgive what the person owes you

- Recognition of a Loan – stops the loan from going stale. Restarts the 6-year limitation period.

Q: Concerning the interest rate, is “as demanded from the lender from time to time” satisfy the ATO’s requirement for the loan to be at “commercial rates”.

I am not sure what you mean by ‘commercial rates’. Best to talk with your accountant.

Q: I borrowed the money from the bank at 2.59%. As this Loan Agreement is for an unsecured loan, do you believe the ATO will allow me to lend the Trust the money at say 2.60% (to provide the profit margin you mentioned) and consider it a “commercial rate”?

As to whether you can claim a tax deduction is a question to should pose to your accountant. This is because everyone’s situation is different. Your accountant knows your individual circumstances.

Further, we do not give tax advice or any advice on Loan Agreements.

Is a loan tax deductible if the family trust borrows to pay a beneficiary?

This is general advice only. We do not advise on this topic.

Are the interest costs deductible when a trustee borrows money to make payments to a beneficiary? This is for a credit loan or an unpaid present entitlement (UPE)?

The Australian Taxation Office states that such interest expenses are not automatically deductible merely because the loan enables the trust to retain income-generating assets.

For these interest expenses to be deductible, there must be a direct link between the borrowing and the trust’s activities that generate assessable income.

See Federal Commissioner of Tax v Roberts & Smith 92 ATC 4380 (Roberts & Smith). The case is considered in the Australian Tax Office Ruling TR 2005/12.

From the Ruling and the Roberts & Smith case, when refinancing any loans or UPEs, a trust must ensure a strong connection to income-generating activities rather than, for instance, distributing funds to beneficiaries.

The crucial factor in demonstrating the trustee’s primary intent in refinancing is to manage the outstanding debt. The ATO looks at each scenario in its specific circumstances.

We do not give legal advice on this. Speak with your accountant.

Does the Borrower have to actually make the repayments? I want to make the interest expense deductible.

We are not accountants. We are taxation lawyers. We also do not know your individual circumstances. Best to talk with your accountant.

However, it may be possible for the Lender to ‘capitalise’ the interest and the capital. Actual payments are probably not generally required to satisfy the laws for borrowing and lending. But you need to talk with your accountant. Further, the Loan will go ‘stale’ if there is no repayment within the 6-year period (3 years for the Northern Territory). But again Legal Consolidated does not give advice on these matters.

Professional lenders of money

There are two types of Lenders:

- Professional lenders: Example: banks such as the Commonwealth Bank of Australia and ANZ, other lending institutions such as AMP; pawnbrokers and shop owners providing laybys.

- ‘Non-professional lenders’: other people such as mum and dad lending money to a child; a person lending money to a friend; a person or company lending money not as part of their business or as a one of the transaction

This Loan Agreement is for ‘non-professional lenders’. If you are a bank, pawnbroker or shop owner providing laybys then please contact us.

What checks should I do on the Borrower – BEFORE I lend any money?

Legal Consolidated provides no due diligence, identification, creditworthiness or similar regarding the people you are lending to. These are only general comments:

Seek advice and due diligence, legal and otherwise, on the creditworthiness and ability of the Borrower to make repayments and perform its obligations under the Loan Agreement.

The Lender seeks such advice independently. You should not rely on any person associated with or related to the Borrower to give you such advice.

You need to make sure the person you are lending to is the person they say they are. If you are in doubt, seek professional and legal help.

There are professional businesses that provide extensive and written credit checks on potential Borrowers. Use their services before you hand over any money. Use their services before you sign the Loan Agreement.

Legal Consolidated gives no advice on these matters. Also, we provide no due diligence or identification checks of your Borrowers and Guarantors.

Do the Lenders and Borrowers have the mental capacity to sign a Loan Agreement?

The Loan Agreement can be attacked. This is by arguing that some or all the parties that signed the Loan Agreement lacked mental capacity.

To sign a Deed, or enter into any legal agreement, you need to be of sound mind.

To reduce the chance of someone arguing that you lack mental capacity get a doctor’s note. This is to say you are of sound mind. And keep all such doctor notes with the Loan Agreement.

Where the Lender or Borrower is a company, then the director(s) needs to get a doctor’s certificate. This is to confirm that the director is of sound mind.

To put the matter beyond doubt every human that signs the Loan Agreement needs to have a doctor’s certificate to say they are of sound mind.

The doctor’s note should be obtained on or around the date that the Loan Agreement is signed.

Are the Lenders of Borrowers tricked or coerced into signing the Loan Agreement?

Another way to render the Loan Agreement of no effect is to argue that one of the parties did not sign the Deed freely. There is no free will.

The person making the attack argues duress, undue influence or elder abuse. Duress is when you are forced to do something against your own will.

The signing of a Loan Agreement should be treated to the same high standard that is given to the signing of a Will. For example, the people potentially benefiting should not be anywhere near the other parties when they sign the Loan Agreement.

The witnesses should be people of substance and independence. They must never be family members or related to people involved in the loan.

Can I just do a Loan Agreement on the back of an envelope?

In the movies, IOUs are often handwritten on a piece of paper. Sometimes instead of a Loan Agreement, someone does a ‘minute’. Both approaches fail. In Rowntree v FCT [2018] FCA 182 shows the additional care required to document even simple related-party transactions, such as loans. In this case, the taxpayer, a practising NSW lawyer, claimed he borrowed over $4m from his group of private companies. The Court said:

‘Mr Rowntree has not deliberately chosen to ignore the law. His evidence presented to the Tribunal suggests that he genuinely believed that there were arguments to support his view that a loan was in existence .’

He failed. Only a legally prepared Loan Agreement has any chance of stopping the ATO, Bankruptcy Courts and Family Court. Only a legally prepared Loan Agreement supports mortgages and debentures.

On-lending money to your family trust. Did you forget the Loan Agreement?

Chadbourne and FCT

Consider the sad case Chadbourne and FCT [2020] AATA 2441:

- the taxpayer, Mr Chadbourne, borrows money from the Commonwealth Bank

- he on-lends the money to his family trust:

- his lawyer and accountant fail to recommend a Loan Agreement

- he has no Legal Consolidated Loan Agreement

- his family trust buys investments

- he attempts to claim a deduction for the interest he is paying the Commonwealth Bank

- the ATO denies the deduction

- the ATO claims:

- you cannot infer a loan relationship

- journal entries and minutes do not equate to a loan agreement

- a written Loan Agreement is required

- you cannot claim deductions in deriving income from a family trust distribution

Mr Chadbourne borrows money from the Commonwealth Bank. This is to finance the purchase of income-producing investment properties. But, Mr Chadbourne purchases the properties in the name of his family discretionary trust.

Later Mr Chadbourne borrows more money. This is to finance the purchase of shares. Once again, the shares are purchased by the family trust, not himself as the taxpayer.

Journal entries, minutes and IOUs are not Loan Agreements according to the ATO – Chadbourne and FCT

Without a Loan Agreement, the ATO argues that there is no nexus between Mr Chadbourne’s interest expense and the assessable income from the trust’s investments. We agree with the ATO.

Mr Chadbourne argues:

- that the motive for purchasing the investment properties and shares is to generate income and profits

- sure the interest is paid by him and the profits are in another entity being a family trust

- but the interest deductions should still be allowed as it is associated with the income-producing assets of the trust?

Mr Chadbourne’s mistake

Without a Loan Agreement between Mr Chadbourne and his family trust, he becomes desperate. Clutching at straws, Mr Chadbourne claims a deduction for the interest expense against the income derived by the trust. However, in truth, the interest expense is claimed against the distribution of income he received from the trust. This is NOT income derived by Mr Chadbourne.

Mr Chadbourne does not derive the assessable income for the purposes of the Income Tax Assessment Act. Without the protection of the Loan Agreement, he merely receives a trust distribution of income.

This makes all the difference. Without a Loan Agreement, there is no nexus between income and expense. It denies him a tax deduction for the interest. If Mr Chadbourne had merely built a Legal Consolidated Loan Agreement lending the money to his trust then the interest is claimable.

Legal Consolidated does not provide any advice on taxation issues and the deductibility of loans and interest charged or not charged. You need to speak with your accountant. Your accountant knows your individual circumstances. We do not.

We do not give advice as to whether the Family Trust should borrow or lend money. Or whether it should get money as a gift or make gifts or forgive a debt. For general information about asset protection.

In this case, Justice Raes states:

‘Rowntree was an experienced lawyer with extensive academic qualifications in law, finance and taxation. Despite having this impressive resumé, Mr Rowntree engaged, during four years of income, in numerous dealings with companies that he controlled from which he received over $4 million. He did not document any of those dealings as having any particular purpose or character at the time at which he received those large sums of money.’

Lawyer Bruce claimed that he ‘borrowed’ over $4m from his group of private companies.

In contrast, the ATO assessed the money as income – not as a loan. The Court agreed with the ATO. The Court found there had been gross carelessness rather than an intentional disregard of Bruce’s tax obligation

Lawyer Bruce failed to properly record in writing that the money transfers were in fact advances made under a legally enforceable loan agreement or agreements before the subject transactions occurred.

Lawyer Bruce’s arguments

Bruce, as the sole director of his companies, argued the money was not income. Rather, Bruce believed that the money was a non-taxable loan principal advances which he had a legal obligation to repay. The Court stated that “he genuinely believed in his own mind that the amounts in question were loans”.

Bruce failed to introduce into evidence a “contemporaneous, corroborating” Loan Agreement.

Instead, Bruce argued that the Loan Agreement did exist but by inference. This was not good enough for the Court. The Court wanted to see the legally prepared Loan Agreement. Bruce even provided financial statements and accounts to show that the accounts recorded the money as a loan. But of course that never works. Journal entries are not loan agreements.

Bruce argues:

“the Corporations Act is largely silent about how a sole director, acting under s 198E(1), should evidence what he causes the company to do. That Act provides that a sole director of such a company may pass a resolution or make a declaration by recording it and signing the record (s 248B). Moreover, a company must keep written financial records that correctly record and explain its transactions, financial position and performance that will enable true and fair financial statements to be prepared and audited (s 286(1)).”

That is a good try, Bruce. But that relates to ASIC requirements. The tax laws require a fully documented Loan Agreement. You could have built a legally prepared Loan Agreement or a Division 7A Loan Agreement on our website in about 12 minutes.

Division 7A argument

Bruce had a read of Div 7A. He argued that s 109N(1)(A) ITAA 1936 required that a compliant Div 7A loan agreement must be recorded in writing “before the lodgment date for the year of income” in which the loan by the company occurred. Bruce argued that a loan agreement may be recorded in writing after the alleged advances had occurred.

I do not think Bruce is correct here. A Div 7A Loan only applies where it can be shown objectively that the transfers of funds were made under a pre-existing loan. Bruce, read Rowntree and FCT [2016] AATA 420 at 64.

Absent a prior dated loan agreement, there must be contemporaneous evidence (e.g. a Loan Agreement to substantiate the nature of the transfer of funds made). This is a trite and obvious law.

Journal entries are not loan agreements

I started practising taxation law in 1988. Since then the standards for taxpayers have increased. The ATO attacks long-standing practices. The Rowntree case continues that steady march.

Every profession and trade has magic in its bag of tricks. The accountant has the magic of ‘journal entries’ for:

- liability for debt, loans and loan set-offs

- payment of employee contributions to reduce FBT issues via a journal to a loan account

- director/family member salaries booked in the accounts without any physical payment

- trust distributions not physically paid to the beneficiary

- unpaid distributions applied to other loan accounts (whether of that beneficiary or others)

- minimum repayments of Div 7A complying loans made by application of a dividend

Do journal entries evidence a transaction? Usually not. Journal entries merely record what happened. Where the only ‘evidence’ you have is the journal entry – be careful.

How the ATO audits journal entries

Recently in ATO audits they look at the accountant and ask for ‘evidence’ and ‘source documents’ of the transactions relating to the journal.

Many businesses run a treasury role. This is where the family runs all businesses through the same bank account. The business or company may have no bank account itself. (E.g. bank offset accounts, consolidation, managing and reducing overdrafts.)

The ATO looks at ‘arms-length’ normal practice. It is not normal for someone other than yourself to hold your money.

Sign the Loan Agreement BEFORE you lend any money

While Loan Agreements prepared after the event is better than nothing, the Loan Agreement should be in place before the money starts moving around. This is what a third party would do. A Loan Agreement signed after the event has less evidentiary value. It is less likely to work.

Do banks lend money and then later get you to sign a Loan Agreement? Do you move into your commercial lease and then sign the Commercial Lease Agreement?

What can accountants and financial planners learn from this mess?

It is not good enough for your clients to transfer intragroup money during the financial year. And then try and cobble together some correcting journal entries or minutes. Build the Loan Agreement or Div 7A before making any loans.

Do you think that I am applying a high onus of proof? Remember the high onus of proof when challenging an ATO adverse assessment. You have to prove the nature of an intragroup transaction. This requires a contemporaneous Loan Agreement or Division 7A Loan Deed. Minutes, journals and other records are not enough.

What does this document contain?

1. Our letter of advice

2. Loan Agreement

See also

See also

Contact us for more legal advice.

You are building your Loan Agreement on a legal practice’s website. Telephone us for legal advice. We can help you build the Loan Agreement. However, start the free building process first. It answers most questions.

The Borrower is the entity (human or company) that is going to receive the capital (e.g. money) from the lender.

The Lender is the entity (human or company) that is passing the capital (e.g. money) to the Borrower.

In this Loan Agreement, the person who is the Lender is lending the money and the person who is the Borrower is the person borrowing the money.

Why is it better to prepare my legal document on a legal practice website?

You are dealing directly with a lawyer website, therefore you:

- benefit from legal professional privilege.

- receive legal advice from us.

How do I build the Loan Agreement?

- Answer the questions on our website

- Read the Summary page

- Lock and Build your document

- Type in your Credit Card details

- The Loan Agreement, our cover letter and Tax Invoice are emailed to you

- Print and sign the Agreement

The Loan Agreement that is emailed to you contains:

- Loan Agreement Document

- Our law firm’s letter of advice is on our law firm’s letterhead and signed by one of our Partners.

Westpac is to be congratulated on its sound advice on the importance of a loan agreement prepared by a lawyer.

I do not know how much I will lend

Sometimes you do not know the amount that you are lending. If you do not know you can leave it as the default answer; ‘as lent from time to time’. This gives you the ability to lend additional amounts later on.

If you do know but are paying it in instalments, then put it all in as one figure.

Otherwise, just put in the total figure. Remember to put in the dollar sign.

Sometimes you might not want to set a specific date in the agreement. You can leave it as the default answer; “payable on demand as demanded by the Lender”. This gives you some wiggle room.

If you want it all paid back on one date, just enter that date in.

If it is being paid back in instalments, you can word it how you like. for example

1) ‘Payable in instalments of 10% per calendar month’

2) ‘Half to be paid on 21 September 2038, and the remainder to be paid on 21 September’

3) ‘$100 to be repaid weekly for 10 weeks starting from 4 July’

There are five ways you can answer this question depending on how you’d like to do it:

1) If you are charging no interest, put in the word ‘Nil’

2) If you aren’t sure what the interest rate is yet, leave it as the default, which is “as demanded from the lender from time to time”

3) You can put in a flat rate, for example, ‘5%’ (do not forget to put the % sign in)

4) Keep it variable, for example, ‘2% above the Commonwealth Bank interest rate’.

5) You can also use the inflation rate. For example, ‘calculated according to the percentage increase in the Consumer Price Index (all groups) for the average of the capital cities of the Commonwealth of Australia. (As published by the Australian Bureau of Statistics or body that takes over that function.)’

Business Structures for Personal Services Income, tax and asset protection

Family trust v Everett’s assignments

- Family Trust Deed – watch the free training course

- Family Trust Updates:

- Everything – Appointor, Trustee & Deed Update

- Deed ONLY – only update the Deed for tax

- Guardian and Appointor – only update the Guardian & Appointor

- Change the Trustee – change human Trustees and Company Trustees

- The company as Trustee of Family Trust – only for assets protection?

- Bucket Company for Family Trust – tax advantages of a corporate beneficiary

Unit trust vs Everett’s assignments

- Unit Trust

- Unit Trust Vesting Deed – wind up your Unit Trust

- Change Unit Trust Trustee – replace the trustee of your Unit Trust

- Company as Trustee of Unit Trust – how to build a company designed to be a trustee of a Unit Trust

Corporate structures and Everett’s assignments

- Partnership Agreement – but what about joint liability?

- Incorporate an Australian Company – best practice with the Constitution

- Upgrade the old Company Constitution – this is why

- Replace lost Company Constitution – about to get an ATO Audit?

- Independent Contractor Agreement – make sure the person is NOT an employee

- Service Trust Agreement – operate a second business to move income and wealth

- Law firm Service Trust Agreement – how a law firm runs the backend of its practice

- Medical Doctor Service Trust Agreement – complies with all State rules, including New South Wales

- Dentist Service Trust Agreement – how dentists move income to their family

- Engineering Service Trust Agreement – commonly engineers set up the wrong structure

- Accountants Service Trust Agreement – complies with ATO’s new view on the Phillips case