Six reasons to set up an Australian Partnership Agreement?

The partnership agreement is a contract between the partners. It agrees to the terms of the business. A Partnership Agreement deals with:

- financial reporting

- responsibilities of the partners

- each partner’s financial contribution – capital contributions

- a procedure for resolving disputes

- a procedure for ending or resigning from the partnership

- a partner’s share of the business’s tax losses is offset against other personal income. This is called the ‘flow through’ effect. In contrast, losses in companies and trusts are ‘trapped’.

What is the purpose of an Australian Partnership Agreement?

A Partnership Deed is a voluntary contract. It is between two or more persons. This is how they share their capital, labour, and skills in a business. This is with the expectation of a sharing of the profits and losses between the partners.

In Australia, when two or more people team up for a business and share its profits and losses, they form a partnership. Unlike a company, a partnership is not a separate legal entity. This means each partner is personally responsible for what other partners do and any debts the partnership gets into. If you are running a partnership business, you need a partnership agreement.

Not having a written partnership agreement is dangerous

We all love the simplicity of a partnership. Indeed, many people are in ‘partnerships’ without their knowledge. But such undocumented partnerships are dangerous.

You have a friend. Together, you have a vision. You work together in your new business to make a profit. Congratulations, you are in a partnership.

Now that you are in a partnership, you need to document it. Build a Partnership Deed on our law firm’s website. Just press the Start Building above. There are hints that explain every question. And you can telephone us anytime to help you answer the questions.

If you do not document your partnership, you suffer risks and potential losses. You also suffer the risk of joint and several liability of you and your partners.

If you do not have a written business partnership contract then what are the rules

In Australia, each state has legislation for partnerships.

What if you have no written partnership agreement? Then you have to rely on out-of-date legislation in each state:

ACT – Partnership Act 1963

NSW – Partnership Act 1892

NT – Partnership Act 1997

QLD – Partnership Act 1891

SA – Partnership Act 1891

TAS – Partnership Act 1891

VIC – Partnership Act 1958

WA – Partnership Act 1895

Does Legal Consolidated work in all states of Australia?

Yes. As a national Australian law firm our Partnership Deed works throughout Australia.s

The worst thing about a business Partnership: Partnerships suffer joint liability

One of your business partners buys a Ferrari in the partnership name. He drives into the sunset never to be seen again. You are liable for 100% of that Ferrari’s payment.

Liability under a partnership is unlimited. In contrast, company shareholders are not exposed to the vehicle’s debt. The shareholder’s liability is limited. (This is the case even if you do not have a Company Shareholders Agreement.)

A written partnership agreement reduces that risk.

Our law firm’s partnership agreement reduces the joint liability. This is between you and your other partners:

- corporate governance is encouraged by a partnership agreement

- tighter rules between parties as to loans

- better documented fiscal restraint

- warranties and indemnities to protect individual parties

Because you built a Partnership Agreement with our firm, you can seek out your rogue business partner who bought a Ferrari under the partnership and sue him.

Is a Partnership a legal ‘entity’?

Neither a partnership nor a trust is a legal ‘entity’. In contrast, a human and a company is a legal entity. Nevertheless, tax records are usually prepared for a partnership (and a trust). But generally, only the partners (or beneficiaries of a trust) pay tax on the revenue.

Are Partners employees?

Partners are not employees. Superannuation contributions and workers’ compensation insurance are not compulsory for partners.

But a Partnership can enter into a separate Employment Contract or independent Contractors Agreement with a partner. Your accountant may also recommend a Service Trust Agreement.

Advantages of a Partnership Deed

- Simple– when compared to a trust or company

- Cost less to set up – than a company or a trust (where partners are all individuals)

- Inexpensive to run – no ASIC yearly fees like a company

- Less paperwork – no reporting obligations to ASIC

- Easy to understand

- Losses flow straight to the partner – losses are distributed to the partners; in contrast, losses are trapped in a family trust, unit trust and company

- Low regulation and privacy – companies are over-regulated through the government agency ASIC. Partnerships (like trusts) are less controlled by the government

Disadvantages of a business partnership contract

- The partners are jointly and severally liable. That is, each partner is liable not only for their share of the partnership debts. But also those of the other partners. At worst, one partner is liable for the entire partnership’s debts. It is unlimited liability. Even if a person only had a 10% partner’s share, he or she is responsible for all 100% of the damage arising from the negligence if the other partners do not have the means to pay.

- Unless you are a Partnership of Family Trusts there is no asset protection for each partner.

- Changing ownership is difficult. It usually requires a new partnership deed to be established. There may be transfer (stamp) duty and Capital Gains Tax issues. This is when you move assets from one partnership to another.

- When a partner dies you have a new partnership. So transfer duty and CGT may operate.

Do Partnerships pay income tax?

Unlike companies, partnerships are not taxed. You and your business partners pay tax separately on the profits made through the partnership.

Each partner gets their income based on their percentage interest in the partnership. They then add that income to their personal tax returns. This is called the partnership ‘flow through’.

A partnership doesn’t pay income tax but is required to lodge a partnership tax return each income year. A partnership carrying on a business distributes its net income or loss to each partner. Each partner includes their share of the net income of the partnership in their assessable income.

Example of how partners in a partnership pay income tax

For example, this financial year, your partnership makes $3m. You currently have 3 partners. They have this percentage interest in the partnership:

- 33 1/3% – add $750k to their tax return

- 50% – add $1.5m to his tax return

- 33 1/3% – add $750k to her tax return

How are the profits of a partnership taxed?

The profits of a partnership are divided among the partners. Each partner is individually responsible for paying income tax on their respective share of the partnership’s profits.

Is a Partnership a separate legal entity?

A partnership is not a separate legal entity. A human and a company are separate legal entities. But Trusts and Partnerships are NOT separate legal entities. However, the business partnership has its own tax file number (TFN). Each financial year the partnership lodges a type of tax return. This is called a partnership tax return. Each of the partners is then taxed separately on their share of the profits.

Your partnership has its own TFN but does not pay income tax on the profit it earns.

Does a Partnership have its own Australian business number (ABN)

A partnership is required to apply for an Australian business number (ABN) if it is carrying on an ‘enterprise’. This includes running a business for profit. The Partnership may also be required to register for the Goods and Services Tax (GST).

Can a partnership employ a partner?

Employ yourself: Individuals as partners cannot ’employ’ themselves. There is no salary packaging, workers’ compensation or employer-sponsored superannuation. Instead, build an:

if a partner wants to provide services to the partnership.

A Partnership Agreement should not try and document services or products supplied by a partner. This includes a person or business related to the partner.

Difference between a Partnership and a Joint Venture

- A Partnership shares profits or losses between themselves. E.g. we made $500k in profit. Now we share that according to our Partnership Interest. (e.g. 1/3rd to me and 2/3rds to you)

- A Joint Venture shares output. E.g. we got oil and gas from the mining site. As agreed, you get the oil. And I get the gas. We take the output. (We do not share or take income or profit.)

Like a partnership, a joint venture is a relationship between two or more parties.

Joint venturers work together. So do partners in a partnership.

But unlike a partnership, each party retains its separate identity.

A joint venture is often put together for a specific one-off purpose.

And, therefore, unlike a partnership, joint ventures often have a short life. There are often short-term or one-off projects.

In a partnership, you carry on an ongoing business. A joint venture is more likely to be a single or isolated transaction.

In a partnership, you are jointly liable. But in a joint venture, liability is usually ‘several rather than joint.

Similarly, one party does not have the capacity to bind another joint venturer.

Tax returns for a Partnership vs a Joint Ventures

A partnership doesn’t pay tax on its income. Instead, each partner pays tax on its share of the partnership’s net income. But still, in a partnership, you prepare a partnership tax return. And the partnership tax return is lodged with the Australian Taxation Office each year

In contrast, there is no requirement to prepare income tax returns for the joint venture.

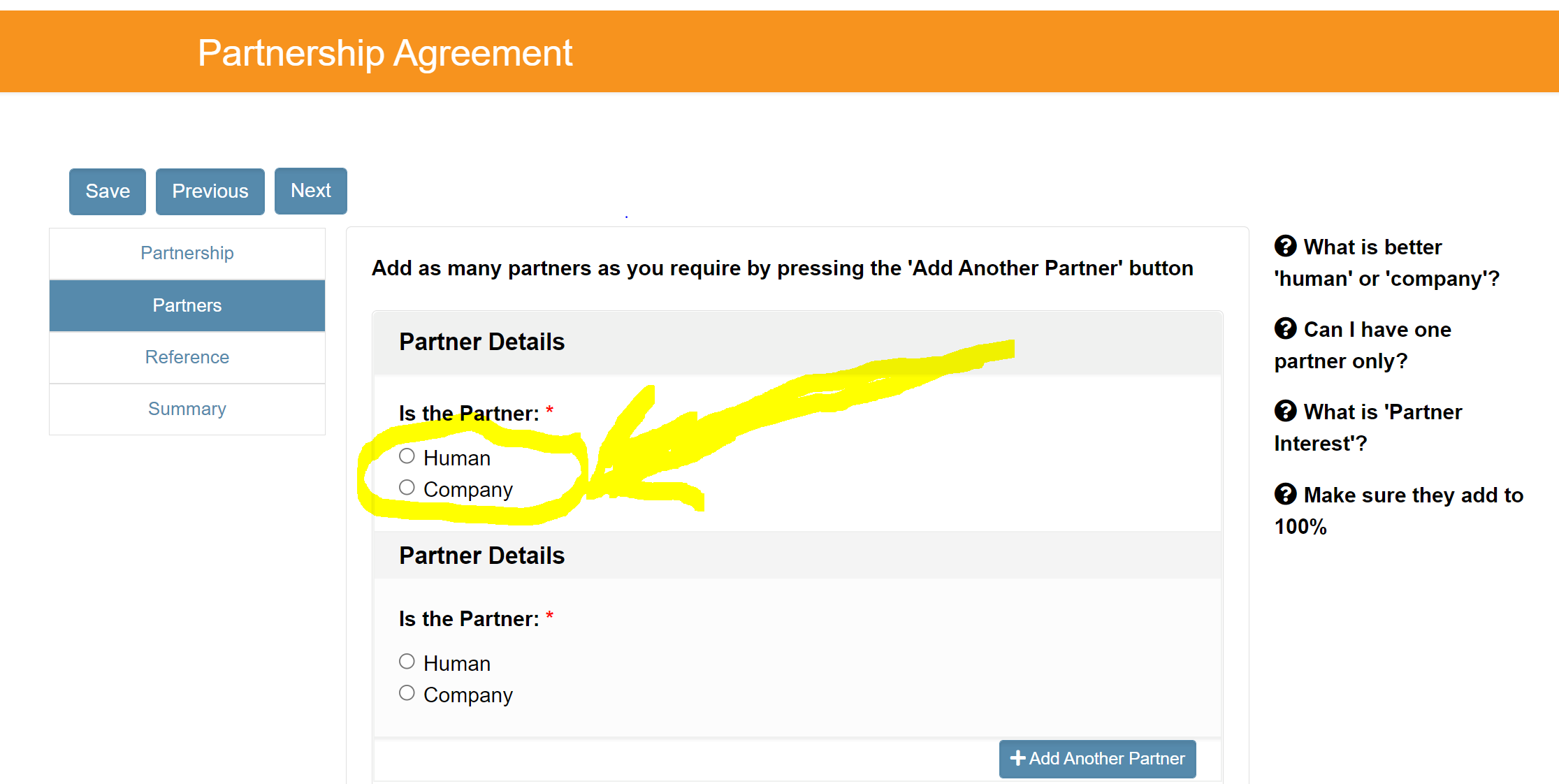

Can the partners be a combination of companies, humans and trusts?

Sorry, but partners are either ‘humans’ or ‘companies‘. (But, humans and companies can be trustees of a trust.)

If a family trust, bare trust or unit trust wants to own an interest in a partnership then it does so through its ‘trustee’.

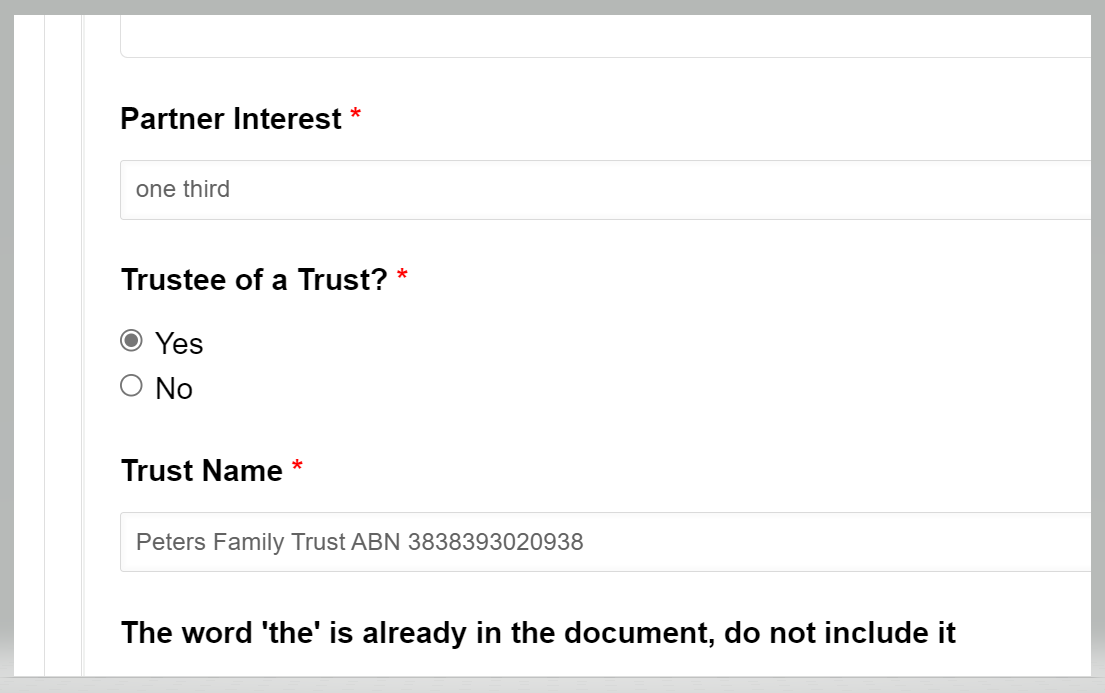

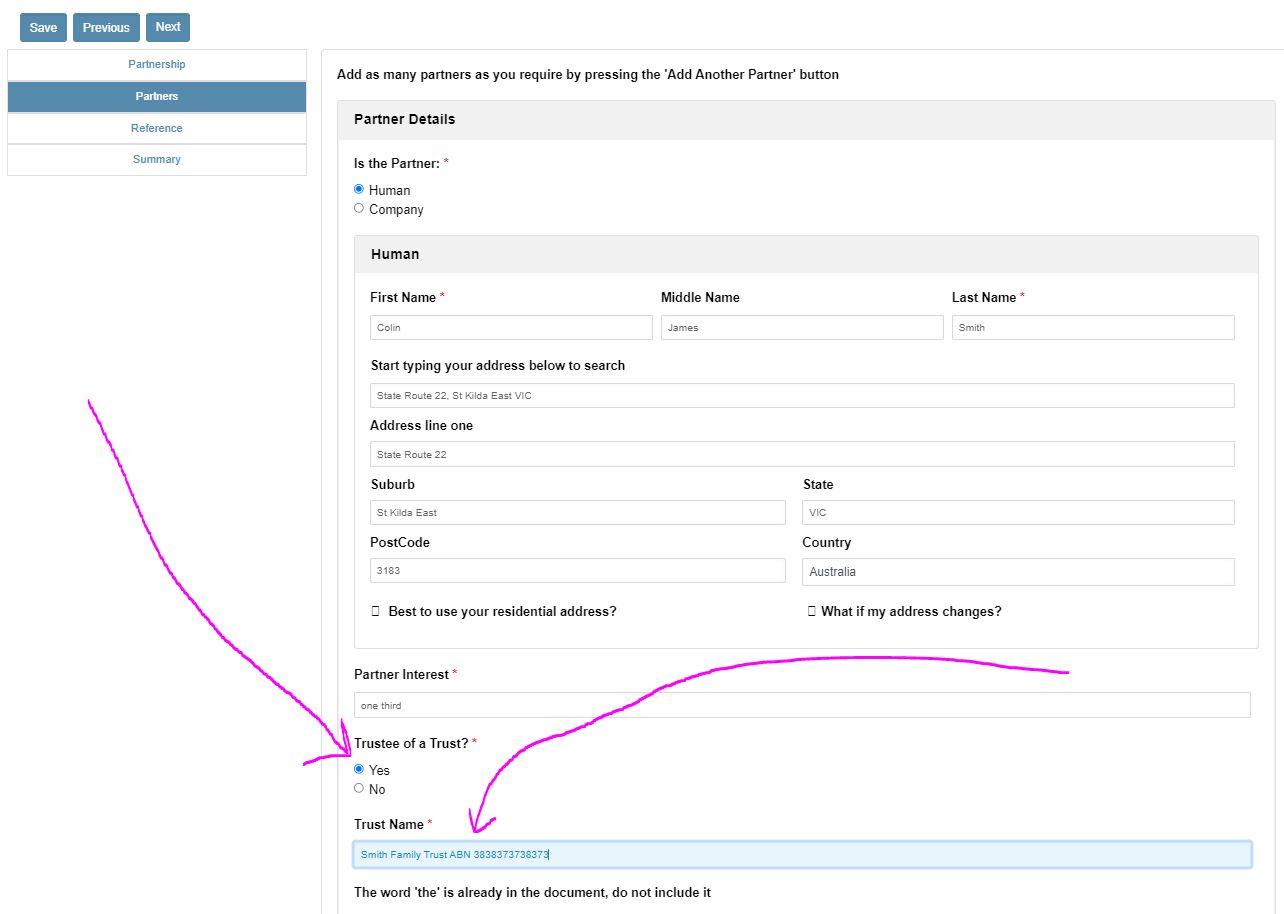

The trustee of the trust holds the partnership interest under the Partnership Deed. But this interest in the partnership is held in trust for the trust. The trustee is not the true or beneficial owner. Instead, the true owner is the trust. The trustee is just the ‘legal’ owner. The ‘beneficial’ owner is the trust. So even though the partnership interest is in the trustee’s name, the true owner is the trust. For example:

Human as trustee of a trust holding an interest in a partnership

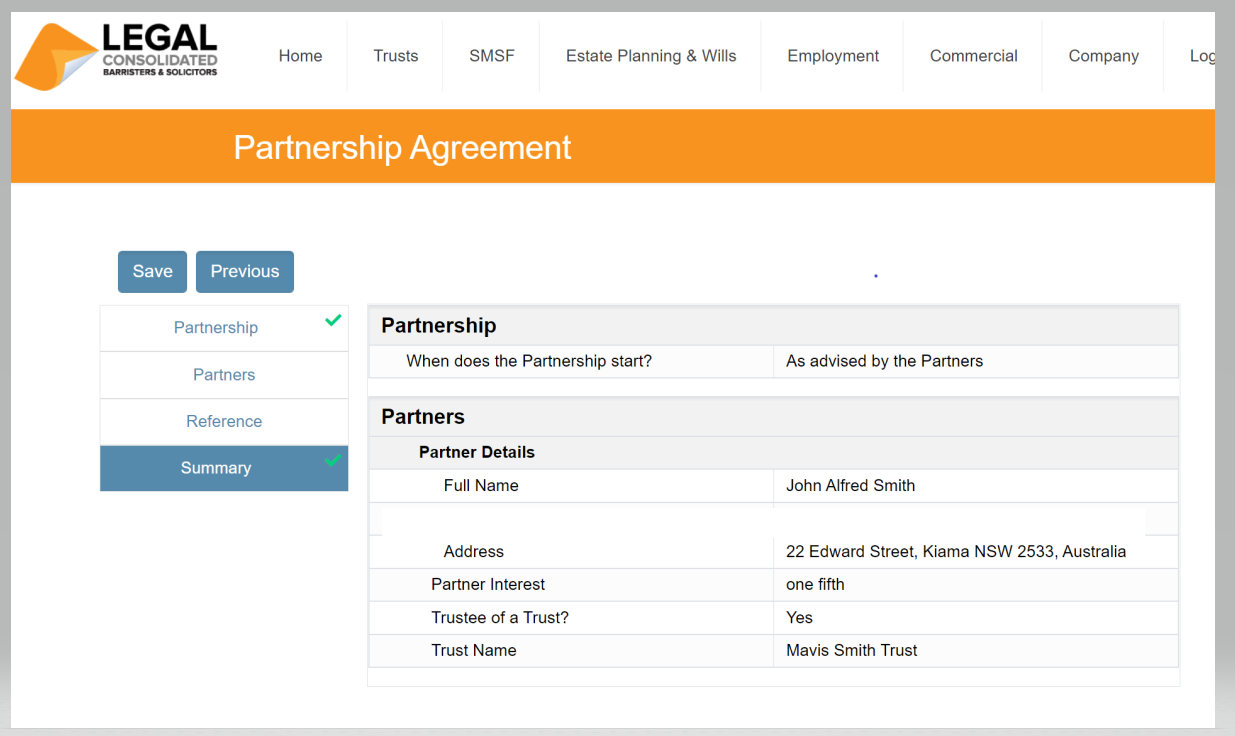

Colin is the trustee of the Peters Family Trust. The Peters Family Trust is going to be the partner in a new Partnership Agreement. But Family Trusts (like all trusts) can only operate through a trustee. Therefore, although the true or beneficial owner is the Peter Family Trust, the trustee, being Colin, holds the legal ownership of the partnership interest. E.g. Colin holds a one-third interest in the Partnership in trust for the Peters Family Trust ABN 3838393020938.

Even though the partnership interest is held in Colin’s name, the trust is the beneficial owner. The Family Trust is responsible for the income that comes from the partnership. Colin does not pay tax on the partnership income. The Peters Family Trust is responsible for the partnership income.

Company as trustee holding an interest in a partnership

Koko Nominees Pty Ltd is trustee of the Koko Family Trust. The Koko Family Trust is going to take up an interest in a partnership. But trusts cannot hold assets in their own name. Trusts operate through ‘trustees’. A trust needs a trustee. The trustee holds the assets on trust for the family trust. In this instance: the partnership interest is owned by Koko Nominees Pty Ltd atf the Koko Family Trust.

Example of a partnership that has partners who are companies, humans and trusts:

- John Alfred Smith (holding his interest as bare trustee for his mother Mavis) – 25%

- Mary Chan – 20%

- Cologne Nominees Pty Ltd (as trustee of the Cologne Family Trust) – 30%

- Fighting Fit Pty Ltd – 25%

In this example, Mary and Fighting Fit Pty Ltd hold their interest in the partnership for themselves – absolutely. They are both the ‘legal’ and ‘beneficial’ owners.

But John and Cologne Nominees Pty Ltd are only ‘legal’ owners. They only hold the partnership interest as trustees. They hold their respective partnership interests on trust for the beneficial owner.

How to build a Partnership of family trusts

A partnership owns an asset or business. The partners share the ‘profit’. That all sounds good. But there is ‘joint and several liability’. If one partner makes a mistake, all other partners are liable 100% each for that mistake. The Legal Consolidated Partnership Deed seeks to reduce that risk. But that only works up to a point.

Another way to reduce the effects of ‘joint and several liability’ is having a partnership of family trusts. (A ‘family trust’ and a ‘discretionary trust’ is the same thing.) Instead of having a group of individuals or companies as partners, each partner is a Trustee of a Family Trust. Each partner to the partnership is a family trust.

If the Partner holds the Partnership Interest for another person or in trust, then:

1. Press ‘yes‘.

2. Type in the name of the trust. And also type in the ABN if the trust has one.

What is a partnership of discretionary trusts?

It is a partnership where each partner is a discretionary trust

Actually, each partner is a trustee of a discretionary trust. Contrast this with a partnership of individuals. Rather than each individual being a partner in the partnership, each individual’s discretionary trust is the partner.

A partnership of discretionary trusts may also have other entities (such as humans and companies) as partners. The Legal Consolidated Partnership Deed allows you to use this strategy.

Example of a Partnership of Family Trusts

Each partner has its own Family Trust. For asset protection they probably only use the Family Trust to be a partner of this partnership. They probably would not use the Family Trust for other purposes. The three partners are:

- Kale Nominees Pty Ltd is trustee of the Smith Family Trust.

- Modern Kay Pty Ltd is the trustee of the Jones Family Trust.

- Mary Bikic is trustee of the Mary and Colin Family Trust.

(It is strange that Mary (a human) is the trustee of this particular Family Trust. The partnership of family trust structure is to protect individuals from exposure to a failed business. It is an asset protection strategy.

Sure, humans are often trustees of family trusts. But this is usually only if the Family Trust is a ‘safe house‘. Perhaps Mary has no assets. She may be following the ‘woman of straw and man of structure‘ asset protection strategy.)

So, for example, the first partner Kale Nominees Pty Ltd holds its interest in the partnership on trust. This is for the family trust called the Smith Family Trust.

The 3 partners of the partnership are Kale Nominees Pty Ltd, Modern Kay Pty Ltd and Mary Bikic. That is what the world sees when the partnership transacts with others.

Asset Protection in a Partnership of Family Trusts

Sure, each family trust, as a partner, is still ‘jointly and severally’ liable for partnership debts. But the only asset the family trust owns is a percentage interest in the partnership. So if the partnership goes down you do not lose any of your other assets. Your non-partnership assets and personal assets are protected.

Tax Benefits of a Partnership of Family Trusts

Share the Partnership profit with family: If you personally own the interest in the partnership then all income you get you pay tax on. You cannot share that tax burden with your spouse or family. But they may be on lower marginal tax rates. And you do not want to ‘waste’ those lower tax rates.

In contrast, the family trust distributes its percentage of the partnership profit as it sees fit. It can, this financial year, distribute to your son who is on maternity leave and is on a low rate of tax. Next year the family trust distributes the partnership profit to just your spouse.

The trustee of each trust distributes the trust’s share of the partnership income among the trust’s beneficiaries as it wishes.

Three disadvantages of a partnership of discretionary trusts

A partnership of family trusts faces 3 challenges:

- It is more complex than a partnership, company or family trust. (Like LEGO® pieces, to end up with a partnership of family trusts you bolt these entities on top of each other to get your partnership of family trusts).

- It is expensive to set up. Each partner needs both a corporate trustee and a family trust deed.

- While financial planners, finance brokers and accountants understand the structure, less qualified people, such as bankers and government departments, may not understand how they operate.

How to set up a partnership of family trusts

- Build a company (to be the trustee of a family trust)

- Build a family trust (make the company the corporate trustee)

- Repeat the above 2 steps for each partner

- Build the Partnership Deed by pressing the blue Start Building button above. Each partner is the trustee of the family trust

Example of a partnership of discretionary trusts

John, Fred and Muriel want a partnership of family trusts. John incorporates a company called “John Australia Nominees Pty Ltd”. Once he gets the Certificate of Incorporation of the company then he builds a family trust. He calls the family trust ‘Avis Family Trust’ after his dead grandfather’s name. (John can call his family trust anything he likes.) Fred and Muriel do the same.

Now with the three companies, they then build a Partnership Deed. The three partners are the three companies. “John Australia Nominees Pty Ltd” and Fred and Muriel’s companies.

Company vs partnership of family trusts

For a business between strangers, commonly your accountant recommends one of three structures a:

- Unit Trust; or

- Company to operate in its own right; or

- a partnership of family trusts

This is where the business is more than one family. Obviously, if it is just mum and dad running the business then you only need a corporate trustee of a family trust.

Income. It is often easier to distribute tax-free (pre-tax dollars) through a partnership of discretionary trusts and unit trusts. This is when compared to a company.

Tax relief on sale. It is also easier for the partners of a partnership of trusts and Unit Trust to access concessional capital gains tax (CGT) treatments. This includes the small business CGT concessions. This is when compared to a company.

Independence. Each partner’s trust is effectively independent of the others. It is even possible to have partners that are not discretionary trusts. Such as unit trusts, companies and humans.

The classic Australian Farming Partnership structure

Traditionally:

- Family land is purchased in Family Trusts and Unit Trusts. With their own corporate trustee.

- In contrast, the day-to-day farming operations are carried out through a (trading) partnership.

For example:

The four farming blocks are purchased over the last 55 years. This is the name of four separate Family Trusts. Each has its own corporate trustee – for asset protection. Or the farming lands are purchased in a Unit Trust (with a special type of Unit Trust corporate trustee) if the children are becoming part owners of the farm earlier than their parent’s death. (We do not recommend that. The children get it soon enough when you are dead. No point rushing it.)

Everyone working on the farm, and their spouses, are made partners. Or they each form a Family Trust. And their Family Trust becomes one of the partners.

The Partnership leases the property from the Family Trusts. This is via a Lease Agreement. The Lease fee is often just a peppercorn rent. For example $10,000 per year.

When one of the farmers dies the old Partnership is dissolved. And you just build a new Partnership Deed. And whoever is left, plus the grandchildren who are interested in coming on, sign the new Partnership Agreement.

In other words, when people exit partnerships, by death or retirement, or enter partnerships, by the addition of new partners such as wives and children, the old partnership dissolves and a new partnership is created.

Apart from a header and a few trucks, there is generally no assets of value in the partnership. Therefore, there is no CGT and very little stamp duty on the hopping from one Partnership to the next over the following 200 – 300 years.

Obviously, you do not put into the farming trading partnership:

- off-farm assets (e.g. homes in the city)

- the farming land itself

This is the common way your accountant and adviser sets up your structure. This is no matter what primary production you engage in:

- Broadacre cropping

- Intensive livestock farming

- Dairy

- Fishing

- Viticulture

- Horticulture

- Aquaculture

Running a farm? Partnership vs company

Rather than a partnership, why not trade via a company?

But, companies are poor structures in which to conduct farming business. They are not eligible for a range of primary production concessions:

- cannot use Financial Risk Management strategies – FMD’s

- are ineligible for primary production averaging

Plus, companies suffer income tax issues:

- You cannot stream income

- E.g. you cannot stream CGT to one person, imputation credits to another, and income tax to a third person

- companies pay tax at a rate of up to 30 cents on the dollar

- If the company is of a size where it is a base rate entity, the company tax rate is 25%. This applies to most family-run businesses: https://www.ato.gov.au/rates/

changes-to-company-tax-rates/

- If the company is of a size where it is a base rate entity, the company tax rate is 25%. This applies to most family-run businesses: https://www.ato.gov.au/rates/

- do not easily get Capital Gains Tax relief

- loans restrictions to shareholders and their associates

But companies are useful as trustees of your Family Trust and Unit Trust. As a mere corporate trustee, the company does not trade in its own right. It trades on behalf of the trust structure and trust beneficiaries.

Tax File Number, GST, ABN and bank accounts for an Australian Partnership

A Partnership Agreement is a contract. It governs a business relationship between two or more individuals (or corporations) that are working together.

A partnership is not a separate legal entity. It is not like a company. But it still has a tax file number (TFN). A Partnership, while not usually paying tax itself, still lodges a yearly tax return. Instead, each partner is taxed separately on their share of the profits.

A partnership is entitled to an Australian business number (ABN) if it is carrying on an enterprise in Australia. For example: running a business for profit that comes within the definition of enterprise in the GST Act.

Your partnership (just like a trust) is not a separate identity for tax. However, you may still need to register for TFN, GST, ABN and PAYG. You can do this for free on the ATO website.

After a Partnership deed is signed, a partnership bank account is opened.

Does the Partnership Agreement mention AASB15 “Revenue from Contracts with Customers”?

As of 1 July 2021, non-listed companies are no longer allowed to prepare Special Purpose Financial Statements (SPFs). Instead, they prepare the arduous General Purpose Financial Statements (GPFS). Small proprietary companies where 5% of their shareholders request GPFS to be prepared are included in the definition of companies that comply with this requirement.

This requirement also applies to SMSF, Trusts and Partnerships, but only where the founding Deed makes mention of AASB15 in its definition of income.

Happily, Legal Consolidated documents do not reference AASB15 in the definition of income.

Further, no Legal Consolidated documents require compliance with the arduous AASB15.

Free legal advice when building your Partnership Deed

Legal Consolidated does not give legal advice on which business structure is best for you. That is a question that your accountant and financial planner consider. They know your circumstances. We do not know your circumstances.

For free, start building your Partnership Deed on our law firm’s website. Read all the free hints. Educate yourself. When you have answered as many questions as you can, you or your adviser can telephone us to check and discuss your answers. But start the Partnership building process BEFORE you call the law firm.

Partnership vs other Business Structures

Partnership Agreement vs Family trust

- Family Trust Deed – watch the free training course

- Family Trust Updates:

- Everything – Appointor, Trustee & Deed Update

- Deed ONLY – only update the Deed for tax

- Guardian and Appointor – only update the Guardian & Appointor

- Change the Trustee – change human Trustees and Company Trustees

- The company as Trustee of Family Trust – only for assets protection?

- Bucket Company for Family Trust – tax advantages of a corporate beneficiary

Partnership Agreement vs Unit Trust

- Unit Trust

- Unit Trust Vesting Deed – wind up your Unit Trust

- Change Unit Trust Trustee – replace the trustee of your Unit Trust

- Company as Trustee of Unit Trust – how to build a company designed to be a trustee of a Unit Trust

Partnership Agreement vs Corporate structures

- Incorporate an Australian Company – best practice with the Constitution

- Upgrade the old Company Constitution – this is why

- Replace lost Company Constitution – about to get an ATO Audit?

Partnerships vs Independent Contractors Agreements

- Independent Contractor Agreement – make sure the person is NOT an employee

- Service Trust Agreement – operate a second business to move income and wealth

- Law firm Service Trust Agreement – how a law firm runs the backend of its practice

- Medical Doctor Service Trust Agreement – complies with all State rules, including New South Wales

- Dentist Service Trust Agreement – how dentists move income to their family

- Engineering Service Trust Agreement – commonly engineers set up the wrong structure

- Accountants Service Trust Agreement – complies with ATO’s new view on the Phillips case