Service Trust Agreement

$849 includes GST

-

• Designed to work throughout Australia • Complies with ATO's latest rulings

• Designed for Family Trusts, Unit Trust, partnerships and companies

Service Trust Agreement

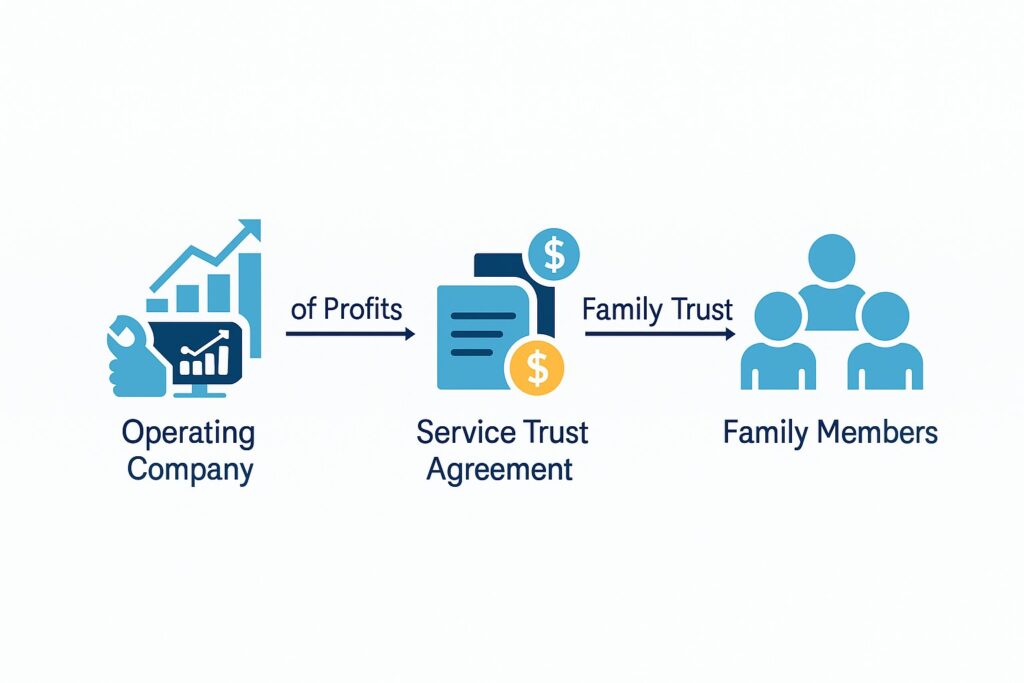

A Service Trust Agreement is the glue between the business and the service trust that services that business. It is common practice for businesses to use a service trust (service entity). A service trust is often a:

- Family Trust – for a single business owner (with a corporate trustee and then, when the profits build up, a bucket company)

- Unit Trust – if two or more business owners (with a company as the trustee of the Unit Trust)

- Company – not common, as profit is trapped and there is no CGT relief. But useful if you have no family because of the 30% tax rate

Build these three types of service trusts on our law firm’s website. All three take advantage of Fortunatow v FCT [2019] FCA 1247.

A service trust is a second business

The service trust is a second business. The service trust provides services to the business. It charges a fee for providing those services. Service trust profits are shared with the business owner’s spouse, children and family. They pay tax at a lower marginal tax rate. Therefore, the service trust saves tax. It helps with superannuation benefits and the spreading of income to family members.

The service trust is a second business. The service trust provides services to the business. It charges a fee for providing those services. Service trust profits are shared with the business owner’s spouse, children and family. They pay tax at a lower marginal tax rate. Therefore, the service trust saves tax. It helps with superannuation benefits and the spreading of income to family members.

But it is not enough to have just a service trust. You need an agreement between the business and the service trust, called a Service Trust Agreement. The Service Trust Agreement is a contract that allows the service trust to supply the business with equipment, staff, a receptionist, tools, a factory, premises, and administration services.

Example where the primary business is stuck in a partnership

The partnership of Colin Smith and James Hardbuckle trades under the business name Smith and Hardbuckle.

It is a well-established Melbourne practice with great name awareness, making a lot of money.

Sure, it should have been set up as a Unit Trust with a corporate trustee, but that is water under the bridge. They are stuck in a partnership, and the Capital Gains Tax and stamp duty are too high to move into a more asset-protective and tax-friendly structure.

Their accountant suggests setting up a second business. The second business will provide cleaning, vehicles, staff, marketing, accounting services and other support. Their accountant goes to a law firm that specialises in this area of law, Legal Consolidated. On Legal Consolidated’s website, they build:

- A company, and once incorporated, a Unit Trust – the wives or their Family Trusts own the units in the Unit Trust (the New Business)

- They need the glue to link Smith and Hardbuckle with the New Business. To do that, they build a Service Trust Agreement. The Principal is Smith and Hardbuckle, and the Trustee of the Unit Trust is the Contractor.

The High Cost of “Handshakes”: FCT v S.N.A Group [2026]

In FCT v S.N.A Group Pty Ltd [2026] FCAFC 10, the Full Federal Court handed the ATO a massive victory. A real estate group (Coronis) paid $19 million in service fees to related entities. The ATO disallowed the deductions. Why? Because their written Service Trust Agreements had expired years earlier.

The taxpayers argued that a contract should be “inferred” from their conduct and the “commercial reality” of their business. The Full Court disagreed. They ruled that without an “objective manifestation” of a contract, there was no legal obligation to pay the fees. No written agreement meant no tax deduction.

Can a Company also benefit from a Service Trust?

When you mention a service trust, we often think of trapped profits in professional partnerships, such as those of doctors, dentists, accountants, and financial planning practices.

However, a typical but old-fashioned business structure is to hold all company shares in the name of a single person. While simple at the outset, this creates a significant problem as your business grows. Extracting wealth and profits from the company is difficult and tax-inefficient.

As the sole shareholder, you are loaded up with dividends, often pushing you into the highest tax bracket. Meanwhile, your spouse and adult children have unused low tax rate thresholds. This is a missed opportunity for tax-effective wealth distribution for your family.

A Service Trust is not just for lawyers, doctors and accountants.

Any business can use one.

It can move trapped company profits into the hands of your family members with low tax thresholds.

How a company can benefit from a service trust and a service trust agreement

In these circumstances, your accountant and financial planner may recommend a Service Trust. A Family Trust is commonly used for this purpose. The Service Trust operates as a separate, stand-alone business (the Contractor) providing services to your company (the Principal):

- Company (Principal)

- Family Service Trust (Contractor)

- Service Trust Agreement (which is a type of Independent Contractors agreement)

The Service Trust Agreement is the legal ‘glue’ that connects your company and your Family Trust. This type of Independent Contract formalises the relationship by:

-

Outlining the specific services provided (e.g., administration, management, marketing).

-

Setting the commercial, market-rate terms for payment.

-

Ensuring the arrangement is compliant with Australian Taxation Office (ATO) rulings.

This agreement establishes your Family Trust as an independent contractor providing services to the Principal, being your company.

How Profits Move out of your company to your family

The Family Trust earns a profit by charging your company for the services it provides. This payment is a tax-deductible expense for your company, which reduces its taxable profit.

The Family Trust, now holding this profit, distributes the income to its beneficiaries – typically your lower-income earning spouse and adult children. This strategy has two benefits:

- it utilises your family member’s lower marginal tax rates, significantly reducing your family’s overall tax burden; and

- unlocks the wealth that is trapped in your company.

When did the first Australian service trust start?

In 1956, eight doctors got together in Cessnock, New South Wales. They set up eight corporate trustees. This is one for each of their respective family trusts. See Peate v FCT (1966) 116 CLR 38. See also the landmark case of 1978 case Phillips v FC of T 8 ATR 783; 78 ATC 4361.

Phillips v Federal Commissioner of Tax

In the realm of service trust agreements, the case of Phillips v FC of T is a landmark decision. This case established the principle that a service entity, such as a family trust or company, can be legitimately used to provide services to a professional practice. This is provided it has two things:

- A legally enforceable contract setting out the relationship (such as this Legal Consolidated Service Trust Agreement), and

- The second new business is genuinely an actual business and acts like an arm’s-length business (it charges the old business what similar contractors would charge).

The key takeaway from Phillips is that for such an arrangement to be effective for tax purposes, it must be commercially realistic.

The service fees charged by the trust must be at a commercial rate for the services provided, such as premises, equipment, and administrative support. The Australian Taxation Office (ATO) accepts these “Phillips arrangements” when they are not a guise for tax avoidance but a genuine commercial arrangement. This allows for legitimate asset protection and the distribution of business profits.

Service Trust Agreements are also popular for:

- Other professionals, such as engineers, doctors, dentists, accountants and lawyers, cannot otherwise share profit easily.

- Asset protection – one entity holds the high-risk activities (employees, tenancies & advice) the other keeps all the ‘good’ assets (land, intellectual property) in a low-risk entity.

- Companies want to liberate wealth and move profit into a trust structure. Unlike a company, the service trust can access the CGT tax concessions. Therefore, the service trust often holds appreciating assets. These include real estate, franchises, copyright and ‘leased out’ business names.

Where is the tax advantage of a service trust?

The service trust is a business. Via the Service Trust Agreement, it provides services, for a profit, to the business. The services are provided at ‘market rates’. This is required by the ATO TR 2006/2. The service trust then distributes any ‘profit’ it makes. This is from running the business. The profit goes to the non-working spouse, children and other taxpayers at a lower tax rate.

Example of a service trust

The firm generates $1.6 million in revenue. The Service Trust provides services to the firm. The Service Trust Agreement sets out the services. Services include office cleaning, providing secretarial support, maintaining a diary, managing computers, marketing, office lease administration, and bookkeeping. The service entity owns the equipment and employs all non-partner staff.

The Service Trust, through the Service Trust Agreement, charges the firm $1.4 million in fees.

By providing these services, the Service Trust earns a profit of $0.8 million. (This is after it pays its expenses of $0.6 million.) That profit is distributed to the spouse, children and other trust beneficiaries.

The business cannot share ‘personal services income’. However, the service trust’s income is not personal services income. This is because the service trust is a separate business from the firm’s practice. The service trust operates on an ‘arm’s length basis’. Therefore, the income is distributed to the spouse, children, and other beneficiaries, including the business owners.

Does the ATO like ‘markups’ in service trusts?

Q: I am having trouble with the example of $1.6M Fees with Service Fee of $1.4M, Service Entity Costs of $0.6M and $0.8M available to be distributed discretionarily. The ATO missives imply that the ATO won’t accept an economically sustainable service fee rather a 30% uplift on salary costs and 10% on expenses and the service entity needs to be absorbing about 18% or more of the expenses leaving a net profit less than 10% of the total service fees, additionally the 10% profit cannot be more than 30% of the combined profit of the professional firm and service entity added together. The ATO’s position seems completely uncommercial and a service entity unviable for the average practice.

A: I think you are completely wrong and fundamentally do not understand what the ATO and I have said. I suggest you re-read this page and the ATO’s views on the matter. As I have stated since 1988, the ATO’s position on service trusts is completely correct. But so misunderstood. Firstly, even contemplating ‘markups’ is silly, lazy, and wrong. Instead, concentrate on the service trust being a separate third-party business. The ATO is just asking for commerciality. And the ATO is right. Rather than try to trap the ATO with these ridiculous and artificial notions of markups, instead look to commercialism:

- Is the service trust behaving like a separate arms-length business?

- Do you have some quotes for cleaning the office from other cleaning companies?

- What does a bookkeeper charge in Kiama? It is probably different to what they charge in Bowral.

Independent Contractors Agreement vs Service Trust Agreement

A Service Trust Agreement is an Independent Contractors Agreement (‘contract for services’).

The principal (business) requests and pays for the services. The person providing the services is the contractor (service trust). The agreement between the principal and contractor is the Service Trust Agreement.

The contractor is ‘independent’. The contractor is not an employee of the principal (business).

Don’t let your Service Trust Agreement expire

The FCT v S.N.A Group Pty Ltd [2026] FCAFC 10 case is a warning to every business owner: The ATO does not care about “intent.” In that case, the directors intended for the service fees to be paid, and the accountants recorded them in the books. But the court held that internal accounting entries and directors’ uncommunicated thoughts do not constitute a contract.

To satisfy Section 8-1 of the ITAA 1997, a deduction must be “incurred.” To be incurred, there must be a present legal debt. Our Service Trust Agreement creates that debt. It provides the “outward manifestation” the Full Federal Court requires to prove your arrangement is a genuine business obligation, not a voluntary gift.

What should the Service Trust charge?

Each financial year, your accountant tells you what to charge. The Service Trust Agreement allows for this. You charge ‘market rates’. Treat the service trust as a separate, non-related business. The Service Trust Agreement allows the service trust to provide many services, including:

- plant and equipment (desks, chairs, library, tools, equipment)

- non-partner staff (build the Employment Contracts here)

- consumables

- the premises

- budgeting, forecasting, bookkeeping, accounting and debt collection services

- marketing, corporate design and identity and brand awareness

- additional services — as agreed by the parties from time to time

How do I update the Service Trust Agreement?

An exchange of emails updates the Service Trust Agreement. This is throughout the life of the Service Trust. Add more services as your accountant suggests over the years. Later, you can add a scope of work, plans, diagrams and specifications.

The Service Trust Agreement is silent on what it charges the firm. Therefore, it is never out of date. Your accountant advises you on the appropriate charges during the financial year.

ATO’s view on service trusts

Practical Compliance Guideline PCG 2021/D2 (Allocation of professional firm profits)

Old ATO rules for Service Trusts

In June 2015, the ATO issued service trust guidelines. This is for allocating profits within professional firms.

However, it was unceremoniously withdrawn in December 2017. The ATO suspended the application of its old guidelines:

Assessing the Risk: Allocation of profits within professional firms

These old guidelines provided that the professional risk of being audited was low if any of the following applied and there were no other compliance issues:

-

- the practitioner received income from the firm as an appropriate return for the services provided;

- the practitioner was assessed on at least 50% of the income to which the practitioner and the associates were collectively entitled; or

- the practitioner and the associates each had an effective tax rate of 30% or higher on the income received from the firm.

- the practitioner received income from the firm as an appropriate return for the services provided;

Why did the ATO scrap the old service trust rules?

The ATO noticed a variety of arrangements exhibiting high-risk factors. These were not contemplated within its old guidelines. The new sharp practices including the use of related-party financing and self-managed superannuation funds.

The ATO started a review. It wanted ‘certainty’ by 30 June 2018. Instead, the ATO allowed taxpayers with pre-14 December 2017 arrangements to continue to rely on the suspended guidelines. This is on a year-by-year basis. I thought that this was rather generous of the ATO.

ATO’s new Guidelines on Service Trusts – more complex

On 1 March 2021, the ATO issued a replacement guide. It is called:

Practical Compliance Guideline PCG 2021/D2 (Allocation of professional firm profits – ATO compliance approach) (Guide).

The Guide affects professional firms. But, it also affects any other person operating a:

- family trust service trust

- unit trust service trust

- company service trust

Guide 2021/D2 ‘looks like’ it only affects professionals

The Guide is concerned with an ‘individual professional practitioner’. This is where the professional redirects income from their practice to an associated entity. This includes a family trust, unit trust or company.

Obviously, this is where it has the effect of reducing the professional’s tax liability. The service trust usually pays tax at a lower overall amount.

The professional can use the safe harbours in the Guide. But first, you satisfy two “gateways”:

- Gateway 1 is the arrangement commercial?

- Gateway 2 requires that the arrangement is not high-risk. These are obvious examples of high risk:

- financing arrangements for non-arm’s length transactions

- abusing the difference between accounting standards and tax law

- where a partner assigns a portion of a partnership interest that are materially different from those in the:

- FCT v Everett (1980) 10 ATR 608; and

- FCT v Galland (1986) 18 ATR 33

- multiple classes of shares and units held by non-equity holders

What if you pass Gateways 1 and 2? The Guide provides a “risk assessment scoring table” that assigns a score depending on:

- the proportion of profit entitlement from the “whole of the firm group” returned in the hands of the professional

- the total effective tax rate for income received from the firm by the IPP and associated entities

- remuneration returned in the professional’s hands as a percentage of the commercial benchmark for the services provided to the firm

Those risk scores are added up to place you within a low, medium or high-risk level zone. This is green, amber or red. Green is good. Amber is neutral. Red is bad.

The Guide gives you and your accountant confidence that if your circumstances are low-risk then the ATO ‘will generally not allocate compliance resources to test the relevant tax outcomes’. That is code that they have bigger fish to fry.

PCG 2021/D2 vs Personal Services Income

Personal Services Income (PSI) is where you cannot share profit. For example, you are a ‘one-man band’. You are not a ‘business’. The Guide does not apply to an enterprise that suffers from the personal services income rules.

The Guide does not relieve taxpayers of their legal obligation to self-assess their compliance with relevant tax laws. Get your accountant to check everything you do.

PCG 2021/D2 vs Part IVA

The general anti-avoidance provisions in Part IVA ITAA 1936 continue to apply. This is especially for ‘schemes’ designed to ensure the professional is not appropriately rewarded for the work he does in the firm.

Does PCG change anything for service trusts?

A Service Trust Agreement is the glue between the Contractor (Old business) and the Service Trust (New business).

To help understand how a Service Trust works start calling the Service trust the ‘New business’ and the Service Trust Agreement an ‘Independent Contactors Agreement’.

Legal Consolidated sees the ATO’s latest views as unchanged. They are more common sense from the ATO. I am embarrassed that the ATO had to state the obvious again.

I suggest that all clients in service trusts or those who want to be in a service trust cling to the bosom of their accountant. Your accountant must ensure you are ‘in the green’. This may involve detailed accounting and financial modelling. Part of that process is to build a service trust agreement. It is the glue between the professional and the service trust, providing services to the professional.

Some professionals restructure to enter the green, low-risk area. This may trigger transfer (stamp) duty and Capital Gains Tax.

The Guide also provides examples. This is determining the “effective tax rate”. It includes some great case studies. I enjoyed reading them. They make sense. But talk with your accountant for the final sign off.

Why each Principal should have its own Independent Contracts Agreement

A service trust is a versatile structure that can efficiently provide services to multiple principals, much like an accountant can manage the affairs of many clients. This flexibility stems from the nature of a service trust as a separate business entity that contracts independently with each principal, offering services such as equipment, staff, or administrative support. However, a service trust agreement should not be set up to serve more than one principal. Instead, each principal must enter into their own distinct Independent Contractors Agreement with the service trust. This ensures clarity, compliance with tax laws, and proper delineation of responsibilities.

Why each principal needs their own Service Trust Agreement

While one Service Trust can sign many Independent Contractor Agreements, each principal needs its own ICA.

For example, imagine four dentists operating their own practices. One service trust (usually a Unit Trust with a company as trustee) can provide each dentist with resources such as dental equipment, receptionists, marketing, brand awareness, cleaning, and office space.

Rather than creating one service trust agreement for all four, the service trust should have four Independent contractor agreements—one for each dentist. This approach mirrors how an accountant handles multiple clients: each relationship is distinct, tailored, and independently managed. The Australian Taxation Office (ATO) supports this structure, as outlined in Taxation Ruling TR 2006/2, which emphasises that service fees must be charged at market rates and reflect a genuine commercial arrangement between separate entities.

Bundling all the principals together in one service trust agreement looks artificial. It is not in keeping with commercial practices, and it raises a red flag. Combining all principals into a single service trust agreement appears contrived and risks undermining its commercial legitimacy.

This principle is reinforced by the Independent Contractors Act 2006 (Cth), which governs the relationship between principals and contractors in Australia. Section 5 of the Act defines a services contract as one where a person provides services to another, highlighting the need for individual agreements to maintain the contractor’s independence. Combining multiple principals into a single agreement risks blurring these lines, potentially leading to misclassification as an employment relationship or scrutiny from the ATO for tax avoidance.

Consider another example: a group of engineers running separate consulting businesses. A service trust could provide them with shared resources, such as drafting tools, software licenses, or administrative staff. Each engineer would sign their own Independent Contractors Agreement with the service trust, ensuring that the service trust operates as a standalone business providing services at arm’s length to each engineer. To do otherwise is akin to an accounting practice (as a contractor) treating all clients (principals) the same, regardless of their size, whether corporate or individual.

Each principal having their own service trust agreement not only complies with legal and tax requirements but also enhances asset protection, keeping the trust’s assets separate from any one principal’s liabilities.

The case of Peate v FCT (1966) 116 CLR 38 illustrates this concept historically. Eight doctors in New South Wales used separate corporate trustees for their family trusts, linked by individual service arrangements. While the structure differed slightly, the principle of distinct agreements with a service entity aligns with modern practice. Similarly, a medical practice with multiple doctors could use one service trust to provide nursing staff or billing services, with each doctor contracting separately to maintain compliance and flexibility.

This is very different to where eight people own units in one Unit Trust or shares in one company (the Old Business). The Old Business (as a single Principal) can engage the services of the New Business using a single Service Trust Agreement (as the Contractor).

A Service Trust can service many Principals, but each Principal needs its own Service Trust Agreement

In summary, a service trust can indeed service multiple Principals, but it must do so through individual Independent Contractors Agreements with each Principal. This ensures adherence to legislation like the Independent Contractors Act 2006 and ATO guidelines while offering a practical way to share resources across independent professionals—be they dentists, engineers, or doctors—without entangling their operations under a single principal.

Lessons from the S.N.A Group

If the ATO audits your Service Trust today, they use the S.N.A Group checklist:

-

Is there a written agreement? Expired or “implied” agreements are rejected.

-

Is there a legal obligation? You cannot just move money because “it’s one group”.

-

Are the terms certain? The court found S.N.A Group’s lack of clear terms fatal.

Building your Service Trust Agreement on a law firm’s website ensures you aren’t relying on “commercial reality” to save you in court. We provide the specific legal framework that the Full Federal Court says is non-negotiable.

The ATO’s position on Service Trusts has not fundamentally changed over time

Here is an ancient article written by Professor Brett Davies Why the worry with Service Trusts. As you will see, both the ATO and Prof Davies have been in agreement about service trusts for decades – a most unusual and unholy alliance, some would say!

Business Structures for Personal Services Income, tax and asset protection

Family trust v Everett’s assignments

- Family Trust Deed – watch the free training course

- Family Trust Updates:

- Everything – Appointor, Trustee & Deed Update

- Deed ONLY – only update the Deed for tax

- Guardian and Appointor – only update the Guardian & Appointor

- Change the Trustee – change human Trustees and Company Trustees

- The company as Trustee of Family Trust – only for assets protection?

- Bucket Company for Family Trust – tax advantages of a corporate beneficiary

Unit trust vs Everett’s assignments

- Unit Trust

- Unit Trust Vesting Deed – wind up your Unit Trust

- Change Unit Trust Trustee – replace the trustee of your Unit Trust

- Company as Trustee of Unit Trust – how to build a company designed to be a trustee of a Unit Trust

Corporate structures and Everett’s assignments

- Partnership Agreement – but what about joint liability?

- Incorporate an Australian Company – best practice with the Constitution

- Upgrade the old Company Constitution – this is why

- Replace lost Company Constitution – about to get an ATO Audit?

- Independent Contractor Agreement – make sure the person is NOT an employee

- Service Trust Agreement – operate a second business to move income and wealth

- Law firm Service Trust Agreement – how a law firm runs the backend of its practice

- Medical Doctor Service Trust Agreement – complies with all State rules, including New South Wales

- Dentist Service Trust Agreement – how dentists move income to their family

- Engineering Service Trust Agreement – commonly engineers set up the wrong structure

- Accountants Service Trust Agreement – complies with ATO’s new view on the Phillips case