Company Registration

$996 includes GST

-

• includes ASIC fee, ASIC Certificate and ACN

• Constitution: Div7A Loan, 30 share classes, electronic secretary file and personalised Share certificates

• Company Officer: registers, minutes and consents

• we oversee & meet with ASIC, as required

Register your Australian company on our law firm’s website

Your new company and constitution are structured to perform many jobs. These include:

- corporate trustee of a family trust

- corporate trustee of a unit trust

- corporate trustee of Self-Managed Superannuation Fund (special purpose company)

- corporate trustee of a Custodian Bare trust when an SMSF borrows money

- bare trustee: Acknowledgement of Trust – ‘AFTER the Trustee buys’

- bare trustee: Declaration of Trust BEFORE you buy – ‘secretly buy’

- bare trustee: Bare Trust Deed – ‘hide assets you own’

- crowd-sourced funding vehicle

- vehicle to operate a business in its own right (rather than through a trust)

- ‘bucket company’ for your Family Trust (see below)

At no additional charge, we talk to ASIC on your behalf. This is to make sure your company is registered correctly. Our law firm provides a complete company register. It contains all minutes and our constitution. The documents are stored online for you to access at any time.

How to choose a name for your new Australian company

As you build your Australian company on our website, check if your preferred company name is available.

Restricted words and expressions in an Australian company:

- ‘bank’

- ‘trust’

- ‘royal’

- ‘incorporated’

You cannot use words that could mislead people about a company’s activities. This includes links to the Government, the Royal Family, or ex-service groups.

ASIC also refuses offensive and illegal names.

Australian Company Name Abbreviations:

- and: &

- Australian Business Number: ABN

- Company: Co, Coy

- Proprietary: Pty

- Limited: Ltd

- Australian: Aust

- Proprietary Limited: Pty Ltd

Company Constitution vs Australian replaceable rules

Australian companies are governed by either:

- a constitution (recommended), or

- replaceable rules

Replaceable rules (from the Corporations Act 2001) provide a basic set of rules for your company. They are not good. Few accountants, lawyers and advisers recommend them.

Replaceable rules are less than the bare minimum. There are many additional powers that a company should have. These are only found in a constitution.

Replaceable rules change at the whim of the current government. While the changes may benefit ‘society’, they may not be in the best interests of shareholders. In contrast, shareholders can amend constitutions anytime.

-

What you get in the Legal Consolidated bucket company

Included in the above price you get:

- start building your company for free. The hints and training videos guide you. Telephone us for legal advice on how to answer the questions

- the law firm oversees the incorporation process, every step of the way, with ASIC

- the law firm meets and speaks with ASIC regarding your company name, as required

- includes:

- all ASIC incorporation fees

- Certificate of Incorporation

- Australian Company Number (ACN)

- comes with the law firm letter:

- confirms a law firm prepared for your company

- show you how to get a free ABN, TFN and GST

- cutting-edge Company Constitution contains:

- Division 7A Loan Deed

- tag along, share buybacks and pre-emptive rights

- accountant-friendly, GAAP-compliant valuation powers

- profit distributions, even when there is no ‘profit’ for ATO purposes

- over 30 different classes of shares, including preference shares

- permits electronic:

- meetings and signatures

- storage of secretarial file

- no need for annual meetings

- allows single directors

- no company seal required

- no restriction on what it can be used for

- personalised Share certificates

- minutes, registers and consents, including:

- Company Officer registers

- Company Officer consent forms

- Application of shares

Your lawyer prepared Company Constitution contains:

- Adj Professor, Dr Brett Davies’ Doctorate was on business succession planning, our pre-emptive rights are cutting edge

- ‘tag along’ requirement forcing minority shareholders to also sell their shares together with majority shareholders

- accountant-friendly, GAAP-compliant valuation powers

- profit distributions, even when there is no ‘profit’ for ATO purposes

- over 30 different classes of shares – see the sample. And you can add to the classes of shares at any time

- allowing Directors and shareholders to use Zoom and other online facilities

- built-in Division 7A Loan Deeds

“Pty Ltd” is an abbreviation for “Proprietary Limited”

- ‘Proprietary’ means the company is privately held.

- ‘Limited’ means the liability of the shareholders to pay the debts of the company is limited. This is called ‘limited liability‘. See here for asset protection.

Minimum requirements for an Australian Pty Ltd company:

- at least one director/secretary living in Australia

- a physical Australian address for the registered office

- at least one shareholder (but no more than 50 non-employee shareholders0

Pty Ltd companies are the vast majority of companies registered in Australia. Over 99% of companies incorporated in Australia are Pty Ltd. (Less common is “Ltd” and “No Liability”.)

Five advantages of using a law firm to incorporate your company

The 5 advantages of using Legal Consolidated:

- when required, we contact ASIC to confirm your company name

- what if your company name is unavailable or challenged by ASIC? We contact you and help you find one that is available

- you receive a secure, personalised email containing

- Certificate of Incorporation

- Company Constitution

- All minutes

- Letter on our law firm’s letterhead

- Share certificates (which you can print off and complete throughout the life of the company)

- as always, our hints and training videos guide you. The law firm is available for legal advice on how to build your document

- a constitution is a deed. Only a law firm can legally prepare deeds.

Australian company tax rates

A company pays tax at a fixed rate. (In contrast, a human being pays tax at different marginal tax rates. The more you earn the higher the tax rate.) Your company (flat) tax rate depends on whether the company is a base rate entity.

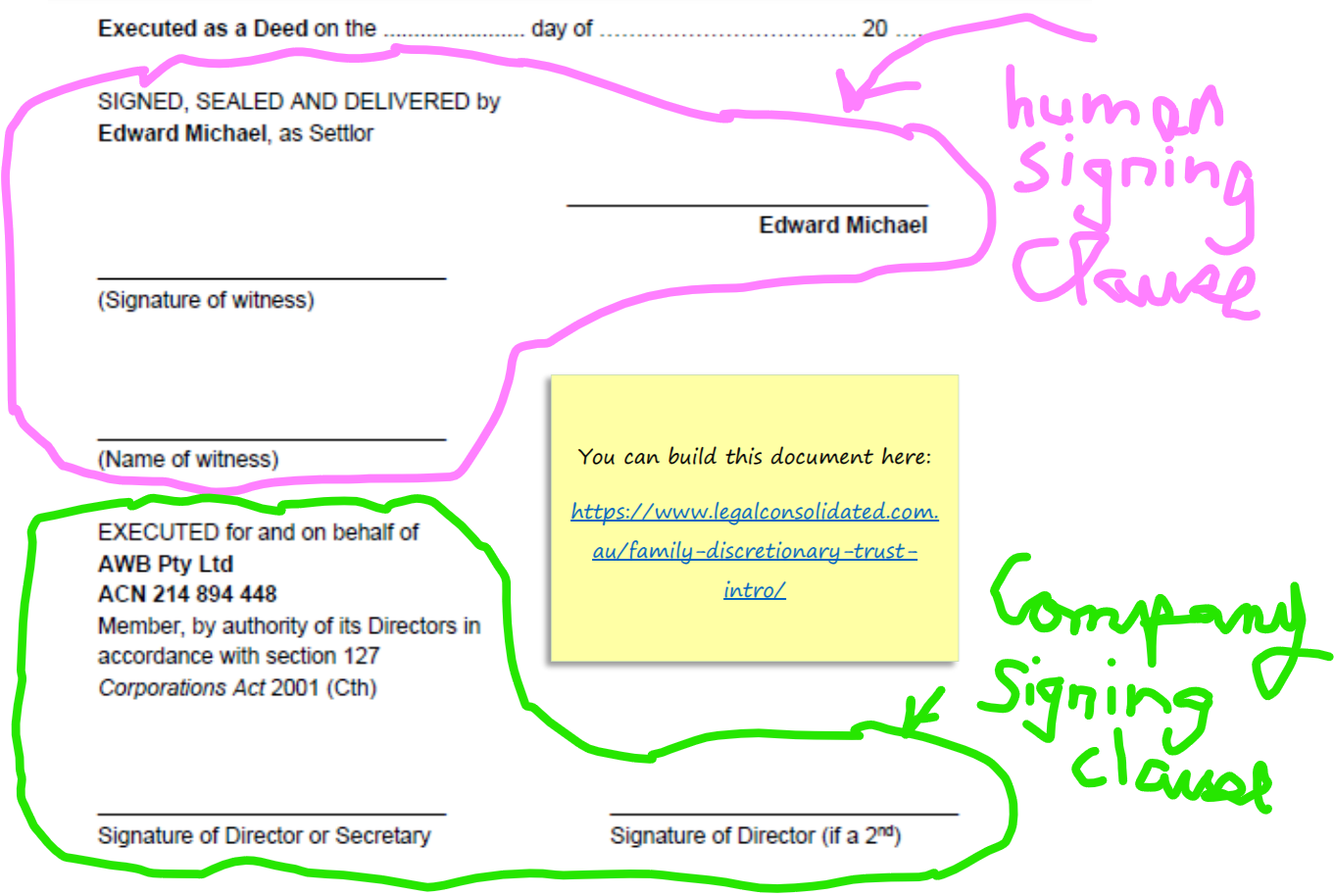

Do Company Directors and shareholders need to sign together?

1. How to sign a Deed if your company only has one director

Except for a company to be trustee of a Self-Managed Superfund, over 87% of companies built on our website site only have one director. This is for asset protection.

The sole director usually also wears two other hats. These are ‘company secretary’ and ‘public officer’.

As such, under a Legal Consolidated company signing clause only one person signs. That is the sole director (who is also the secretary and public officer). And the ‘second director/secretary’ signing position is left blank.

2. How to sign a Deed if you have two or more directors of your company

If you have two or more directors, then two directors must sign the company signing clause. They can sign on different days. And in different locations. (Or a person holding a Company POA can sign on behalf of the company.)

While a ‘human’ signing clause requires a witness, a company signing clause does not have witnesses. To labour the point, a director signs the company signing clause. The director’s signature is not witnessed.

For example:

The company has 5 directors. Colin is one of the directors. Colin lives in the Gold Coast. He signs the company signing clause as one of the directors. The next day he couriers the deed to be signed by another director to the Barossa Valley. This is where one of the other directors’ lives. The other director a few days later gets around to signing the deed as the second director.

Neither director requires a witness. This is because company signing clauses do not have witnesses.

3. How shareholders of a company sign a Deed

Shareholders can each sign in different locations. And with different witnesses. And on different days.

As stated above, a ‘human’ signing clause (in contrast to a company signing clause) requires a witness.

Constitution allows for digital signatures

Q: When purchasing a new company on your website, does the constitution by default include a clause allowing for digital signatures for Directors? I know you do not like digital signatures!

A: You are correct, I do not like digital signatures. But the Company Constitution is fully updated to allow for all legislation of digital signatures and over Internet meetings, such as:

- Zoom

- Microsoft Teams

- Webex Meetings

- GoToMeeting

- Google Hangouts Meet

- BlueJeans Meetings

- join.me

- Cisco Jabber

- TeamViewer

- Adobe Connect

Can an Australian company, itself, give a Power of Attorney?

Yes. It is called a Corporate Power of Attorney. Legal Consolidated Constitutions allow for Company POAs.

Is my company a ‘bucket company’ for my Family Trust?

When you build a company, any company, it becomes a beneficiary under a Family Trust prepared by Legal Consolidated or Brett Davies Lawyers. This is the case for most Australian Family Trusts, as well.

You could build the company many years after you built the Family Trust deed. It does not matter. The company automatically becomes a beneficiary under your family trust. You are then able to use it as a ‘bucket’ company if you so wish.

Similarly, if get married and have children then they automatically become beneficiaries under the Family Trust.

This is because the Family Trust has ‘classes’ of ‘beneficiaries’. And these classes are ‘open’.

The definition of beneficiaries generally includes ‘my spouse, children, grandchildren, great-grandchildren and any company I have an interest in, from time to time‘.

So generally any company you have an interest in is also a beneficiary under your Family Trust.

Interestingly, if you have a share in say, Rio Tinto, and if Rio Tinto has 300,000 beneficiaries, then all 300,000 beneficiaries are also beneficiaries of your family trust!

So pretty much any company you have an interest in is a beneficiary of your family trust. Obviously, a “Special Purpose Company” (while also a beneficiary of your family trust) can not be used as a bucket company. This is because a Special Purpose Company can only do one job. This is to be a trustee of your Self-Managed Superannuation Fund.

Why is it called a ‘bucket company’ in a family trust?

Your Family Trust distributes to humans beneficiaries (mum, dad, children) first. This is to use up their low marginal tax rates. When there is no one left on low marginally tax rates then the family trust pours the rest of the income into the ‘bucket’ company. The company gets whatever income is left to be distributed.

Unlike humans, companies pay a fixed percentage rate of tax. Whether the company gets $10,000 or $100,000 in trust income it pays the same percentage tax rate.

However, bucket companies are rarely used, these days. This is because of the draconian and cruel Division 7A.

Different types of Directors in a Pty Ltd

Over 99% of Pty Ltd companies only have one director. This is for asset protection. But you can have more. There are distinctions in the types of directors. These are all ‘nicknames’ for different roles a director may hold. You can mix and match these powers as the shareholders see fit:

- Managing Director – appointed, by the directors. The “MD” may take all of the board’s power

- Chair of directors – exercises procedural control at the meetings and signs the minutes

- Nominee director – represents the interests of a particular group. For example, employees may be entitled, pursuant to the company constitution, to elect a director

- Alternate director – fills in during a director’s absence

- Executive director – a full-time employee of the company

- Non-executive director – not involved in full-time management of the company. Not an employee. An outsider is free of any business or other relationship with the company. Considered ‘independent’. Often these are experts. They provide specific expertise for certain areas of the company’s business

- Governing director – see below

The above expressions are descriptive. They are not strict legal terms. Because you have a Legal Consolidated Constitution you can change and amend the powers of the directors.

Maintaining a company register

A Pty Ltd company in Australia requires a company register. All Australian companies keep some form of written financial records that:

- record and explain the financial position and performance

- enable accurate financial statements to be prepared

Requirements for company ‘books’ and registers

Section 9 Corporations Act defines ‘books’ to include:

- registers

- records of information

- financial reports

- financial records

- other documents

All Australian Pty Ltd companies maintain ‘books’. The common expression is the ‘company secretary file’. The Corporations Act sets out how this is maintained. It also states who is provided access to the information in the company secretary file.

You suffer penalties if you fail to maintain the company’s books, destroy or falsify them. For example, false minutes carry a fine and two years in jail.

Mandatory company books and their requirements are:

-

The Constitution – Is available for inspection at the company’s registered office. Access is provided (at no charge) to ASIC, directors, the auditor, liquidators, receivers, administrators, debenture holders and anyone authorised by ASIC and (for a fee) to shareholders (Authorised Persons).

-

Financial Records – Are kept for seven years. See section 286. They are also available for inspection. Keep them at the company’s registered office. Otherwise, you need to go out of your way to let ASIC know where they are kept. You provide access to the finances to the Authorised Persons for a fee. However, members see the finances for free.

-

These financial records can be electronic. But they must be convertible into hard copies. You must be able to print them.

-

Even if the financial records are held by your accountant, you, as a company officeholder, are still responsible for providing copies to auditors or anyone entitled to inspect your records.

-

-

Minute book of Directors’ Meeting – Minutes are recorded in the Directors’ minute book. This is within one month of the meeting. These are available for inspection at the registered office and principal place of business. The Authorised Person, other than members, access Directors’ Minutes.

-

Minute Book of Members’ Meetings – As with Directors’ meetings minutes are recorded within one month of the members’ meeting. They are available for inspection at the registered office, principal place of business or elsewhere approved by ASIC. The Authorised Person accesses the shareholders’ meeting minutes.

-

Register of Members – Section 169 Corporations Act requires an up-to-date register of all shareholders. This is for 7 years. And showing the changes over the 7 years of incoming and outgoing members. The register is kept in Australia. This is at either the registered office, principal place of business or at an ASIC-approved share registry. It is available for inspection. Access to these documents is provided to both the Authorised Persons and the general public for a fee. This Register of Members includes:

-

names

-

addresses

-

share certificate number

-

amount paid for the shares

-

number of shares held

-

-

Debenture holders and option holders – only if they exist these interests are also recorded.

Can an Australian Company Secretary file be held electronically?

Section 1306 Corporations Act 2001 permits companies to prepare and store their ‘books’. This includes registers and minutes, in a ‘mechanical, electronic and other device’.

But, the data stored in the device must be able to be reproduced ‘at any time’ in a written form. You must be able to print it out.

Also, Pty Ltd companies take reasonable precautions to protect their records against damage and tampering.

A company is also obliged to keep written financial records that correctly record and explain the company’s activities, financial position and performance. See section 286 Corporations Act 2001.

These records are kept for seven years. Section 288 allows financial records to be kept electronically. But, again, this is so long as they can be converted into a hard copy on demand.

Australian company Minutes require a wet signature

Electronic signatures are recognised in Australian law under the Electronic Transactions Act 1999 (Cth). States adopt similar rules.

But these provisions do not apply to the Corporations Act 2001. Therefore, minutes are signed in hard copy before electronic storage.

And in any event, Legal Consolidated is not an advocate of electronic signatures.

Governing Director in an Australian Pty Ltd company

Q: I want to appoint a Governing Director. This is so they cannot be removed. They are on the Board until they die, become of unsound mind or resign.

The powers of the Governing Director are:

- Appoint new Directors and remove them

- Solely call a Shareholder meeting

- Had final approval on any discussions past at Directors’ meetings

A: Also, a Governing director has:

- life tenure; and

- control of the board for life. This is not the case for public companies.

Shareholders Agreement for your new Australian company

After your company is incorporated think about a Shareholders Agreement. This is if you have more than just you and your spouse control the Pty Ltd company. Shareholders’ agreements are in addition to the constitution. It is between the members. It governs share ownership and transfers, dividend policies and management roles. They override the Constitution.

Build a Shareholders Agreement. And in the Minutes the shareholders unanimously agree to the powers of the Governing director.

Holding shares in trust for another person (18 or otherwise)

Q: I will hold shares in the company for my child. This is as bare trustee. She is currently under 18 years of age.

- When the child turns 18 must I then transfer the shares to her?

- Does the Legal Consolidated company come with an ‘off-market’ transfer forms?

A: Legal Consolidated’s company constitutions allow for a person (including shareholders and directors) to hold the beneficial interest in the share for someone else. And yes, this someone else can be a person under 18 years of age.

- To prove this trust relationship (to the family court, Centrelink, bankruptcy court and ATO) on the same day you build the Legal Consolidated company you also build a Declaration of Trust; or

- If you are issuing more shares after incorporation (e.g. 20 years after you built the company) and the beneficial owner is not the shareholder then you need to build, sign and date the Declaration of Trust on the day you transfer or issue those shares.

Now it is not correct to suggest that when a minor turns 18 you immediately transfer the shares from the legal shareholder to the beneficiary. (For an explanation of Australian trust law see here.)

Any person that is of sound mind and over 18 can direct a bare trustee to transfer the legal ownership of the shares to that beneficiary. Or, indeed, to any person the beneficiary wishes.

So, when the beneficial owner of the shares turns 18 then they can, if they wish, direct the trustee of shares to transfer them. Or not. It is the beneficiary owner’s decision. For example, the beneficial owner of any asset, not just shares, can direct these actions:

- “Harry be a good lad and transfer the shares to a new bare trustee.” (No stamp duty or CGT.)

- “Harry transfer the legal ownership into my name.” (No stamp duty or CGT.) The trust ceases to exist as the trustee and the sole beneficiaries are now the same person.

1. Bare trust when a beneficiary of the shares is over 18:

For example Fred holds 15 shares in a Legal Consolidated company. But he holds them in trust for his brother Brian. Brian is currently 30 years old. (In other words, Brian is over 18 when the trust relationship starts).

-

- Twenty years later Brian instructs Fred to transfer legal ownership to Muriel.

- Five years after that, Brian instructs Muriel to transfer the legal ownership of the shares to a New Company that Brian just set up.

- And 8 years after that Brian instructs New Company to transfer the legal ownership to Brian himself. (When the legal owner and beneficiary owner become one and the same then the trust is finished.)

As Brian was at all times the beneficial owner of the shares, Brian declares all income from the shares on his personal income tax returns. If Brian goes bankrupt or gets divorced the shares are lost.

2. Bare trust where a beneficiary is currently under 18:

Igal is a loving father of a 4-year-old daughter called Muriel. Igal issues and allots 60 shares in a company he controls to himself. But as bare trustee for his 4-year-old Muriel. Igal is merely a bare trustee.

-

- Time passes. Muriel is now 18. Igal offers to transfer the 60 shares into Muriel’s name. Muriel says no. She is happy for the shares to be legally owned in her dad’s name.

- At all times Muriel is the beneficial owner. And as such declares all income from the shares on her personal income tax return.

- Nine years later Muriel, is now a medical doctor. She is therefore, like all medical doctors, a high risk of bankruptcy.

- She instructs her dad, Igal, to transfer the legal ownership of the shares to her husband. (He is a schoolteacher and therefore low risk of bankruptcy. And, therefore, is the perfect ‘spouse of substance‘.)

- And she also transfers her beneficial ownership in the shares to her husband. She pays Capital Gains Tax. And the husband pays any transfer (stamp) duty. This is on the transfer of the beneficial ownership of the shares.

- As Muriel’s husband is now the beneficial owner of the shares, he now starts declaring the income from the shares on his personal income tax return.

- Time passes. Muriel is now 18. Igal offers to transfer the 60 shares into Muriel’s name. Muriel says no. She is happy for the shares to be legally owned in her dad’s name.

All transfers of Pty Ltd shares are “off-market transfer”

When discussing the transfer of Pty Ltd shares, you do not need to use the expression “off-market transfers”. Since Pty Ltd cannot be listed on the Australian Stock Exchange all such transfers are ‘off-market’.

And the Legal Consolidated Company Constitution comes with share certificates, transfers, share registries and the like. You merely print them off and complete them as required.

Eight most common questions for Director Identification numbers

1. Does every director need a Director ID number?

Every person who is a director of a Pty Ltd company must have a “Director ID” number.

Further information about the application process, and step-by-step instructions, can be found via this link: https://www.abrs.gov.au/director-identification-number/apply-director-identification-number

ASIC controls companies. But the ABRS is controlled by the Australian Taxation Office (ATO). But ASIC is responsible for enforcing director ID offences. This is within the Corporations Act 2001. Yes, this is rather confusing for both ASIC and ATO. Let’s hope that they find their inner strength to start working together as a united team.

It is a criminal offence if you do not apply for a Director ID on time. This is a bit draconian. This is especially given the turf wars between the ATO and ASIC.

It is time that the services of ASIC are removed from the federal government. And those services are looked after by the private sector. Governments are not good at running businesses.

2. Self-Managed Super Funds and Family Trust. Do their corporate trustees also need a Director ID number?

All directors apply for a director ID, including directors of corporate trustees of self-managed super funds (including Special Purpose Companies), Family Trusts, Unit Trust and Legal Consolidated’s famous Corporate partnership of family trusts.

3. Is your director ID number for life?

Yes. A director ID is a unique identifier. You apply for it once. And you keep it forever.

You keep your director ID until death. This is even if you stop being a company director, change your name or move interstate or overseas.

4. What is the value of a director identification number?

Every company in Australia is issued with a unique, nine-digit number. This is when your company is registered on our website. This is an Australian Company Number (ACN). It is displayed on all company documents.

The director ID helps prevent the use of false and fraudulent director identities.

It confirms your identity. It links you to all Australian companies.

5. Can my Accountant and Financial Planner do the application to get me a director ID number?

Sadly, your accountant and financial planner can not apply for a director ID number for you. No one, not even your tax agent, can apply for the director ID number on your behalf.

You need to do it yourself. The Australian Business Registry Services must personally verify your identity.

The Australian Business Registry Services (ABRS) needs to verify information held on your ATO records. This includes your Notice of Assessment.

But you are allowed and should seek assistance from your accountant and adviser with finding this information. Once the ABRS has your information, the online application is intuitive. It takes less than 5 minutes. You get your director ID number instantly.

6. Can an Enduring POA or Corporate POA apply for a Director ID on my behalf?

Q: Professor Davies the whole reason for having an Enduring POA and Company POA is so that others can do things on your behalf. In any event, one of our directors has lost mental capacity. Another is living overseas.

A: Neither a POA nor a Corporate Trustee can apply for a director ID on your behalf.

But your question worries me. It is a good idea for every company to have a Company POA. This is just in case you cannot get hold of a director quickly. For example, the director is on a Heli Ski trip and the Internet is not available. This is also fine if the director has just died or just lost mental capacity.

However, you need to be aware that dead people and people that have lost mental capacity cannot be directors of Australian companies. A Corporate POA does not rectify a dead or mentally incapacitated director.

7. Does it cost money to get a Director ID number?

No. It is free to apply for a Director ID number via your myGovID.

8. I am a volunteer NFP director do I need a DIN?

Those voluntary, unpaid director roles on not-for-profit organisations and Company Title Buildings. You all need a DIN.

And a registered Australian body, an ASIC-registered foreign company and an ATSI corporation require a DIN.

I hate the Director ID number! Can I have a trust without a company?

Q: I have been in turmoil over this director’s digital ID. I had no idea that setting up a trust & company would allow a government to take over my life in such a way that I have no freedom at all.

This is not what I had in mind when I set up the company and trust.

I merely wanted to leave my children a little security and a home. Not be forced into a corporate prison run by corrupt politicians.

Any director (or alternate director) who inadvertently fails to comply with the rules suffers civil and criminal penalties. The civil penalty is up to $1 million.

More serious liability arises if a director, by mistake, applies for multiple Director Identification Numbers, provides false information in their application, or misrepresents their Director Identification Number. These offences include imprisonment. Civil penalties also apply to any person who aids, abets, counsels, procures or induces such acclivities.

A: A company can hold assets in its own right. Or it can act as trustee of a family trust or trustee of a unit trust.

A company is ‘over-regulated‘ when compared to a trust. And the Director ID number is just more regulation. However, the introduction of director IDs will hopefully create a fairer business environment. This is by helping prevent the use of false and fraudulent director identities. In my personal view, this goes a long way to better identify and eliminate director involvement in unlawful activity.

You appear to have a company as trustee of a family trust. A company as a trustee is good for asset protection. But if you are holding only ‘safe’ assets such as shares and real estate then you may not need the additional protection of a corporate trustee.

There is no law that requires you to have a corporate trustee for your family trust. Instead of a company, as trustee, you could have a human as trustee of the family trust.

On another matter, you mention a ‘home’ in a trust. Your main residence (your home) is generally exempt from capital gains tax (CGT). This is called the ‘main residence exemption’. This is valuable. You probably do not want to lose that tax advantage.

You may be able to put a home into a bare trust or a Special Disability Trust and keep the principal place of residence CGT tax-free status. But if you put a family home into a family trust then the tax-free status of the home is usually lost. Plus if you are a pensioner you may lose Centrelink and local council discounts.

Business Structures for Personal Services Income, tax and asset protection

Family trust v Everett’s assignments

- Family Trust Deed – watch the free training course

- Family Trust Updates:

- Everything – Appointor, Trustee & Deed Update

- Deed ONLY – only update the Deed for tax

- Guardian and Appointor – only update the Guardian & Appointor

- Change the Trustee – change human Trustees and Company Trustees

- The company as Trustee of Family Trust – only for assets protection?

- Bucket Company for Family Trust – tax advantages of a corporate beneficiary

Unit trust vs Everett’s assignments

- Unit Trust

- Unit Trust Vesting Deed – wind up your Unit Trust

- Change Unit Trust Trustee – replace the trustee of your Unit Trust

- Company as Trustee of Unit Trust – how to build a company designed to be a trustee of a Unit Trust

Corporate structures and Everett’s assignments

- Partnership Agreement – but what about joint liability?

- Incorporate an Australian Company – best practice with the Constitution

- Upgrade the old Company Constitution – this is why

- Replace lost Company Constitution – about to get an ATO Audit?

- Independent Contractor Agreement – make sure the person is NOT an employee

- Service Trust Agreement – operate a second business to move income and wealth

- Law firm Service Trust Agreement – how a law firm runs the backend of its practice

- Medical Doctor Service Trust Agreement – complies with all State rules, including New South Wales

- Dentist Service Trust Agreement – how dentists move income to their family

- Engineering Service Trust Agreement – commonly engineers set up the wrong structure

- Accountants Service Trust Agreement – complies with ATO’s new view on the Phillips case