Declaration of Trust BEFORE You Buy (‘secretly buy’)

Let’s say that you own 7 out of 8 of the units in the same block. The last unit finally comes onto the market. The vendor knows that you own all the other units and is going to hold out for a lot of money. But you never approach the vendor. Instead, you get a friend to sign a Declaration of Trust BEFORE You Buy. Your friend is the trustee. You are the beneficiary.

You, as a Trustee, sign the Declaration of Trust BEFORE You Buy first. Only then does your friend offer to buy the unit. The vendor sells the home to your friend – unaware that you are the true purchaser. Your friend delivers the contract of sale to you and using the Declaration of Trust BEFORE You Buy the property settles in your name for no additional stamp duty or any CGT. The vendor is furious, but there is nothing he can do.

Your friend was just the ‘trustee’ of the asset. You, as the beneficiary, own the asset in equity – you are the ‘true’ owner. At any time, the beneficiary can direct, the Trustee, to transfer the asset to the beneficiary. There is generally no stamp duty or CGT for the transfer from the Trustee to the Beneficiary.

Open a bank account for another person?

You can also use this document to open an account for your children and partner.

Another type of bare trusts you can build on our law firm’s website:

Acknowledgement of Trust – ‘AFTER the Trustee buys’

/acknowledgment-of-trust/

About to incorporate a company to be the trustee of my Family Trust

Q: I am building a company (corporate trustee) to be the trustee of my Family Trust.

I want the shares in the corporate trustee to be beneficially owned by my 12 and 15-year old children.

Obviously, as my children are under 18 they are minors. Minors cannot sign agreements and deeds. Children cannot hold shares in their own names. They have to hold the shares via a trustee of a trust or bare trust.

(The Family Trust will own shares in other companies. But that is irrelevant. And I am not sure why I mention it. Obviously, the assets of my Family Trust belong to the Family Trust. The assets in my Family Trust do not beneficially belong to the corporate trustee. A corporate trustee generally owns nothing beneficially for asset protection. Thank you for your free training video on Family Trusts.)

When the children turn 18, I intend to transfer the legal ownership of the shares in the corporate trustee to the children.

A: Shares in a corporate trustee are normally worthless. The corporate trustee is just the person holding the assets for something else such as a Family Trust (in your case). But corporate trustees can also be used for Unit Trusts and Self-Managed Super Funds.

I assume you are setting up a succession plan for your children, for your Family Trust, in case you die, go bankrupt or divorce. You may be doing this to help with the Backup Appointor clause.

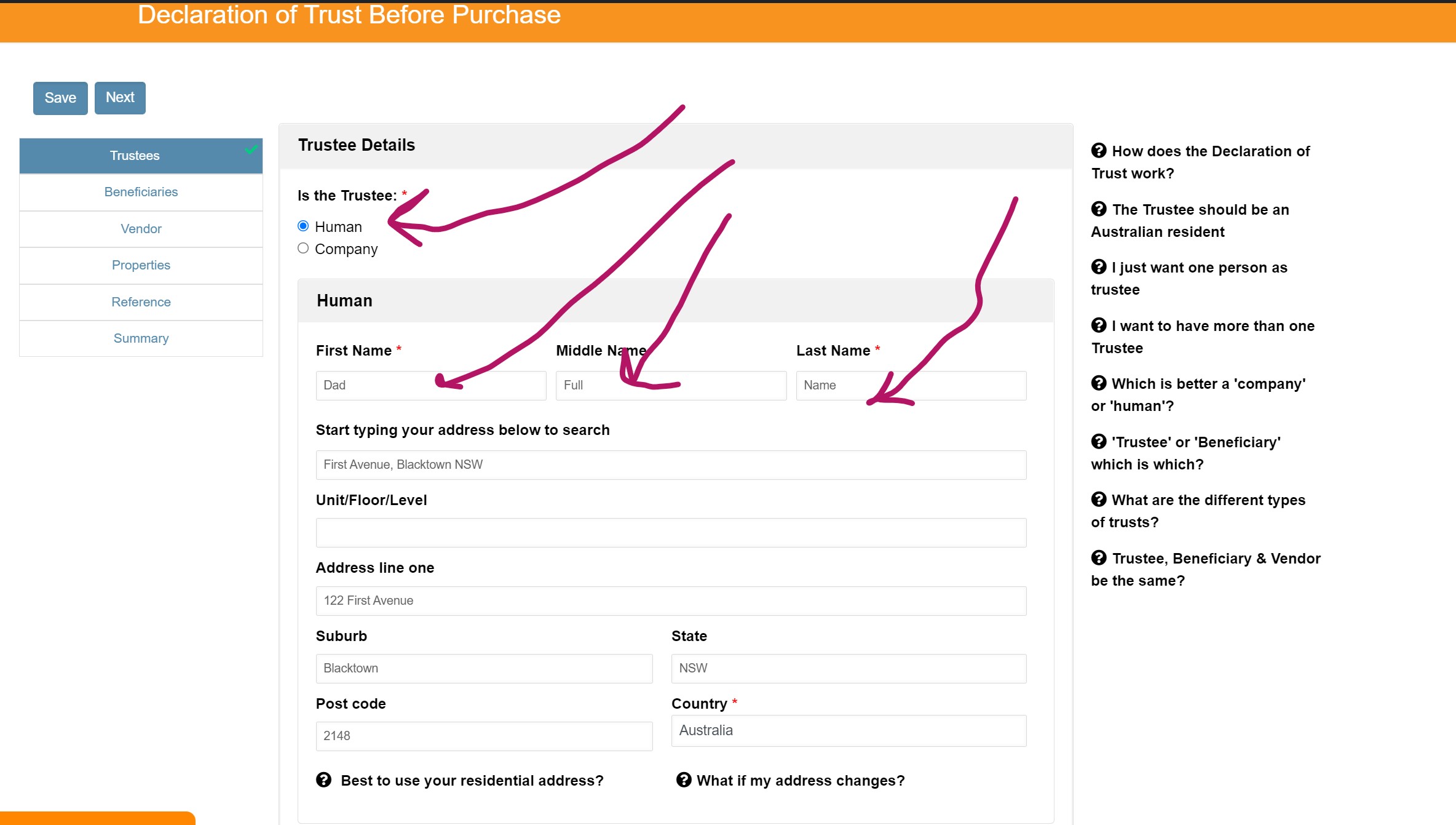

This is how you build the Bare Trust called a Declaration of Trust BEFORE you buy:

Trustee: Dad Full Name

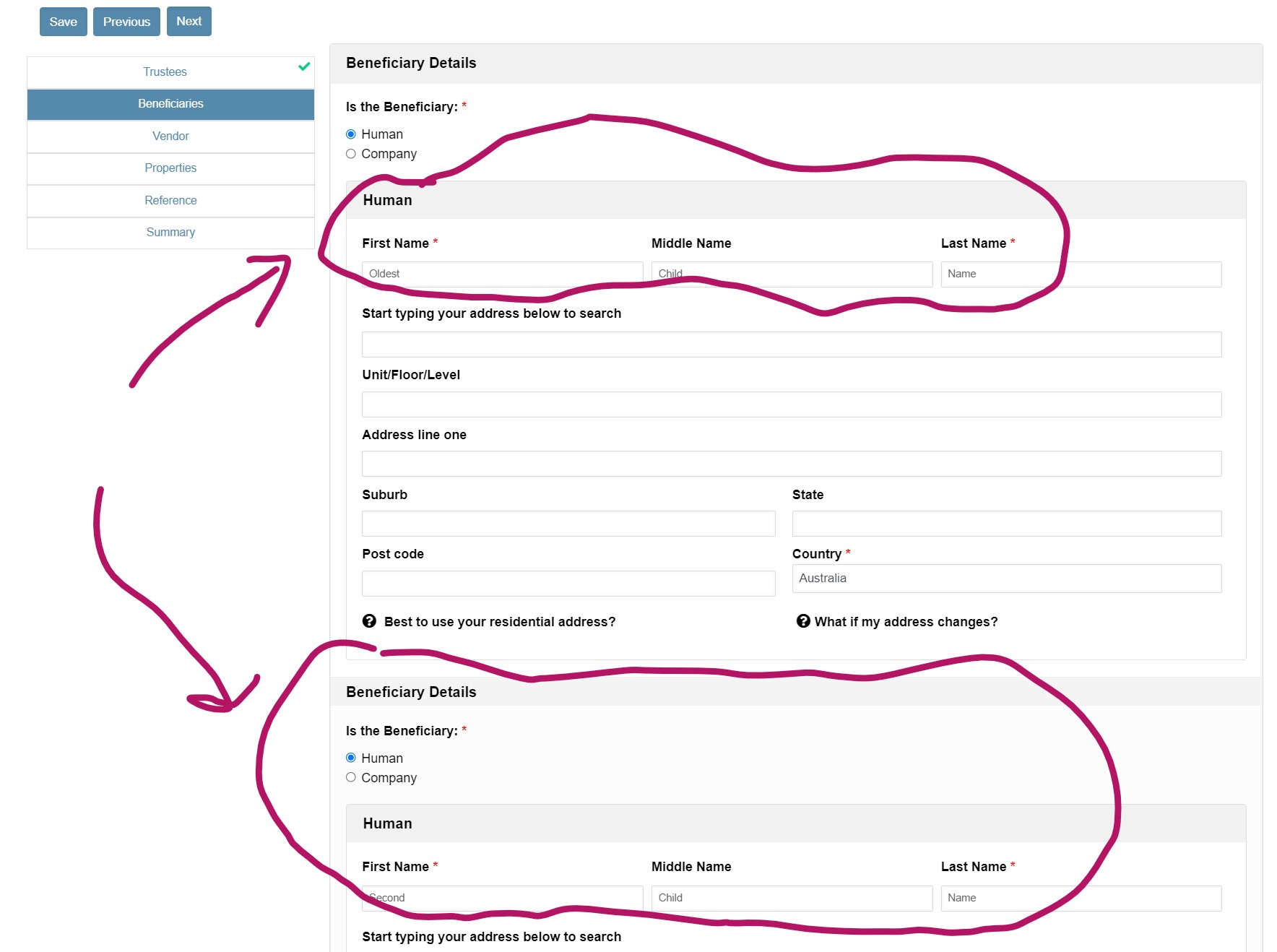

Beneficiary: First Child Name

– and then press +Add Another Beneficiary –

Beneficiary: Second Child Name

Vendor: Dad Full Name

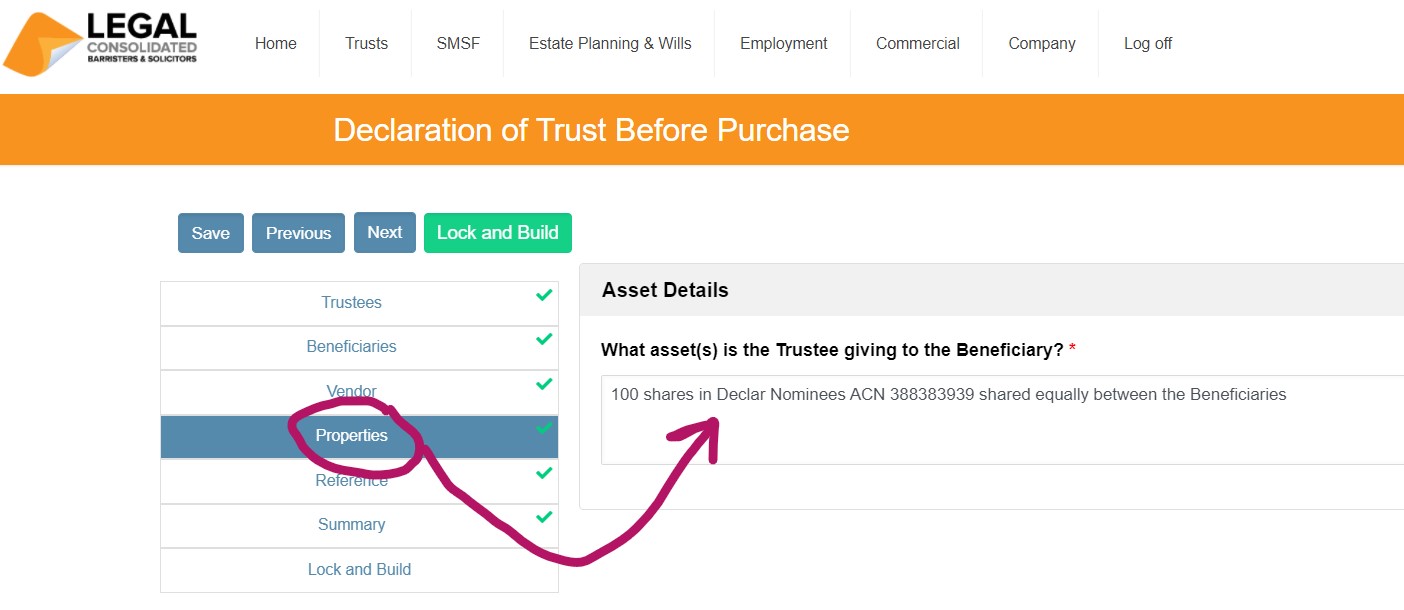

Properties (assets) – 100 shares in Declar Nominees ACN 388383939 shared equally between the Beneficiaries

Q: But what if the corporate trustee shares are already held by me beneficially?

If the shares have no value, because the company holds no assets beneficially, then there should be no CGT or stamp duty if they were currently in your name as Dad. And wished to now transfer the beneficial interest to your minor children. To do that, instead, build a Bare Trust called an Acknowledgement of Trust – After you buy.

Please contact the law firm for further legal advice on building the Declaration of Trust BEFORE you buy – ‘secretly buy’ online.

Business Structures for Personal Services Income, tax and asset protection

Family trust v Everett’s assignments

- Family Trust Deed – watch the free training course

- Family Trust Updates:

- Everything – Appointor, Trustee & Deed Update

- Deed ONLY – only update the Deed for tax

- Guardian and Appointor – only update the Guardian & Appointor

- Change the Trustee – change human Trustees and Company Trustees

- The company as Trustee of Family Trust – only for assets protection?

- Bucket Company for Family Trust – tax advantages of a corporate beneficiary

Unit trust vs Everett’s assignments

- Unit Trust

- Unit Trust Vesting Deed – wind up your Unit Trust

- Change Unit Trust Trustee – replace the trustee of your Unit Trust

- Company as Trustee of Unit Trust – how to build a company designed to be a trustee of a Unit Trust

Corporate structures and Everett’s assignments

- Partnership Agreement – but what about joint liability?

- Incorporate an Australian Company – best practice with the Constitution

- Upgrade the old Company Constitution – this is why

- Replace lost Company Constitution – about to get an ATO Audit?

- Independent Contractor Agreement – make sure the person is NOT an employee

- Service Trust Agreement – operate a second business to move income and wealth

- Law firm Service Trust Agreement – how a law firm runs the backend of its practice

- Medical Doctor Service Trust Agreement – complies with all State rules, including New South Wales

- Dentist Service Trust Agreement – how dentists move income to their family

- Engineering Service Trust Agreement – commonly engineers set up the wrong structure

- Accountants Service Trust Agreement – complies with ATO’s new view on the Phillips case