Family Trust - Distribution Statements

$55 includes GST

-

Complies with section 100A and Owies v JJE Nominees compliant

What is a Family Trust Distribution Minute?

A “Family Trust – Annual Distribution Minute” is a formal document that records the decisions to distribute income and assets from a family trust. This is for a financial year ending 30 June. The Distribution Statement records the details of how the trust’s income is distributed among its beneficiaries. The beneficiaries are the person entitled to receive the trust’s income and assets.

What are Distribution Minutes?

Before the end of each financial year, the trustee signs a minute stating who gets the income from the Family Trust, Testamentary Trust or 3-Generation Testamentary Trust.

I do not know the Trust’s income by 30 June

Before 30 June, the Family Trust usually does not know:

- its own family trust income.

- the beneficiaries’ personal incomes and marginal tax rates.

Therefore, including dollar amounts in the Trust Minutes is not usually possible. Yet, the Australian Taxation Office requires signed minutes to establish present entitlement and avoid adverse tax outcomes.

Putting dollar amounts in Trust Minutes is dangerous

The ATO has intensified scrutiny of Trust Distribution Minutes that rely on the outdated practice of including dollar amounts.

The Australian Tax Office is on the lookout for Trust Minutes that have dollar amounts. It is unlikely you would know the trust’s or beneficiary’s income before the financial year ends.

Therefore, the ATO alleges you prepared the minutes after 30 June. Instead, prepare minutes by using the tax bracket methodology.

Sign minutes now; do tax returns after 30 June

While you need to sign the Distribution Minutes before 30 June, the family trust accounts and beneficiaries’ tax returns can be completed after 30 June.

Legal Consolidated Minutes use the tax bracket methodology, not specific dollar amounts:

-

- Beneficiary A receives income up to the relevant tax bracket.

- Beneficiary B, a company, receives franked dividends up to the net tax bracket.

- Beneficiary C, a non-resident, receives foreign-sourced income.

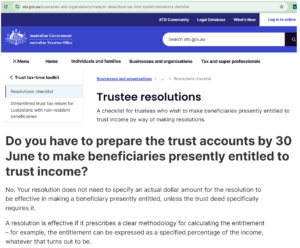

This methodology ensures that beneficiaries are presently entitled to the trust’s income by 30 June as required by the Australian Taxation Office. The ATO confirms this approach in its Trustee Resolution Statement:

“Your resolution does not need to specify an actual dollar amount for the resolution to be effective in making a beneficiary presently entitled, unless the trust deed specifically requires it. A resolution is effective if it prescribes a clear methodology for calculating the entitlement.”

While you do not know the Family Trust income before 30 June, you must still sign the Trust Distribution Minutes.

The ATO allows you to do this via the Legal Consolidated methodology.

Why the Tax Bracket Methodology is usually best

The tax bracket methodology ensures effective Family Trust distributions by:

-

ATO Compliance: Aligns with Australian Taxation Office rulings, such as Tax Determination TD 2012/22 (and withdrawn TR 2010/3 and PS LA 2010/4), allowing a clear methodology for distributions.

-

Flexibility: Accommodates uncertain income figures while meeting the 30 June deadline.

-

Tax Optimisation: Allocates income to beneficiaries’ lower tax brackets to minimise tax.

-

Legal Precedent: Incorporates case law refinements, including:

How the tax bracket methodology works in a trust minute:

-

Before 30 June: Trustees sign the Minutes, allocating income using tax brackets (e.g., Beneficiary A gets income up to their tax bracket; Beneficiary B, a company, gets franked dividends).

-

After 30 June: Your accountant calculates exact dollar amounts based on the Minutes’ methodology, recording them in the trust’s and beneficiaries’ tax returns.

Update your Family Trust deed to define income as ‘net income’

Update your Family Trust Deed to define trust income as “net income“.

“Accounting net income” differs from “net income for tax purposes” due to factors such as:

-

Capital gains tax indexation

-

Loss carryforwards

-

Accelerated depreciation rates for tax purposes

-

Segregation of foreign losses

-

Non-deductible provisions

-

Prepaid expenses

The Beneficiaries must patiently wait for the Trust Distribution Minutes to be completed and signed.

Handling Unpaid Present Entitlements

Our Family Trust Distribution Minutes do not stop you from dealing with Unpaid Present Entitlements (UPEs), like loans, through:

-

Reimbursement Agreements: Not recommended.

-

Deeds of Debt Forgiveness: Currently uncertain due to evolving ATO guidance.

-

Deeds of Gift: A potential option to transfer UPEs without repayment.

What happens to the UPE if the child is bankrupt, divorced or dead?

Leaving Unpaid Present Entitlements (UPEs) unresolved or paying them out to a child beneficiary is a problem if the child:

-

Goes bankrupt: The Trustee in Bankruptcy calls in the debt that the family trust owes the child.

-

Gets divorced: The family court directs the Family Trust to pay the money owed to your ex-in-law.

-

Dies: the executor calls in the debt from the family trust.

-

Withholds funds: An ungrateful child may not return the money your family trust gave them when you retire.

Your accountant may recommend forgiving the debt for ‘natural love and affection’ or a Deed of Gift.

Example of how a Family Trust Distribution Statement works

Each financial year, your Family Trust gets an income. It may be due to passive rental of property or holding shares. It may be from operating a business.

Someone has to pay tax on that income. Every year, you get the choice of which beneficiary pays tax on the income.

Perhaps your son is on paternity leave. His marginal tax rate is low, so you may wish to distribute a significant income to your son that year. In the following year, he may return to work and earn a good salary. In that case, you do not distribute any income to him from the Family Trust.

Perhaps your 18-year-old granddaughter is at school and not earning any money. In that case, you distribute to that granddaughter using up her low marginal tax rate.

The beneficiaries that you distribute rarely see any money.

The money owed to beneficiaries is called Loan Accounts or, more precisely, Unpaid Present Entitlements (UPEs). Regularly, the children or beneficiaries sign a Debt Forgiveness Agreement to reduce the money the Family Trust owes them to zero.

Do I need to prepare Family Trust Distribution Minutes annually?

Every financial year, the trustee of a discretionary trust exercises its discretion. This is to distribute its income among the trust’s beneficiaries. “Net income” is defined in your Family Trust Deed. If not, update your Family Trust Deed.

Can I backdate my Trust Minutes?

Backdating family trust distribution minutes is illegal across all Australian states and territories, as it constitutes fraud by misrepresenting the date of a document’s creation or effect. This practice leads to severe penalties, including criminal charges, and is closely scrutinised by the Australian Taxation Office (ATO). Professionals who support this illegal practice are usually struck off. The client is the first person who will inform the ATO that their accountant, lawyer, or adviser suggested the Trust Minutes be backdated.

Criminal Penalties when backdating Family Trust distribution minutes:

-

-

In New South Wales, backdating with intent to deceive can result in up to 7 years imprisonment under section 192E of the Crimes Act 1900 (NSW), with penalties escalating to 10 years for aggravated offences like forgery under section 254.

-

In Victoria, creating false documents carries up to 7 years imprisonment under section 83A of the Crimes Act 1958 (Vic).

-

In Queensland, fraud or forgery involving false documents incurs up to 7 years under section 408C or section 488 of the Criminal Code Act 1899 (Qld).

-

In Western Australia, fraud-related offences under section 409 of the Criminal Code Act Compilation Act 1913 (WA) carry up to 7 years.

-

In South Australia, deceptive practices under section 139 of the Criminal Law Consolidation Act 1935 (SA) can lead to 7 years imprisonment.

-

In Tasmania, fraud or false documents under section 297 of the Criminal Code Act 1924 (Tas) incur up to 7 years.

-

In the Australian Capital Territory, making false documents under section 346 of the Criminal Code 2002 (ACT) carries 7 years.

-

In the Northern Territory, fraud or forgery under section 227 of the Criminal Code Act 1983 (NT) can result in 7 years.

-

At the federal level, providing false or misleading information to the ATO (e.g., backdated minutes) is an offence under section 137.1 of the Criminal Code Act 1995 (Cth), with up to 7 years imprisonment.

-

Why are Distribution Statements updated each financial year?

Since 1994, as a tax lawyer, I have provided an Annual Family Trust Minute for each financial year. I attend many ATO audits. My doctorate was in tax. The tax laws change. The ATO changes its mind. We prepare the Family Discretionary Trust Minute of Distribution to reflect those particular rules for each unique financial year.

The six cases that explain the Family Trust Distribution Minute

As well as keeping a close eye on ATO procedures and checklists each year, Legal Consolidated Trust Minutes take into account these six court cases:

1. Federal Commissioner of Taxation v Bamford [2010] HCA 10

The Bamford case clarified that the trust deed determines a trust’s “net income” for tax purposes. The High Court held:

-

-

-

-

Trust deeds are the primary reference for income distribution.

-

Trustees must distribute income per the deed’s terms and tax laws.

-

Clear trustee resolutions are essential for transparent distributions.

-

-

-

This decision emphasises the importance of precise trust deed provisions in defining beneficiary entitlements and ensuring tax compliance.

2. FCT v Clark [2011] FCAFC 5

Clark’s case confirmed that family trust distribution resolutions must be made within the required time frame and align with the trust deed to be valid for tax purposes.

3. Thomas v FCT [2017] FCAFC 57

The Thomas case examined how a family trust distributes company dividends and its franking credits (tax credits) to beneficiaries. In what is very good news for us taxpayers:

-

-

-

-

Beneficiaries entitled to the trust’s dividends receive the franking credits with them.

-

Franking credits are part of the trust’s net income and cannot be distributed separately.

-

-

-

This case highlights the need for trust distributions to comply with the trust deed and tax laws, ensuring that beneficiaries can utilise franking credits to reduce their tax liability. Update your Family Trust for streaming.

4. FCT v Greenhatch [2012] FCAFC 84

Before 2010, family trusts could not distribute specific types of income, such as capital gains from the sale of assets, to certain beneficiaries. Instead, all beneficiaries had to share every kind of trust income, such as dividends and capital gains, based on their share of the trust’s total income. The Greenhatch case illustrates why trustees must draft clear trust minutes when distributing trust income.

5. Callus v KB Investments – one child gets more

Acting under the direction of the Appointor, the Trustees decide who gets trust income and assets. The law requires good faith, proper purpose, and genuine consideration. But does this happen? Callus v KB Investments [2020] VCC 135 shows that trustees can favour one child without explanation. The case questions whether trustees act with care or exploit their power.

In Callus, the parents’ trust gave the property to the son, not the daughter. She sued to cancel the transfer and remove the son’s trustee company. The court upheld the transfer of the property, as the deed allowed “absolute discretion,” like Legal Consolidated’s Family Trust Deeds. However, the court removed the son’s Trustee.

6. Owies v JJE Nominees: Can courts look at the Trustee’s motives?

The Trustee manages the Family Trust, determining who receives the trust income. This is under the advice of the Guardian/Appointor. Appointors can sack them—courts rarely look at whether the trustee’s decisions are fair. That makes Owies and Owies v JJE Nominees Pty Ltd [2022] VSCA 142 a strange case. In Owies, the court states that trustees must genuinely consider the needs of beneficiaries. This case shocked many. Is it a one-off?

What Happened in Owies v JJE Nominees?

In 1970, John and Eva started the Owies Family Trust. JJE Nominees Pty Ltd, a corporate trustee, ran the trust. Their children—Michael, Paul, and Deborah—were default beneficiaries. This meant that if there were no trust minutes, they received the income.

For seven years, there were trust minutes each year. The trust minutes distributed the income:

-

-

-

-

40% to John

-

40% to Michael

-

20% to Eva

-

-

-

However, in 2019, the trust minutes said that 100% of the trust income to only John. The out-of-favour Paul and Deborah got nothing from their parents’ family trust. They sued, saying the trustee ignored their needs. They wanted the distributions changed.

The court strangely agreed and said that the trustee, JJE Nominees Pty Ltd, erred in not considering the needs of these two children. However, due to a technical legal issue, the minutes were not changed. Still, the case shows trustees may no longer ignore beneficiaries.

Is the Owies case a one-trick pony?

The Owies case feels odd. Most Family Trusts have many beneficiaries, unlike Owies’ small group. Owies is unlikely to be followed.

Nevertheless, Legal Consolidated’s Trust Minutes incorporate the Owies’ requirements. Our minutes help show genuine consideration of the beneficiaries’ financial positions and circumstances. This is rather than just following the appointor’s instructions.

Do I give a copy of the Annual Family Trust Minute to the ATO?

The Australian Taxation Office (ATO) does not require and does not want to see your Distribution Statement. The ATO assumes you have complied with the law.

The law requires that you sign your Family Trust Distribution Statement before the end of the financial year. The ATO can demand the original signed Family Trust Distribution Statement. Make sure you have it. Email a copy of the signed Minute to your accountant, as well. Do the email before 30 June.

Who Pays Tax on Family Trust Income?

Beneficiaries, not the trustee, usually pay tax on a Family Trust’s income. This is why you build the Family Trust Distribution Minute. The trustee manages the trust but does not typically pay tax on its income. Instead, the income is allocated to beneficiaries, who report it as part of their taxable income, like adding a slice of the trust’s “income pie” to their own income.

How does a beneficiary pay tax on the family trust income?

-

The trust’s income is divided among beneficiaries as per the Distribution Minute.

-

Each beneficiary includes their share in their personal tax return, taxed at their personal marginal rate.

-

Beneficiaries are “presently entitled” to the income, meaning they have a right to it, even if the trust does not physically pay them.

Are old people using their Bucket Companies again?

Running out of beneficiaries on low marginal tax rates? Consider distributing the remaining family trust income to a company. A company pays a constant rate of tax. The rate is 30% or less. So, while a human’s marginal tax rate climbs to almost 50%, the company never pays more than 30%.

When you run out of human beneficiaries, tip the rest of the trust income into a ‘bucket’ company. Most companies can be a bucket company (but not a Special Purpose Company that is trustee of your SMSF). The company needs to be a beneficiary under the Family Trust deed.

The term ‘bucket’ is used because the company sits below your trust. It is one of the trust’s many beneficiaries. You ‘pour’ the leftover family trust income into the bucket company. This is to reduce tax. It caps your tax payable at a corporate tax rate. This is 30% or less.

Distributing to a bucket company is not popular because:

1. .Division 7A

You distribute family trust income to your wife in the Trust Minute. This is up to her marginal tax rate. However, human beneficiaries rarely get the money. It simply sits in the Family Trust’s accounts as an Unpaid Present Entitlement (UPE), which is essentially a loan.

In contrast to human beneficiaries, the ATO’s compliant Division 7A Loan requires you to pay the debt to the company. This is over 7 years.

2. Wealth is trapped in a company

Thanks to Division 7A, the company ends up with the money. However, wealth in a company is ‘trapped’ in the company. One way to extract money from a company is to pay a dividend to the shareholder (e.g., a wife). But the dividend gets added to your wife’s taxable income, which is precisely what you were trying to avoid with the bucket company in the first place!

However, you can wait until your wife retires and is on a low income. You then drip-feed her the dividends over many years. The franking credits can bring her tax rate to zero, or even lower.

How is Small Business Income handled in Family Trust Distribution Minutes?

Why is there no separate section for Small Business Income?

The Trust Distribution Minutes intentionally omit a dedicated section for small business income to maintain a flexible, Australian Taxation Office-compliant framework. This design accommodates all income types, including small business income, within the trust’s net income, as defined by the Income Tax Assessment Act 1936 and 1997.

How is Small Business Income Included?

Small business income, encompassing ordinary trading income or capital gains eligible for Capital Gains Tax (CGT) small business concessions under Division 152 of the Income Tax Assessment Act 1997, forms part of the trust’s net income. The minutes allow trustees to manage this income seamlessly alongside other income sources.

Classifying and Streaming Small Business Income

The minutes enable trustees to classify and stream small business income to specific beneficiaries, optimising tax efficiency. For example, capital gains from active business assets can be allocated to beneficiaries to leverage CGT concessions, such as the 50% active asset reduction, as supported by Bamford v Commissioner of Taxation [2010] HCA 10.

Customising Allocations

Trustees can use the “General Tax Distribution” and “Capital Gains Distribution” sections to make handwritten allocations for small business income or gains. This flexibility ensures precise distribution tailored to the trust’s needs and beneficiaries’ marginal tax rates.

Ensuring Compliance and Tax Efficiency

Trustees must confirm the trust deed permits income streaming and consult a qualified accountant to verify eligibility for CGT concessions. This ensures small business income is distributed prudently, minimising tax liabilities while adhering to legal and taxation obligations. If your Family Trust is over 7 years old, update it.

Why Distribute to another Family Trust?

While not common, distributing income to another family trust may help with tax and protect assets. For example:

- Tax Optimisation: The second family trust may have beneficiaries on lower tax rates, reducing tax liability.

- Asset Protection: helps shield assets from creditors or legal disputes arising from divorce.

- Income Streaming: Directs income types (e.g., dividends) for tax benefits under the ATO rules.

- Succession Planning: Supports wealth transfer with extended trust structures.

How to distribute to another Family Trust?

Ensure the second trust is an eligible beneficiary per the first trust’s deed. Read the Family Trust deed to find out.

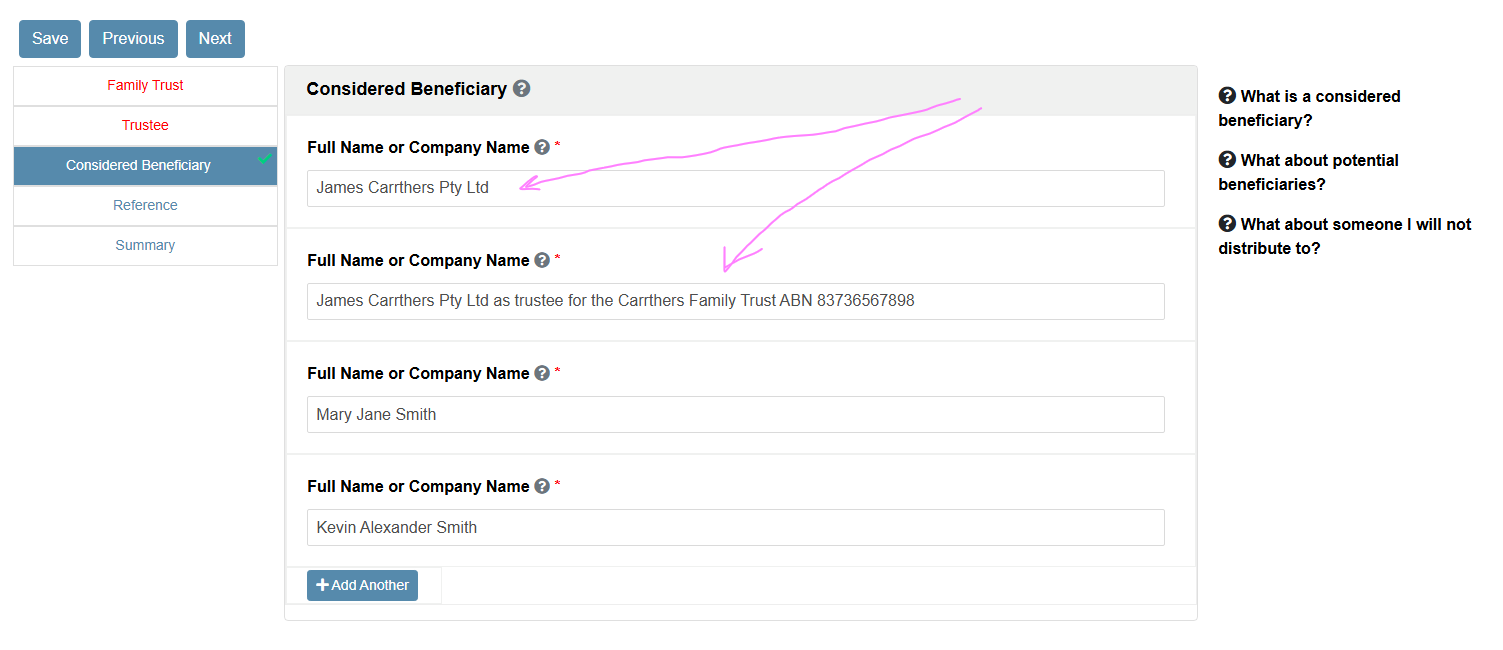

Our Trust Distribution Statement allows you to handwrite on the minute. E.g.:

“James Carrthers Pty Ltd as trustee for the Carrthers Family Trust ABN 83736567898”

The corporate trustee of the Family Trust does not usually trade in its own right, so it does not typically have an ABN.

Example of a trust distributing to another trust – Domazet v Jure Investments

In Domazet v Jure Investments Pty Limited [2016] ACTSC 33, Trust No. 1 (started in 1980 in the ACT) distributes income, including a substantial capital gain, to Trust No. 2. Trust No. 2 began in 2005. Trust No. 1 allows distributions to another trust only if the recipient trust vested (ended) before Trust No. 1’s vesting date.

The advisers in Queensland wrongly thought that an 80-year limit applied to Trust No. 1, just like in Queensland law. But the ACT’s 80-year rule only started in 1985, after Trust No. 1 was created. This meant Trust No. 1 followed the old common law rule (ending 21 years after the death of the last related living person). The standard 80-year rule did not apply.

Therefore, Trust No. 2’s vesting date exceeded Trust No. 1’s, invalidating the distributions. This exposed Trust No. 1 to taxation at the highest marginal rate without the wonderful 50% capital gains tax discount.

The ACT court granted rectification, amending Trust No. 2 so that it vested no later than Trust No. 1. The distribution is now valid.

Check perpetuity rules and vesting dates across jurisdictions when distributing between trusts. Our Family Trust Distribution Statements facilitate compliant allocations using the tax bracket methodology, ensuring present entitlement and adherence to ATO guidelines.

How do I show consideration for another Family Trust?

Trust minutes must provide a list of persons the Family Trust considered. This is the case even if you never distribute to them. This includes Family Trusts that are related to other Family Trusts

Ensure your Family Trust Distribution Minute includes all eligible beneficiaries—individuals, companies, and trusts—as permitted by the trust deed.

For example, if the Appointor controls a company that serves as the corporate trustee for another family trust, both the company and the trust must be listed as potential recipients in their respective capacities.

Include Tax File Numbers on Family Trust Distribution Minutes

No, you should not include Tax File Numbers (TFNs) in Family Trust Distribution Minutes. TFNs are private and sensitive information, and including them in a document like trust minutes, which may be shared or stored, could breach privacy and increase the risk of identity theft. While TFNs may be required for tax reporting purposes, they should be kept confidential and stored securely, not recorded in the minutes themselves.

If you need to reference beneficiaries or distributions for tax purposes, use other identifiers like names or account details, and ensure TFNs are provided separately to the relevant authorities (e.g., the Australian Taxation Office) through secure channels, such as tax returns or related forms.

Include mid-year distributions in Family Trust Minutes

Still waiting for Dad to sign those Family Trust Distribution Minutes!

Trust minutes document the trustee’s resolutions to allocate trust income for the financial year. The ATO requires this to establish present entitlement.

A common misconception is that these minutes must detail distributions already made during the year, such as interim dividends or payments to beneficiaries. However, this is unnecessary.

The ATO’s focus is on the trustee’s year-end resolution. Your accountant will treat distributions during the year as advances or loans. Including them in the minutes usually creates unnecessary complexity and risk discrepancies in tax reporting. Instead, the minutes should reflect the final allocation of income, using methods like the tax bracket methodology to ensure flexibility and compliance

How do I distribute to a charity from a Family Trust?

Distribute to a charity by notifying or paying the charity within two months. This is after the financial year. This is required to establish present entitlement under 100A ITAA 1936 (anti-avoidance rules).

See also

Advanced Family Trust Training Course – Free

Family Trust vs other Business Structures

Firstly, let’s look at Family trust

- Family Trust Deed – watch the free training course

- Family Trust Updates:

- Everything – Appointor, Trustee & Deed Update

- Deed ONLY – only update the Deed for tax

- Guardian and Appointor – only update the Guardian & Appointor

- Change the Trustee – change human Trustees and Company Trustees

- The company as Trustee of Family Trust – only for assets protection?

- Bucket Company for Family Trust – tax advantages of a corporate beneficiary

Unit trust vs Family Trusts

- Unit Trust

- Unit Trust Vesting Deed – wind up your Unit Trust

- Change Unit Trust Trustee – replace the trustee of your Unit Trust

- Company as Trustee of Unit Trust – how to build a company designed to be a trustee of a Unit Trust

Business structures that are NOT trusts

- Partnership Agreement – but what about joint liability?

- Incorporate an Australian Company – best practice with the Constitution

- Upgrade the old Company Constitution – this is why

- Replace lost Company Constitution – about to get an ATO Audit?

- Independent Contractor Agreement – make sure the person is NOT an employee

- Service Trust Agreement – operate a second business to move income and wealth

- Law firm Service Trust Agreement – how a law firm runs the backend of its practice

- Medical Doctor Service Trust Agreement – complies with all State rules, including New South Wales

- Dentist Service Trust Agreement – how dentists move income to their family

- Engineering Service Trust Agreement – commonly engineers set up the wrong structure

- Accountants Service Trust Agreement – complies with ATO’s new view on the Phillips case