What is a Product Disclosure Statement (PDS) for an SMSF?

A Product Disclosure Statement (PDS) is a document. It provides information to help you understand your roles and responsibilities as a trustee and member of a Self-Managed Superannuation Fund (SMSF). It summarises details to help you manage your SMSF.

Why do I need a Product Disclosure Statement for my Self-managed Superfund?

The PDS protects both the Member and the Trustee of the SMSF.

When legislation passed requiring a Product Disclosure Statement for an SMSF, many lawyers could not understand its value.

However, now it would be a brave lawyer who says you do not need one.

This is because the SMSF PDS protects the trustees as individuals. It also provides essential legal protection for financial advisers, accountants, auditors, lawyers, and other professionals involved in managing your SMSF.

Additionally, the SMSF PDS ensures transparency and compliance with legal obligations. Outlining the rules, responsibilities, and risks associated with managing the SMSF helps safeguard trustees against claims of negligence and misunderstanding.

Having an SMSF PDS demonstrates good governance and accountability. It offers peace of mind, knowing that all parties involved in the SMSF are clear about their roles and responsibilities, reducing the risk of disputes or legal issues in the future.

Example of an SMSF without a Product Disclosure Statement

The Legal Consolidated SMSF Product Disclosure Statement shields Members, Trustees, the accountant, the lawyer, and the financial planner from risks and disputes.

John and Mary start a Self-Managed Superannuation Fund. This is to take control of their retirement savings. Their lawyer dismissed the need for a Product Disclosure Statement (PDS), claiming it was a waste of money and time. “You know what you’re doing, John,” the lawyer barked confidently.

John, a well-respected business owner, did manage the SMSF well. With the help of his financial planner, accountant and auditor, it is fully compliant. However, one year, due to market downturns and some high-risk investments, the SMSF’s value plummeted by 47%. That same year, Mary decided to leave John, making it a devastating time for him.

Unfortunately, things only got worse.

Mary’s family lawyer noticed that the SMSF lacked a PDS during the divorce proceedings. The family lawyer argued that Mary did not understand how the SMSF operated and had not been properly informed of the risks involved. In court, the lawyer declared that if Mary had been given a PDS, she would have never agreed to John’s high-risk investments.

The family court agreed. It ruled that Mary should be compensated for her losses and ordered additional payments from the SMSF to ensure she did not suffer a financial disadvantage.

John sues the financial planner and accountant as they had remained silent on whether a PDF was required. They, in turn, shifted blame to the lawyer who claimed that skipping the PDS would ‘save money’. The parties end up in a costly legal battle that a simple PDS would have prevented.

The Legal Consolidated SMSF PDS contains:

-

- A letter on our law firm’s letterhead explaining how to sign the document to comply with the SIS Legislation.

- Updated SMSF Product Disclosure Statement (compliant for both accumulation and pension phases)

- Minutes for the SMSF Trustee to accept the SMSF Product Disclosure Statement

Full free copy of the updated SMSF Product Disclosure Statement

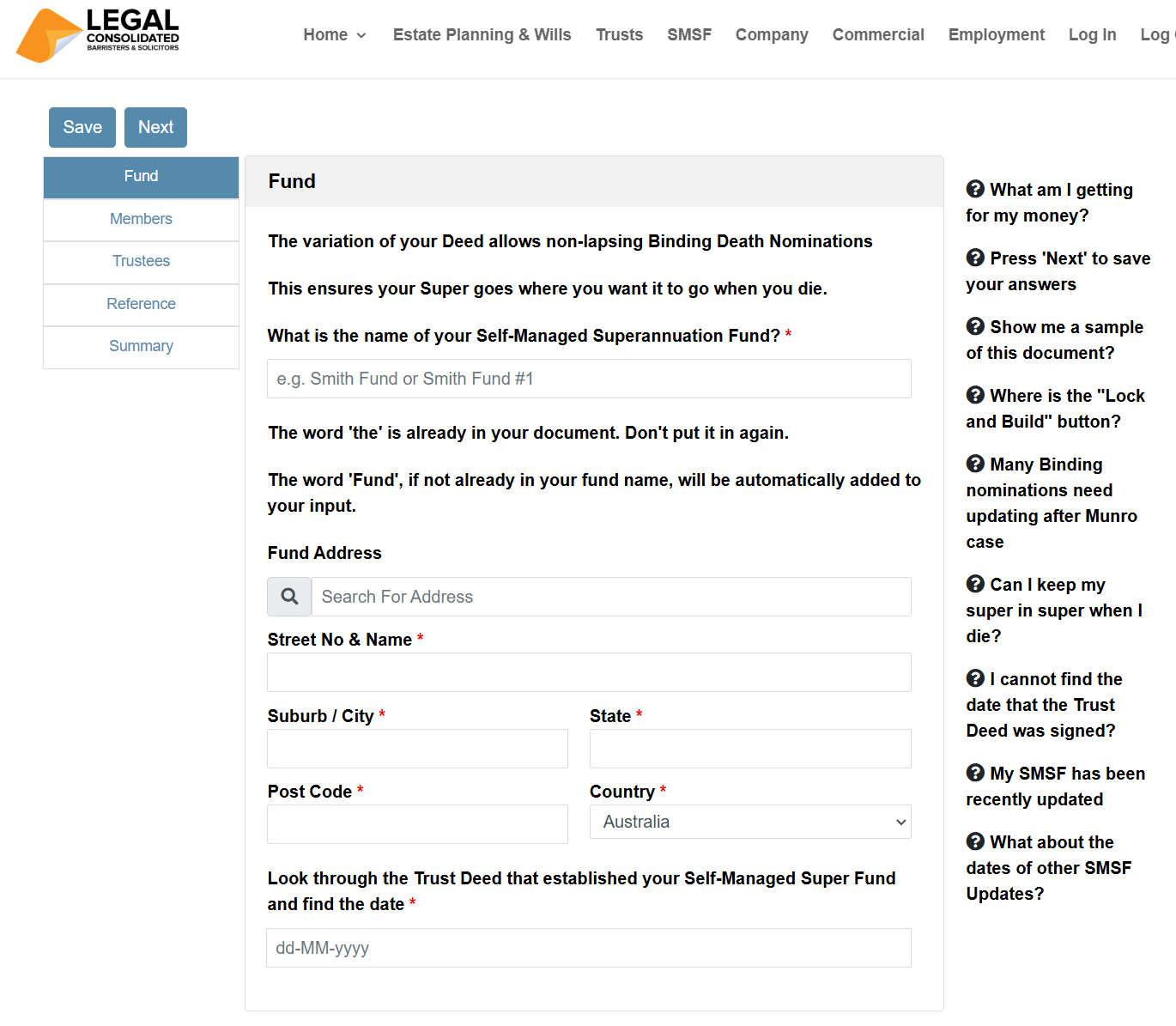

To see the cover, letter and minutes of the SMSF PDS update, open the PDF above. It also contains hints and notes.

While your cover letter, minutes, and SMSF PDS will look different, they will educate you on what you are building on our law firm’s website.

Free checklist on what is required to update an SMSF PDS

Press the blue Checklist button above to see the questions we will ask you when you build the PDS.

Free education on how SMSF’s Product Disclosure Statements work

Press START BUILDING FOR FREE above to see the free hints and learn more. The building process is educational and entertaining. Well, it is educational, but perhaps not that much entertaining!

| Build these SMSF documents online | |

|---|---|

| SMSF Deed – built over 18,000 times | |

| Special Purpose Company – to be trustee of SMSF | |

| Convert old Company into a Special Purpose Company – to be trustee of SMSF | |

| Investment Strategy – ATO audit friendly | |

| Vest and Wind up SMSF – wind up, end and close down old SMSFs – get rid of your SMSF | |

| SMSF Loan to Third Party | |

| Commercial lease for SMSF – where the SMSF owns the commercial property | |

| Reversionary Pension Kit – keep your dead spouse’s super in the Super Fund | |

| Power of Attorney for SMSF Corporate Trustee – if the director dies or has dementia, compliant with Fund Manager release forms | |

| SMSF Training Course – includes the SMSF Deed |

| Update your SMSF Deed for: | |

|---|---|

| 1. Everything – Update Trustee, Upgrade Deed, Binding Nomination and PDS (Recommended) | |

| 2. Trustee only | |

| 3. Upgrade Deed only | |

| 4. Binding Nomination only – updates SMSF Deed as well | |

| 5. Product Disclosure Statement only – fully compliant with budget | |

| Other SMSF updates | |

| Change SMSF name – no CGT or stamp duty issues |

Business Structures for Personal Services Income, tax and asset protection

Family trust v Everett’s assignments

- Family Trust Deed – watch the free training course

- Family Trust Updates:

- Everything – Appointor, Trustee & Deed Update

- Deed ONLY – only update the Deed for tax

- Guardian and Appointor – only update the Guardian & Appointor

- Change the Trustee – change human Trustees and Company Trustees

- The company as Trustee of Family Trust – only for assets protection?

- Bucket Company for Family Trust – tax advantages of a corporate beneficiary

Unit trust vs Everett’s assignments

- Unit Trust

- Unit Trust Vesting Deed – wind up your Unit Trust

- Change Unit Trust Trustee – replace the trustee of your Unit Trust

- Company as Trustee of Unit Trust – how to build a company designed to be a trustee of a Unit Trust

Corporate structures and Everett’s assignments

- Partnership Agreement – but what about joint liability?

- Incorporate an Australian Company – best practice with the Constitution

- Upgrade the old Company Constitution – this is why

- Replace lost Company Constitution – about to get an ATO Audit?

- Independent Contractor Agreement – make sure the person is NOT an employee

- Service Trust Agreement – operate a second business to move income and wealth

- Law firm Service Trust Agreement – how a law firm runs the backend of its practice

- Medical Doctor Service Trust Agreement – complies with all State rules, including New South Wales

- Dentist Service Trust Agreement – how dentists move income to their family

- Engineering Service Trust Agreement – commonly engineers set up the wrong structure

- Accountants Service Trust Agreement – complies with ATO’s new view on the Phillips case