Wind up Family Trust – how to get rid of a Discretionary Trust

Vest Family Trust for Centrelink? Wind up and get rid of a Discretionary Trust

You have finally retired and applied to Centrelink for a pension. Unfortunately, Centrelink takes issue with the fact that you have an old discretionary trust that was created 30 years ago. It hasn’t been used for years. There is no money left in it. The trust has a nil value. It has no assets and no debts.

What can you do?

You need to formally wind up (vest) the trust to close down this unused structure. Build this Vesting a Discretionary Trust deed on our law firm’s website.

Vest and windup a Family Trust to reduce yearly costs

Every year, you pay to prepare Trust tax returns for trusts that are no longer in use. Perhaps your Trust was set up for a specific purpose. But that time has passed.

Is the Trust no longer required? Vesting your trust and closing it saves you money. Perhaps an opportunity may arise in the future for your old trust? Rarely is reusing a trust worthwhile. A Discretionary Trust Deed is like a car, it requires regular updates. These are called Deeds of Variation. The cost to set up a new trust is usually less expensive than updating an old Discretionary Trust deed. And a new trust does not have any baggage or festering problems with it.

I cannot find my original Family Trust deed – I only have a copy

You started your Family Trust many years ago. It has been updated a number of times. But you cannot find the original Trust Deed or one of the original Deeds of Variation. Sure, you have copies. But the banks and others demand to see the ORIGINALS. With only copies, the bank is refusing to open a new bank account. You are frantic. Your accountant is worried.

The accountant recommends that, since the Family Trust has no assets, it should be closed immediately. ‘It is a dangerous creature’ the accountant declares.

This Deed of Vesting closes the Family Trust and gets rid of the nightmare.

Re-use my old Family Trust Deed?

The rule of thumb is to get rid of old Family Trust deeds, companies and Unit Trust deeds. This is as often and as quickly as possible. If any of those vehicles get down to a zero balance sheet take advantage of getting rid of them.

You may think you know what your own trusts have been up to over the years. But that is often not the case. Also, laws and tax rules change.

Also, trust deeds go out of date. On average in Australia, every 6 – 7 years your trust deed needs to be updated. You can update Family Trust Deeds here. But it is generally more expensive. A new trust deed is less expensive.

Wind up Discretionary Trust you don’t want? Get rid of a Trust.

You have an old Family Discretionary Trust. Your accountant or financial planner suggests that it is more trouble than it is worth. The Vest Family Trust Deed is simple and straightforward. Just build this Terminate a Discretionary Trust deed.

Why dissolve a Discretionary Trust?

• The Trust has achieved its original purpose

• It has no assets (if it has debts do a Debt Forgiveness Deed first)

• The controllers of the trust don’t want to continue

• The trust has reached its vesting date

How to terminate a Family Trust?

1. Distribute any capital that is left

2. Build a Debt Forgiveness Deed to forgive loans and Unpaid Present Entitlements owed to beneficiaries

3. Prepare any outstanding tax returns

4. Build and sign the Windup Family Trust Deed and the minutes

Get rid of my Family Trust via a ‘minute’?

A ‘minute’ is a record of something you have done. It is just recording an event. In contrast, a Deed of Variation to vest your Trust is the actual document that vests and winds up your Trust.

The Discretionary Trust Deed started the trust. The way to terminate the Trust is to do another Deed. A minute is not good enough. It is not best practice and your accountant would not be prepared to take the risk of just using a ‘minute’. A ‘minute’ does not satisfy the ATO or other government departments. See Taxation Ruling TR 2018/6.

Any CGT or stamp duty issues to dissolve a family trust?

Provided you follow the procedures set out in our cover letter (which comes with the Deed of Variation) there are no Capital Gains Tax issues. There is also no ad valorem stamp (transfer) duty in any Australian State or Territory.

This is because your Balance Sheet has nothing on it. You need to get your Balance Sheet to almost zero before you can wind up and get rid of your old Family Trust.

Stamp duty and CGT when you close the family trust

Your documents to get rid of a family trust are drafted so that there are:

- no stamp duty

- no transfer duty

- no Capital Gains Tax

- no family law issues

- no bankruptcy clawback

Stamp Duty and Transfer Duty are State-based taxes. However, in all Australian States and Territories, they do not apply to the closing of a family trust prepared by Legal Consolidated Barristers & Solicitors.

Capital Gains Tax is a tax levied by the Federal Government. Again, there is no CGT payable on these vesting documents.

However, we confirm that you have not instructed us to provide you with any taxation, family law or insolvency/asset protection advice.

Tax when vesting a Family Trust that has assets still left in it

This Family Trust Vesting Kit is on the basis that there are no assets in the Family Trust. The Balance Sheet is zero, or close to zero.

However, if you do vest a Family Trust with assets in it, then, upon vesting, one or more of the beneficiaries become “absolutely entitled” to the assets as against the trustee.

If there is one beneficiary who becomes absolutely entitled to an asset, CGT event E5 happens. The trustee becomes liable for CGT on the difference between the market value of the assets and their cost base. See Income Tax Assessment Act 1997 (Cth), s 104-75(1), (3).

Of course, the tax liability is, instead, ultimately borne by the beneficiaries if:

- one or more of them is entitled to the trust income. See Commissioner of Taxation v Bamford (2010) 240 CLR 481; or

- the beneficiary who becomes absolutely entitled is also specifically entitled to the capital gain. See s 115-228 Income Tax Assessment Act 1997 (Cth)

If two or more beneficiaries become absolutely entitled to a trust asset CGT event E5 may not happen, depending upon the view one takes of “absolute entitlement” and the nature of the trust property. See Draft Taxation Rulings TR 2004/D25 and TR 2017/D10 at [18]-[19].

Forgive UPEs before you vest the Family Trust

Build and sign a Deed of Debt Forgiveness to get rid of Family Trust UPEs and Loans.

Get rid of Unpaid Present Entitlements before you terminate the Family Trust

Before you wind up your Family Trust the balance sheet must show zero. No assets and no liabilities of the family trust you are about to get rid of.

However, often there are Unpaid Present Entitlements (UPEs) on the Family Trust balance sheet. A UPE is created when your Family Trust distributes income to a beneficiary. The beneficiary rarely sees the money. Instead, the beneficiary merely ‘lends’ the money back to the Family Trust.

As the years go by the UPE builds up. It is not uncommon to have UPEs where the Family Trust owes millions of dollars to beneficiaries.

A UPE is a liability on the Family Trust balance sheet. To get rid of the UPE the beneficiary forgives the ‘loan’. The beneficiary signs a Deed of Debt Forgiveness. Build that document here.

Get rid of beneficiary loan accounts before you terminate the Family Trust

Question: Our Trust has a $60K capital loss. This is the balance of the beneficiary loan accounts. Is this the debt to be forgiven?

Answer: Along with non-financial and non-produced asset transactions your accountant may include debt forgiveness in the capital account. We, however, are not accountants. You need to talk with your accountant.

Question: So if my husband and I are forgiving the debt would we each be able to claim the capital loss on our own personal tax returns of the amount forgiven?

Answer: You need to speak with your accountant. Read the letter of advice that comes with the Deed of Debt Forgiveness. And speak to your accountant.

Question: Do we purchase two debt forgiveness agreements? And then this Family Trust Deed of vesting?

Answer: Yes. You need to build those three documents.

What is the difference between a UPE and a Loan?

- Unpaid Present Entitlements: A UPE is when a family trust makes you ‘presently entitled’ to a Family Trust distribution. But then does not pay the money. It is an ‘unpaid’ ‘present entitlement’. The beneficiary just waits around. This is until the beneficiary gets his money.

- Loan: A Loan is when a person lends you some money. For example, you may want to buy a necklace for your wife. You pay for that necklace from the family trust’s bank account. You are borrowing the money from the family trust. You are the borrower. Your family trust is the lender.

However, do not get too caught up in the delicate distinction between a UPE and a Loan.

Either way, you must get rid of them. This is to get your family trust balance sheet to zero. The Legal Consolidated Debt Forgiveness Agreement is designed to get rid of both the UPE and the Loan Agreement between the family trust and one person.

ATO’s view of closing a family trust – Taxation Ruling TR 2018/6

ATO Taxation Ruling TR 2018/6 sets out the views on the income tax consequences of a trust vesting. Our vesting deed complies with the ruling.

A trust’s ‘vesting” or ‘termination’ date is the day on which the beneficiaries’ interests in the property of the trust become ‘vested in interest and possession’.

Centrelink vs closed Family Trust

To get Centrelink, you move your assets into your Family Trust. In 2002 the laws changed and Centrelink and the ATO started data-matching. I remember it well. I was sitting on the Tax Institutes’ Education Committee and organised a paper to be delivered. Try as I might I couldn’t find a taxation lawyer to present the paper. So I had to write and deliver the paper myself.

Centrelink deems you to own 100% of the Family Trust assets

Family trusts are flexible. There are over 400,000 beneficiaries in an Australian trust. But you generally only distribute to your immediate family. Centrelink’s specific assessment rules do not cope. They are far too broad-reaching. Centrelink has an unrefined and unfair catch-all set of attribution rules. If you had any involvement with a family trust as an appointor, trustee or one of the 400,000 beneficiaries, you:

- are assessed as owning all the family trust assets; and

- you are deemed to earn the corresponding income.

This is under Centrelink’s attribution rules.

Sadly, little old grandmas, destined to get none of the assets out of their children’s and grandchildren’s family trusts are caught up in this. Centrelink is harsh and unsympathetic.

We had one disabled nephew client (who did not even know he was a potential beneficiary) attacked by the shameful and heavy-handed Centrelink.

Sadly, even family trusts with no assets in them attract the enmity of Centrelink. Wind up the Family Trust and escape the Centrelink attacks.

If your Family Trust still has assets and you want to keep it going then talk with your accountant about changing the Trustee and Appointor.

Does my Family Trust finish after 80 years?

A Family Trust deed often states a date that it must end. This is usually 80 years. Stupidly it may be less.

The Family Trust deed often calls this the ‘vesting date’ or ‘termination date’.

On vesting, the beneficial interests in the property of the trust become fixed. This is to avoid breaching the ‘rule against perpetuities’. If your Family Trust has reached its vesting date then build this Vesting Deed kit.

Legal Consolidated Family Trust Deeds do not have a vesting date for South Australia. Legal Consolidated South Australian Family Trusts can go on forever.

Also if the 80-year limitation period is ever rescinded, in a particular State, then the Legal Consolidated Family Trust vesting periods are extended to infinity. This is automatic.

The Vesting Date is linked to His Majesty King George VI. Can I still wind up the Family Trust?

“Royal lives clause”

Royal lives clause

Q: Dear Dr Davies, our law firm is instructed to close an old discretionary family trust he set up in 1976. The husband and his wife are the Primary Beneficiaries. The wife is dead.

The family trust deed has never been varied or updated. So it is hopelessly out of date. And we want to get rid of it as soon as possible.

- The trustee is a company.

- For asset protection, his dead wife is the Appointor/Guardian. This is during her lifetime.

- The husband is and remains the “Supervisor”. (This is an expression I have never seen in a Family Trust before.)

Normally the Vesting Day is 80 years minus one day. For this Family Trust Deed, the Vesting Date is:

“Vesting Day is the 21st anniversary of the death of the last survivor of the issue of the now living of his Late Majesty King George VI or such earlier day as the Trustee may in their absolute discretion at any time during the lifetime of the Guardian with the consent of the Guardian OR if the Vesting Day is later than the day of the death of the last surviving Guardian then after such last-mentioned date without any consent appoints PROVIDED ALWAYS that notwithstanding anything herein contained all powers and dispositions made by or pursuant to or contained in this Deed which but for this provision would or might vest take effect or be exercisable after the expiration of the perpetuity period shall vest and take effect and be exercisable only until the last day of the perpetuity period.”

I am setting out this definition in full as it is written in the most archaic language. It is not what you find in a Legal Consolidated discretionary trust!

As you recommend in your Family Trust Vesting kit, the accountant is preparing the Family Trust balance sheet showing nil assets. I confirm:

- The assets are transferred out of the Family Trust.

- Net assets are distributed to the beneficiaries.

- The Loan Accounts are forgiven.

- The final ATO tax return is about to be lodged.

5 questions regarding the Family Trust Vesting Deed:

- Does this Vesting Day definition pose problems using the Legal Consolidated Vesting Deed to close the Family Trust?

- What do we do about the dead Guardian?

- What do we do with the ‘Supervisor’?

- As a lawyer, I would like to play around with the wording of the finished Family Trust Deed Update. But I understand I cannot and should not change anything.

- Can I contact Legal Consolidated for help both before and after we build the Family Trust Vesting Kit?

Answers to vesting a Family Trust

1. Does this Vesting Day definition pose problems using the Legal Consolidated Vesting Deed to close the Family Trust?

A: The Vesting Day wording is common for Family Trusts of this vintage. That wording is fine. I note the vesting day definition also states ‘or such earlier day’. But this lifeline is not required.

2. What do we do about the dead Guardian?

A: The full answer is contained elsewhere on this page. And it is repeated in our cover letter that comes with the Vesting Kit.

The short answer is that whoever is the Backup Appointor signs as the Appointor/Guardian. This is the person mentioned in the Family Trust deed. It is often expressly stated to be Dad or the children. While it is not good practice the Backup Appointors may be Mum’s ‘legal personal representative’. These are the executors of Mum’s Will.

3. How do we deal with the Supervisor?

A: The full answer is contained elsewhere on this page. And it is repeated in our cover letter that comes with the Vesting Kit.

The short answer is to treat the “Supervisor” as one of the controllers of the Family Trust. And have them sign, in effect, as one of the Appointors. It is a conservative and cautious position to take. The more people that ‘seem’ to be in control of the Family Trust that sign the Vesting Deed, the better.

I know that Dad is not dead. But if Dad was dead, then his next of kin or executors normally sign where Dad would normally sign the Vesting Deed.

4. As a lawyer, after I build the document, I would like to play around with the wording. But I understand I cannot and should not change anything.

A: We have been providing Deeds of Vesting of a Family Trust since 1988. The kit you are building is based on 100s of ATO desktop audits that we have attended or accountants have relayed to us.

As with all Legal Consolidated documents you build on our website, they cannot and should not be altered.

A Family Trust with no assets is no longer a trust. So from a trust law position, the Family Trust ended the moment you got to that empty balance sheet from your client’s accountant. This vesting deed is to formally close the family trust to the satisfaction of the following:

-

-

-

-

-

-

- Australian Taxation Office

- the state (stamp) duty office

- bankruptcy court

- family court

-

-

-

-

-

5. Can I contact Legal Consolidated for help both before and after we build the Vesting Kit?

A: Yes. Telephone for help as often as you require. My direct line is 02 9071 7900. And in emergencies, my after-hours is 0477 796 959.

Start building the Family Trust Vesting Kit:

-

-

-

-

-

-

- The building process is highly educational, informative and fun.

- Well, it is not much fun!

- But it does guide you into questions you should be asking.

- Each question has informative hints.

- And telephone me or the law firm if you need more help answering the questions.

-

-

-

-

-

6. What about the Primary Beneficiaries being dead?

A: You did not ask this question. But it needs to be addressed. Often, the Primary (Default) Beneficiaries are long dead when the Family Trust is to be vested. The Primary Beneficiaries, in that capacity, do not need to consent to the vesting.

My old Family Trust deed already allows the winding up of the Family Trust

Q: My Family Trust Deed already confers on the trustee the power to terminate the Discretionary Trust at any time. Therefore, what additional benefit does your Family Trust Vesting Deed pack provide?

A: The Family Trust Vesting pack contains 5 items. One of them is a Family Trust Winding Up deed. But the Legal Consolidated Family Trust Winding Up deed does a lot more than just amend the old Family Trust deed to allow for a winding up.

You are correct. Most Family Trust deeds, Self-Managed Super Fund deeds and Unit Trust deeds already have the power to end the trust. The Deed of Variation to wind up a Family Trust contains many things. This includes expressly allowing you to terminate the Family trust and the process to follow.

Also, often the vesting powers in the old trust deed do not allow ‘earlier’ vesting. Or the old deed requires a vesting process which may no longer be sanctioned or best practice. The process may trigger stamp duty and Capital Gains Tax. The Family Trust Winding Up pack complies with the ATO’s latest rulings.

Further, the power to end the trust in the old trust deed is only part of the process. The Family Trust Vesting Pack contains five documents:

-

Law firm letter of Advice on ending the Family Trust:

- signed by a partner of our law firm, on our law firm letterhead

- setting out the process and tax consequences of the winding-up

- confirmation and statement that there is no resettlement for tax purposes

- confirmation that the Family Trust is authorised to be ended in this manner set out in the Family Trust Winding Up kit

- Capital Gains tax issues are addressed

- what to do with the capital and assets in the Family Trust in compliance with the ATO

- when a Family Trust final tax return is required and the wording the ATO requires

-

Family Trust Vesting Minutes:

- containing the required resolutions to end the Family Trust

- required by your accountant’s due diligence file

-

Vesting of a Family Trust Deed:

- updating the Appointor and Trustee, in consequence of an audit by the ATO

- allowing earlier winding up of the Family Trust

- augmenting the Family Trust’s Trustees’ powers to allow all things necessary to vest and terminate the Family Trust

- no ‘partnership’ relationships to reduce the threat of Trustee, Appointor and Default Beneficiaries being joint and severally liable for the winding up

-

Checklist to end a Family Trust:

- Step-by-step guide

-

Family Trust Certificate of Vesting

The old Family Trust Deed already fully sets out the process and authorises the ending of the Family Trust

Q: The old Family Trust Deed confers on the Trustee a wide power to amend any provisions of the Trust Deed. This includes the Vesting Date. It also sets out how the Family Trust is to be terminated. What additional benefit does your Family Trust Vesting Deed pack provide?

A: The Family Trust was created by a Deed. Entities and trusts created by a deed should be ended by a deed. The other method to use is to end the Unit Trust via Minutes. However, few accountants and lawyers would recommend ending a trust via only minutes. And, I have never known an accountant or lawyer courageous enough to put in writing that minutes are enough.

Instead, in years to come, if the Family Court, Bankruptcy Court, Centrelink or the ATO come to review the affairs of the Family Trust then you have the documentation. This is signed off by us, as your lawyers.

Our Family Trust vesting pack follows best practice. It complies with the ATO’s latest rulings. It is for clients that like to sleep at night, and not take risks or shortcuts. The Family Trust Vesting pack provides peace of mind.

Does the government give me the rules to wind up a family trust?

Q: There are Federal statutory schemes to liquate and de-register companies. There are also rules for each state to dissolve and wind up a partnership. Surely, there are statutory rules to get rid of old Family Trusts?

A: Thankfully, trusts are not a creature of government. Apart from SMSFs, Family Trusts and Unit Trusts are under the control of the user. That is why it is important to use a specialist trust law firm, like Legal Consolidated, to build your trust deeds and updates.

Neither the Federal government nor state governments have rules for bringing a Family Trust or Unit Trust to an end. The ATO has some tax requirements. But they do not tell us how to get there – but the Legal Consolidated Family Trust Vesting kit does.

Appointor is dead. There is no Backup Appointor. Who signs the Family Trust Vesting Deed?

Q: The Family Trust Deed has an Appointor. But she, the wife, is dead. To repeat the same thing three times (sorry but I want to make the facts clear):

- there is no Backup Appointor

- the wife (Appointor) never appointed another person

- the wife never consented for her husband (or anyone else for that matter) to be the Backup Appointor

Who signs for the dead Appointor? Can her husband sign? Can we get the Trustee of the Family Trust to appoint the husband as the Appointor?

Secondly, the husband is named as a separate type of person called a Supervisor. He is alive. Therefore, there are two people who need to sign as ‘controllers’ of the Family Trust? These are:

- the dead wife (as Appointor); and

- husband (as Supervisor)?

A: I would not get too delicate here. It may have been a breach of:

- trust law

- the Family Trust deed; and

- the ATO

that the Trustee has been merrily distributing income and capital out of the Family Trust without the Appointor’s approval. This is for all these years since your wife died.

We are not instructed in the above. And you will need to get your own legal and accounting advice on the above matter. Rather, Legal Consolidated is only accepting instructions to prepare a Family Trust Vesting Kit. And this is on the basis that the Family Trust has no assets in it. So, at trust law, the Family Trust has already ceased to exist.

Now, having said that, let us answer your two questions:

- Appointor is dead. Best practice is to have a Backup Appointor named in the Family Trust deed or the Deed of Family Trust Appointor Update. If this has not been done then the Family Trust deed may have the replacement Appointor being the dead Appointor’s ‘Legal Personal Representative’. In which case, get the Executor in the dead Appointor’s Will to sign. This is on behalf of the dead Appointor.

- Additional people appear to also be controlling the Family Trust. If there are other persons who may appear to also be controlling the Family Trust then it does no harm for them to be included as one of the Appointors, as well. The ‘Supervisor’ should be treated as a ‘controller’ of the Family Trust. And, accordingly, added as the second Appointor when building the Family Trust Winding-up kit.

So let us say:

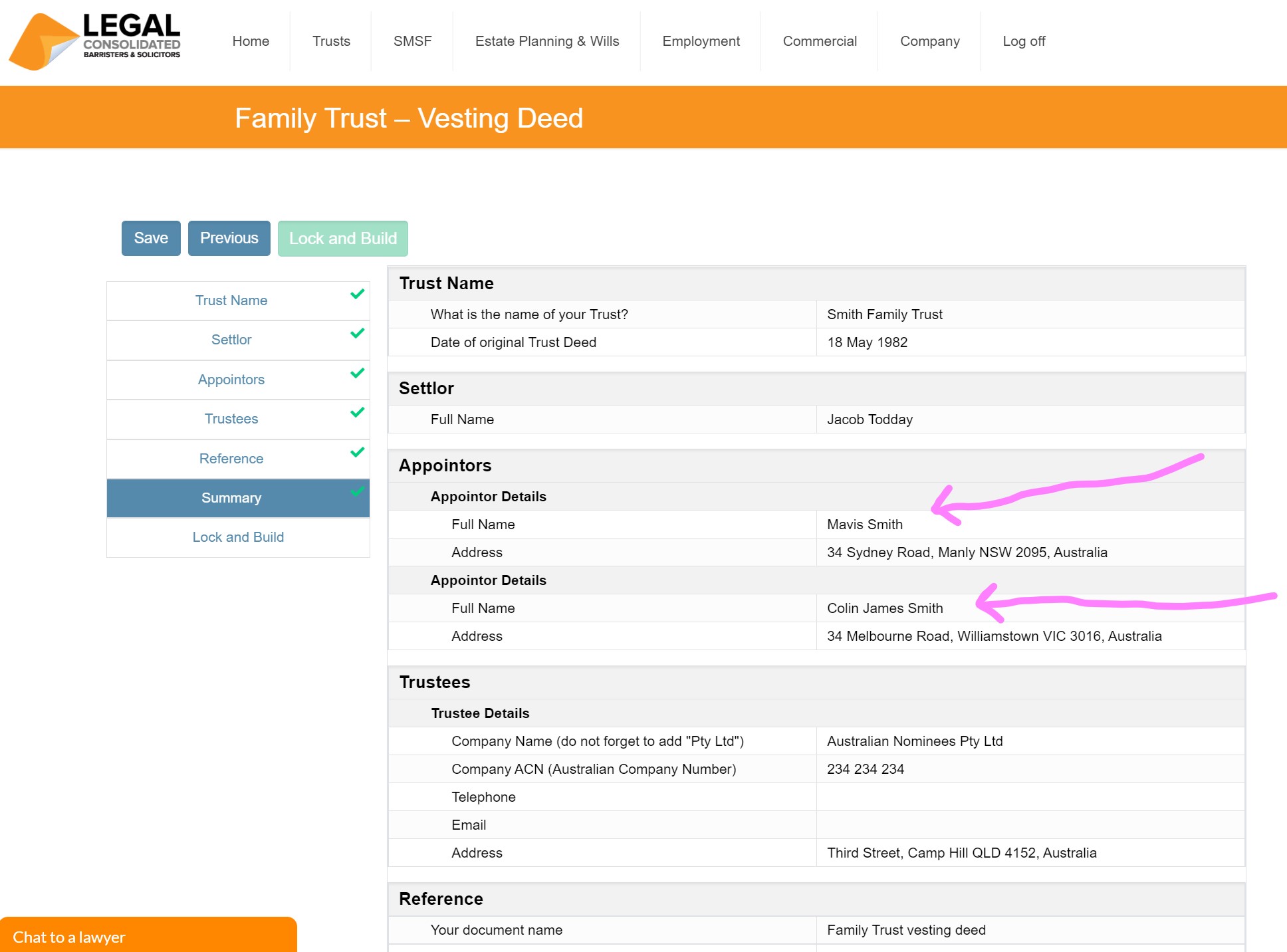

- your dead wife’s name (Appointor) is: Mavis Smith (use your wife’s last address while she was alive)

- your name, as the husband (Supervisor), is: Colin James Smith

Then this is how you answer the Appointor question for the Family Trust Vesting Deed:

You ask if there is any value in the Trustee of the Family Trust now appointing you, as the husband, as the Appointor.

Trustees normally do not have that power. You could, however, include the Trustee as a third Appointor. In this case, in the above example, the Trustee wears two hats. One as the trustee. And the second is as the third Appointor. It is probably not needed but does no harm.

Lodge the final Family Trust tax return after the Family Trust Vesting pack is signed

Q: Our accountant prepared the tax return for the Family Trust for the financial year that just ended. He intends to notify ATO the Family Trust is not lodging tax returns in the future. We now need to build the Family Trust Vesting pack. Is it necessary to prepare a return for the period for the following financial year? Or can we simply rely on the tax return for last year’s financial year?

A: The best practice is to sign all the documents relating to the Family Trust Vesting Deed and then lodge the final Family Trust tax return. But if the final Family Trust tax return has already been correctly lodged then you do not need to do another one. But you do need to let the ATO know that the Family Trust is finished. Our letter of advice sets out how the accountant does this.

To end a Family Trust get a balance sheet showing ‘nil’

Q: Our accountant has financial statements for the Family Trust for the last financial year. If we wish to build your Family Trust Vesting Deed pack is it necessary to prepare financial statements for the following financial year? Or can we simply rely on the financial statements for the last financial year?

A: A balance sheet (statement of financial position) provides a snapshot of your assets and liabilities. It shows the Family Trust’s net worth. This is at a single point in time. (This is unlike other financial statements. Such as profit and loss reports. These only give information about your Family Trust over a period of time.)

The ATO is not so interested, from a CGT point of view, in financial statements. Rather it wants to see a Family Trust balance sheet showing zero. Before you wind up your Family Trust you need to have your accountant prepare a Balance Sheet showing the Family Trust has (or will have) no assets.

Who signs the Family Trust winding up minutes?

Q: In your section for the Family Trust Vesting Deed, you state as to the Minutes: “Pass a resolution stating the that the trust is vested (terminated)”. Two questions:

- Who needs to pass this resolution? The Trustee, Appointor or Default Beneficiaries?

- Are these Minutes included as part of your Family Trust vesting package?

A: The minutes are in the Sample. Have a look at the Sample to see the answer to that question. And, of course, that Minute is in the Family Trust winding-up pack. Have a look at the Sample for what you get.

How do I get free legal advice when building the Family Trust vesting deed?

Start building the Family Trust Vesting Deed. Read the many hints for each question. Answer as many questions as you can. And then telephone the law firm for a good chat. If you want to speak to me personally you can always get me on my personal mobile: 0477 796 959.

We have been winding up Family Trusts deeds since 1988. Your ‘unique’ questions about your individual circumstances regarding the winding up of your Family Trust may already be addressed in the many hints you can read during the building process.

Build this Closing Family Trust deed on our website

Your Family Trust vesting kit includes:

1. Letter of advice – signed by a partner of Legal Consolidated Barristers & Solicitors

2. Minutes – for your Accountant’s due diligence file

3. Termination of Family Trust Deed – just print and sign, it amends your Family Trust deed to allow it to be vested and wound up

4. Certificate of Vesting

Have a look at the Vest Family Trust sample document. Plus there are many training videos and hints as you build the Family Trust vesting kit.

How to vest and end other trusts

Free Centrelink tool kit

These free resources empower you on how to deal with Centrelink:

- Centrelink attacking innocent grandparents – what we do for our children

- Family Trusts:

- Wind up Family Trusts

- Replacing the Appointor in a Family Trust – succession planning for a person wanting Centrelink

- Company to replace pensioner as trustee of a Family Trust

- Can grandma disclaim a trust distribution?

- What to do before the end of year financial year – to appease Centrelink

- Wind-up Unit Trusts

- Abandon a gift in a Will to keep the pension?

- Centrelink compliant Power of Attorney – keeps your family in control, not Centrelink

- 3-Generation Testamentary Trust Wills – beneficiaries retain Centrelink benefits in your Will

- Special Disability Trust – to avoid Centrelink deprivation rules

You have finally retired and applied to Centrelink for your Age Pension.

Unfortunately, Centrelink takes issue with the fact that you have an old trust that was created 30 years ago. It hasn’t been used for years. There is no money left in it. The trust has a nil value. It has no assets and no debts. What can you do? You need to formally wind up (vest) the trust to close down this unused structure, you can do so with this Vesting Deed

Why should I get rid of the trust?

– The Trust has achieved its original purpose

– It has no assets

– The trust has reached its vesting date

What do I need to do to get rid of the trust?

1. Distribute to beneficiaries the trust capital.

2. Payout all trust liabilities. Or get them to forgive all debt with a Deed of Debt Forgiveness. This includes any existing or future

tax liabilities that arise as a result of the termination of the trust.

3. The Trustee must pass a resolution determining that the trust is to be vested (terminated).

4. The final accounts of the trust, including a final tax return, must be prepared.

Once this is done, you can build our Deed of Vesting of a Trust and build a set of documents that allows you to vest and close the family trust.

After building this document on our website you are emailed:

1. Family Trust – Deed of Variation of Vesting

2. Minutes

3. law firm Letter of advice

What do I need to do to terminate the trust? Get rid of a trust.

1. The capital of the trust must be distributed in accordance with the trust deed.

2. The Trustee must satisfy any existing liabilities of the trust. This includes any existing or future

tax liabilities that arise as a result of ending the trust.

3. The Trustee must pass a resolution determining that the trust is to be vested (terminated).

4. The final accounts of the trust, including a final tax return, must be prepared.

5. Build this document

To update your Trust, we need to first identify it. We do this by referring to:

1. The Trust name (e.g. Jones Family Trust)

2. Date the Trust Deed, that established the Trust, was signed

3. The Settlor’s name and address, as it appears in the Family Trust Deed

Every trust has a name. Sadly, they are generally quite boring. E.g. Smith Family Trust, named after Mr Smith.

The trust name is a ‘nickname’. It is not registered anywhere. It just helps you and your accountant identify your Trust.

Take out your Deed of Trust that first started your Trust. Have a look at the front cover. It often has the name of your Trust. It repeats in the body of the Deed as well. Check any subsequent Deeds of Variation, to make sure that your Trust didn’t change its name.

Be careful to not confuse the Family Trust name with your Trustee. Your Trustee (e.g. XYZ Pty Ltd) is not your trust name.

There is generally no difference between a:

– Family Discretionary Trust

– Family Trust

– Discretionary Trust

We, tax lawyers, tend to call them ‘Discretionary Trusts’. This is because we like the fact that every year the Trustee has the discretion to distribute income to different beneficiaries.

While, our friends the accountants, usually call them ‘Family Trusts’. This is because only mum and dad and the immediate family operate a family business or hold assets in a ‘Family Trust’. If people out of the immediate family are involved in the business then a ‘Family Trust’ is not appropriate.

Resettlement of a Family Trust

‘Resettlement’ happens when you alter the Trust to such a level that it becomes a new trust. You would then suffer Capital Gains Tax, Stamp Duty and other issues. Resettlements are bad.

As a taxation law firm, we ensure that you do not suffer a ‘resettlement’.

Your Discretionary Trust vesting kit complies with:

1. Commissioner of Taxation v Clark and the subsequent

release of Taxation Determination TD 2012/21.

2. High Court decision in FC of T v Commercial Nominees [2001] HCA 33

3. ATO’s (now withdrawn, but still loved by many at the ATO) Statement of Principles on the Creation of a New Trust. Plus the related ATO’s Decision Impact Statement.

Can I download the soft copy of the vesting deed and email it to my client for signing? She is currently overseas

Yes. All our documents come in soft copy. This is a locked PDF. A copy is emailed to you within a few seconds of you paying for the Family Trust Vesting Deed with your credit card. You can also log in anytime to “Your Documents” and download the document again.

Business Structures for Personal Services Income, tax and asset protection

Family trust v Everett’s assignments

- Family Trust Deed – watch the free training course

- Family Trust Updates:

- Everything – Appointor, Trustee & Deed Update

- Deed ONLY – only update the Deed for tax

- Guardian and Appointor – only update the Guardian & Appointor

- Change the Trustee – change human Trustees and Company Trustees

- The company as Trustee of Family Trust – only for assets protection?

- Bucket Company for Family Trust – tax advantages of a corporate beneficiary

Unit trust vs Everett’s assignments

- Unit Trust

- Unit Trust Vesting Deed – wind up your Unit Trust

- Change Unit Trust Trustee – replace the trustee of your Unit Trust

- Company as Trustee of Unit Trust – how to build a company designed to be a trustee of a Unit Trust

Corporate structures and Everett’s assignments

- Partnership Agreement – but what about joint liability?

- Incorporate an Australian Company – best practice with the Constitution

- Upgrade the old Company Constitution – this is why

- Replace lost Company Constitution – about to get an ATO Audit?

- Independent Contractor Agreement – make sure the person is NOT an employee

- Service Trust Agreement – operate a second business to move income and wealth

- Law firm Service Trust Agreement – how a law firm runs the backend of its practice

- Medical Doctor Service Trust Agreement – complies with all State rules, including New South Wales

- Dentist Service Trust Agreement – how dentists move income to their family

- Engineering Service Trust Agreement – commonly engineers set up the wrong structure

- Accountants Service Trust Agreement – complies with ATO’s new view on the Phillips case