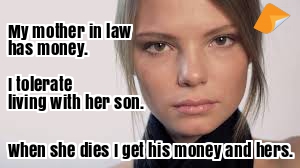

Working with your accountant and financial planner Estate Planning ensures that your estate goes to those you care about and not to the ATO and inlaws.

3-Generation Testamentary Trusts Wills

We were in the first group of lawyers in Australia to prepare Testamentary Trust Wills. This was in May 1994. We stopped preparing them in 1997 when we developed the superior 3-Generation Testamentary Trust. The 3-Generation Testamentary Trust:

- works for the next 3 generations. Your children can pass down the 3-Generation Testamentary Trust to their children.

- is permissive. Each beneficiary (without speaking to any other beneficiary) can set up none or as many 3-Generation Testamentary Trusts as they wish.

For example, you die leaving everything equally to your three children:

-

-

- The first child sets up one 3-Generation Testamentary Trust for herself.

- The second child sets up none – just takes the money (that is not tax effective, but it is their decision).

- The third child sets up five 3-Generation Testamentary Trusts. Why did the third child set up five death trusts? You would need to ask them that question. Perhaps:

- there were high-risk business assets and their accountant wanted to quarantine them.

- they had a succession plan for their own children.

- some of their inheritance is going to be invested overseas.

-

In contrast, the standard Testamentary Trust is mandatory. There is one trust per beneficiary – or worse still, only one testamentary trust between all your children. That is not flexible.

Sadly, the standard Testamentary Trust Will requires, that all assets go straight into a Testamentary Trust – it is a mandatory requirement of the Will. In contrast, in a 3-Generation Testamentary Trust Will, the beneficiaries decide what goes or does not go into their own 3-Generation Testamentary Trusts. It is not always appropriate to automatically put every asset into a trust. For example, for a family home, your beneficiaries have two (often three) years to sell it and not pay any CGT on the increased value from the date of your death. However, they lose that two-year CGT-free period if you put a dead parent’s family home into a death trust.

If all the beneficiaries agree they can take specific assets without stamp duty or triggering CGT. For example, you may have $1m in shares, $1m in real estate and $1m in cash. One child wants only shares. The other only wants real estate. The youngest wants cash. With a 3-Generation Testamentary Trust Will, they can distribute your estate in that way and not incur any stamp duty or CGT. In contrast, with a standard Testamentary Trust, the children often have to pay stamp duty and trigger CGT to obtain that outcome.

Your beneficiaries can use these additional trusts which are in the 3-Generation Testamentary Trust Will:

-

- 3-Generation Testamentary Trusts – reduces CGT, income tax & stamp duty for up to 80 years from the date of death

- Superannuation Testamentary Trust – stops the 17% or 32% tax on Super going to adult children

- Bankruptcy Trusts – if a beneficiary is bankrupt

- Divorce Protection Trust – if a child separates from their partner

- Maintenance Trust – if the beneficiary is under 18 or vulnerable

Estate Planning can be narrowed down to one word – flexibility

Your Will must be flexible. This is because we do not know three things about you;

- the date of your death

- the laws will be at your death (perhaps death duties are introduced)

- what assets you own (you get dementia, move into a nursing home, and your family home is sold)

The most flexibility that you can put in a Will is a 3-Generation Testamentary Trust Will.

Will the Tax Man smile when I die?

Imagine $1.5 trillion “up for grabs!” That is the projected total value of estates from Australians who die in the next 20 years. This is from defacto death taxes including CGT, transfer duty, income tax, Centrelink and the 32% on super.

A 3-Generation Testamentary Trust, Superannuation Testamentary Trust and other protections in your Legal Consolidated Will reduce those threats.

Protecting Vulnerable and Young Children tool kit

Free resources to help protect young and vulnerable children:

- Vulnerable children in Wills – watch the training course

- Loans to children – in case they divorce or go bankrupt

- Divorce Protection Trusts in Wills – when a beneficiary, child or grandchild separates

- Making Wills for Your Children

- Special Disability Trusts – for disabled children

- Elder Abuse – protecting the children as well

- Life Estates do NOT protect children and they are NOT tax-friendly

- Child renounces a gift or Family Trust distribution to keep Centrelink & stop Trustee-in-Bankruptcy

- Children paying 32% on your super when you die

- Only young and disabled children can benefit from your SMSF Reversionary Pension

- Parent dies child pays 66% tax

- Dad’s Will: child vs charity

- Son loses farm to his two sisters

- Disabled dad has $9m, two children and no Will – statutory Wills

- Court rewrites disabled Dad’s Will to protect children

Example of a Will without a 3-Generation Testamentary Trust:

Tom always wanted to build his retirement home on the canals where he had purchased a block a few years ago. Unfortunately, Tom died before realising his dream to build on the block.

As a dutiful husband, Tom left everything to his much-loved wife Jenny.

Little did Tom know, but Jenny never shared Tom’s vision to live by the canals. Their 2 children did share Dad’s vision. Jenny decided to give the children the block of land. After all, it was now interfering with her aged pension and pharmaceutical entitlements.

The gift made the children excited. The block had increased in value to $175,000. However, the children were less excited when they got a stamp duty bill of over $4,200.

Later, Jenny gets a notice from the ATO to pay Capital Gains Tax of $28,000.00 on the “disposal” of the block. (“But I just gave it away!” she lamented)

The nightmare continues when Centrelink advises Jenny that the gift is subject to the deprivation rules.

Tom could have put 3-Generation Testamentary Trusts into his Will. Tom’s Will then leaves everything to his wife, children and extended family. Tom also makes his wife the Trustee of the 3-Generation Testamentary Trust. Jenny:

- controls the assets; but

- does not own the assets for tax purposes.

Do the children have control over what Jenny does with her husband’s estate?

No.

Jenny has full control of who gets what from the estate. With a 3-Generation Testamentary Trust, Jenny can give everything to herself or give some things to the children, grandchildren or any of the extended family as she so wishes. With her financial planners and accountant’s help, Jenny takes advantage of the lower income tax rates paid by some members of her family. That is flexibility.

Flexibility: 3-Generation Testamentary Trust?

In the above case, Jenny could have merely distributed the block to her children through Tom’s Will using the 3-Generation Testamentary Trust this is even if the change of control took place years after Tom’s death. Therefore:

-

- There is often no stamp duty payable because Jenny did not own the land – she merely controlled the land in the 3-Generation Testamentary Trust

- There is no ‘disposal’ of the property. Therefore, Jenny does not have a Capital Gains Tax bill – CGT Generation Skipping.

- Alternatively, the asset could have been kept out of Jenny’s hands to potentially protect her Centrelink entitlements.

Capital Gains Tax on your family home when you die

Death and Probate Duties were abolished by 1981. However, in 1985 the Federal Government introduced Capital Gains Tax. Capital Gains Tax now earns the Australian Federal Government more money on deceased estates in a single year than in the cumulative history of death duties.

Contrary to what Treasurer Paul Keating told us back in 1985 when he introduced CGT, Capital Gains Tax and stamp duty applies often to your family home. Even your pre-1985 family home can be subject to Capital Gains Tax.

A 3-Generation Testamentary Trust is the most effective safeguard to put into your Will to dampen the effects of Capital Gains Tax and Stamp Duty.

Even a pre-1985 family home can suffer CGT at death

The ATO is angry that the family home is exempt from CGT. It tries to claw your family home back into the CGT regime, whenever it can. Subsection 108-70(2) Income Tax Assessment Act 1997 provides that if an improvement is made to a pre-CGT asset then that improvement is treated as a separate asset.

The ATO confirmed this in Taxation Determination TD 2017/1:

“Can intangible capital improvements made to a pre-CGT asset be a separate asset for the purpose of subsections 108-70(2) or (3) Income Tax Assessment Act 1997?”

For example, you do an improvement (‘new asset’) on your family home. You then run a business from home. The new asset is subject to CGT. Therefore, you pay CGT on that new asset when you sell the home. The new asset, by law, forms part of your home. This would include a new bedroom or garage. But under CGT it is considered a separate asset. A very unfair outcome.

This is an example of just one of the loopholes that the ATO and the state governments exploit when you die.

Grandchildren benefit from the 3-Generation Testamentary Trust Will

In Family Trust and Bare Trusts, the ATO penalises your children, grandchildren, and other beneficiaries under 18 years old when they receive trust income over $416 per year. Above this amount, minors are taxed at the highest marginal rate (up to 66% in some instances), under Division 6AA of the Income Tax Assessment Act 1936.

Nevertheless, there are over 1.1 million Family Trusts in Australia. They are popular. This is because each year you can hunt down adults who are on low marginal tax rates.

In a 3-Generation Testamentary Trust Will, there is an exemption to the draconian Division 6AA. Under section 102AG minors in your 3-Generation Testamentary Trust Will are exempt from Division 6AA.

Therefore, minors can take advantage of the low marginal tax rate of an adult. Your children, grandchildren and great-grandchildren under 18 benefit from the 3-Generation Testamentary Trusts in your Will.

The Section 102AG exemption is only one of the many advantages of a 3-Generation Testamentary Trust.

Other protections in a 3-Generation Testamentary Trust Will

The 3-Generation Testamentary Trust Wills are not just about saving tax. Other advantages include:

- Divorce Protection Trust

- Bankruptcy Trust

- Protects your right to sell your parents’ home up to 3 years after their death – tax-free

- Special Disability Trust – and still get Centrelink benefits

- Reducing the 32% tax on the dead person’s superannuation

- Considered Person Clause – to stop people from challenging your Will

Can each Beneficiary ‘turn on’ the different death trusts as they each see fit?

Q: The front page of the Legal Consolidated 3-Generation Testamentary Trust Will states that it contains the following trusts:

- 3-Generation Testamentary Trust

- Super Testamentary Trust

- Bankruptcy Trusts

- Protective Maintenance Trusts

- Divorce Protection Trust

- Severability Rights Protection

Does each beneficiary have the right to set up one or all of these trusts? This is independent of each other? Can the executor also set up these forms of protection?

A: That list is just some of the death trusts. As required by the ultimate goal of flexibility, your Legal Consolidated Will contains many more trusts. They are discretionary and flexible. Each beneficiary sets them up as required. If a beneficiary is ‘vulnerable’, suffering a divorce etc… then the Executor will turn them on and off, as required. However, the executor always acts in the Primary Beneficiary’s best interests.

Many trusts in our Wills can be set up years after you die.

When dead who turns on and off the trusts to protect my family?

As a taxation law firm, we are amazed, since we introduced the 3-Generation Testamentary Trust in 1994, to the flexible contained in the Wills. We are often telephoned by lawyers, accountants and financial planners who excitedly tell us what they have achieved with the 3-Generation Testamentary Trust after the willmaker is dead.

The different trusts and combinations of trusts are being used in ways we could never have imagined. It brings us joy and we continue to provide the greatest flexibility in our 3-Generation Testamenaty Trust Wills. We seek to empower lawyers, accountants and financial planners to continue to innovate using our 3-Generation Testamentary Trust Wills after the willmaker is dead.

Can the Testamentary Trusts be ‘turned on’ by my family BEFORE I die?

Q: My lawyer and accountant are very excited as to what my Beneficiaries can do with the many available trusts in my Legal Consolidated Will. Can any of them be ‘turned on’, before I die?

A: I know that 3-Generation Testamentary Trusts are better than Family Trusts but your Will only starts at your death. The Will is dormant until then. All the wonderful protection in your Will is only available when you die! The ultimate sacrifice to your family!

Make sure your parents have 3-Generation Testamentary Trust Wills.

Can a dead person be a beneficiary under their own Will?

Yes, from a tax perspective, the 3-Generation Testamentary Trust Will allows you to use the dead person’s generous marginal tax rates for up to three years from their date of death.

So the dead person should be included in the classes of beneficiaries in their own 3-Generation Testamentary Trust Will. This is useful for tax planning.

As a dead person, you can get a new tax file number from the Australian Tax Office. When listing the classes of beneficiaries in a 3-Generation Testamentary Trust Will, include the deceased. This ensures the widest possible range of beneficiaries. It reduces the risk of tax problems and provides greater flexibility for tax planning, asset protection, and income distribution.

Tax advantages of including the deceased in the classes of beneficiaries

Tax-effective estate planning continues even after death. Including the Willmaker in the classes of beneficiaries under a 3-Generation Testamentary Trust Will allows the estate to access concessional tax rates for up to three years. This ensures flexibility and minimises unnecessary tax burdens.

The 3-Generation Testamentary Trust Will allows the estate to use the dead person’s marginal tax rates for up to three years from the date of death. Normally, a trustee pays tax at the highest marginal rate. The same applies to the Executors of a deceased estate.

But when the Executors lodge the first deceased estate trust tax return, they apply for a concessional rate of tax. The concessional rate matches the dead person’s income tax rate. This includes the full tax-free threshold. This can result in significant tax savings during the administration of the estate.

The Australian Taxation Office (ATO) requires Executors to apply for a new Tax File Number (TFN) for the deceased estate. The estate is treated as a separate entity for tax purposes. The tax concessions apply under the Income Tax Assessment Act 1997. The estate benefits from individual tax rates for up to three years. After this period, the tax-free threshold no longer applies, and the estate may be taxed at higher rates.

Including the deceased in the classes of beneficiaries ensures the testamentary trust has full flexibility in distributing income. This protects the estate from unnecessary tax liabilities. It also maximises tax planning strategies for the beneficiaries. If you have to narrow down estate planning to one word, it is flexibility. Making the classes as wide as possible provides flexibility.

Any value in a Superannuation Testamentary Trust if my super goes to my wife?

While your wife does not pay 32% tax on the super she will pay tax on the income that the superannuation generates after you die. The Superannuation Testamentary Trust lowers income tax and also helps:

- if your spouse remarries – your assets are protected by the Divorce Protection Trust

- if your spouse goes bankrupt – your assets are protected by the Bankruptcy Trust

- if your spouse loses mental capacity – they are protected by both the Maintenance Trust and the Special Disability Trust

- the capital gains tax from the sale of your assets is reduced, often to zero

Also, your spouse may die before you. In this case, your beneficiaries gain the benefits of the 3-Generation Testamentary Trust Wills.

What is the cost for my beneficiaries to set up and maintain 3-Generation Testamentary Trusts?

Only after you die are your beneficiaries at liberty to activate their 3-Generation Testamentary Trusts you put in your Will all those years ago. There is no cost for them to set them up. However, your beneficiaries instruct their accountant to do yearly trust tax returns. For example, the accounting fees for my now deceased father, for the yearly tax returns on his Testamentary Trust, is $660 per year. That is what the accountant charges.

There is no cost to set up the Testamentary Trusts when you die – they are already in your 3-Generation Testamentary Trust Will. They sit dormant in your Will.

Only after you do your beneficiaries consider activating some or all of the Testamentary Trusts in your Will. That is the decision of each beneficiary. Each beneficiary independently sets up their Testamentary Trust(s) without regard to what the other beneficiaries are doing.

For example, if you have three children then after you and your spouse die the 3 children get a third each:

- One child may set up four Testamentary Trusts for their third interest in your estate.

- The second child may activate just one Testamentary Trust.

- The third child activates no testamentary Trust – that child just takes the money (which is sad because the 3-Generation Testamentary Trusts in your Will are natural tax havens.)

What if my child does not want to use any of the testamentary trusts?

The advantage of a 3-Generation Testamentary Trust over the standard Testamentary Trust is that each Primary Beneficiary chooses how many testamentary trusts they wish to set up.

A beneficiary can even set up no testamentary trust. There are no tax consequences for the beneficiary doing so. There is no vesting of the trust as it is never started. However, sadly, the benefits of the 3-Generation Testamentary Trust are immediately lost. When the beneficiary comes to dispose of an asset then they have to suffer CGT and income tax. This is on their personal tax return. Just like a non-tax effective Will.

Before you decide to set up testamentary trusts from dead people’s Wills talk with your accountant and financial planner. There are major tax and asset protection advantages.

Can my child, after I die, draw from the testamentary trust?

Yes, your beneficiaries can do with their interest in your estate as they see fit.

However, I do not think an accountant would recommend that strategy. This is of taking out money from the testamentary trust. The 3-Generation Testamentary trust, once you are dead, are great tax havens and provide asset protection.

Instead, the beneficiary may with to ‘borrow’ the money from their testamentary trust. The beneficiary can do so for no interest if they desire.

However, should the beneficiary wish to just withdraw money from the testamentary trust then they can do so.

But, if the 3-Generation Testamentary Trust has income then income tax has to be paid. This is whether the proceeds are taken out of the trust or not. If a capital asset is being sold then there is a CGT liability. This is whether the proceeds of the sale remain in the trust or are taken out.

But there are different matters. Instead of the beneficiary paying the tax on their own personal income tax, they have other beneficiaries, including young children and grandchildren, to pay the tax at their low or even zero tax rates.

Can Testamentary Trusts lend money for free?

Your beneficiary using a 3-Generation Testamentary Trust prepared by Legal Consolidated can lend money to anyone. This includes themselves. They can lend money to their children or strangers. They can do whatever they want. (They can just transfer the wealth out of the 3-Generation Testamentary Trust and give it away if they wish).

The money can be lent with or without a Loan Agreement. You should prepare a Loan Agreement if you want the money back, or to protect the assets from the family court and bankruptcy court. You can lend the money at zero interest. You can lend the money at any interest rate you want. You can have the loan repayable on demand etc…

Is Probate more expensive when the Will contains 3-Generation Testamentary Trusts?

Probate is the proving of the Will. With Legal Consolidated Wills you can apply for probate yourself. You do not need to use a lawyer. For free, we will show your executors how to do this.

What happens to my Testamentary Trust after 80 years? Why must it vest?

Does it really matter? All Australian trusts vest after 80 years. See here. But for trusts in Wills, the 80 years only starts on the date of your death. So your spouse and children are all dead by the time the 80-year period comes about. Probably your grandchildren have died of natural causes as well.

No one knows what is going to happen to Australia. We have no idea of the tax laws that will apply. The 80-year law of perpetuity will likely be abolished. That is why if you narrow estate planning and Wills to one word it is ‘flexibility’. The 3-Generation Testamentary Trust is the most flexible structure you can put in a Will.

But to answer your question: under the current Australian CGT laws when a trust vests CGT is payable on those assets as if they were ‘disposed’ of. However, during the 80 years, the beneficiaries can sell and manipulate your estate assets as they see fit. They have 80 years to plot and plan. However, generally with a 3-Generation Testamentary Trust, your beneficiaries have the highest chance of reducing CGT and stamp duty to zero. And obviously, cash can be distributed from a 3-Generation Testamentary Trust for free at any time.

South Australia does not restrict its trusts to 80 years. They can go on forever.

Resources to empower you to comply with Centrelink

Free Centrelink tool kit:

- Estate Planning:

- Centrelink compliant Power of Attorney – keeps your family in control, not Centrelink

- 3-Generation Testamentary Trust Wills – beneficiaries retain Centrelink benefits in your Will

- Special Disability Trust – in your spouse’s Will to avoid Centrelink deprivation rules

- Abandon a gift in a Will to keep the pension?

- Loans to parents – not means tested by Centrelink

- Family Trusts:

- Replacing the Appointor in a Family Trust – succession planning for a person wanting Centrelink

- Company to replace pensioner as trustee of a Family Trust

- Wind up and get rid of the Family Trust – Centrelink-compliant

- Can beneficiaries disclaim a Family Trust distribution?

- Self-Managed Super Fund:

- Removing a pensioner as a member of an SMSF

- Keep super in the fund when your spouse dies – escape means testing

- Get rid of unused Self-Managed Super Funds Deeds

- Wind-up Unit Trusts

- What to do before the end of year financial year – to appease Centrelink

Rich enough for a 3-Generation Trust Will?

Of all the people who paid Capital Gains Tax, 80% earned an income of less than $80,000.

Capital Gains Tax is a tax on the middle class.

The only people who don’t need a Testamentary Trust in their Wills are people who feel guilty for not paying enough tax during their life! Even if your only major asset is your family home, you can gain tax advantages from a Testamentary Trust.

Estate Planning is not for the rich. It is for people who don’t like paying taxes.

Tax Man takes my Superannuation when I die?

Adult children can pay 32% in tax on their super.

Instruct your Tax Lawyer to include a Superannuation Testamentary Trust in your Will to wash out the 32% of tax.

Unless you decide otherwise, Super goes to who your Trustee decides.

Can I do Estate Planning after I die?

If there are no Testamentary Trusts in your Will then your family may be able to set up a Post Testamentary Trust after you die. A Post Testamentary Trust has limits that do not exist for a Testamentary Trust. It is a poor second-best option.

Also, there is no value in a Post Testamentary Trust unless you die while your children are still under 18 years of age. So if your children are all over 18 when you die, a Post Testamentary Trust has no value.

How come my Partner loses the Aged Pension when I die?

Your gift may partially or fully reduce Centrelink and other pensions.

“I’ll just renounce the gift because I want to keep my pension for the medicines subsidy. Even better, I’ll just keep the gift & give it to my children”.

Even abandoning a gift under a Will presents complications for pensioners. It leaves that pensioner open to the so-called “deprivation” rules of Centrelink. Centrelink considers the gift an “asset”.

‘Gifts’ reduce pensions?

Why is Centrelink so tough on Pensioners? The philosophy is that those who can provide for themselves should. Give careful thought to how to leave assets to pensioners. Your well-intentioned wishes may result in an Aged Pensioner losing all or part of their entitlements. Estate Planning can help.

Public Trustee as executor?

You appoint an Executor in your Will. Executors handle your affairs after you die. Most people appoint their spouse and then their children when both parents are dead. You can appoint alternative executors in case the executors are never born or are under 18 years of age or dead. Be careful appointing professional trustees and lawyers as executors. They charge to administer your Estate. Your children also can not sack the executor – without an order from the court.

My children hate each other. Should I appoint all of them?

If your children do not get on together then you should appoint them all as executors. Contrary to popular rumour, the job of an executor is one of servant – not master. The executor can’t boss the beneficiaries. The beneficiaries, however, can boss around the executors. Therefore appoint all the children if they fight.

If the children all love each other and get on well, then appoint them all as your executors.

What does an Executor in a Will do?

Your Executor arranges the funeral, applies for Probate, pays debts and distributes your assets according to your Will. These are not normally difficult jobs and the Executor can always get professional help.

Divorcing children

Many trusts are put in your Will:

1. 3-Generation Testamentary Trust to reduce the defacto death duties

2. Bankruptcy Trust if a beneficiary goes bankrupt

3. Maintenance Trust if a child is too young or can’t look after money

4. Protective Trust and Special Disability Trust if your child is not able to look after money or is vulnerable

5. Superannuation Testamentary Trust to reduce the 17% or 32% tax on your Superannuation when it goes to adult children

6. Divorce Protection Trust

The Divorce Protection Trust delays or stops any capital or income going to the beneficiary who is suffering divorce or separation proceedings. It is designed to reduce the opportunity for the Family Court to get its hands on your money.

The Divorce Protection Trust sits dormant in the Will until needed. The Divorce Protection Trust activates for the benefit of the married person and that person’s children and grandchildren. It removes that person’s power to control the trust while they are suffering the separation.

The Divorce Protection Trust benefits the current and succeeding generations. This helps protect the assets from the Family Court.

Apart from the Will, Enduring POA and Medical POA what else should I consider for my Estate Planning?

You may also consider:

- Contractual Wills Agreements – for 2nd marriages

Plus when you have a Family Trust:

- Family Trust Update with succession planning

- Deed of Debt Forgiveness to get rid of money the Family Trust owes the children

Plus when you have a Self-Managed Superannuation Fund:

If you die leaving orphans then you can recommend Guardians to the Family Court in your Will.

You can consider:

- Does your Trustee conserve your estate for your children’s education?

- At what ages do your children receive the trust capital and in what amounts?

- If a child dies before you, who then receives the property? Your grandchildren, your other children or charities?

- What happens if one of your children is bankrupt or of unsound mind when you die?

Can my Will be challenged?

Family Law and the Family Maintenance Provision Act affect married and de facto couples alike. Your spouse (and sometimes your ex-spouse) is entitled to make a claim on your estate.

Even your parents, children and grandchildren can make a request to the court for some of your estate – irrespective of how little or how much you leave them in your Will. A small gift of say $1 000 left to a wayward son does not stop that son from challenging your Will. It is unwise to make such gifts as it gives the person more rights over your Will.

An Estate Planning strategy reduces the chances of these people being successful in their request to the court.

Stop government meddling?

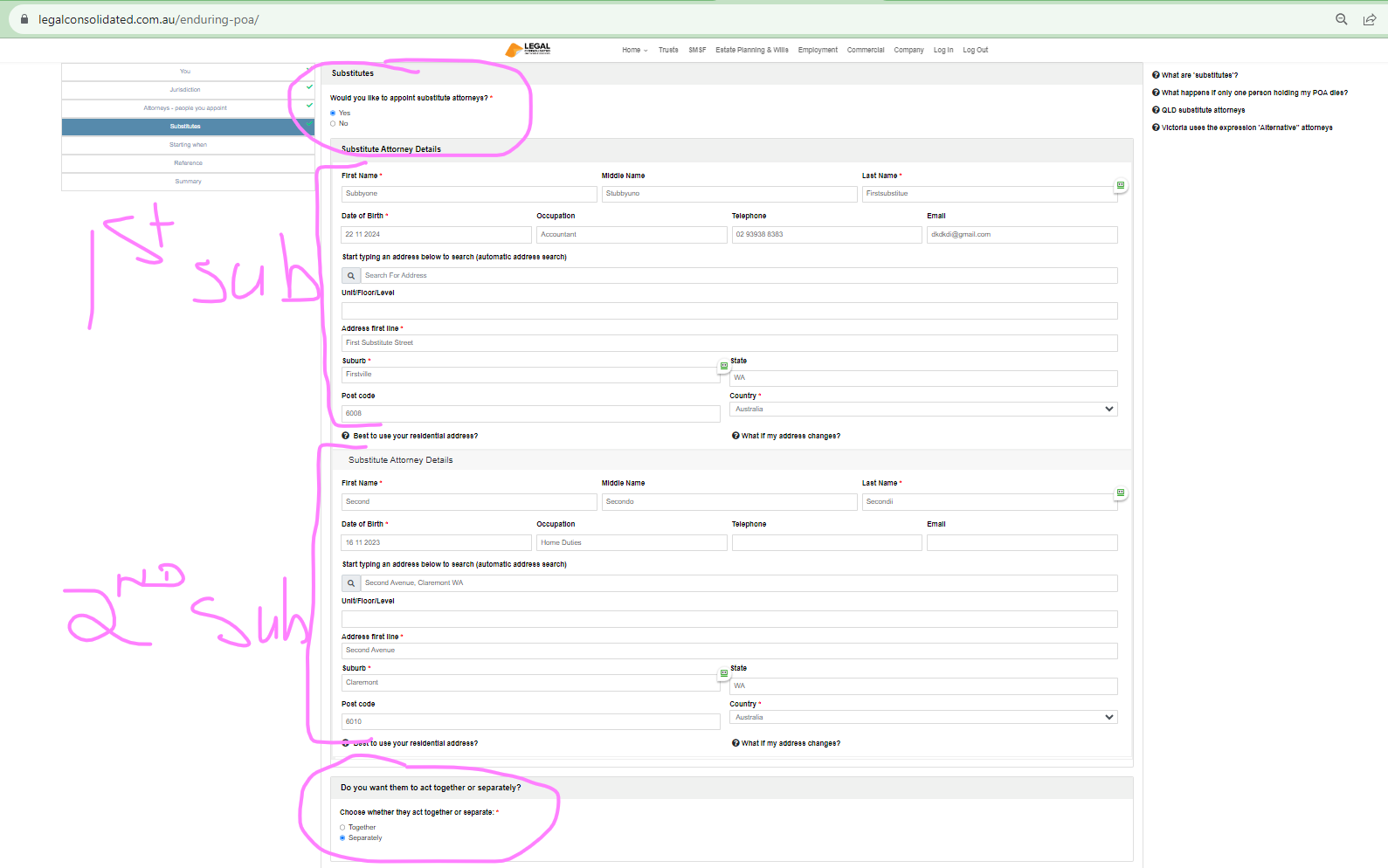

Western Australia allows you to have no substitutes, one substitute, or two substitutes.

Power of Attorneys and Medical Power of Attorneys

Sadly, your spouse gets Alzheimer’s disease at 61 years of age. Your children have left home. You decide to sell the large family home. You want to buy a smaller home closer to amenities that can help your spouse.

The family home is in both your names. Your spouse no longer has the legal capacity to sell the home. While there are many different types of Power of Attorney, you have none. Therefore, your only option is to apply to a government instrumentality for permission to sell the home.

During this Tribunal procedure, your children are asked to swear in court as to whether you are a “spendthrift”. Other people such as friends, other family members and even nosy neighbours may be contacted by the government to see whether they support your application. At the hearing, you are cross-examined as to whether you are a “good person” to look after the affairs of your partner.

Eventually, this government department tells you that you are allowed to sell your home. However, it can direct that you hold your spouse’s half of the proceeds in a separate bank account. If you need to buy toilet paper for your partner then you may need to provide a receipt.

Without all the proceeds from the sale of the home, you cannot afford to buy another property.

Overcome the government’s meddling with both a Power of Attorney and a Medical Power of Attorney. (Medical Treatment Decision Maker in Victoria.)

Do homemade and Post Office Wills work?

Homemade and Post Office Wills are not tax-effective. They are also often informal. Or, do not work at all.

Protects from death duties, divorcing and bankrupt children and a 32% tax on super.

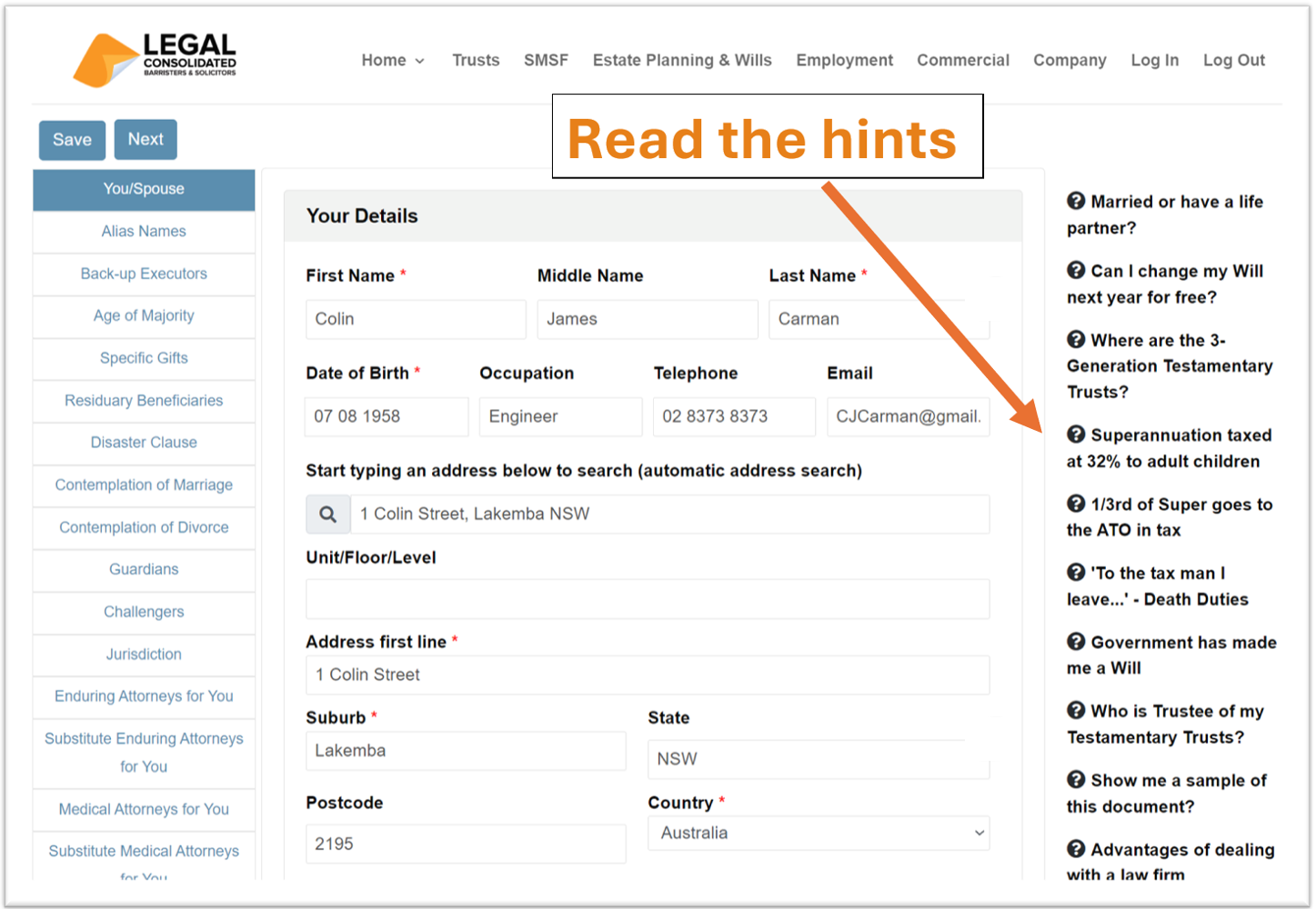

Build online with free lifetime updates:

Couples Bundle

includes 3-Generation Testamentary Trust Wills and 4 POAs

Singles Bundle

includes 3-Generation Testamentary Trust Will and 2 POAs

Death Taxes

- Australia’s four death duties

- 32% tax on superannuation to children

- Selling a dead person’s home tax-free

- HECs debt at death

- CGT on dead wife’s wedding ring

- Extra tax on Charities

Vulnerable children and spend-thrifts

- Your Will includes:

- Divorce Protection Trust if children divorce

- Bankruptcy Trusts

- Special Disability Trust (free vulnerable children in Wills Training Video)

- Guardians for under 18-year-old children

- Considered person clause to stop Will challenges

Second Marriages & Challenging Will

- Contractual Will Agreement for second marriages

- Wills for blended families

- Do Marriages and Divorce revoke my Will?

- Can my lover challenge my Will?

- Make my Will fair: hotchpot clauses v Equalisation?

What if I:

- have assets or beneficiaries overseas?

- lack mental capacity to sign my Will?

- sign my Will in hospital or isolating?

- lose my Will or my home burns down?

- have addresses changed in my Will?

- have nicknames and alias names?

- want free storage of my Wills and POAs?

- put Specific Gifts in Wills

- build my parent’s Wills?

- leave money to my pets?

- want my adviser or accountant to build the Will for me?

Assets not in your Will

- Joint tenancy assets and the family home

- Loans to children, parents or company

- Gifts and forgiving a debt before you die

- Who controls my Company at death?

- Family Trusts:

- Changing control with Backup Appointors

- losing Centrelink and winding up Family Trust

- Does my Family Trust go in my Will?

Power of Attorney

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

Money POAs: NSW, VIC, QLD, WA, SA, TAS, ACT & NT

- be used to steal my money?

- act as trustee of my trust?

- change my Superannuation binding nomination?

- be witnessed by my financial planner witness?

- be signed if I lack mental capacity?

- Medical, Lifestyle, Guardianships, and Care Directives:

- Company POA when directors go missing, insane or die

After death

- Free Wish List to be kept with your Will

- Burial arrangements

- How to amend a Testamentary Trust after you die

- What happens to mortgages when I die?

- Family Court looks at dead Dad’s Will