Most Div 7A loans fail to comply with ATO’s latest ruling

The government left open the Div7A loopholes in its latest budget. The ATO is not happy.

The government left open the Div7A loopholes in its latest budget. The ATO is not happy.

The ATO looks to any excuse to render the Div 7A loan ‘agreement’ as faulty. These are the 6 drafting errors the ATO is targeting:

Drafting a Div7A Loan – ATO’s 6 concerns

1. Prepare loans as ‘deeds’ – ‘agreements’ do not work

‘Deeds’ do not require ‘consideration’. However, a loan drafted as an ‘agreement’ requires ‘consideration’.

‘Agreements’ require money changing hands. But, often no money changes hands in a Division 7A. This is because of

the close relationship between the company and you.

Rather than money changing hands often you record the movement of money by a ‘journal entry’. That is fine. However, ‘journal entries’ are not ‘consideration’. The Loan Agreement does not operate. It is not valid. (This is the case for any loan. Including a Loan to a Company or a Loan to a Child. The Family Court, Bankruptcy Court, and the ATO exploit this ‘weakness’ in the Courts.)

Instead, deeds do not require consideration:

- All loans should be drafted as ‘deeds’.

- All Div 7A Loans must be drafted as deeds. This includes a Division 7A Loan from a company to its shareholder or a ‘related party’

Is my Div 7A Deed valid? How to check if your Division 7A Loan Deed is correct?

These are the 3 requirements of a Div 7A Loan ‘Deed’:

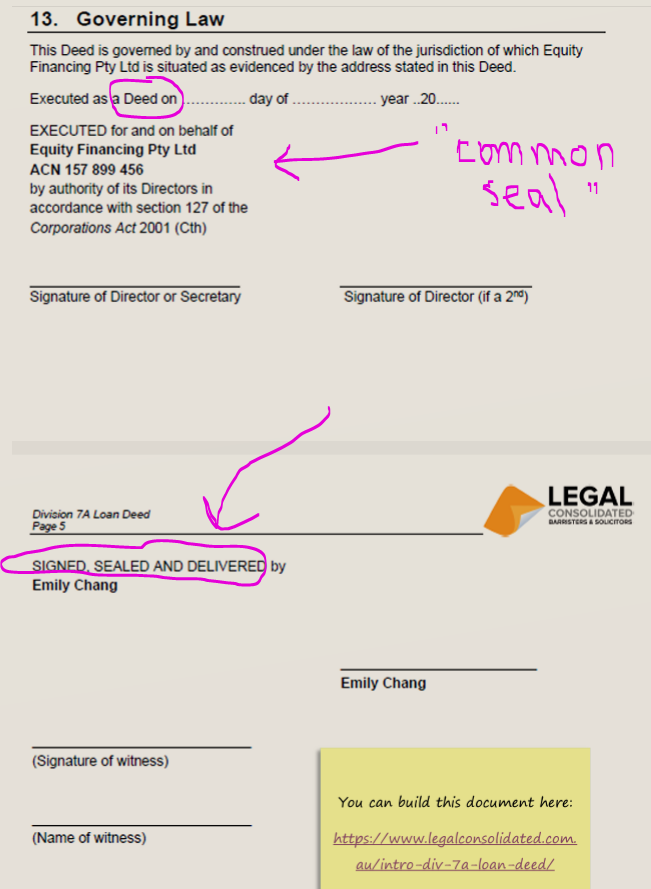

- Firstly, a Deed requires this wording: ‘Executed as a Deed‘. This is on the last page of the Loan deed. This is just before the signing clause.

- Secondly, the wording of a company signing clause is enshrined in legislation. This is called a ‘common seal’ signing clause. The rules of the ‘common seal’ signing clause are set out in the 127 Corporations Act 2001 (Cth).

- Finally, the wording of a human signing clause is very exact for a deed. Most lawyers, including Legal Consolidated, use the expression “SIGNED, SEALED, AND DELIVERED”.

The Deed can use the expression ‘agreement’ in the Loan agreement. The use of the word ‘agreement’ is fine. But you need the three things above.

If you are worried about the validity of your Div 7A loan build a new one on our law firm’s website.

Is your Div 7A prepared and protected by a law firm?

If your Loan Agreement does not have a law firm name on it, then out of an abundance of caution build a Div 7A on our website.

2. A Division 7A loan requires 8 things to be enforceable:

- Offer and Acceptance: an offer from one party and acceptance from the other

- Intention: intention to be legally bound; social or domestic agreements don’t count

- Consideration: payment is given for the promise (i.e. signed as a deed) – see above

- Capacity: parties are competent to contract (i.e. old enough and of sound mind)

- Free Consent: no coercion, undue influence, fraud, misrepresentation, or mistake

- Lawful Object: the purpose cannot be illegal, immoral, or against public policy

- Certainty: clear as to what the words mean

- Possibility of Performance: possible to perform, physically or legally

3. Out-of-date legislation in a Div 7A

There are Div 7A loans sold on websites (operated by non-lawyers) that refer to ‘ATO Practice Statement PS LA 2007/20’. The Practice Statement is withdrawn and no longer applicable. This contaminates the loan.

4. Failure to contain an ‘acceleration clause’ in a Division 7A Deed

An ‘acceleration clause’ requires the borrower to pay the entire debt if there is a breach immediately. It is standard in all ‘commercial’ loans. Here, I agree with the ATO. Without an acceleration clause, your Division 7A. The loan falls foul of the ATO.

If you do not have an Acceleration clause, then it is not a ‘commercial’ loan and can fall foul of the ATO. An acceleration clause is a particular term in a loan agreement. It is also associated with mortgages. It means that if there is a failure to pay one of the regular instalments, all interest, and all capital become immediately owing. It is “accelerated.”

See an acceleration clause in our Sample Div 7A Deed.

5. Sections of Acts that change in a Div 7A agreement

Division 7A Income Tax Assessment Act 1936 (Cth) stops private companies from making tax-free distributions to shareholders and their associates. Many Div7A loans incorrectly reference section 109E(5) Income Tax Assessment Act 1936. If the section is changed the integrity of the Div 7A loan is at risk. The correct way of drafting a Div 7A loan is to reference the laws, only “from time to time”.

6. Freshen up a Div7A, for free, by printing it out and signing it again

As set out below, a Div7A is an ‘at call’ loan. It stops working after 6 years. However, the Legal Consolidated Div 7A Loan Agreement allows ‘dovetailing’. Once purchased, you can, for free, print it off, as often as you wish and resign it. It starts the 6-year Statute of Limitation again for another 6 years.

Our Division 7A Deed complies with:

- TD2011/15 – Division 7A – unpaid present entitlements – factors the Commissioner will take into account in determining the amount of any deemed entitlement arising under s 109XI ITAA 1936

- TD2015/20 – Division 7A: is a release by a private company of its unpaid present entitlement a “payment” within the meaning of Div 7A?

- TR2015/4 -CGT small business concessions: unpaid present entitlements and the maximum net asset value test

TD 2022/11 sets out the ATO’s approach to Div 7A. This is where a private company beneficiary is presently entitled to trust income from 1 July 2022: see 2022 WTB 29 [576].

The withdrawn documents (TR 2010/3 and PS LA 2010/4) continue to apply to pre-1 July 2022 entitlements.

What is the benchmark interest rate?

The government requires that you pay a minimum interest rate on the money your company lends you and your family.

That rate is published by the ATO each year.

It is called the ‘benchmark interest rate’. It changes each financial year. The benchmark interest rate adopts the Indicator Lending Rates – Standard Bank Variable Housing Loans Interest Rate published by the Reserve Bank of Australia. The ATO gives you the interest rate before the start of the new financial year.

Your Legal Consolidated Div 7A Loan Deed merely adopts the benchmark interest rate automatically. Your interest rate is always up to date.

Division 7A interest rate for 2023-24

The benchmark interest rate changes each financial year.

However, the Legal Consolidated Division 7A Loan automatically updates for the current benchmark interest rate. So you only have to build the Division 7A Loan deed once. This is for each shareholder.

The benchmark interest rate for Div 7A purposes is 8.27% for the 2023-24 income year (up from 4.77% for 2022-23). This is the “Indicator Lending Rates – Bank variable housing loans interest rate”.

This is the rate published by the Reserve Bank for May immediately before the start of the relevant financial year.

The ATO no longer issues annual Taxation Determinations for the benchmark interest rate.

The benchmark rate was 4.52% for 2021-22.

How does the ATO view a Div 7A Loan?

You ‘own’ your company. Therefore, you take whatever money you want from the company.

You see a wonderful piece of jewellery for your wife. Out comes the company credit card. You buy her the gift.

This is a personal item. It is not part of the business. You have gained a financial advantage from your company.

The ATO says you are wrong. You are not your company. Your company is a separate legal entity that pays tax at an, often, lower rate than you and your wife.

Without a valid Div 7A Loan Deed, you suffer a ‘deemed dividend’. The tax penalties for taking money from your company is almost 100%.

Instead, you should have ‘borrowed’ the money from your company. The Div 7A Loan Deed treats the company money as a Div 7A complying ‘loan’.

Tax consequences when you benefit from your company

Speak to your accountant if you are a director, shareholder, associate of a shareholder, trustee or beneficiary, child, wife, or mistress and you use the company money or assets for private purposes. Also:

- keep complete and accurate records to explain these transactions

- report them correctly in your company or trust tax return and in your tax return.

There are tax consequences if you do not. You trigger Division 7A of Part III ITAA 1936, This means that transactions are treated as an unfranked deemed dividend in your assessable income. You pay an additional penalty tax.

Money or assets used for private purposes can include:

- salary and wages

- fringe benefits

- director fees

- dividends

- trust distributions

- the company ‘lending’ money to the Family Trust (including – unpaid present entitlements – UPEs) – this is opposite to the Family Trust or Mum and Dad lending money to the company

- allowances or reimbursements of expenses

What is the mischief in ‘borrowing’ money from my company?

Companies pay a constant ‘low’ flat rate of tax. In contrast, mum and dad can pay a high marginal tax rate.

- Therefore, in the good old days (before Div7A), Mum and Dad’s company earned the income.

- The company pays tax at a lower tax rate. (It saves Mum and Dad paying a higher rate of tax.)

- The company ‘lends’ money to Mum and Dad. Mum and Dad buy a boat, have a holiday or whatever.

- Mum and Dad never bother to pay back the debt. Therefore, Mum and Dad never bother to pay the difference between the low company tax rate and their higher marginal tax rate.

- Mum and Dad merely freshen up the ‘loan’ every 5 years with a Deed of Acknowledgment of a Loan.

The government got sick and tired of this and introduced Division 7A Income Tax Assessment Act 1936.

According to the ATO, Div 7A ‘ensures that private companies are no longer able to make tax-free distributions of profits to shareholders’. The ATO also states:

‘It ensures that all advances, loans and other credits by private companies to shareholders, are treated as assessable dividends. In addition, debts owed by shareholders which are forgiven by private companies are treated as dividends.’ Explanatory Memorandum to Act No 47 of 1998.

Now, Mum and Dad:

- need a proper commercial loan deed that the company with the Division 7A rules; and

- repay the money that the company ‘lent’ them.

Our Div7A protects you in 5 ways:

- you get money from your company

- you get a financial benefit from your company (use of the company boat)

- you get a loan from your company

- your company forgives a debt you owe

- your Trust has ‘unpaid present entitlements’ owing to the company

You need a separate Div7A Loan Deed for each person

For example, if you have:

- Husband

- Wife

- Son

- Daughter

- Trustee of a Family Trust

- Bucket company (the company is a beneficiary)

Then you need 6 separate Division 7A Loan Deeds. Sign them, date them and put them in your company secretary file.

Is a Division 7A Loan Agreement a revolving line of credit?

The Legal Consolidated Division 7A Deed is a revolving line of credit. Therefore, you do not need to create a new Deed each year. This is a unique feature of Legal Consolidated 7A Loan Deeds. We listen to the ATO. We get a lot of information from accountants and lawyers attending ATO desktop audits. We ensure that our Div7A Loan Deeds are carefully prepared not only under the law but also with what the ATO believes is best practice.

ATO’s seven deadly sins of Div 7A Agreements

Recently I was privy to the ATO’s checklist for Division 7A Loan Deeds. These are the 7 deadly sins of Div 7A – and how to avoid them:

- Sign the Div 7A Deed BEFORE you lodge the company returns – the earlier you sign a Div 7A Deed the better

- Sign the Deed as a ‘Deed’, not as an ‘agreement’. Agreements are not usual or commercial for loan agreements. Commercial loan documents are signed as ‘deeds’. All Legal Consolidated Div 7A Deeds are deeds. As lawyers, we would never let you build ‘agreements’. If you are unsure look to the area where the Deed is signed it should say ‘Signed as a Deed’. If not go back to the lawyer that drafted the Div 7A and ask for your money back.)

- Payback 1/7 of each separate debt each financial year. Therefore, at the end of year 7, that particular loan is fully paid off. (Telephone us if you want a secured Div 7A loan.)

- Ensure the Deed automatically adjusts each year to the new ATO set ‘benchmark interest rate’

- Pay the ‘benchmark interest rate’ set by the government each financial year

- Build a Div 7A Loan Deed for the shareholders, children and loved ones. Anyone who may get some money from the company

- Ensure that your Div 7A Loan deed is ‘revolving’. This means you don’t have to do a new one every year. The same Div 7A Loan Deed deals with each new ‘7-year loan’ you create each year.

Repaying Division 7A loans by Journal Entry

I am scared of journal entries. A journal does not create a transaction. It does not do anything. It merely records transactions that happen Journal entries are fraught with danger.

However, the practice of using a journal entry to pay a dividend to make a Div 7A loan repayment is widespread. But be careful when it comes to complying with rules governing the payment of a dividend by journal entry. This is to make a “minimum yearly repayment” on a complying Division 7A loan.

The Division 7A Loan agreement needs to be signed as a ‘deed’. Or the journal entry is doomed to failure. (See above.)

Division 7A Rules and the Dividend Strategy

Section 109E ITAA 1936 states that an unfranked deemed dividend arises. This is to a shareholder (or associate of a shareholder) of a Pty Ltd (private company). This is if the shareholder fails to make a “minimum yearly repayment” by 30 June each year. This is under a complying Div 7A loan deed.

Now, I would feel safer if the shareholder (or associated) made a cash payment to the company. However, often the company’s profits are used to pay a dividend by a journal entry. This is in satisfaction with the “minimum yearly repayment” obligation owed by the shareholder.

Principle of mutual set-off for a Div 7A

A journal is a payment only if the principle of mutual set-off is satisfied. This involves two parties. They mutually owe each other an obligation. And they agree to set off their liabilities against each other. The mutual debts are discharged. The moving of money in and out of bank accounts is not required.

The journal making the MYR is effective only if the shareholder’s obligation to the company to make the MYR is set off against an obligation owed by the company to the shareholder to pay the dividend. This dividend strategy is not available where the “minimum yearly repayment” is owed by an associate of a shareholder.

Journal entry ineffective in dealing with Division 7A

What if the company owes no obligation to the shareholder? This is because no dividend is validly declared by 30 June to create the company’s indebtedness to the shareholder. Then, the payment of the “minimum yearly repayment” by the journal entry fails.

Watch out for the Corporations and tax laws as well:

1. Do not forget the Company rules when it comes to Division 7A

Section 254T Corporations Act 2001 sets out the rules when making a dividend. There may be additional rules, also in the company constitution. Declaring a dividend appears in the director’s minutes. This is put on the company secretary’s file. This is within one month of the minutes. See section 251A.

For example, you declare the dividend on 30 June. Therefore, the directors’ minute is filed in the company register by 31 July.

2. Tax rules for Div 7A

A private company making a frankable distribution gives the shareholder a distribution statement. This is no later than 31 October. (Four months of year-end.) See 202-75 ITAA 1997.

Are the accounts of a debtor company enough to create an acknowledgment by a debtor? VL Finance Pty Ltd v Legudi

Q: I note that the ATO has concerns regarding Deeds and ‘journal entries’. But are the accounts of a debtor company enough to create an acknowledgment by a debtor? Surely, the annual company return of the creditor company is sufficient to create the relevant acknowledgment?

A: You are playing with fire here. I am not sure why you are looking for trouble.

In any event, your argument fails under VL Finance Pty Ltd v Legud [2003] VSC 57. Your question about the annual company returns of the creditor company being enough to create the acknowledgment is rejected by the Court. This is the case, even though:

- The returns are signed by the directors who are the actual debtors!

- And the accounts identified the debts.

The annual returns are not:

A statement ‘made’ by the directors in their capacity as debtors ‘to’ the company in its capacity as the creditor. As your accountant will tell you, the annual return is merely a statement ‘by’ the company.

One of my students, who helped with the research for this article dug up the case of Lonsdale Sand & Metal v FCT 38 ATR 384. In this case, the statement in the accounts of a debtor company is accepted as evidence of an acknowledgment by a debtor. However, this case relates to the old Section 108 loans. This predates Div7A. I would not rely on this case.

My family trust has no ‘spare’ cash. How can it pay back the money it owes the bucket company?

Q: I distribute money to my bucket company. This is so that we pay the lower corporate tax rate.

However, how is the discretionary trust ever able to pay the loan back if every year, all income (including capital gain) must be distributed?

How can I possibly pay back the money if I am only distributing it to a bucket company? If I was distributing also to human beneficiaries, then I would get them to sign Deeds of Debt Forgiveness. This would free up cash.

A: The terror of Division 7A was introduced in 1997. Since then, my own Family Trust has never been distributed to our bucket company. It is too complex. I would rather pay the tax.

Your question reflects the complexity. Firstly, you do need to distribute the trust income and realized capital gains. Otherwise, the trustee of the Family Trust ends up paying tax at the human highest marginal tax rate. This highest marginal rate is 45%. Div 7A is designed to stop you from permanently taking advantage of the lower constant company tax rate.

(Obviously, you only pay capital gains if you dispose of an asset. If your family trust has shares in BHP and they triple in price, but you don’t sell them, then you don’t pay capital gains. It is only when you sell or dispose of the BHP shares that you then pay CGT.)

With a Div 7A Loan, you pay back 1/7th of the debt plus the statutory interest rate. This is each financial year.

You claim that your Family Trust has no ready cash lying around to pay that 1/7th of the debt. Well, like all of us, you have to pay your debts. Sell Family Trust assets. The Family Trust can borrow. Or the Family Trust can declare insolvency allowing the bucket company to sell the Family Trust assets to try and claw back the debt.

You make mention that if you are distributing to human beneficiaries then they can just forgive the debt. I agree. But I do not see how that frees up any ready cash. You were not going to hand over any cash to them anyway!

Sub-trust vs Division 7A Loan Agreement

Q: Why not put the money the Family Trust owes the bucket company in a sub-trust? The money is, therefore, earmarked for the sole use and enjoyment of the corporate beneficiary. And you have complied with Division 7A ITAA 1936.

A: Sub-trust arrangements stopped in 2022.

This is because of the ATO’s Draft Determination TD 2022/D1. The full name of the Determination is:

“Income tax: Division 7A: when will an unpaid present entitlement or amount held on sub-trust become the provision of ‘financial accommodation’?”

The TD 2022/D1 sets out the ATO’s view. This is when a private company beneficiary (bucket company) provides “financial accommodation”. This is to the Family Trust, Family Trust trustee, or a shareholder of the bucket company. This is for Division 7A purposes:

- for an Unpaid President Entitlement (UPE): The bucket company knows an amount that it can demand immediate payment. But it does not demand payment. It, therefore, consents to the Family Trust trustee keeping that amount for the Family Trust’s use; or

- for a sub-trust held for the bucket company’s benefit: The bucket company knows that a shareholder (or associate) is using all or part of the sub-trust funds.

I have always believed that such arrangements fall foul of the provision for financial accommodation. In our view, this is for the very purpose of s 109D(3) ITAA 1936 Act. This is where a bucket company of the family trust knows a UPE. But does not demand payment. The ATO accepts that position.

The ATO states that when a UPE is placed on a sub-trust there is no provision of financial accommodation. This is unless and until the associated funds are used by the bucket company’s shareholder or associate.

The sub-trust arrangement is dead.

Legal Consolidated has never been involved in sub-trust arrangements. As a conservative taxation law firm, we have always seen them as too risky and too complicated.

Why did the ATO kill off sub-trusts in Family Trusts for Division 7A

The ATO once gave out supportive views on the use of sub-trusts. See the old Ruling TR 2010/3 and Practice Statement PS LA 2010/4.

However, the ATO’s old views were never convincing. Legal Consolidated has never been involved or advocated sub-trusts for Division 7A and bucket company issues.

The ATO’s revised view is that a Family Trust corporate beneficiary with a UPE provides financial accommodation

“to anyone, the company allows to have access to the amounts to which they are entitled (whether or not they pay interest or other compensation)”.

The first time Legal Consolidated officially heard of the ATO’s anti-sub-trust approach was in the 2014 Board of Taxation minutes. But even before then, it was clear to us that sub-trusts were a risky approach.

See also the ATO’s Practical Compliance Guideline PCG 2017/13. This is under Division 7A – PS LA 2010/4 sub-trust arrangements maturing in or after the 2016-17 income year. This is the fifth update to PCG 2017/13!

Am I allowed to update – or build another – Division 7A Loan?

Q: My clients had a non-law firm website prepare a Division 7A Loan Agreement. For the reasons you state in your article, it is wrong. I telephoned the website and they said they were not lawyers. But were reselling a law firm’s template. She agreed with the Legal Consolidated article and she apologised.

She said that she used a commercial lawyer’s old template and that the commercial lawyer did not practice in tax. This begs the question of why the lawyer went outside their expertise. To add to the insult the lawyer had retired!

Anyway, the faulty Div 7A Loan Agreement started on 30 June last year. If the loan agreement started on 30 June last year and I built a correct Div 7A Loan Deed on your website, a year later, how is this viewed by the ATO?

A: You can do as many Division 7A Loans as you wish. Sadly, the correctly prepared Div 7A Loan only operates ongoing. You are stuck with the badly drafted Div 7A loan agreement for the previous year. But the new one that you are building on our law firm website overrides the old one and applies for new loans.

Made an honest Division 7A mistake?

Law Administration Practice Statement PS LA 2011/29 allows the ATO to exercise discretion on Div 7A deeming matters. The statement provides relief for taxpayers who trigger a deemed dividend as a result of an honest mistake or inadvertent omission. In section 109RB, the Commissioner has the discretion to either disregard a deemed dividend or allow it to be franked.

But it is better not to make a mistake. Better to build the Division 7A Loan Agreement. And comply with the rules. It is never a good idea to rely on the largesse of a government department.

History of Division 7A

Division 7A was introduced on 4 December 1997. Div 7A automatically deems certain payments/benefits:

- provided by a private company (e.g. Pty Ltd) as an unfranked dividend

- assessable to the shareholder or associate.

On 12 December 2002, Div 7A was expanded. This is to transactions between trusts and companies, where the company becomes presently entitled to trust income. This is where it is not paid and the cash is distributed to shareholders/associates.

On 1 July 2009, the Div 7A rules were further extended. This is to arrangements where interposed entities are used between trusts and shareholders/associates.

In October 2018, the Treasury updated the Div 7A regime yet again.

What is the purpose of Division 7A ITAA 1936?

Division 7A is a provision in the Australian income tax law (Income Tax Assessment Act 1936).

Div 7A applies to private companies (e.g. Pty Ltd). But only if:

- the company has unpaid present entitlements (UPEs) from a Family Trust distribution; or

- ‘loans’ outstanding to their shareholders or their shareholders’ ‘associates’.

Division 7A forces these UPEs and loans:

- be treated as ‘dividends’ from the company; and

- included in the shareholder’s assessable income.

Div 7A’s purpose is to stop private companies from avoiding tax. This is by making tax-free distributions to their shareholders. This is in the form of UPEs or loans: rather than dividends.

Under Division 7A, a private company must either:

- repay a UPE or loan to a shareholder or their associate within seven years. This can only be done if you have a Div 7A Loan Deed, or

- the UPE or loan is treated as a dividend and included in the shareholder’s assessable income.

Exceptions to Division 7A

There are certain exceptions to Division 7A. These include where the UPE or loan is ‘genuine and commercial’. That is it is not a means of avoiding tax.

Division 7A has significant adverse tax consequences for private companies and their shareholders.

Do Div 7A Loan agreements expire after 6 years?

Q: Professor Davies, you claim that all Div 7A loan deeds expire after 6 years. Now, I accept that:

- there is legislation in each Australian state where ‘at call loans’ cease to work after 6 years – under the Statute of Limitation;

- loans under division 7A are ‘at call loans’; and

- if the Div7A is so ‘expired’ it is unrecoverable – and automatically forgiven, in the eyes of the ATO – disaster!

However, concerning these 6 years, it starts from the date the ‘claim is made’. This is when the cause of action arises. This could be in 50 years. So, in other words, the company just needs to send an email to the shareholder/related party ‘demanding’ payment. And the 6 years start again.

A: Your argument is not without merit. It is often argued that the start date for the limitation period is the date that a demand is made for repayment of the debt. So the argument goes that the company sends an email to the shareholder or their related party. This is to demand payment. And the argument goes that the The 6-year period starts again.

However, meet the ATO’s friend: VL Finance Pty Ltd v Legudi

Our friends at the ATO dispute your approach. The ATO relies on the Victorian case of VL Finance Pty Ltd v Legudi [2003] VSC 57. The ATO’s view is that the limitation period for Division 7A, at least, starts on the date that it is signed. Not from the time when the ‘first call for repayment’ is made.

Legal Consolidated is happy to bring court proceedings against the ATO to test what the ATO states is correct. I did a Tax Institute talk many years ago with an ATO Second Commissioner. In the heat of the debate, I reminded him that Legal Consolidated wins 50% of all our actions in the courts against the ATO. And that the ATO shouldn’t carelessly state a position to the detriment of the taxpayers of Australia – especially when it does so by press release. He, of course, shot back with ‘Yes, Dr. Davies, but we win against you the other 50% of the time!’. Which I thought was a clever comeback.

However, rather than spend a lot of money fighting the ATO, it is best to keep your head down.

How to stop a Division 7A from being statute barred after 6 years

To stop Div 7A from going ‘stale’, there are three ways to protect the longevity of a Legal Consolidated Division 7A Deed:

- After 5 years (do not wait until 6 years have passed) log back into Legal Consolidated’s website. Go to “Your Documents” and, for free, print out the same Division 7A Loan Deed again. Sign and print it on that day’s date. A unique advantage of a Legal Consolidated Div 7A Loan Deed is that it ‘dovetails’ with older Legal Consolidated Div 7A loan deeds. You could, for example, print (for free) the same Deed and sign it every year. (That would be overkill.)

- If you do not have a Legal Consolidated Div 7A Loan then build one now. Sign it today. And print it out every 5 years. As per the above.

- Or, build a Deed of Recognition.

However, if 6 years have passed then it is too late. If the loan has ‘expired’ then nothing can bring it back from the dead. Contrary to what some of my lawyers may think, we are not gods.

Is the Division 7A Loan agreement for single use?

Q: Is the Legal Consolidated Div7A Loan Deed a single-use template or is there an accountant’s version that can be reused for clients in my practice?

A: Legal Consolidated does not sell templates. When you build a document on our website Legal Consolidated is responsible for the document. They are finished with legal documents. Each comes with a cover letter confirming that Legal Consolidated prepared the document. That protects the accountant. If you reuse a Div7A template you are engaging in legal work. And that is illegal.

Q: Can my client buy a Legal Consolidated Div7A and use it for all members of his family?

No. They cannot do so.

For example, you have a mum, dad and 3 children. You, therefore, need to build five Div7A Deeds.

However, you can, for free, print out the five Deeds each year. For example, once you build the Div7A for Mary, each year you just log back into our website. Go to “Your Documents” and print out Mary’s Div7A Deed again. This is free. You have already paid for Mary’s Div7A Loan.

If Mary has a brand new baby brother, then you need to build a sixth Div7A Loan Deed. This is for the new child.

What do I get when I build the Div7A loan on your website?

We email you within 60 seconds of you building the Division 7A agreement:

- Our law firm’s letter of advice on our law firm’s letterhead

- Minutes

- ATO-compliant Division 7A Loan Deed

How to sign a Division 7A Loan Agreement as a deed

1. ‘Signing’ as a Deed

To be valid, a deed must be signed by the parties making the deed. This signature is typically required to be made in front of a witness who also signs the deed.

2. ‘Sealing’ a Div 7A Loan Agreement

Historically, deeds are distinguished from other legal documents by the presence of a seal. While the use of seals has largely become symbolic, some jurisdictions, including Australia, still recognise the concept of sealing. In practice, a seal may be ‘affixed’ to the deed. This is often alongside or near the signature. However, in many jurisdictions, including Australia, the requirement for a seal has been relaxed, and a deed can be valid without one.

3. ‘Delivery’ of a Deed for a Division 7A Loan Deed

Delivery refers to the intention of the party signing the deed to be bound by its terms. In Australia, ‘physical’ delivery is typically inferred from:

- the act of signing or sealing the deed;

- coupled with the intention to be legally bound by its contents.

Physical transfer of the document is not necessary for delivery to occur; rather, it is the intention to be bound that matters.

4. Witnessing of a Deed for a Division 7A Loan

Usually, and best practice is that deeds must be witnessed to be valid. The specific witnessing requirements may vary depending on the jurisdiction within Australia. Generally, a witness must be present when the deed is signed and must also sign the deed to confirm that they witnessed the signing. The witness does this by writing their name and signing and dating the document below or next to your signature.

We had a worldwide pandemic starting in late 2019 (sadly it was not acknowledged by the Australian government until well into 2020) and silly and ill-conceived rules came in to allow electronic witnessing. To make it worse every state came up with its own conflicting rules that did not work when you take the deed across state borders. Legal Consolidated is considered a conservative law firm but we were never involved in these shenanigans. Get a blue pen and the witness into the room at the same time. This is how to witness a Will in isolation.

See also for Family Trusts and Unpaid Present Entitlements:

Drafting Division 7A Loan Agreements: ATO’s 4 concerns

Advanced Family Trust Training Course – Free

ATO says ‘loans’ from a company were not loans

Business Structures for Personal Services Income, tax and asset protection

Family Trust v Divison 7A Loan Deed

- Family Trust Deed – watch the free training course

- Family Trust Updates:

- Everything – Appointor, Trustee & Deed Update

- Deed ONLY – only update the Deed for tax

- Guardian and Appointor – only update the Guardian & Appointor

- Change the Trustee – change human Trustees and Company Trustees

- The company a Trustee of Family Trust – only for assets protection?

- Bucket Company for Family Trust – tax advantages of a corporate beneficiary

Unit trust vs Divison 7A Loan Deed

- Unit Trust

- Unit Trust Vesting Deed – wind up your Unit Trust

- Change Unit Trust Trustee – replace the trustee of your Unit Trust

- Company as Trustee of Unit Trust – how to build a company designed to be a trustee of a Unit Trust

Corporate Structures and Divison 7A Loan Deed

- Partnership Agreement – but what about joint liability?

- Incorporate an Australian Company – best practice with the Constitution

- Upgrade the old Company Constitution – this is why

- Replace lost Company Constitution – about to get an ATO Audit?

Service trust and Independent Contractors Agreements

- Independent Contractor Agreement – make sure the person is NOT an employee

- Service Trust Agreement – operate a second business to move income and wealth

- Law firm Service Trust Agreement – how a law firm runs the back-end of its practice

- Medical Doctor Service Trust Agreement – complies with all State rules, including New South Wales

- Dentist Service Trust Agreement – how dentists move income to their family

- Engineering Service Trust Agreement – commonly engineers set up the wrong structure

- Accountants Service Trust Agreement – complies with ATO’s new view on the Phillips case